INTRODUCTION

There has been a wealth of conversation addressing the amendment to the definition of a "U.S. Shareholder" in the context of a controlled foreign corporation ("C.F.C.") introduced by the 2017 Tax Cuts and Jobs Act ("T.C.J.A."). The phrase "10% of the voting rights or 10% of the total value of shares of all classes of stock" has been discussed several dozen times in every tax journal by now. But how does it really affect the U.S. Persons (as defined) who find that they have become U.S. Shareholders? And, in particular, how does it affect those who own nonvoting preferred stock in a foreign corporation? This article answers those questions and provides an in-depth analysis of the allocation of Subpart F Income among U.S. Shareholders of a C.F.C.

PRE-T.C.J.A. TAX RULES

Before plunging into the issues, a quick recap of the law that existed prior to the pre- T.C.J.A.: A U.S. Shareholder was previously defined as a U.S. Person that owned shares of stock representing 10% or more of the total voting power of all stock of the foreign corporation.1

Thus, a U.S. Person holding nonvoting preferred stock representing 10% or more of the value of all shares of the foreign corporation was not treated as a U.S. Shareholder. However, the percentage of value owned by that U.S. Person was taken into account for purposes of determining whether a foreign corporation was a C.F.C. Thus, even if the foreign corporation was a C.F.C., the U.S. Person was not subject to U.S. tax under Subpart F since the person failed to meet the definition of a U.S. Shareholder, provided that the two classes of stock had economic substance and were not a subterfuge to avoid the scope of Subpart F.2

The T.C.J.A. expanded the definition of a U.S. Shareholder to include a U.S. Person that owns shares representing 10% or more of the value of all shares of the foreign corporation.3

As a result, a U.S. Person holding only nonvoting preferred shares will be swept within the definition of a U.S. Shareholder if the value of the nonvoting preferred shares is 10% or more of the total value of shares of all classes of stock.4 The pro rata share of the corporation's Subpart F Income will be included in the gross income of the U.S. Shareholder. If the U.S. Person is an individual, the person will be taxed at ordinary tax rates (i.e., the tax rate based on the tax bracket applicable to the U.S. Shareholder and not the highest effective tax rate).5 In the case of a corporation, Subpart F Income is taxed at 21%.

ALLOCATION OF SUBPART F INCOME

Once a U.S. Person becomes a U.S. Shareholder of a C.F.C., that person is required to include a pro rata share of the C.F.C.'s Subpart F Income in gross income.6 The determination of the pro rata share of Subpart F Income is dependent on several factors, such as the following:

- Whether the foreign corporation is a C.F.C. for the full tax year

- Whether the U.S. Person is a U.S. Shareholder for the full tax year

- Whether the C.F.C. declared actual dividends during the year to prior owners of the same shares

- Whether the C.F.C. has one or more classes of stock outstanding

- Whether the board of directors of the C.F.C. has discretionary rights to distribute dividends to the stockholders

How Subpart F Income is allocated to a U.S. Shareholder and the effect of the above factors are the main focus of this article.

The Code and the regulations provide a complex formula to determine a U.S. Shareholder's pro rata share of Subpart F Income includable in gross income. Generally, a U.S. Shareholder's pro rata share is the amount that would have been received with respect to stock owned in the C.F.C. under the rules of Code §958(a) if the C.F.C. actually distributed its Subpart F Income ("Hypothetical Distribution") as dividends to shareholders on the last day of its taxable year ("Hypothetical Distribution Date").7 In simplest terms, the pro rata share of Subpart F Income can be determined in the following steps:8

- A Hypothetical Distribution of Subpart F Income is deemed to have been made on the last day of the tax year in which the foreign corporation is a C.F.C.

- The Hypothetical Distribution is limited to the amount that is attributable to the period for which the foreign corporation is a C.F.C. In other words, the total Subpart F Income under Step 1 is multiplied by the percentage of the year during which the foreign corporation qualifies as a C.F.C.

- The amount determined in Step 2 is allocated to the U.S. Shareholder based on the percentage of its ownership interest held in the C.F.C. For Step 3, the direct and indirect ownership determined under Code §958(a) is considered. Stock owned constructively under Code §958(b) using modified constructive ownership rules of Code §318 is ignored in this step.

- The amount determined under Step 3 is

reduced by the lesser of the following to arrive at the pro

rata share of Subpart F Income of the C.F.C. attributable to

the U.S. Shareholder:

- The amount equal to the actual dividends received by persons other than the U.S. Shareholder (i.e., prior stockholders, if any) with respect to the same shares of stock

- The amount that the prior stockholders would have received if the total distributions had equaled the foreign corporation's Subpart F Income for the year multiplied by the percentage of the year during which the U.S. Shareholder did not own the stock (directly or indirectly)

DETERMINATIONS IN VARIOUS FACT PATTERNS

A C.F.C. with Only One Class of Stock Outstanding

When a C.F.C. has only one class of stock outstanding during the year, a U.S. Shareholder's pro rata share of the C.F.C.'s Subpart F Income is the amount that would have been received by such U.S. Shareholder had the C.F.C. made a pro rata dividend distribution of its Subpart F Income to all of its shareholders on the last day of its taxable year. Subpart F Income is allocated on a per share basis.9 The above can be illustrated with the help of the following examples:

Example 1

Facts:

F.C. X is a foreign corporation. One hundred shares of common stock are outstanding for the entire year. On January 1, 2018, A, a U.S. Person, owns 60 shares and B, also a U.S. Person and A's spouse, owns 10 shares of the common stock. The remaining 30 shares are owned by foreign persons. F.C. X is a C.F.C. under Code §957(a). On May 26, 2018, A sells all holdings of the F.C. X stock to C, a foreign individual. At that point, only 10% of the F.C. X stock is owned by a U.S. Person, B Consequently, F.C. X ceases to be a C.F.C. after May 26, 2018. All parties have the calendar year as the tax year. F.C. X has $100 of Subpart F Income for the entire 2018 tax year and has $200 of earnings and profits ("E&P"). It makes no distributions during 2018.

Analysis:

A and B are U.S. Shareholders under Code §951(b) since both own 10% or more of the stock of F.C. X. In addition, F.C. X is a C.F.C. because more than 50% of the voting power is owned by U.S. Shareholders, A and B. The pro rata share of F.C. X's Subpart F Income allocable to A and B can be determined by following the above-mentioned steps:

- A Hypothetical Distribution of Subpart F Income is deemed to have been made on the last day of the tax year in which F.C. X is a C.F.C. Thus, it is assumed that F.C. makes a distribution of its Subpart F Income of $100 as on December 31, 2018.

- The E&P for the year exceeds the Subpart F Income, and for that reason, the limitation based on E&P is not relevant.

- The total Subpart F Income under Step 1 is multiplied by the percentage of the year during which F.C. X is a C.F.C. to ensure that only the Subpart F Income attributable to the period during which F.C. X is a C.F.C. is allocated to the U.S. Shareholders. F.C. X's Subpart F Income for the period during which it is a C.F.C. (January 1, 2018 through May 26, 2018) is $40 ($100 * 146 / 365).

- When a C.F.C. has only one class of stock, Subpart F Income is allocated on a per share basis. Stated differently, it is allocated based on the percentage of the ownership interest held by the U.S. Shareholders in the C.F.C. A must include $24 in his gross income as his pro rata share of Subpart F Income for 2018 (60 shares / 100 shares * $40). Although Code §958(b) treats A as constructively owning B's 10% interest in F.C. X under spousal attribution rules, such constructive ownership is ignored in computing A's pro rata share of F.C. X's Subpart F Income. Similarly, B must include $4 in her gross income as her pro rata share of Subpart F Income for 2018 (10 shares / 100 shares * $40). The constructive ownership of A's 60% interest in F.C. is ignored when determining B's pro rata share of Subpart F Income.

Example 2

Facts:

The facts are the same as in Example 1, except that A initially acquired 60% of the stock of F.C. X on May 26, 2018, from N, a foreign person who owned the stock interest for many years. Thus, N owned the shares at all times in 2018 leading up to the date of sale. Before A's acquisition of the shares of stock in F.C. X, F.C. X distributed a dividend of $15 to N in 2018 with respect to the shares of stock subsequently sold to A.

Analysis:

- A Hypothetical Distribution of F.C. X's Subpart F Income ($100) is made as of December 31, 2018.

- The total Subpart F Income under Step 1 is multiplied by the percentage of the year during which the foreign corporation was a C.F.C. F.C. X is a C.F.C. from May 26, 2018, through December 31, 2018, because more than 50% of the voting rights of all shares is held by U.S. Shareholders. Subpart F Income allocable to the period from May 26 through December 31, 2018 (219 out of 365 days) is $60 ($100 * 219 / 365).

- Subpart F Income determined under Step 2 is allocated to A based on his ownership interest in F.C. X. A's pro rata share of Subpart F Income is $36 (60% of $60). Similarly, B's pro rata share of Subpart F Income is $6 (10% of $60).

- A's pro rata share of

Subpart F Income under Step 3 is reduced by the lesser of the

following:

- The amount equal to the actual dividends received by N with respect to the same stock as owned by A as on December 31, 2018 (i.e., $15)

- The amount that N would have received if the total distributions had equaled the foreign corporation's Subpart F Income for the year multiplied by the percentage of the year during which the U.S. Shareholder did not own the stock directly or indirectly (i.e., $24 or 60% of $100 * 143 / 365)

The determination of the pro rata share of Subpart F Income of a U.S. Person who owns 10% or more of the stock (by reason of having 10% or more of the voting power as opposed to owning 10% or more of the total value) in a foreign corporation does not require continuous vigilance. This is because a U.S. Person typically enters into a stockholder's agreement with the corporation, which grants the voting rights, and the U.S. Person is treated as owning the stock from the effective date of the agreement. Thus, Subpart F Income can be prorated for the period starting from the effective date of the agreement through the end of the C.F.C.'s tax year or an earlier date where the U.S. Shareholder sold its stock before the end of the tax year.

In comparison, the determination of the pro rata share is uncertain in case of a U.S. Person who owns 10% or more of the total value of all classes of stock. The 10%-of-value threshold requires continuous analysis throughout the year and is not confined only to the last day of the C.F.C.'s tax year. Thus, if a U.S. Person is said to own 10% or more of the total value of the foreign corporation at any time of the year, the foreign corporation will be treated as a C.F.C. where all other conditions are met for C.F.C. status to exist. Consequently, the change in the definition of a U.S. Shareholder causes a foreign corporation to be mindful of its net worth and the total value of all shares of stock held by U.S. Persons. Hence, a foreign corporation is at risk if it does not undertake a valuation of its net worth and the value of each class of shares – or perhaps each sizeable block of shares under common ownership – each time it makes substantial investments or earns considerable profits.

When a C.F.C. Has More than One Class of Stock Outstanding and One or More Classes of Stock Have Only Nondiscretionary Distribution Rights

The abovementioned standalone four-step analysis is relatively straightforward for a C.F.C. having only one class of stock. However, Treas. Reg. §1.951-1(e)(3)(i)10 requires additional analysis for a C.F.C. having more than one class of stock outstanding of which one or more of the outstanding classes of stock have only nondiscretionary distribution rights. A class of stock is said to have nondiscretionary distribution rights if the corporation is obligated to declare a fixed rate of return based on the face value of the shares (e.g., fixed rate of 5% on face value of preferred stock).

Treas. Reg. §1.951-1(e)(3)(i) provides as follows:

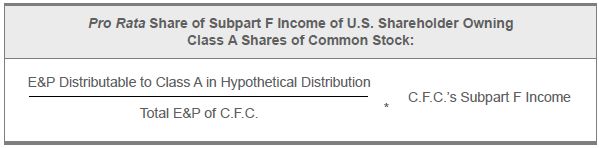

If a controlled foreign corporation for a taxable year has more than one class of stock outstanding, the amount of such corporation's subpart F income . . . for the taxable year taken into account with respect to any one class of stock . . . shall be that amount which bears the same ratio to the total of such subpart F income . . . for such year as the earnings and profits which would be distributed with respect to such class of stock if all earnings and profits of such corporation for such year (not reduced by actual distributions during the year) were distributed on the last day of such corporation's taxable year on which such corporation is a controlled foreign corporation (the hypothetical distribution date), bear to the total earnings and profits of such corporation for such taxable year.

Let's translate the above into English and then see how the underlying arithmetic works in practice. Broken into is principal clauses, the foregoing provision of the regulations provides as follows: Subpart F Income attributable to a class of stock will be (i) that proportion of the C.F.C.'s Subpart F Income that (ii) the E&P Distributable to such class in a Hypothetical Distribution of all the C.F.C.'s E&P (not reduced by actual distributions) would bear to (iii) the C.F.C.'s total E&P for the year.

In other words, the numerator (E&P Distributable) is the amount of the E&P that would have been distributed to a particular class of stock (Class A) if the entire E&P was deemed to have been distributed at the end of the C.F.C.'s tax year.

Consequently, if a C.F.C. has only one class of stock, Subpart F Income is deemed to be distributed on the Hypothetical Distribution Date based on the ownership of that single class. In comparison, when the C.F.C. has more than one class of stock:

- The first step is to compute E&P rather than Subpart F Income.

- The second step is to allocate the E&P Distributable based on the way it would be distributed to the holders of the various classes of shares on the Hypothetical Distribution Date.

- Once the E&P Distributable is computed and then allocated to each particular class of shares, the third step is that Subpart F Income is allocated in the same percentages to each of those classes.

- The final step within each class of shares is to apportion the Subpart F Income allocable to each share within a particular class, which is deemed to be distributed on the distribution date. In essence, the last step of the process follows the default rule when only one class of stock is issued and outstanding. The attribution of Subpart F Income among holders of various classes of shares follows the waterfall of earnings among those classes.

Meaning of E&P Distributable with Respect to Preferred Stock

With respect to a preferred stock that has the right to a fixed rate of return (viz., non-discretionary distributions), this amount is typically the amount of the dividends mandatorily payable to the preferred stockholders prior to the distribution of dividends to holders of common shares. The preference must be honored, and the board of directors must have an actual obligation to pay the nondiscretionary dividends prior to discretionary dividends. If the terms of the shareholder's agreement are such that the obligation to pay the dividend may or may not arise in the C.F.C.'s taxable year in question (depending on an exercise of discretion by the C.F.C.'s board of directors), the stock will be deemed to have discretionary distribution rights. In such cases, the allocation rule under Treas. Reg. §1.951-1(e)(3)(ii) would apply (discussed in the next section of the article).11

Meaning of E&P Distributable with Respect to Common Stock

The balance of the E&P remaining after paying the nondiscretionary distributions is the E&P Distributable to the common stockholders.

A Stock Redemption Amount Is Not Treated as E&P Distributable in the Hypothetical Distribution

In determining E&P Distributable to a class of stock, the amount paid in redemption of a class stock, in liquidation, or as a return of capital is ignored.12 The rule applies even if the redemption is treated as a dividend under Code §302(a). This implies that if the preferred stock is redeemed by a C.F.C., the redemption amount is not treated as E&P Distributable to the preferred stock in the Hypothetical Distribution. In other words, the redemption amount is not included in the numerator of the formula used for calculating the pro rata share of Subpart F Income of the preferred shareholder.

The above provision serves as an anti-abuse rule to prevent the shifting of Subpart F Income to a non-U.S. Person who owns redeemable or retractable shares of preferred stock of a C.F.C. in circumstances where the redemption would be treated as a dividend for U.S. income tax purposes. Dividend treatment is mandated where the redemption fails to meet any of the tests of Code §302(b):

- It is essentially equivalent to a dividend.13

- It is not substantially disproportionate redemption.14

- It is not a redemption of all of a shareholder's stock.15

- It is not a partial liquidation.16

An example would involve (i) a non-U.S. Person (ii) who holds 80 shares of common stock in a non-U.S. corporation for which 100 shares of common stock have been issued and are outstanding and 50 shares of preferred stock bearing a coupon have been issued and are outstanding; (iii) ten shares of preferred shares are redeemed; (iv) the foreign country treats the redemption as a sale or exchange for tax purposes; and (v) U.S. tax law treats the redemption as a dividend under Code §302(d).17 (It is assumed that the preferred shares do not meet the definition of Section 306 Shares.)18 In the foregoing circumstances, the redemption is not substantially disproportionate because (i) none of the tests described in note 17 have been met, (ii) the redemption is essentially equivalent to a dividend, and (iii) neither of the remaining tests for capital gain distribution are applicable to the facts. Consequently, the redemption proceeds will be given dividend treatment to the extent of the E&P of the foreign corporation. Nonetheless, the transaction does not attract any of the C.F.C.'s E&P for purposes of apportioning Subpart F Income. Stated differently, the amount of the redemption price is not includible in E&P Distributable to the class of shares redeemed. See Example 8, below.

The method of computing the amount of E&P Distributable to a class of stock can be illustrated with the help of the following examples.

Example 319

Facts:

F.C. X, a C.F.C., has issued 70 shares of common stock and 30 shares of nonparticipating, voting, preferred stock having a par value of $10 per share and bearing a coupon of 4%. All of the shares are outstanding in 2018. The common shareholders are entitled to dividends when declared by the board of directors. Corp A is a U.S. corporation and a U.S. Shareholder of F.C. X. It owns all of the common shares. Individual B, a foreign individual, owns all of the preferred shares.

For 2018, F.C. X has $100 of E&P, of which $50 arises from Subpart F Income. In 2018, F.C. X distributes nondiscretionary dividends of $12 (4% of $300) to Individual B with respect to his preferred shares. F.C. X makes no other distributions during that year.

Analysis:

- F.C. X has two classes of stock – common stock and preferred stock.

- The class of preferred stock has a nondiscretionary distribution right to receive 4% dividends each year. Therefore, Subpart F Income will be allocated in accordance with Treas. Reg. §1.951-1(e)(3)(i).

- If $100 of E&P were distributed on December 31, 2018, $12 would be mandatorily distributed with respect to Individual B's preferred shares.

- The remainder, $88, would be distributed with respect to Corp A's common shares.

- Accordingly, under Treas. Reg. §1.951-1(e)(3)(i), Corp A's pro rata share of F.C. X's Subpart F Income is $44 for taxable year 2018 ($88 / $100 * $50).

- The 4 Step analysis is not required since F.C. X is a C.F.C. for the full taxable year, Corp A owns 100% of the common stock, B owns 100% of the preferred stock, and no actual dividends have been distributed by F.C. X other than the 4% dividend on preferred shares.

Example 4

Facts:

F.C. X, a C.F.C. has issued the following classes of stock, all of which are outstanding:

- 50 shares of common stock, of which A, a U.S. citizen, owns 30 and N, a foreign individual, owns 20

- 120 shares of nonparticipating, nonvoting, preferred stock with a par value of $100 per share and bearing a coupon of 6% (30 shares owned by A and 90 shares owned by N)

For 2018, F.C. X has $1,000 of E&P, of which $500 arises from Subpart F Income.

Analysis:

- F.C. X has two classes of stock: common stock and preferred stock.

- The preferred stock provides for a nondiscretionary distribution right to receive 6% dividends each year. Therefore, Subpart F Income will be allocated in accordance with Treas. Reg. §1.951-1(e)(3)(i).

- The 4-Step analysis will be required

to determine the pro rata share of Subpart F Income

allocable to A since he owns less than 100% of the common stock and

preferred stock.

- If F.C. X makes a Hypothetical

Distribution on the last day of its tax year (i.e.,

December 31, 2018), the E&P of $720 (6% of $12,000) would be

distributed with respect to the preferred stock. Accordingly,

Subpart F Income allocated to the preferred stock is $360 ($720 /

$1,000 * $500).

The balance E&P of $280 ($1,000 - $720) would be distributed with respect to the common stock. Accordingly, Subpart F Income allocated to the common stock is $140 ($280 / $1,000 * $500). - Step 2 is not relevant for the analysis of the present example because F.C. X is a C.F.C. for the full year.

- Once Subpart F Income attributable to

a class of stock is determined, further allocation to different

shareholders holding that class of stock is done on a per share

basis.20

A's pro rata share of Subpart F Income allocable to the preferred stock is $90 (30 shares / 120 shares * $360). A's pro rata share of Subpart F Income allocable to the common stock is $84 (30 shares / 50 shares * $140). Therefore, total Subpart F Income includable in A's gross income for 2018 is $174 ($90 + $84). The remaining $90 of actual preferred dividends distributed ($180 - $90) will be treated as qualified dividends taxed at 20% for an individual, if all required conditions are met. If A were a U.S. corporation, then the remaining dividends would likely be exempt under Code §245A, if all of required conditions are satisfied. - Step 4 is not relevant since the E&P is not reduced by the amount of the actual dividends as, mentioned in Treas. Reg. §1.951-1(e)(3)(i).

- If F.C. X makes a Hypothetical

Distribution on the last day of its tax year (i.e.,

December 31, 2018), the E&P of $720 (6% of $12,000) would be

distributed with respect to the preferred stock. Accordingly,

Subpart F Income allocated to the preferred stock is $360 ($720 /

$1,000 * $500).

To view this article in full, please click here.

Footnotes

1. Code §951(b) under the pre-T.C.J.A. law.

2. If on the other hand, U.S. Shareholders formally owned shares representing 50% or less of the corporation's voting power, the corporation could be a C.F.C. if control existed in disguised form. See, e.g., Treas. Reg. §1.957-1(b)(2), which provides in part that "any arrangement to shift formal voting power away from United States shareholders of a foreign corporation will not be given effect if in reality voting power is retained." While this provision addresses the definition of a C.F.C. rather than a U.S. Shareholder, the principle is similar if the effect is that a U.S. Person owns shares that effectively control the foreign corporation.

3. Code §951(b) as amended by the T.C.J.A.

4. The theory is that if a U.S. Person owns shares representing substantial value, the person will take steps to protect its interest in the operations of the foreign corporation.

5. Code §951(a)(1).

6. Code §951(a)(1)(A).

7. Code §951(a)(2); Treas. Reg. §1.951-1(b).

8. Id.

9. Treas. Reg. §1.951-1(e)(2).

10. The I.R.S. issued proposed regulations on October 10, 2018, amending Treas. Reg. §1.951-1(e)(3) to provide that the E&P Distributable among different classes of stock is based on the distribution rights (as opposed to the fair market value test (as discussed later in the article) of each class. Further, the distribution rights of a class are determined by taking into account all facts and circumstances related to the economic rights and interest in the current E&P of each class, including the terms of the class of stock and any agreement between the shareholders. However, these rules will be effective only after they become final. In the meantime, the current final regulation s are effective.

11. Preamble to Final Treasury Regulations 1.951-1 dated August 9, 2005

12. Treas. Reg. §1.951-1(e)(3)(i).

13. Code §302(b)(1). This test is a catch-all that applies when none of the objective tests are met. It is a facts and circumstances test, which allows capital gain treatment for the redemption.

14. Code §302(b)(2).

15. Code §302(b)(3).

16. Code §302(b)(4).

17. Code §302(b)(2)(B) sets an objective standard by which a redemption would be treated as substantially disproportionate. In broad terms, (i) the shareholder receiving the distribution must own shares representing less than 50% of the total combined voting power, (ii) the percentage of voting shares must be reduced by more than 20%, and (iii) the percentage of common shares held in the corporation – whether voting or nonvoting – must be reduced by more than 20%.

18. Under Code §306, the amount realized from the redemption of Section 306 Shares is treated as a dividend. If the amount realized results from a sale, it is treated as ordinary income.

19. Based on Treas. Reg. §1.951-1(e)(6), ex.2

20. Treas. Reg. §1.951-1(e)(2).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.