An antitrust reverse termination fee (ARTF), sometimes called an antitrust reverse breakup fee, is a fee payable by the buyer to the seller if and only if the deal cannot close because the necessary antitrust approvals or clearances have not been obtained. The idea behind an antitrust reverse termination fee is twofold: (1) it provides a financial incentive to the buyer to propose curative divestitures or other solutions to satisfy the competitive concerns of the antitrust reviewing authorities and so permit the deal to close, and (2) it provides the seller with some compensation in the event the deal does not close for antitrust reasons.

Our sample now covers 1282 strategic negotiated transactions announced between January 1, 2005, and June 30, 2019. Of these, 157 transactions, or 12.2% of the total, had antitrust reverse termination fees. The fees were very idiosyncratic and showed no statistically significant relationship to the transaction value of the deal or trend over time, with fees ranging from a low of 0.1% to a high of 39.8%. The average antitrust reverse termination fee for the entire sample was 5.2% of the transaction value, although several high percentage fees skewed the distribution to the high end. A better indicator may be the median, which was 4.4% of the transaction value.

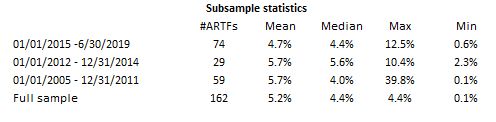

We thought it might be helpful to give some statistics for

various subsamples covering different periods so that you

could get an idea of how, if at all, antitrust reverse terminations

fees are varying over time.

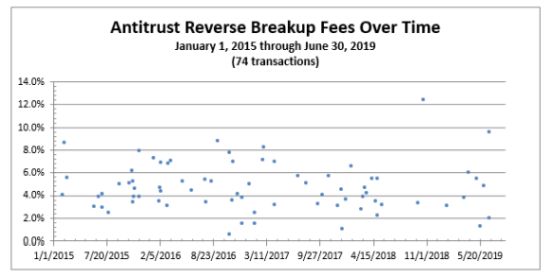

The most recent subsample covers the four-year period from January 1, 2015, through June 30, 2019. This subsample covered 356 transactions, of which 74, or about 20.8%, had antitrust reverse termination fees. The fees in this sample had a mean of 4.7%, 0.5 percentage points less than the 5.2% of the full sample, and a median of 4.4%, the same as the full sample. The relative convergence of the mean and the median is consistent with a tighter distribution of the fees, which ranged from a low of 0.6% to a high of 12.5%.

Of the 74 transactions signed since January 1, 2015, with an antitrust reverse termination fee, the antitrust reviews have been completed for 65 transactions. Of the transactions for which reviews have been completed, 50, or about 77%, were cleared without any antitrust challenge. Three transactions (Staples/Office Depot, Aetna/Humana, and Anthem/Cigna) were terminated after the reviewing agency obtained a preliminary injunction in federal district court, one transaction (Walgreens Boots/Rite Aid) was abandoned in the face of agency opposition, nine transactions closed subject to a DOJ or FTC consent order, one subject to a Public Utilities Commission order, and one transaction (AT&T/Time Warner) defeated an Antitrust Division preliminary injunction challenge and closed (the DOJ has appealed).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.