A Health Savings Account (HSA) is a popular vehicle for paying health care costs. Employees find HSAs attractive because they can control the amount of money contributed, determine when to withdraw money, and enjoy the benefits of what is essentially a tax-favored savings account – money can be contributed, earned, and distributed for qualified expenses on a tax-free basis. Not to mention the fact that HSAs are portable.

In order to participate in an HSA, an employee must be enrolled in a high deductible health plan (HDHP) that meets specific IRS guidelines. Because qualifying HDHP coverage is a precondition for HSA contributions, employers must ensure that their HDHPs are compliant with an ever-evolving matrix of federal guidelines impacting the plan coverage.

One fundamental requirement of an HDHP is that it may not provide benefits in any plan year until the deductible for that plan year is satisfied. However, the IRS provides an exception to that general rule for certain types of "preventive care" – preventive care provided without cost sharing under the ACA (mandatory), and preventive care that may be provided with no or low-cost sharing or lower deductibles, via other applicable IRS guidance and safe harbors (permissive).

So What's New?

On June 24, 2019, President Trump issued Executive Order 13877, requiring the Treasury Department and IRS to consider ways to lawfully expand the use and availability of HSA-HDHPs, specifically the accessibility of preventive care coverage for individuals with existing chronic conditions. On July 17, 2019, the IRS issued Notice 2019-45, guidance on the subject in response to the executive directive. It became effective immediately upon publication.

In Notice 2019-45, the IRS and Treasury Department reiterated and confirmed that preventive care does not generally include services, benefits, or treatment for existing conditions, illnesses, or injuries. However, the agencies acknowledged the serious complexities – and harsh impacts – associated with applying this rule to persons with chronic conditions.

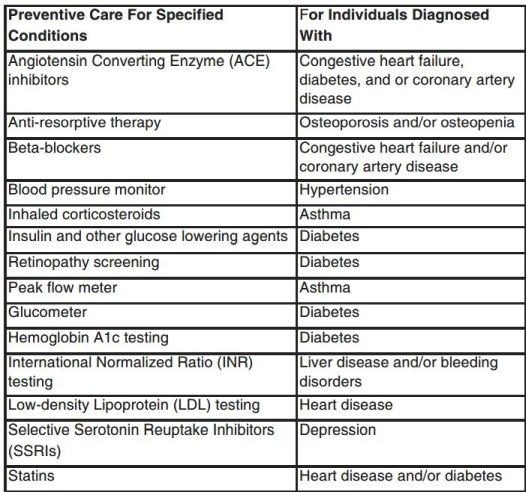

Upon consultation with the Department of Health and Human Services, the IRS and Treasury Department provided a specific "List of Additional Preventive Care Services and Items For Chronic Conditions That May Be Treated As Preventive Care For Purposes of Section 223(c)(2)(C)" – i.e., preventive care benefits that can be provided under a HDHP without impacting a participant's ability to contribute to an HSA.

The Appendix reads as follows:

The IRS and Treasury Department commented on characteristics shared by the medical services and items, namely:

- The service or item is low-cost;

- There is proven evidence of a large impact to preventing the exacerbation of the chronic condition or development of a secondary condition; and

- There is clinical documentation and strong likelihood that use of the specific service or item will prevent the exacerbation of the chronic condition or development of a secondary condition that requires significantly higher cost treatments.

Although the criteria used to compile the list was shared, the drafters noted three very important points. First, they reiterated that the items listed in the Appendix, and the criteria used to select those items, do not expand the scope of preventive care. Second, Notice 2019-45 does not alter the ACA's definition of preventive care benefits, so those benefits must continue to be offered without cost-sharing. Third, although the items on the list are considered preventive, for IRC §223 purposes (which are permissive), they are not considered preventative for ACA purposes (which are mandatory) – therefore the new preventive care benefits for chronic conditions can be subject to copays, coinsurance, and deductibles.

What Does This Mean For Plan Sponsors?

The Guidance in Notice 2019-45 became effective immediately, so plan sponsors may amend their HDHPs now or incorporate changes at the start of the next plan year. Also, plan sponsors may permit the plan to cover the specified preventive care benefits for chronic conditions at no cost or with some form of cost sharing.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.