The great uncertainty surrounding the United States economy will undoubtedly send most manufacturers scrambling for ways to maintain revenues and cut costs. Unfortunately, Frank Lynn & Associates predicts most manufacturers will ignore what is probably the biggest opportunity to improve profitability and increase revenues. In fact, not only is it likely the largest opportunity to improve profitability and increase revenues—in most cases this opportunity also offers the quickest return on your investment.

What is this big opportunity that manufacturers are missing?

CHANNEL DISCOUNTS or more precisely CHANNEL COMPENSATION

Channel Compensation (discounts) is far and away the most mismanaged source of profits and increased revenues for manufacturers with channel partners. Consider this:

- If manufacturer's assume the average channel partner's gross margins is between 15% and 50%, then channel compensation represents between 20% and 100% of a manufacturer's total revenues

- Two studies were completed to evaluate the impact on a manufacturer's profit of a l% improvement in four different business areas metrics:

- Fixed costs

- Sales volume

- Variable costs

- Price

The results of both studies produced the same clear winner—increasing price by 1% improved profitability by almost twice the next closest alternative.

- With regard to payback on investment, Frank Lynn & Associates' experience (which is supported by a recent study) suggests that the average payback period, for efforts involving improvements of channel compensation, is 12 months or less

Why is channel compensation (discounts) the most mismanaged source of revenues and profits?

1. The CFO Does Not Track It- manufacturers do not track most forms of channel compensation, in particular discounts, on their financial statements. As a result, no one really knows how much you are spending on channel compensation—let alone how you might chose to spend it more wisely to improve profits and revenues.

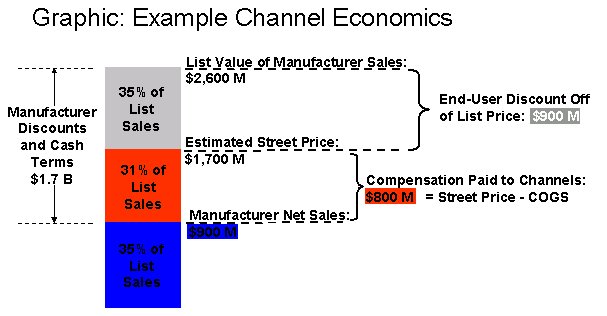

For illustration, we present a real life example of channel economics. This manufacturer collected $900M (blue) in revenue from various channel partners in exchange for their products. The channel partners then resold that product and collected $1.7B (blue plus red) from the end-user customers for that same $900M in products. This means the total channel compensation for this manufacturer $800M (red) which is equivalent to an average 47% gross margin. In effect, the channel received almost half $800M out $1.7B in end-user value for these products.

The manufacturers never viewed the economics of their business in this way and immediately undertook steps to begin spending the $800M much more wisely, recouping additional profits while at the same time demanding and achieving improved performance from channel partners.

2. Manufacturer's Do Not Understand the Law- the lack of understanding marketing anti-trust law—in particular what you can and can not do relative the Robinson-Patman and Sherman Act—creates all kinds of lost opportunities for increased profit and revenues.

Common misperceptions that undermine profits and growth:

- Everyone has to get the same price

- Once we sold the channel partner something, we can not control where it goes

- We have to sell channel partners everything we make

3. Manufacturer's Confuse Channel Partners with Customers - channel partners are not customers and by calling them customers, manufacturers begin to create a myth that will cost manufacturers' profits and revenues. If manufacturers allow channel partners rather then end-user customers to determine the value of their product and/or service, it will always be undervalued. Manufacturers have to follow their customers when they move channels, manufacturers do not have to stick with an underperforming or dying channel.

The examples we like to give is personal computers—in the early 1980s personal computers were a new product and they were first sold out of computer specialty stores like Egghead.

- 1984 - Egghead was founded

- 1988 – Egghead goes public

- 1989 – Egghead had over 100 retail stores and $350M in revenue

- 1998 – Egghead faced with the changes in consumer buying behavior and new channel competition (internet and mass merchant electronic retailers) closed all their retail stores and became an internet only retailer

- 2001 - Egghead filed for bankruptcy

In this example, you can see the channel was quickly replaced and the manufacturers had no choice, but to follow the customer to the internet and to mass merchant electronic retailers.

Regardless of reasons why channel partner discounts are not managed

well - Here are some very basic questions you should ask yourself

about your current channel compensation structure:

1. Today, which channel partners do the most for your products and brand?

2. Today, which channel partners do the least for your products and brand?

3. Which channel partners get the best deal?

a. Do the best partners always get the best pricing? Why or Why not?

4. Going forward, what things should your channel partners be doing to better support your customers and you?

a. Do they get paid more when they do those things, or conversely do they get paid less when they don't?

In conclusion, if you are struggling to meet profit and revenue goals and you have not revaluated which channel partners should or should not be getting more compensation (discounts, rebates, special incentives, special pricing, technical support, sales support, marketing funds, free freight, cash discounts, volume, quantity and order size discounts, etc...) you are missing what may be your best opportunity.

To contact Mike Kelly, call 312-559-4832 or mkelly@franklynn.com or go to the following link:

http://franklynn.com/about/?t=2539&st=3877&sst=433

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.