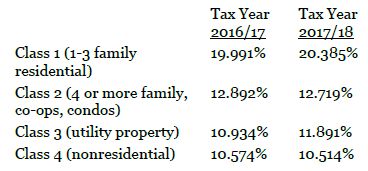

The City of New York has finalized the real estate tax rates for tax year 2017/18, which began July 1, 2017 and will end June 30, 2018. The rates for Class 2 residential properties and Class 4 nonresidential properties (i.e., commercial) are down from last year.

The following is a comparison of the annualized tax rates for tax years 2016/17 and 2017/18:

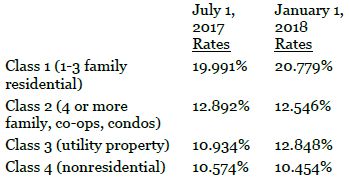

The new tax rates were not in place for the July 1, 2017 tax bill. Adjustments will be made to subsequent tax bills to reflect the changes. The tax rates to be applied for the second half of tax year 2017/18 are as follows, beginning with the tax bill due January 1, 2018:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.