The obligation for central clearing of OTC derivatives under the European Market Infrastructure Regulation will apply from June 2016. A Delegated Regulation that imposes a mandatory clearing obligation for interest rate swap contracts entered into with any European counterparty has now finally been published. Market participants trading OTC IRS derivatives that are not centrally cleared should consider how they are categorised under this legislation and when they will need to implement central clearing.

Introduction

The European Markets Infrastructure Regulation ("EMIR") introduced a mechanism for a legal obligation to clear certain classes of OTC derivatives through clearing houses, also referred to as central counterparties ("CCPs").1 The European Securities and Markets Authority ("ESMA") has determined that certain interest rate swaps ("IRS") classes fulfil the criteria of standardisation, having sufficient volume, liquidity and pricing information, and so should be subject to mandatory clearing. Regulatory Technical Standards ("RTS") imposing a clearing obligation for those products have now been published. ESMA's draft standards for the clearing of certain credit derivatives have not yet been adopted by the European Commission.

In previous client notes, we have discussed the proposed RTS and ESMA's consultation approach.2 We have updated this information now that the final clearing obligation has been published. This note discusses who will be subject to the clearing obligation, sets out which asset classes must be cleared via a CCP and considers issues in the application of the new obligation to third country counterparties. A checklist of the practical implications is set out at the end of this note.

Scope of the Clearing Obligation

EMIR created broadly two categorisations for purposes of the clearing obligation: financial counterparties ("FCs") and non-financial counterparties ("NFCs"). A NFC would only be subject to mandatory clearing if its derivatives position exceeds a clearing threshold which has been set at, in gross notional value:

- EUR 1 billion – credit derivative and equity derivative contracts; and

- EUR 3 billion – interest rate derivative, foreign exchange derivative and commodity derivative contracts and other derivatives.

For the above purposes (but not for purposes of the separate thresholds in the table below), NFCs must aggregate positions across non-financial entities in their group but may exclude, subject to certain conditions, hedging arrangements. ESMA recommended, in its response to the European Commission's EMIR Review, that the hedging provisions should be removed from EMIR on the grounds that they do not properly allow for the identification of those NFCs that actually pose significant risk to the financial system.3

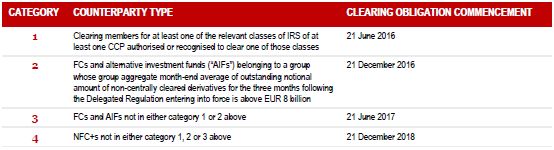

All FCs and NFCs that exceed the applicable clearing threshold ("NFC+") will be required to clear certain classes of IRS. The Delegated Regulation further categorises those two kinds of counterparties into four new categories for the purpose of phasing in compliance with the requirements and dealing with the frontloading issue (discussed below).

A contract between two counterparties in different categories would be subject to the clearing obligation from the later of the two dates specified above.

Certain industry groups, such as AIMA, have taken the view that foreign funds are to be considered as NFCs under EMIR. Those funds will now need to consider whether they are an AIF or a non-AIF NFC. The position of some entities under the four categories for the IRS clearing obligation remains unclear. To date, ESMA's view has been that non-EU AIFs that are marketed by a non-EU alternative investment fund manager ("AIFM") and EU AIFs that are marketed without a passport by non-EU AIFMs should be considered NFCs. Presumably, the same sort of logic can be applied to these new categories, in light of the drafting issues in connection with the applicability of this Delegated Regulation to third country entities (see below).

Application to Third Country Counterparties

EMIR provides that trades between a FC and an entity established in a third country that would be subject to the clearing obligation if it were established in the Union are caught by the clearing obligation.4 However, the Delegated Regulation does not specifically state that the clearing obligation for IRS applies to third country entities and does not include them in the categories of counterparties. As a result, it could be argued that no effective deadline is established under the Delegated Regulation for the clearing of EU entity to third country entity trades, on a literal interpretation. However, the assumption should be that third country counterparties should identify themselves into the four categories on an "as if they were" basis. This would be consistent with ESMA's July 2014 consultation paper5 and with the classification letter published by the International Swaps and Derivatives Association.6

There is an extension of the application of the clearing deadline date, subject to certain conditions being met, where one counterparty is established in the European Union and the other is established in a third country and both are part of the same group. This only applies if the counterparties fall into any of categories 1, 2 or 3. For such trades, the clearing obligation would apply from either: (i) 21 December 2018 where there is no equivalence decision for the third country entity's country of establishment; or (ii) where an equivalence decision has been adopted, the later of: (a) 60 days after an equivalence decision on the clearing obligation for IRS; and (b) the date when the clearing obligation would apply according to which category the counterparties fall into. This exemption would make little sense if third country counterparties were not a priori within scope.

Equivalence Decisions have been made for the regulatory regime for CCPs in Australia, Hong Kong, Japan, Mexico, Singapore, South Korea, South Africa, Switzerland and for the Canadian provinces of Alberta, British Columbia, Manitoba, Ontario and Quebec. The Decisions declare equivalence between the legal and supervisory regimes of those countries or provinces and EMIR for the regulation and supervision of CCPs.7 Third country CCPs in these countries that have been recognised by ESMA can be used as a venue to satisfy the clearing obligation.

The recognition of a third country CCP is also important for the clearing members of the CCPs because lower capital requirements are imposed for exposures to a recognised CCP (which is afforded QCCP status) than for exposures to a non-QCCP CCP under the EU Capital Requirements Regulation. Under the CRR transitional measures, the enhanced capital requirements would have applied for exposures to non-QCCPs from 15 June 2014. Previously, the European Commission has used its powers to extend that deadline three times and may do so again. In particular, the deadline may be extended further given that there are CCPs established in major derivatives jurisdictions, such as the US, which are not yet recognised under EMIR.

Class of IRS Subject to Mandatory Clearing

The classes of IRS that must be cleared are:

- Float-to-Float (basis) IRS that reference the Euro Interbank Offered Rate ("EURIBOR") or the London Interbank Offered Rate ("LIBOR"), have a maturity of 28 days to 50 years and are settled in either euro, pounds sterling, Japanese yen or US dollars;

- Fixed-to-Float (plain vanilla) IRS that reference the EURIBOR or LIBOR, have a maturity of 28 days to 50 years and are settled in either euro, pounds sterling, Japanese yen or US dollars;

- Forward Rate Agreements that reference EURIBOR or LIBOR, have a maturity of three days to three years and are settled in either euro, pounds sterling or US dollars; and

- Overnight Index Swaps that Reference Euro OverNight Index Average, FedFunds or the Sterling OverNight Index Average, have a maturity of seven days to three years and are settled in either euro, pounds sterling or US dollars.

ESMA recently proposed extending the scope of the clearing obligation for IRS to include fixed-to-float IRS denominated in Czech koruna, Danish krone, Hungarian forint, Norwegian krone, Swedish krona and Polish zloty to forward rate agreements denominated in Norwegian krone, Swedish krona and Polish zloty.8 The Commission has not yet adopted the proposed final draft RTS.

Exemption for Covered Bonds

Derivative contracts with covered bond issuers or with cover pools for covered bonds are exempt from the mandatory clearing obligation provided that they are:

- Only used to hedge interest rate or currency mismatches of the cover pool for the covered bond;

- Registered and recorded in the cover pool of the covered bond in compliance with national legislation;

- Not subject to termination in the event of the failure of the covered bond issuer or the cover pool;

- With a counterparty that is ranked at least pari-passu with the covered bond holders, unless that counterparty is the defaulting party or waives the pari-passu rank;

- In compliance with the requirements set out in the EU Capital Requirements Regulation, which includes disclosure of certain information by an issuer to institutional investors and rules on eligibility of assets for collaterisation;9 and

- Subject to a regulatory collaterisation requirement of at least 102%.

Calculation of Thresholds

The Delegated Regulation requires that the threshold for category 2 counterparties be based on "all of the group's non-centrally cleared derivatives, including foreign exchange forwards, swaps and currency swaps." It appears, although not expressly stated, that there is no exemption for intra-group hedging arrangements or for derivatives entered into solely for hedging purposes from the calculation of the threshold for any uncleared derivatives. This contrasts with EMIR,10 which provides that NFCs may exclude hedges for purposes of determining if they are NFC+s. The approach and language mirrors that taken in the proposed RTS on margin for uncleared derivatives11 as well as the related BCBS/IOSCO framework12 for the calculation of the threshold for the phase-in period for the margin requirements.

For AIFs or Undertakings for Collective Investment in Transferrable Securities, the EUR 8 billion threshold would apply individually at fund level.

It is not entirely clear whether counterparties must include in the threshold calculation derivatives that are cleared through a CCP that is not yet authorised13 or recognised14 by ESMA, such as any non-EU CCP. The term "non-centrally cleared" is, however, a move away from the usual EU-approved-venue-linked language in EMIR. It is therefore reasonable to assume that trades cleared elsewhere are excluded for threshold calculating purposes. However, this position should be monitored as any ESMA or European Commission Q&A become available to provide clarification.

Frontloading

Under EMIR, some derivatives might be required to be cleared if executed prior to the clearing obligation being imposed. The risk of carrying out derivatives trades whose economics might later be altered by mandatory clearing is referred to as "frontloading." Under the Delegated Regulation, frontloading has been minimized so as to apply only to FCs. Following the European Commission's notification to ESMA that it intended to adopt the final draft RTS with modifications, the start date of the frontloading obligation has been further postponed with applicable dates being determined according to the category of the counterparty, the class of IRS and the minimum remaining maturity of the derivative. The revised EU approach to frontloading goes as far as might be possible under the Level 1 text as it will provide counterparties with the time to determine which category they belong to before they become subject to the clearing obligation.

ESMA has recently recommended eliminating frontloading altogether in its response on the EMIR Review. It is unclear if this will be made law in time for the IRS clearing obligation.

The ISDA Classification Letter

ISDA published an "EMIR Classification Letter" and related guidance15 in July 2015. The Letter is intended to help counterparties to determine and communicate their classification, including the classification of third country entities, under EMIR. The Letter aims to facilitate that determination by asking a series of questions.

Comparison with the CFTC Clearing Determination

The IRS classes specified in the Delegated Regulation are largely identical to the IRS subject to the clearing determination issued on 28 November 2012 by the US Commodity Futures Trading Commission ("CFTC") pursuant to authority conferred under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "CFTC Clearing Determination").16 The CFTC Clearing Determination also covers the following classes of index credit default swaps: North American Untranched (CDX) and European Untranched (iTraxx). Market participants were required to comply with the clearing requirement for the aforementioned products triggered by the CFTC Clearing Determination on a phased-in basis similar to that contemplated under the Delegated Regulation. CFTC rules classify, for purposes of a clearing requirement, market participants as either a Category 1 Entity (dealers, major participants and private funds active in the swap market) or a Category 2 Entity (financial entities other than a non-Category 1 Entity and third party managed sub-accounts, including ERISA pension plans). Category 3 Entities are all other market participants, including third party managed sub-accounts and ERISA pension plans, which are party to a swap not subject to the end user exception to mandatory clearing. With the exception of iTraxx CDS, swaps subject to the CFTC Clearing Determination were required to be cleared from 11 March 2013, 10 June 2013 and 9 September 2013 where both parties were Category 1 Entities, Category 2 Entities and Category 3 Entities, respectively. Clearing of iTraxx CDS was required as of 26 April 2013, 25 July 2013 and 23 October 2013 pursuant to the same phased in compliance framework. As provided under the Delegated Regulation, swaps between counterparties with different category classifications were required to be cleared as of the later compliance date.

Practical Implications and Checklist for Entities Holding OTC IRS

1 Determine if you have an IRS contract with an EU counterparty and whether it falls within the class of IRS that is required to be cleared.

2 Consider which of the four categories you will fit into – see table under Scope of Clearing Obligation.

3 Determine the clearing compliance deadline according to your category and that of your counterparty.

4 Communicate your classification to your relevant counterparty/ies by either executing the ISDA Classification Letter, adhering to the NFC protocol or completing equivalent bank documentation.

5 If not already set up to clear derivatives, ensure that all policies, agreements, procedures and arrangements are in place.

6 Clear the relevant IRS by the applicable deadline.

Footnotes

1 Article 4(1) of EMIR requires mandatory clearing of certain OTC derivatives (as determined by ESMA) which are entered into between parties who are EU authorised counterparties, relevant non-financial counterparties and certain non EU entities. For further information, you may refer to Client Note OTC Derivatives Regulation and Extraterritoriality III (8 February 2013), available here.

2 Our previous client notes are available here.

3 ESMA's responses to the EMIR Review are available here. Details of the European Commission's consultation on the EMIR Review are available here.

4 Article 4(1)(a)(iv) of EMIR.

5 ESMA's consultation paper is available here.

6 ISDA's EMIR Classification letter is available here.

7 You may like to see our client note, "Update on Third Country Equivalence under EMIR," dated 18 November 2015, available here.

8 The consultation paper is available here.

9 See Article 129 of the Capital Requirements Regulation for the full set of requirements.

10 Article 11(3) of EMIR.

11 The second consultation paper is available here.

12 The revised framework published in March 2015 is available here.

13 The list of EU authorised CCPs is available here.

14 The list of non EU recognised CCPs is available here.

15 The Letter and guidance are available here.

16 The CFTC Clearing Determination differs from the Delegated Regulation in that the maximum maturity for basis and plain vanilla IRS settled in yen is 30 years, forward rate agreements settled in yen are included and the maximum maturity for overnight index swaps is two years.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.