High-Yield in Context

High-Yield Bonds Compared to Traditional Bank Financing

High-yield bonds (or notes) provide companies with the benefits associated with long-term debt financing but with covenants that are typically less onerous than standard credit facility covenants. In addition, the covenant package can be self-administered rather than requiring an ongoing dialogue with creditors or regular inspections by a bank lender. The high-yield bond covenant package largely does not include traditional bank financing maintenance covenants, which require that the Issuer maintain a certain financial health or the lenders can call or accelerate the loans. Instead, the high-yield covenant package includes incurrence covenants, which are evaluated only when the Issuer (or any of its Restricted Subsidiaries) seeks to take some action such as incurring indebtedness, paying a dividend or making an investment.

The high-yield covenant package rewards positive financial performance with additional flexibility, while poor financial results reduce flexibility to protect investors but does not cause a default or acceleration by itself.

As a whole, the high-yield covenant package has been designed to (i) prevent the Credit Group (consisting of the Issuer, any Guarantors and all Restricted Subsidiaries) from becoming over-leveraged by either borrowing too much or decreasing its cash-generating assets without concurrently decreasing its debt, (ii) protect the position of noteholders in the Credit Group's capital structure by limiting the ability of the Credit Group to effectively subordinate the bonds through structural or lien subordination and (iii) preserve the assets of the Credit Group and the Issuer's access to such assets. Through the covenant package, positive cash flow is preserved for debt service while transactions that could deplete assets of the Credit Group are monitored to prevent deterioration of the assets producing such cash flow. Moreover, such covenants are designed to scale with the Issuer's business as it grows in size over the lifetime of the bonds.

High-yield covenants place restrictions (with numerous carve-outs that will be discussed later) on the ability of the Credit Group to:

- incur debt;

- declare or pay dividends, invest outside the Credit Group or make certain other restricted payments that would result in value leakage out of the Credit Group;

- grant security interests over its assets (securing indebtedness other than the bonds);

- sell assets and the capital stock of subsidiaries;

- enter into affiliate transactions;

- issue guarantees of debt incurred by others;

- engage in mergers or consolidations or sell substantially all of the Issuer's or a Guarantor's assets;

- enter into new types of business activities;

- enter into transactions that would fundamentally alter the ownership structure of the credit group; and

- agree to restrictions on distributions and transfers of assets within the Credit Group.

The Ideal High-Yield Bond Candidate

High-yield bond issuers are typically (i) established companies without investment-grade ratings, (ii) private companies looking to reorganize their capital structures or (iii) companies that are the targets of a leveraged buyout financing. A high-yield issuer exhibits some or all of the following characteristics:

- stable and resilient business model;

- strong financial track record;

- growth or recovery story;

- market-leading positions in their industry or geography;

- favorable industry trends;

- experienced management team with proven track record;

- solid cash generation and future deleveraging potential; and

- financing needs of at least US$100 million.

practice tip

The typical Asian high-yield covenant package is, in many ways, stronger than the customary U.S. and European covenant packages, thereby addressing enforcement challenges (and numerous negative enforcement experiences) in certain Asian jurisdictions post-default.

The Credit Group and Building the Credit Story

Understanding high-yield debt requires knowing which entities within a corporate group need to comply with the covenants. This basic concept will impact the covenant analysis and application that we discuss later in this Guide. For complex corporate structures, this structuring aspect can get fairly complicated, but the simple principle remains: the covenants should apply to entities generating positive cash flow and holding key operating assets that noteholders will look to for repayment.

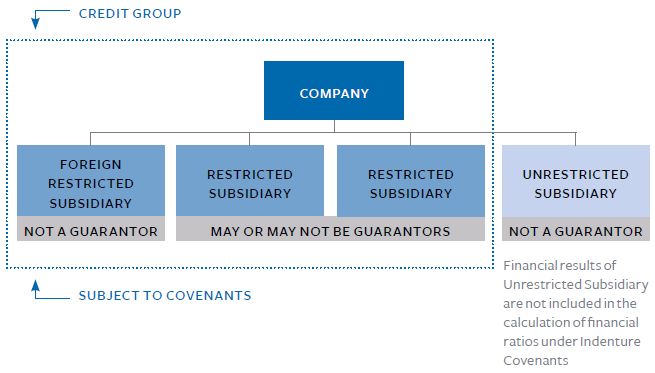

The Issuer, any Guarantors and all Restricted Subsidiaries constitute the "Credit Group" and fall within what is sometimes referred to as "the box." Only the entities comprising the Credit Group (in other words, only those entities sitting within the box) are subject to the covenant package. The covenants aim to protect the noteholders from diminution in the assets and creditworthiness of the Credit Group during the lifetime of the bonds. The financial strength and asset quality of the Credit Group form the basis of the credit story presented to investors and rating agencies, and ultimately impact the marketability and pricing of the bonds. Set forth below is an illustration of a typical Credit Group with the dotted line indicating "the box:"

THE ISSUER

The selection of the entity to act as the issuer of the bonds depends on a variety of factors such as the capital structure of the company and any existing senior debt permitted under its current obligations. However, the high-yield product encourages holding company ("HoldCo") financing with free movement of cash flows from subsidiaries to the HoldCo and vice-versa. The issuance structure matches neatly against the holding structure for many Asia-based issuers, where the offshore HoldCo will serve as the issuance vehicle with onshore operating subsidiaries deploying the proceeds from the offering.

Although technically the issuance vehicle could be either the ultimate parent holding company, an intermediate operating holding company or a lower level operating company, the Parent holding company will typically serve as the issuer. This decision will raise important tax considerations and, for certain jurisdictions, these tax considerations will be so considerable as to drive issuance structures. The classic example would be structures used by Indonesian issuers. See A Closer Look at High-Yield Bonds by Asia-Based Issuers — Key Considerations for Offerings by Indonesian Issuers.

SUBSIDIARIES: RESTRICTED AND UNRESTRICTED

The covenant package classifies all subsidiaries as either Restricted Subsidiaries or Unrestricted Subsidiaries. Restricted Subsidiaries are bound by the covenant package, which protects positive cash flow to service the bonds. Unless expressly designated as Unrestricted Subsidiaries, all subsidiaries of the issuer would be classified as Restricted Subsidiaries, meaning that their activities are subject to and limited by the covenant package contained in the indenture governing the notes. For a first-time issuer, there needs to be a good reason to exclude a subsidiary from the Credit Group. For Asia-based issuers, a classic example of a subsidiary to exclude would be a new project company, which has not yet become cash flow positive. This entity would not be directly relevant to investors on the issuance date because its cash flow isn't supporting the credit story and its assets are likely pledged to third-party project lenders. Later, when the project has been completed and is operational, the Issuer might consider re-designating the project company as a Restricted Subsidiary so as to gain the benefit of its positive cash flow on various covenants in exchange for subjecting it to the limitations imposed by the covenant package. For a discussion of the limitations and process on re-designation, see The High-Yield Bond Covenant Package — Limitation on Designation of Restricted and Unrestricted Subsidiaries.

Returning to the Credit Group, however, it is important to consider things from the other perspective: what entities properly sit outside the Credit Group? Unrestricted Subsidiaries are, by definition, not part of the Credit Group and are not subject to the covenant package. This position means that they can incur unlimited amounts of debt (on a non-recourse basis to entities in the Credit Group) and engage in transactions without applying the covenant package. This arm's-length relationship of an Unrestricted Subsidiary with the Credit Group will result in various impacts under the covenants, for example:

- the financial results of Unrestricted Subsidiaries are not included in the calculation of financial ratios under the covenants and therefore do not affect (positively or negatively) covenant compliance for the Credit Group; and

- intercompany transactions between Unrestricted Subsidiaries, on the one hand, and the Issuer and the Restricted Subsidiaries, on the other hand, are subject to greater limitations than those solely between and among Restricted Subsidiaries and the Issuer.

The high-yield covenant package seeks to limit activities by the Credit Group to avoid value being transferred outside the box and to prevent deteriorating credit actions when business performance declines. However, the Issuer may elect to grow new businesses outside the constraints of the bond covenants by forming Unrestricted Subsidiaries or re-designating Restricted Subsidiaries as Unrestricted Subsidiaries.

THE GUARANTORS

High-yield bonds are frequently guaranteed by most, if not all, of the Issuer's Restricted Subsidiaries ("Upstream Guarantees"), and in secured offerings such Guarantors also typically provide asset security for the bonds. The Upstream Guarantees give noteholders a direct claim against the relevant Guarantor Subsidiaries and their assets in the event of default by the Issuer, which overcomes some structural subordination issues. See General Observations — Subordination — Structural Subordination. If the Issuer is an entity other than the ultimate parent company, there may also be a parent guarantee ("Downstream Guarantee") in order to provide additional financial support to its subsidiary issuer.

practice tip

For investors in typical PRC high-yield structures, noteholders only receive subsidiary guarantees (and related share pledges) from non-PRC subsidiaries. In a default scenario, such structural subordination significantly limits noteholder access to onshore assets and places offshore creditors at a significant disadvantage to onshore lenders.

Often, however, a Restricted Subsidiary is required to guarantee the bonds only if it guarantees other debt of the Issuer and another Guarantor. In some jurisdictions, guarantees by foreign subsidiaries can have negative tax consequences and it is therefore necessary to consult tax specialists early in the structuring process. For example, foreign subsidiaries of U.S. issuers usually do not act as Guarantors because, under prevailing tax law, a guarantee by a foreign subsidiary of a U.S. parent company's debt is deemed a dividend, subject to certain exemptions. Additionally, in some jurisdictions, foreign subsidiaries simply cannot serve as guarantors due to regulatory hurdles or prohibitions related to such foreign subsidiary guaranteeing offshore debt.

As a general matter, the Issuer and the underwriters should consult local law experts as to any requirements for, and the validity of, subsidiary and parent guarantees under applicable fraudulent conveyance, insolvency or similar laws.

To view the full article click here

Visit us at www.mayerbrown.com

Mayer Brown is a global legal services organization comprising legal practices that are separate entities (the Mayer Brown Practices). The Mayer Brown Practices are: Mayer Brown LLP, a limited liability partnership established in the United States; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales; Mayer Brown JSM, a Hong Kong partnership, and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2018. The Mayer Brown Practices. All rights reserved.

This article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein. Please also read the JSM legal publications Disclaimer.