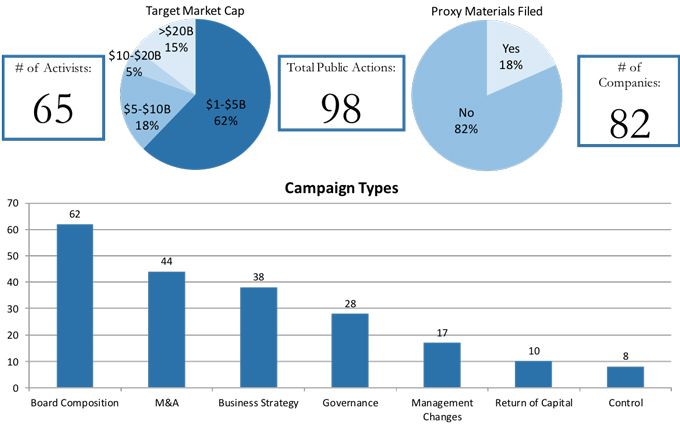

This Client Alert provides an update on shareholder activism activity involving NYSE- and Nasdaq-listed companies with equity market capitalizations in excess of $1 billion during the second half of 2018. Shareholder activism underwent a modest decline in the second half of 2017, but accelerated again in the first half of 2018. A similar pattern emerged during the second half of 2018, with a modest decline relative to the second half of 2017 in the numbers of public activist actions (40 vs. 46), activist investors taking actions (29 vs. 36) and companies targeted by such actions (34 vs. 39). However, in light of the robustness of shareholder activism activity in the first half of 2018, full-year numbers for 2018 are virtually identical to those of 2017, including with respect to the numbers of public activist actions (98 vs. 98), activist investors taking actions (65 vs. 63) and companies targeted by such actions (82 vs. 82).

During the period spanning July 1, 2018 to December 31, 2018, four of the 34 companies targeted by activists were the subject of multiple campaigns, led by Dell Technologies Inc., which was the subject of four different activist campaigns. Bunge Limited was also the subject of two simultaneous campaigns by D.E. Shaw Group and a company before settling both campaigns at the same time. As to the activists, seven out of the 29 covered in this Client Alert launched multiple campaigns. The market capitalizations of those companies reviewed in this Client Alert ranged from just above the $1 billion minimum to just under $100 billion, as of December 31, 2018 (or as of the last date of trading for those companies that were acquired and delisted).

By the Numbers – 2018 Full Year Public Activism Trends

Additional statistical analyses may be found in the complete Activism Update linked below.

Compared to the first half of 2018, activists focused their campaigns more squarely on M&A as compared to other rationales. In the case of 65% of campaigns, M&A, including advocacy for or against spin-offs, acquisitions and sales, was an activist motivation (as compared to 32% in the first half of 2018), followed by business strategy (50% of campaigns, as compared to 36% in the first half of 2018). Changes to board composition, which had gained prominence in the first half of 2018 as the most common rationale for activist campaigns, represented the goal of activists in 45% of campaigns in the second half of 2018 (as compared to 76% in the first half of 2018). On the other hand, advocacy for changes in governance (20% of campaigns in the second half of 2018), return of capital (15% of campaigns), managerial changes (13% of campaigns) and attempts to take corporate control (5% of campaigns) represented less-frequently cited rationales for activist campaigns. Proxy solicitation transpired in 15% of the campaigns, representing a modest decline relative to the first half of 2018, in which 20% of campaigns featured activists filing proxy materials. (Note that the above-referenced percentages sum to over 100%, as certain activist campaigns had multiple rationales.)

Consistent with the heightened focus on M&A and diminished attention paid by activists in their campaigns to board composition and governance, the number of publicly filed settlement agreements declined to nine (as compared to 21 in the first half of 2018). Consistent with prior trends, certain key terms have become increasingly standard in such settlement agreements. Voting agreements and standstill periods appeared in each of the settlement agreements, and non-disparagement covenants and minimum and/or maximum share ownership covenants appeared in all but one of the settlement agreements. Expense reimbursement appeared in over half of the settlement agreements reviewed (five), continuing a trend that began in the first half of 2018, when 62% of publicly filed settlement agreements contained such a provision (as compared to an historical average of 36% from 2014 through the first of 2017). Strategic initiatives did not figure prominently in settlement agreements entered into during the second half of 2018, being included in only two settlement agreements. We delve further into the data and the details in the latter half of this edition of Gibson Dunn's Activism Update.

Gibson Dunn 2018 Year-end Activism Update - Click here for complete update

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.