The new, modernised Swiss inheritance law came into force on 1 January 2023. The revision has important practical implications – also with regard to the existing inheritance contracts and last wills.

OVERVIEW

The Swiss inheritance law as in force until the end of 2022 was more than a century old, its main features having remained unchanged ever since its adoption in 1907. Social developments, such as the acceptance of new family models and lifestyles or the creation of social welfare schemes to provide security for the older generation, have fundamentally changed the requirements for estate planning options and prompted the Swiss legislator to adapt inheritance law provisions accordingly.

The focus of the new law is on the testator's increased freedom of disposition deriving from a reduction so-called forced heirship shares. These minimum shares in the estate, which the law guarantees to certain heirs, are reduced or eliminated under the new law, so that the testator can freely dispose of a larger portion of his or her assets. Notably, the revised law reduces the forced heirship share of descendants or it states that in cases where a spouse predeceases his or her partner during ongoing divorce proceedings, the surviving spouse is no longer entitled a forced heirship share.

The revision was also an opportunity to clarify several technical issues. The Federal Council, however, decided to treat these issues separately. Likewise, it decided to use a separate revision to address the reform of Swiss inheritance law regarding succession of family businesses. These two legislative projects are currently in progress; the Federal Council passed a draft bill focusing on the facilitation of company succession on 10 June 2022. However, the new reforms are still subject to discussions in the parliament and the resulting modifications will only become effective in the years to come.

REDUCTION OF FORCED HEIRSHIP SHARES

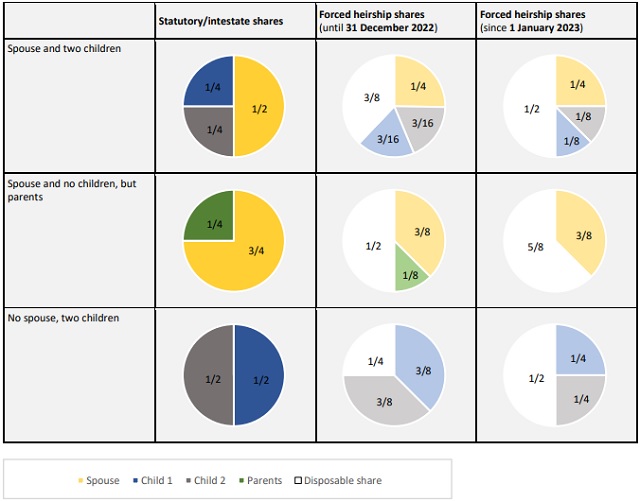

The statutory heirship shares, defined as the shares of the estate provided by law in the absence of a last will or inheritance contract (so-called intestate succession) are not affected by the new law. However, the statutory heirship shares form the basis for the calculation of the forced heirship share, which have been changed as follows:

Under the old law, descendants, the surviving spouse, registered partner and, in the absence of descendants, the parents of the deceased were entitled to a forced heirship share.

The forced heirship share of the descendants amounted to three quarters (3/4) of their statutory heirship share. Since 1 January 2023, the forced heirship share of the descendants only amounts to one half (1/2) of their statutory heirship share. The latter remained unaffected by the inheritance law revision and depends on whether the deceased was married, and on his or her number of descendants.

For the surviving spouse or registered partner, the forced heirship share according to the new inheritance law remains unchanged. The spouse's or registered partner's statutory heirship share, depends on whether the deceased leaves, in addition to the surviving spouse or registered partner, direct descendants or whether there are relatives in the parental lineage of the deceased.

Under the previously applicable law, the parents of the deceased were entitled to a forced heirship share of one half (1/2) of their statutory heirship share if the testator was not survived by any descendants. The inheritance law revision has completely abolished this forced heirship share for the older generation and increased the freedom of disposal of childless testators accordingly.

To sum up and put it simply, descendants, spouses and registered partners have an equal forced heirship share amounting to one half (1/2) of their statutory heirship share since 2023, resulting from the reduction of the descendants' forced heirship share from three quarters (3/4) to one half (1/2), while spouses and registered partners continue to be entitled to one half (1/2) of their statutory heirship share. The example (see box) and the illustrations below serve to further illustrate the amended legal situation.

Example: A testator is survived by two descendants (A and B) and her spouse. Her entire estate consists of liquid assets amounting to CHF 1'000'000. According to the previousforced heirship law provisions, the surviving spouse would have been entitled to CHF 250'000, A and B to CHF 375'000 (CHF 187'500 each). The testator would thus have been free to allocate the remaining CHF 375'000 to her spouse and children or to give them to a third party (e.g., a charitable organisation). Under the new law, the surviving spouse would still be entitled to a forced heirship share of CHF 250'000, whereas A and B would only be entitled to CHF 250'000 (CHF 125'000 each). While under the old law, the testator in this example could freely dispose of CHF 375'000, she would be allowed to freely dispose of CHF 500'000 according to the new law.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.