CHAPTER I: PARTNERSHIPS IN THE LUXEMBOURG TOOLBOX

1. TYPES OF PARTNERSHIPS

Although the SCS, SCSp and SCA are all "partnerships", the SCS and the SCSp are comparable to Anglo-Saxon types of partnerships, whereas the SCA is similar to a public limited liability company (société anonyme or "SA").

Therefore, although it is still subject to some flexibility, the SCA remains a more continental type of partnership subject to several corporate requirements.

Managers who are contemplating launching a vehicle in the form of an SCS should also carefully consider the few key differences between the SCS and the SCSp.

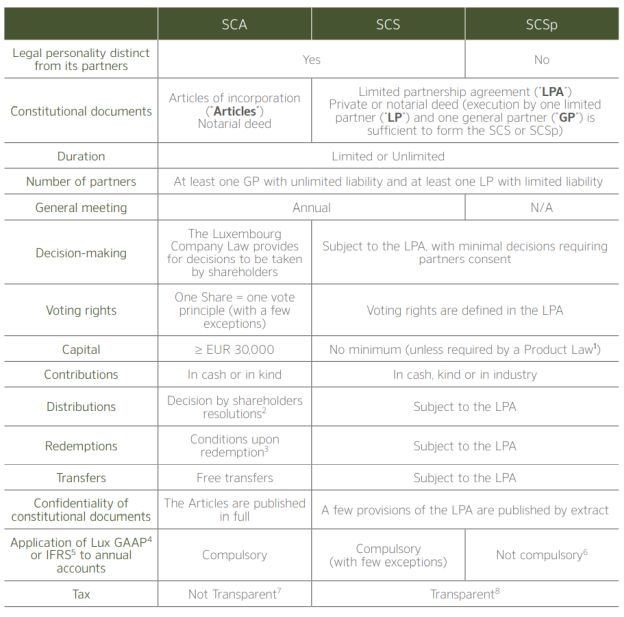

The following table offers a comparison of the main distinctive factors between Partnerships:

2. REGULATORY OPTIONS AVAILABLE

Luxembourg offers several regulatory options under which partnerships may be set up. In a nutshell, a partnership may take the form of a vehicle that is:

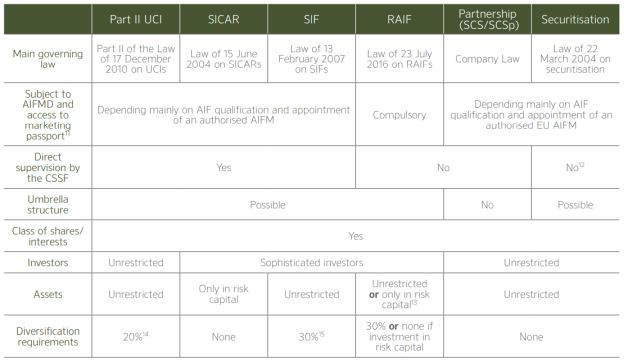

- supervised by the Luxembourg financial regulator (Commission de Surveillance du Secteur Financier or "CSSF") i.e. a Part II undertaking for collective investment ("Part II UCI(s)"), a specialised investment fund ("SIF(s)") or an investment company in risk capital ("SICAR(s)") (with the possibility of falling within the scope of the AIFMD – in which case it will be eligible for the AIFMD marketing passport – or not);

- not directly supervised by the CSSF but may benefit from the AIFMD marketing passport provided that it qualifies as an alternative investment fund under the AIFMD ("AIF(s)") and appoints an alternative investment fund manager ("AIFM(s)") authorised in the European Union ("EU")9, i.e. a reserved alternative investment fund ("RAIF(s)") or a "simple" AIF (i.e. not under a Product Law);

- neither supervised by the CSSF nor in scope of the AIFMD, e.g. a "simple" Partnership such as a non-AIF (a holding vehicle or a fund of one), an AIF managed by a non-EU AIFM or an AIF managed by a "small"' AIFM10;

- a securitisation vehicle, which will not be supervised by the CSSF (unless it issues financial instruments to the public on a continuous basis) and may benefit from the AIFMD marketing passport if it qualifies as an AIF and appoints an authorised AIFM.

The next table summarises the different regulatory options under which a Partnership may be set up and the key differences between them:

To view the full article, click here.

Footnotes

1. "Product Laws" refer collectively to Part II of the Law of 17 December 2010 on UCIs, the Law of 15 June 2004 on SICARs, the Law of 13 February 2007 on SIFs and the Law of 23 July 2016 on RAIFs

2. Flexibility available if set up under a Product Law. Interim dividends can be paid on decision of the GP.

3. Flexibility available if set up under a Product Law.

4. "Lux GAAP" refers to the Generally Accepted Accounting Principles applicable in the Grand Duchy of Luxembourg.

5. "IFRS" refers to International Financial Reporting Standard.

6. "US GAAP"refers to the Generally Accepted Accounting Principles applicable in the United States and is generally available for an SCSp but some limitations on other GAAP will apply in case the SCSp qualifies as an AIF and has appointed an authorised AIFM.

7. Possibility to check the box for US tax purposes.

8. Certain jurisdictions might not recognise the transparency of the SCS/SCSp. This might result in hybrid mismatches under ATAD 2.

9. For the purposes of this Memorandum, the terms "European Union", "EU" and " Member States" also refer to and include the European Economic Area ("EEA") and the States that are contracting parties to EEA agreement other than the Member States of the European Union, within the limits set forth by this agreement and related acts.

10. "Small AIFM" refers to an AIFM who manages AIFs whose total assets under management, including any assets acquired through use of leverage, do not exceed EUR 100 million, or whose total assets under management do not exceed EUR 500 million and whose portfolios of AIFs consist of AIFs that are unleveraged and have no redemption rights exercisable during a period of 5 years following the date of initial investment in each AIF.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.