This post updates the public deal antitrust reverse termination fee database through September 30, 2018.

An antitrust reverse termination fee (ARTF), sometimes called an antitrust reverse breakup fee, is a fee payable by the buyer to the seller if and only if the deal cannot close because the necessary antitrust approvals or clearances have not been obtained. The idea behind an antitrust reverse termination fee is twofold: (1) it provides a financial incentive to the buyer to propose curative divestitures or other solutions to satisfy the competitive concerns of the antitrust reviewing authorities and so permit the deal to close, and (2) it provides the seller with some compensation in the event the deal does not close for antitrust reasons.

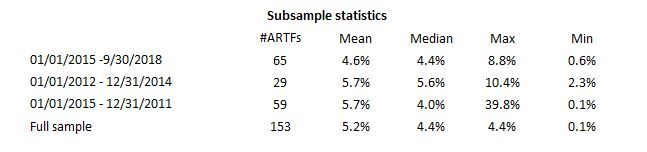

Our sample now covers 1217 strategic negotiated transactions announced between January 1, 2005, and September 30, 2018. Of these, 154 transactions, or 12.7% of the total, had antitrust reverse termination fees. The fees were very idiosyncratic and showed no statistically significant relationship to the transaction value of the deal or trend over time, with fees ranging from a low of 0.1% to a high of 39.8%. The average antitrust reverse termination fee for the entire sample was 5.2% of the transaction value, although several high percentage fees skewed the distribution to the high end. A better indicator may be the median, which was 4.4% of the transaction value.

We thought it might be helpful to give some statistics for various subsamples covering different periods so that you could get an idea of how, if at all, antitrust reverse terminations fees are varying over time.

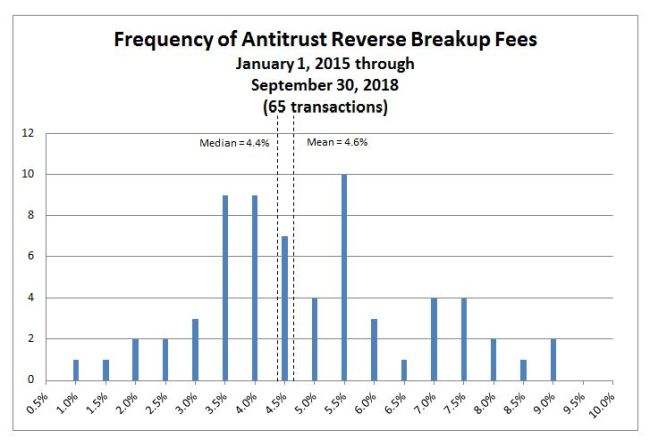

The most recent subsample covers the three-year-plus period from January 1, 2015, through September 30, 2018. This subsample covered 395 transactions, of which 65, or about 16.5%, had antitrust reverse termination fees. The fees in this sample had a mean of 4.67%, a little more than one-half of a percentage point less than the 5.2% of the full sample, and a median of 4.4%, the same as the full sample. The relative convergence of the mean and the median is consistent with a tighter distribution of the fees, which ranged from a low of 0.6% to a high of 8.8%.

The chart below gives the frequency of antitrust reverse breakup fees across the three-year-plus subsample set.

Of the 55 transactions signed since January 1, 2015, with an antitrust reverse termination fee for which the antitrust reviews have been completed, 43, or about 78%, were cleared without any antitrust challenge. Three transactions (Staples/Office Depot, Aetna/Humana, and Anthem/Cigna) were terminated after the reviewing agency obtained a preliminary injunction in federal district court, one transaction (Walgreens Boots/Rite Aid) was abandoned in the face of agency opposition, six transactions closed subject to a DOJ or FTC consent order, and one transaction (AT&T/Time Warner) is in litigation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.