Hybrid mismatch arrangements can be used to achieve double non-taxation including long-term deferral. The OECD report on Action 2 of the 15 BEPS Actions, titled "Neutralising the Effects of Hybrid Mismatch Arrangements", published in September 2014 (the "Report"), comprises two parts—Part I, which provides recommendations with respect to domestic law provisions, and Part II, which relates to treaty provisions.

The principal targets of the Report are tax mismatches resulting from: (i) arrangements involving tax deductions for expenses (normally interest) with no corresponding taxation of the receipt (deduction/no-inclusion or "D/NI"), or (ii) a tax deduction for the same expense in two or more jurisdictions (double deduction or "DD"). These arrangements typically involve a hybrid entity: opaque (e.g., a company) in one jurisdiction, transparent (e.g., a partnership or branch) in another; or a hybrid instrument—debt in one jurisdiction, equity in another. The Report also considers indirect hybrid mismatches where a mismatch arrangement is imported into a third jurisdiction.

Recommendation

BEPS Action 2 will be implemented based on the extent of the present mismatch. This is determined by comparing the tax treatment of the payment under the laws of each jurisdiction. D/NI mismatches occur where a proportion of payment deductible in one jurisdiction does not correspond to the proportion of ordinary income in another. DD mismatches occur where all or part of a payment is also deductible in another jurisdiction. Whilst differences in payments can give rise to mismatches by way of fluctuating foreign currency, they will not give rise to a D/NI outcome. Unilateral, equitable tax deductions will also fail to produce a mismatch because they are economically closer to a tax exemption. Hybrid mismatch rules should not be applied to entities where tax concerns are not raised. The OECD proposals in the Report are mechanical, and there is no need to show purpose.

Scope

The Report states that the hybrid mismatch rules are designed to:

- neutralise mismatches in tax treatments without changing the tax characterisation and commercial outcome of the arrangement or instrument;

- be comprehensive;

- apply automatically;

- avoid double taxation through rule co-ordination;

- minimise disruption to existing domestic law;

- be clear and transparent in their operation;

- provide sufficient flexibility to allow for implementation in each jurisdiction;

- be workable for taxpayers and keep compliance costs to a minimum; and

- be easy for tax authorities to administer.

The Report also states that jurisdictions should co-operate on measures to ensure recommendations are implemented and applied consistently and effectively. These measures include:

- developing agreed guidance on the recommendations;

- co-ordinating the implementation of the recommendations (including time);

- developing transitional rules (with no assumed grandfathering of existing arrangements);

- reviewing the effective and consistent implementation of the recommendations;

- exchanging information on the jurisdiction as treatment of hybrid financial instruments and hybrid entities;

- endeavouring to make relevant information available to taxpayers; and

- considering the interaction of the recommendations with other BEPS Actions including Action 3 (CFC rules) and Action 4 (Interest).

The Report limits the scope of the application of the recommended rules to specifically stated circumstances; most of the rules would apply only to hybrid arrangements involving related persons and members of the same controlled group or to certain "structured arrangements". "Structured arrangement" is defined as any arrangement where the hybrid characteristic is priced into the terms of the arrangement, or the facts and circumstances of the arrangement indicate that it has been designed to accomplish a hybrid mismatch.

The Report provides a nonexhaustive list of facts and circumstances that indicate the existence of a structured arrangement:

- an arrangement that is designed to create, or is part of a plan to create, a hybrid mismatch;

- an arrangement that incorporates the terms, steps or transactions used to create a hybrid mismatch;

- an arrangement that is marketed, in whole or in part, as a tax advantaged product where some or all of the tax advantage derives from the hybrid mismatch;

- an arrangement that is primarily marketed at taxpayers in the jurisdiction where the hybrid mismatch arises;

- an arrangement that contains features that alter the terms of the arrangement, including the return if the hybrid mismatch is no longer available; and/or

- an arrangement that would produce a negative return absent the hybrid mismatch.

The taxpayer will not be regarded as a party to a structured arrangement when neither the taxpayer nor any member of the same control group could reasonably be expected to know there is a hybrid mismatch and did not share any of the tax benefit resulting from such mismatch. (There is no suggestion in the Report of a possibility for jurisdictions to provide safe harbours to taxpayers.)

Two persons would be related if they were in the same control group or if one person has a 25 percent or greater investment in the second person or if a third person holds a 25 percent or greater investment in both. (In the earlier OECD discussion draft, the relationship threshold reported was 10 percent rather than 25 percent). Two persons would also be in the same control group if:

- they are consolidated for accounting purposes;

- the first person has an investment in a second person who grants the former effective control, or a third person has such an investment in the first two;

- the first person has a 50 percent or greater investment in the second person, or a third person has a 50 percent or greater investment in both; or

- the two persons can be regarded as associates of enterprises under Article 9 of the OECD Model Tax Convention. The person will be regarded as holding the investment if it directly or indirectly holds a percentage of voting rights or value in the equity of another person.

There are also rules regarding acting together, so that a person who acts together with another person in respect of ownership or control of any voting or equity rights or interest will be treated as owning the other person's rights or interest. Acting together will be deemed to happen if: (i) the persons are members of the same family; (ii) the person regularly acts in agreement with another person's wishes; (iii) the two persons have entered into an agreement that materially impacts the value or control of the assets or the ownership or control of such rights or (iv) the interests are managed by the same personal group or person. In the case of a collective investment vehicle, the presumption of acting together can be rebutted if, based on the terms and circumstances of an investment arrangement, it can be demonstrated to the satisfaction of the relevant tax authority that no such conduct is involved.

Part I of the Report—Recommendations for the Design of Domestic Rules

Part I illustrates situations where a D/NI outcome may be achieved by using both hybrid instruments and hybrid entities, but the Report refers only to hybrid entities when analysing a D/D outcome. The Report also makes recommendations in respect of payments that produce indirect D/NI outcomes.

The Report proposes a primary rule or "response" in each situation that determines which jurisdiction should first counteract the mismatch and, usually, a secondary rule or "defensive" rule which applies if the primary jurisdiction does not counteract.

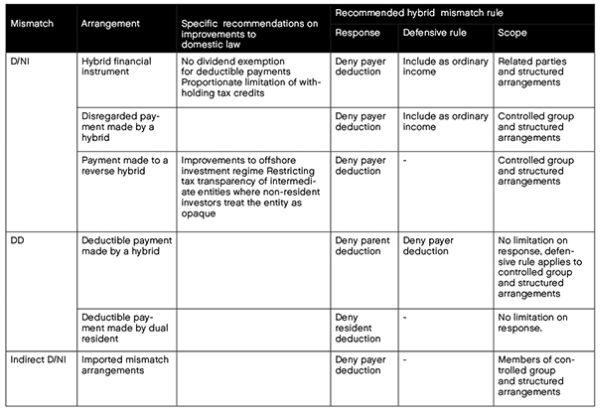

The recommendations are summarised in the report as:

Examples

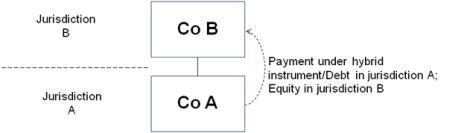

D/NI—Hybrid instrument

Primary rule: Deny deduction for interest in Company A in jurisdiction A

Defensive rule: Include interest as ordinary income of Company B in jurisdiction B

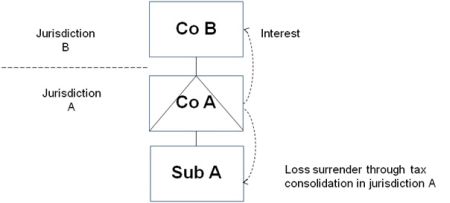

D/NI—Hybrid payer

Company B owns Company A. Company A is hybrid entity disregarded in jurisdiction B. Loan between B and A is disregarded in jurisdiction B so loan interest is N/I. Loan interest is deductible by Company A in jurisdiction A and Company A can surrender the tax benefit of its interest deduction to Sub A to shelter Sub A's profits.

Primary rule: Deny deduction for interest in Company A in jurisdiction A

Defensive rule: Include interest as ordinary income in Company B in jurisdiction B

D/NI—Reverse hybrid

Company A pays interest to Company B. Interest is deductible for Company A in jurisdiction A.

Company B is not taxed on receipt of interest in jurisdiction B because it is a transparent entity in jurisdiction B and jurisdiction B regards Company B's income as being taxable in jurisdiction C

Company B is seen as opaque by jurisdiction C so jurisdiction C regards Company B's income as being taxable in jurisdiction B—N/I interest.

Primary rule: Deny deduction in Company A

Defensive rule: Not necessary as there are recommendations made in the Report regarding CFC and offshore investment regimes

DD—Hybrid payer

Company B is disregarded in jurisdiction A. Payment of interest by Company B is regarded as a deductible payment by Company A in jurisdiction A. Payment is also deductible in jurisdiction B by Company B.

- Primary rule: Deny deduction in A

- Secondary rule: Deny deduction in B

- DD payment by dual resident: Deny deduction to the extent it exceeds dual inclusion income

No limitation in scope of primary rules but secondary rule applies only if parties are in the same control group or payment made under structured arrangements to which Company B is a party.

Indirect D/NI—Imported mismatch

- Interest deduction in jurisdiction C for Company C

- Neutral in jurisdiction A for Company A; receives interest from Company C and pays interest to Company B

- Outcome is deduction for Company C in jurisdiction C but not taxable as exempt dividend received by Company B in jurisdiction B

The Report recommends that jurisdictions should introduce legislation so that a reverse hybrid is treated as a resident taxpayer in the jurisdiction in which it is established (i) if it is not otherwise within the charge to tax on income in that jurisdiction and (ii) the accrued income of a nonresident investor in the same control group as the reverse hybrid is not within the charge to tax under the laws of the investor jurisdiction.

- Primary rule: Deny deduction in Company A

- Defensive rule: Include as ordinary income in Company B

- Backstop: Deny deduction in Company

C

Part II of the Report—Recommendation on Treaty Issues

Part II examines treaty issues with recommendations on changes to the OECD Model Tax Convention to ensure that hybrid instruments and entities are not used to obtain treaty benefits. The recommendations also address treaty issues that may arise from the recommended domestic law changes. Part II generally reflects the proposals in the discussion drafts.

The first recommendation is to amend Article 4(3) of the OECD Model Tax Convention (part of the work on Action 6 Treaty Abuse) so that treaty residence of a dual resident entity can be determined mutually by the competent authorities of the relevant jurisdictions determining where effective control is exercised. In the absence of an agreement, the dual resident entity cannot claim treaty benefits from either of the jurisdictions involved except as agreed by the competent authorities. The Report states that this is not enough to effectively mitigate BEPS concerns with dual resident entities, however, since the entity could be resident in one state under the treaty but resident in the other state under domestic law. This could enable foreign losses to be shifted to another resident company under its domestic law group relief system and claim treaty protection against taxation of foreign profits. The Report concludes that the solution must be to change domestic law so that a resident of one state under a double tax treaty is denied domestic residence in the other state (as is currently the case in the UK and Canada).

The second recommendation addresses the use of transparent entities to benefit from treaty provisions. The Report recommends an amendment to Article 1(2) of the Model Tax Convention to include a rule on fiscally transparent entities whereby income derived by or through an entity or arrangement that is treated as wholly or partly fiscally transparent under the tax law of one of the contracting states will be considered to be income of a resident only to the extent that the income is treated for the purposes of taxation by that state as the income of a resident of that state.

The Report suggests that the OECD commentary on transparent entities should be widened from just a consideration of partnerships to other noncorporate entities.

Finally, Part II considers the interaction between Part I and tax treaties.

The primary response to the mismatch—the denial of deduction for a payment to the extent it gives rise to D/NI—raises questions as to whether tax treaties would permit such a denial. Deductibility issues, however, are often matters of domestic law. (Article 7 the OECD Model Treaty—Business Policies).

Defensive rule: If the payer jurisdiction cannot neutralise the mismatch, then the payee will require such payment to be included as ordinary income to the extent it gives rise to D/NI. Two recommendations were also given as to the elimination of double taxation, including preventing a dividend exemption and restricting relief in proportion to the net taxable income. Again, this is largely a matter of domestic law.

Exemption method (Article 23A) and Credit Method (Article 23B): In the case of dividends, the credit method applies even where the exemption method applies to other income. It is acknowledged, however, that a number of bilateral tax treaties depart from this provision. The Report emphasises that the credit method should be followed.

Article 23B (the credit method) advocates that relief should be restricted in proportion to the net taxable income provided under an arrangement. Double non-taxation may still occur, however, where treaty or domestic law departs from the credit method provision.

Anti-discrimination: The Report concludes that the recommendations do not appear to raise any issue of discrimination based on nationality. The rules solely govern taxation regarding an establishment's business.

Next Steps

The final OECD Report and commentary are due in September 2015.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.