As most employers are likely aware, effective Dec. 31, 2016, new minimum wages went into effect in New York. The rates vary for employers, depending on size and location. For those who may have missed this change, the new minimum wages are listed in the table below.

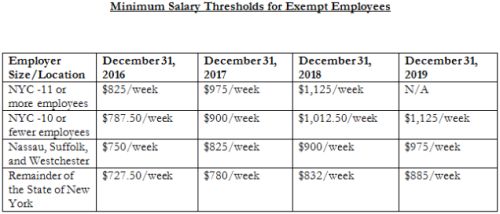

Additionally, New York employers may or may not know that the New York State Department of Labor (NYSDOL) had several proposals pending that would affect employees' pay. For instance, the NYSDOL had a proposal to raise the minimum salary threshold in order for an employee to qualify as exempt from overtime under New York law. There had been little to no conversation about the progress of the recent proposal on the NYSDOL website, but the proposal has in fact passed, and has been implemented by the new wage orders, making the new salary thresholds (and other requirements contained in the proposal) effective as of Dec. 31, 2016. Below are some highlights of the provisions of the wage orders; however, employers should be cautioned to consult with an employment attorney prior to implementing any of the changes provided below, as different requirements or restrictions may apply to a specific industry. Please feel free to contact a member of the BakerHostetler employment team, who would be happy to guide you on this process.

Maximum Amount Permitted for Tip Credit – In General Not Including the Hospitality Industry

For employees who receive tip amounts between the "low" and "high" amounts listed below, an employer may only take a credit for the "low" number listed below. For employees who receive tip amounts greater than the "high" number listed below, an employer may take a tip credit in the amount of the "high" number.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.