The European Market Infrastructure Regulation (EMIR1) imposes new reporting, clearing, collateral and conduct of business requirements on all derivatives market participants which are based in the EU or deal with EU counterparties. Various requirements on risk mitigation are already in place, and the deadline for new reporting requirements is imminent. The manner in which financial institutions deal with their clients and take collateral is undergoing significant structural change which will continue for the foreseeable future. This note discusses what corporates using derivatives in their businesses should be doing now to ensure compliance2.

Mandatory Reporting

EMIR requires all counterparties to derivatives to report all derivative contracts (OTC and exchange traded) to a trade repository. The reporting obligation applies separately to each counterparty, although generally speaking, only EU counterparties are covered (see Extraterritoriality below). Modifications and terminations must also be reported.

The requirement to report will come into effect on 12 February 2014. Counterparties are required to make a report in respect of each transaction no later than the working day following the conclusion, modification or termination of a derivative contract. A significant 'backloading' process for existing transactions is also required. The reporting deadlines for historic derivative contracts (i.e., currently live or that were live on 16 August 2012) are set out in Table 1.

From 12 August 2014, financial counterparties ("FCs") and non-financial counterparties exceeding a "clearing threshold" (NFC)+s3 will be required to provide daily reports to trade repositories of mark-to-market/mark-to-model information of all reportable derivative contracts and collateral information, together with their transaction reports to trade repositories.

Counterparties are further required to maintain a record of their derivative contracts until at least five years after a contract has terminated.

The information in trade repositories will be visible only to reporting counterparties, repositories and regulators. Only anonymised, aggregated data will be published.

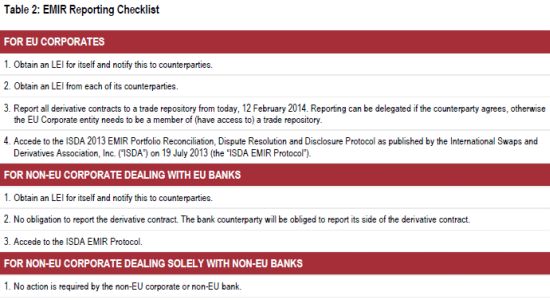

In order to comply with the reporting requirements, all European parties to derivative contracts are required to have a Legal Entity Identifier ("LEI") and will need an LEI in respect of each of their counterparties. The global LEI system ("GLEIS") is not fully operational and so counterparties must have obtained a pre-LEI or CFTC Interim Compliant Identifier ("CICI") before 12 February 2014. Pre-LEIs will transition into LEIs upon the GLEIS becoming fully functional. Pre-LEIs and CICIs can be obtained from the London Stock Exchange, DTCC and various other institutions. Table 2 includes a checklist that can be used to assist fulfillment of the EMIR reporting requirements.

There are now six trade repositories registered in the EU, any of which can be used for trade reporting: (i) DTCC Derivatives Repository Ltd., based in the United Kingdom; (ii) Krajowy Depozyt Papierów Wartosciowych S.A., based in Poland; (iii) Regis-TR S.A., based in Luxembourg; (iv) UnaVista Ltd. (an affiliate of the London Stock Exchange), based in the United Kingdom; (v) ICE Trade Vault Europe Ltd., based in the United Kingdom; and (vi) CME Trade Repository Ltd., based in the United Kingdom. It remains to be seen which will gain traction—European counterparties will need to become members or users of at least one of them. Many market participants are presently having troubles connecting to repositories due to the volume of applications being published. The UK, Irish and Luxembourg regulators have informally taken the position that compliance to a repository is needed only on a 'best endeavours' basis and that counterparties which are not yet connected should notify their regulator.

Corporates should consider if they should carry out the reporting of their derivative contracts themselves or delegate reporting to their bank counterparties or to a third party. Reporting to a trade repository requires a significant amount of preparation and resources, such as selecting and registering with a trade repository and putting in place internal systems to enable reporting of derivative contracts. Bank counterparties are not obliged to offer reporting services, and some have been hesitant about doing so. To help market participants meet their reporting obligations, ISDA and the Futures and Options Association ("FOA") published the ISDA/FOA EMIR Reporting Delegation Agreement (the "RDA") on 13 January 2014. The RDA is a bilateral standard form of reporting delegation agreement, whereby a reporting delegate may, on the client's behalf, report relevant data to a trade repository or the European Securities and Markets Authority ("ESMA").

Mandatory Clearing

In Europe, central counterparties ("CCPs") had to (re-)apply to their competent authorities for authorisation under EMIR by 15 September 2013. The competent authorities may take up to six more months to consider applications. An additional six months (maximum cut-off date of 15 September 2014) may be taken before ESMA submits to the European Commission for endorsement draft regulatory technical standards for the imposition of a clearing obligation to a class of OTC derivative contracts. There is effectively a June 2014 backstop date for CCP authorisation, given the effect of new capital requirements. The actual date of application of a clearing obligation will depend on the date of entry into force of the technical standards and the expected phase-in period per type of counterparty.

ESMA is expected to start publishing consultations on the clearing obligation during 2014.

The first mandatory clearing obligations are expected to start some time in the second half of 2014 or 2015. There may also be phasing of FC-FC trades for clearing before FC-NFC+ trades. The market expects the first mandatory clearing obligations to be in respect of the most standardised/liquid classes of OTC derivative contacts which already cleared.

Conduct of Business Standards for Derivatives

EMIR requires that counterparties entering into OTC derivative contracts have appropriate procedures and arrangements in place to measure, monitor and mitigate operational risk and counterparty credit risk.

For NFCs, some of these requirements only arise for OTC derivative contracts entered into on or after the clearing threshold is exceeded.

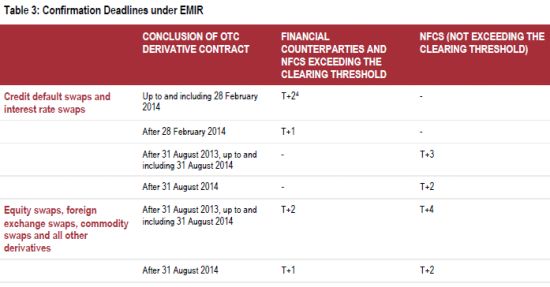

Since 15 March 2013, the following requirements have been in force:

- requirement on all counterparties to have in place formalised procedures for timely confirmation, where available electronically, of the terms of the OTC derivative contract.

- FCs and NFC+s required to mark-to-market/mark-to-model their outstanding non-cleared OTC derivative contracts on a daily basis.

- FCs must hold a proportionate amount of capital to manage the risks not covered by appropriate exchange of collateral.

Since 15 September 2013, the following requirements have been in force:

- requirement on all counterparties to have agreed procedures with all their counterparties to reconcile portfolios, manage associated risk and identify and resolve reconciliation disputes; and

- all counterparties with 500 or more non-cleared OTC derivative contracts with a single counterparty to have in place with that counterparty procedures to regularly, and at least twice a year, analyse the possibility to conduct a portfolio compression.

The ISDA EMIR Protocol is intended to facilitate parties amending their OTC derivative contracts to comply with the documentation-related aspects of the dispute resolution and portfolio reconciliation requirements. It also contains provisions whereby parties give their consent to disclosure of information to comply with EMIR reporting requirements. Parties may amend their existing OTC derivative contracts by adhering to the July 2013 Protocol or bilaterally, using an ISDA Standard Amendment Agreement or an alternative bilateral agreement. For new OTC derivative contracts, parties may comply with the dispute resolution and portfolio reconciliation requirements by incorporating the July 2013 Protocol into the OTC derivative contract or entering into a separate bilateral agreement.

Collateral Issues

In Europe, the collateral exchange requirement in relation to non-cleared OTC derivative contracts requires FCs to hold an appropriate and proportionate amount of capital to manage risk not covered by appropriate exchange of collateral. The extent of the FCs obligations under the Regulation have not yet been set out in regulatory technical standards. It is thought that the collateral exchange requirement will come into effect in December 2015 on a phased-basis.

Corporates should consider how differing collateral requirements impact on where trades should most efficiently be carried. There will likely be significant additional collateral required to support trades and an increased burden in funding and sourcing collateral in the future.

Documentation

New standardised client clearing documentation has been developed to facilitate more widespread clearing of OTC derivatives. In Europe, ISDA and the FOA have published an ISDA/FOA Client Cleared OTC Derivatives Addendum and the FOA has also published a FOA Clearing Module, which is a simplied version of the ISDA/FOA addendum. CCPs have been making changes to their rulebooks and related documentation to facilitate the use of market standard client clearing documentation and the various account/segregation models now available.

Both dealers and buy-side market participants will need to review and reconfigure their OTC documentation in readiness for these changes. Dealers will refresh their client-facing documentation significantly in order to allow clearing. Buy-side participants, including corporates, may want to select a handful of clearing members with whom they negotiate and sign full client clearing documentation (as compared with executing dealers with whom they trade before giving up transactions for clearing), which could represent a change from past practices where they may have executed full derivatives documentation with a larger number of counterparties. Whichever of the ISDA/FOA Addendum or the FOA Clearing Module is used as the starting point, the client clearing documentation will need to be tailored to the needs of particular dealers and clients.

Extraterritoriality

Both the new US and EU legislative regimes have an extraterritorial dimension in that they may capture OTC trades which are executed outside their jurisdiction. For example, EMIR will regulate trades that have been entered into between non-EU entities but which have a "direct, substantial and foreseeable effect" within the EU or where to do so is necessary to guard against anti-evasion. ESMA submitted to the European Commission on 15 November 2013 the final report regarding the regulatory technical standards required under Articles 4(4) and 11(4) of EMIR on direct, substantial and foreseeable effect of contracts within the EU and to prevent the evasion of rules and obligations (the "Extraterritoriality RTS").

The European Commission has three months to decide whether to endorse ESMA's draft Extraterritoriality RTS.

According to the draft Extraterritoriality RTS, an OTC derivative contract will be considered as having a direct, substantial and foreseeable effect within the EU:

- when at least one third country counterparty benefits from a guarantee provided by a financial counterparty established in the EU which covers all or part of its liability resulting from that OTC derivative contract, to the extent that the guarantee meets certain conditions; and

- where the two counterparties established in a third country enter into the OTC derivative contract through their branches in the EU and would qualify as financial counterparties if they were established in the EU.

There are also anti-evasion provisions requiring business substance and economic justification in the OTC derivative contract.5

Organisations or particular subsidiaries which have historically considered themselves not subject to either EU or US regulation may need to re-assess this and consider whether any steps should be taken, whether to avoid falling within the scope of new regulations, or to comply.

Corporates will need to consider their most efficient business structure as the new rules evolve.

Categorisation as NFC+s or NFC-s

Some corporate groups may include regulated financing vehicles or occupation retirement schemes, which are treated as FCs. For other corporate entities, EMIR applies differently to corporates depending on the way in which they are structured and the way they use derivatives. Categorisation of corporates into NFC+s and NFC-s6 is important as it determines which EMIR obligations an NFC will be subject to. It is also important for FCs as it will determine the timeframe for confirmations, the frequency of portfolio reconciliation and clearing and collateral obligations. As the EMIR clearing and collateral obligations become closer to coming into effect, categorisation of NFCs becomes more significant for FCs as it will determine whether there is an obligation to clear or to collateralise derivative contracts with that NFC. Therefore, NFCs may now that find written confirmation of status as a NFC+ or NFC- forms part of the diligence required by bank counterparties.

Determining whether a derivative contract should be counted towards the clearing thresholds and whether a clearing threshold has been exceeded is not straight-forward. Importantly, hedging trades are excluded and a threshold of EUR 1-3 billion national applies per product class (FX, CDS, IRS etc.)

Conclusion

It is vital that corporates carrying out derivatives transactions (i) ensure they are in compliance with the conduct of business requirements that are already in place and (ii) re-assess their processes and documentation to be ready to comply with the new reporting, clearing and collateral requirements.

Footnotes

1 Regulation (EU) No. 648/2012 of the European Parliament and of the Council on OTC derivatives, central counterparties and trade repositories.

2 If you wish to view further information on regulatory reforms, please refer to our dedicated website http://www.shearman.com/dodd-frank/ and our client publications, which are available here.

3 A non-financial counterparty ("NFC") is an NFC+ when the rolling average position in OTC derivative contracts (other than 'hedging' derivative contracts) over 30 working days of that NFC and any other NFC and non-financial entity in that NFC's group exceed the clearing threshold of any derivative contract asset class.

4 T is the date of execution of the contract and the number represents the number of business days following T.

5 For more on extraterritoriality, see our prior publications: 'OTC Derivatives Regulation and Extraterritoriality', 'OTC Derivatives Regulation and Extraterritoriality II' and 'OTC Derivatives Regulation and Extraterritoriality III'.

6 An NFC is an NFC- when the rolling average position in OTC derivative contracts (other than 'hedging' derivative contracts) over 30 working days of that NFC and any other NFC and non-financial entity in that NFC's group is at or below all of the clearing thresholds in all derivative contract asset classes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.