Many of us take our civil rights for granted. It is only when they are threatened, do we take notice and then action (well, maybe). While all rights are not created equal, when we have the ability to control certain aspects of our life, it behooves us to do so. So here is your call to arms to take advantage of your right to control the disposition of your estate when you die or face the ramifications of failing to do so.

All states recognize the right of an individual to express his or her directions as to the disposition of assets upon death via a Last Will and Testament. The states vary as to what constitutes a valid Will, but here in Maryland, it must be in writing, signed and acknowledged. Each state, in addition, has a back-up plan for those of us who die without a valid Will and have not otherwise disposed of our assets through the use of joint accounts or allowable beneficiary designations. Such "plans" are typically referred to as Intestacy Laws.

In Maryland, Sections 3-101 et seq., of the Estates and Trusts Article of the Annotated Code of Maryland, set forth the pattern of distribution at death if you do not have a Will. The laws are convoluted, but can generally be summarized as follows:

- The share of your surviving spouse,

if you have one, will be:

- ½ of the net estate if you have surviving minor children;

- $15,000.00 plus ½ of the net estate if you do not have surviving minor children, but do have surviving lineal descendants (adult children, grandchildren, great grandchildren . . . referred to under the law as "issue";

- $15,000.00 plus ½ of the net estate if you die without children or issue, but are survived by your parents;

- The entire estate if you are not otherwise survived by children, issue or parents.

- If you do not have a surviving spouse

but do have surviving issue, your net estate will be divided into

equal shares and distributed to your issue by representation.

Distribution by representation means that your closest relatives,

as a group, will inherit first (your children), and if a member of

that group has predeceased you, his or her share will be

distributed in equal shares to his or her descendants (your

grandchildren).

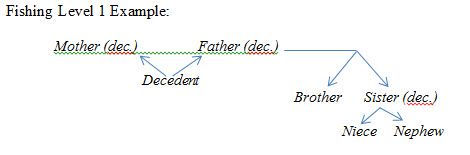

- If you have neither a surviving spouse nor surviving issue, the fishing expedition for relatives begins. It requires an analysis of blood relatives by moving up the chart of ancestors and then dropping down each step to look for an heir. It starts with your parents and, if no heir is found, it goes up to your grandparents and then your great-grandparents.

- If the fishing expedition does not result in the identification of an heir, any stepchildren will inherit by representation. If you have no stepchildren, your net estate will be paid over to the Department of Health and Mental Hygiene if you received medical assistance or to the Board of Education in the County where you lived.

Sound like a good plan? Easy to navigate with no chance of misinterpretation or litigation? Probably not. Each year thousands of Marylanders die without a Will and the result is all too often unfair and unintended distributions, family estrangement, litigation and legal fees. A simple Will, while not bulletproof, is certainly the first line of defense in avoiding the high cost, both personally and financially, of intestacy. Much better to exert your personal will by developing your own plan of distribution, selecting you own heirs and putting it all down in a valid Last Will and Testament. It's your right—don't sleep on it!

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.