Activity Level of New England Series A Transactions

Activity Level of New England Series B and Later Round Transactions

Size of New England Q1 2011 Series A Transactions by Industry

Size of New England Q1 2011 Series B Transactions by Industry

THE NUMBERS

Set forth below are analysis and commentary regarding the information reported in the various tables throughout this issue of Venture Perspectives.

Activity Levels

During Q1 2011, the total number of New England Series A transactions dropped 46% from Q4 2010 and 53% from Q1 2010 level. The technology sector accounted for 86% of the Q1 2011 total and the "other" sector accounted for the remainder. There were no Series A cleantech or life sciences transactions.

The total number of New England Series B/Later Round transactions during Q1 2011 decreased 21% from Q4 2010 and 42% from Q1 2010. The technology sector showed the strongest performance, accounting for 58% of the Q1 2011 total. The life sciences and "other" sectors each accounted for 15% of the Q1 2011 total, and the cleantech sector accounted for 12%.

At the national level, the reported Q1 2011 information presents a somewhat different picture from the quarterly New England information. Nationally, the total number of Series A transactions decreased 16% from Q4 2010 (compared to a 46% decrease in New England) but increased 14% over Q1 2010 (compared to a 53% decrease in New England). Similarly, the total number of Series B/Later Round transactions at the national level declined 13% from Q4 2010 (compared to a 21% decrease in New England) but increased 5% over Q1 2010 (compared to a 42% decrease in New England). There was also considerable variation between the New England data and the national data with respect to the relative number of transactions represented by each of the various sectors. In New England, the sector with the greatest relative percentage of the reported transactions for the quarter was technology, but nationally it was the "other" category.

Deal Size

During Q1 2011, 43% of the New England Series A transactions involved investments under $5 million, and 43% involved investments between $5 million and $10 million. No deals topped $15 million invested. During Q1 2011, 15% of the New England Series B/Later Round transactions involved investments under $5 million, 38% involved investments between $5 million and $10 million, 19% involved investments between $10 million and $15 million, 12% involved investments between $15 million and $20 million, 15% involved investments greater than $20 million.

Implied Pre-Money Valuations

Series A Round

The reported New England Series A information for Q1 2011 presents the usual varied picture both across and within industry sectors:

- Cleantech: There were no cleantech transactions.

- Life Sciences: There were no life science transactions.

- Technology: In the six technology transactions, the implied pre-money valuations ranged from $4.0 million to $26.3 million.

- Other: There was one transaction in the "other" category, with an implied pre-money valuation of $21.0 million.

Series B/Later Round

The reported New England Series B/Later Round information for Q1 2011 also presents a varied picture across and within industry sectors:

- Cleantech: Of the two reported cleantech transactions, one was a Series B up round with a $39.4 million implied pre-money valuation and the other was a Series C down round with a $7.3 million implied pre-money valuation.

- Life Sciences: Of the two reported life sciences transactions, one was a Series B up round with a $29.9 million implied pre-money valuation and the other was a Series D up round with a $52.9 million implied pre-money valuation.

- Technology: There were eleven reported technology transactions, of which five were up rounds, three were even rounds, and three were down rounds. The implied pre-money valuations ranged from a low of $6.6 million in a Series B down round to a high of $192.8 million in a Series E up round.

- Other: The two reported transactions in the "other" category were both Series C up rounds, with implied premoney valuations $37.5 million and $164.2 million.

Terms

The bar graph relating to terms for selected New England Series A transactions shows the following trends in Q1 2011 as compared to the comparable prior year quarter and the immediately preceding quarter:

- a decrease in the percentage of transactions with cumulative dividends (43% in Q1 2011 versus 54% in Q1 2010 and 69% in Q4 2010);

- a decrease in the percentage of transactions with a participating liquidation preference (43% in Q1 2011 versus 46% in Q1 2010 and 62% in Q4 2010);

- an increase in the percentage of transactions with a redemption provision (86% in Q1 2011 versus 54% in Q1 2010 and 77% in Q4 2010); and

- a decrease in the percentage of transactions with a pay to play provision (14% in Q1 2011 versus 23% in Q1 2010 and 31% in Q4 2010).

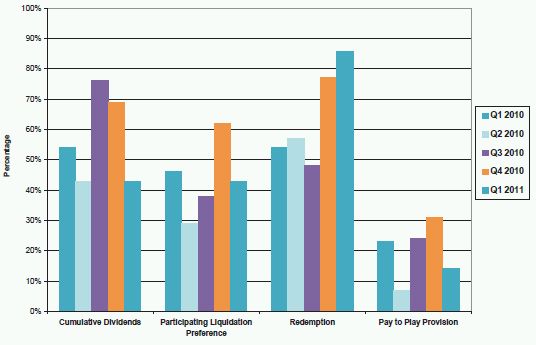

The bar graph relating to terms for selected New England Series B/Later Round transactions shows the following trends in Q1 2011 as compared to comparable prior year quarter and the immediately preceding quarter:

- a decrease in the percentage of transactions with cumulative dividends (53% in Q1 2011 versus 69% in Q1 2010 and 61% in Q4 2010);

- a decrease in the percentage of transactions with a participating liquidation preference (35% in Q1 2011 versus 56% in Q1 2010 and 45% in Q4 2010);

- an increase in the percentage of transactions with a redemption provision (82% in Q1 2011 versus 64% in Q4 2009 and 76% in Q4 2010); and

- an increase in the percentage of transactions with a pay to play provision (41% in Q1 2011 versus 28% in Q1 2010 and 24% in Q4 2010).

Conclusion

The significant decrease in activity levels in Q1 2011 compared to Q4 2010 for New England in both Series A rounds and Series B/Later Rounds is a cause for concern. But there are also positive trends: the implied pre-money valuations for New England transactions during Q1 2011 were generally at reasonable levels, only 24% of the New England Series B/ Later Round transactions during the quarter were down rounds, and deal terms were generally more company- favorable during Q1 2011 than during recent quarters, with a significant decrease in the percentage of transactions with cumulative dividends and a participating liquidation preference.

There are also significant positive signs at the national level:

- Thomson Reuters and the National Venture Capital Association have reported that M&A exit levels for venture-backed companies have stabilized over the past year. There were 109 venture-backed M&A exits during Q1 2011 compared to 122 in Q1 2010 and 97 in Q4 2010. Of the Q1 2011 venture-backed M&A deals with reported values, 47% returned more than 4X the venture investment, while 14% had reported values less than 1X the venture investment.

- Thomson Reuters and the National Venture Capital Association have also reported that the IPO market for venture-backed companies has continued to improve, with Q1 2011 being the strongest opening quarter for venture-backed IPOs since 2007.

On the negative side, the level of venture capital fundraising activity continues to be a source of concern. According to Thomson Reuters and the National Venture Capital Association, during Q1 2011 36 venture capital funds raised $7.1 billion. In terms of dollar commitments, this represents the strongest quarter of US venture capital fundraising since Q3 2008 and the strongest opening quarter since Q1 2001. However, the Q1 2011 dollar volume includes funds raised by three multi-billion dollar funds, which together accounted for roughly 58% of the $7.1 billion capital commitments for the quarter. The number of funds able to raise capital during Q1 2011 represented the lowest quarterly level since Q3 2009.

Selected New England Series A Round Transactions

Selected New England Series B and Later Round Transactions

Terms of Selected New England Series A Rounds 2010-2011

p>

p>

The chart above summarizes publicly available information about various terms included in the Certificates of Incorporation for Series A financings for companies headquartered in New England. For the purposes of this table we have focused solely on transactions that appeared to us, from the public filings, to be identifiable as Series A financings. We have excluded transactions that appeared to us to involve considerations and concerns different from those applicable in a typical Series A round, such as might occur, for example, in the case of a recapitalization. For this reason, the set of transactions described above may vary somewhat from the set of transactions described in the tables elsewhere in this publication. We have selected terms to report on that we believe will be of particular interest to entrepreneurs. A definition of each of these terms may be found on our website. Information included in the table above is based on information made publicly available by participants in the relevant transactions and is not comprehensive.

Terms of Selected New England Series B and Later Rounds 2010-2011

The chart above summarizes publicly available information about various terms included in the Certificates of Incorporation for Series B and later round financings for companies headquartered in New England. For the purposes of this table we have focused solely on transactions that appeared to us, from the public filings, to be identifiable as Series B and later round financings. We have excluded transactions that appeared to us to involve considerations and concerns different from those applicable in a typical Series B or later round, such as might occur, for example, in the case of a recapitalization. For this reason, the set of transactions described above may vary somewhat from the set of transactions described in the tables elsewhere in this publication. We have selected terms to report on that we believe will be of particular interest to entrepreneurs. A definition of each of these terms may be found on our website. Information included in the table above is based on information made publicly available by participants in the relevant transactions and is not comprehensive.

The National Activity Level Summary

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.