Restrictions on Placement of Shares issued by Ukrainian Issuers Abroad

The Ukrainian law provides for certain restrictions on the placement of shares issued by Ukrainian issuers outside Ukraine. Main of those restrictions are the following:

- shares of Ukrainian issuers must be denominated in the national currency only and the par value of a share must be specified in the share certificate1;

- the shareholders of a joint stock company have a preemptive right to purchase its additionally issued shares (in case of a private placement of shares)2;

- circulation of securities of Ukrainian issuers outside Ukraine requires a permit (the "Permit") from the Securities and Stock Market State Commission (the "SSMSC")3; and

- as a condition precedent to obtaining the Permit from the SSMSC, the following requirements must be met by Ukrainian issuers: (i)shares of Ukrainian issuers must be listed on any Ukrainian stock exchange prior to listing their shares abroad; (ii) the issuer's registered capital must be not lower than UAH 5,000,000.00 (five million hryvnias); (iii) the aggregate amount of securities of the Ukrainian issuer to be placed outside Ukraine may not exceed 25% (twenty-five) percent of the issuer's registered capital; (iv) the issuer must comply with the Ukrainian foreign currency control legislation (which is not meant for such kind of transactions); (v) securities placed abroad may not be returned to Ukraine within 18 (eighteen) months from the date of their placement; and (vi) recording of ownership title to securities circulating outside Ukraine must be performed in accordance with the Ukrainian depository legislation (such condition is rather unattractive to foreign investors and may adversely affect the offering price)4, as well as some other requirements.

Furthermore, when issuing a Permit, the SSMSC is entitled at its sole discretion to determine the type of placement and the stock exchanges outside Ukraine where the shares of the Ukrainian issuer are to be placed.

The above incompliance of Ukrainian law requirements with the requirements of foreign stock exchanges and persistent interference by the SSMSC in decision making process by the issuer in respect of the IPOs, along with the lack of any explicit procedure for obtaining the Permit for a foreign IPOs lead to actual impossibility for Ukrainian issuers to have their shares listed on foreign stock exchanges (within the existing regulatory framework).

Consequently, Ukrainian issuers have not performed any direct listing of their shares on foreign stock exchanges so far. Therefore, the choice of jurisdiction for IPOs of Ukrainian issuers deserves a detailed analysis.

IPO Structures

1. Issue of Global Depositary Receipts

The Ukrainian issuers may enter European stock markets through issuance of global depositary receipts ("GDRs").

A set of requirements for IPOs to be performed through GDRs issue depends on the trading platform selected by the issuer. The main European trading platforms ready to list Ukrainian issuers are London Stock Exchange, Luxemburg Stock Exchange, Frankfurt Stock Exchange, Vienna Stock Exchange, Warsaw Stock Exchange and Berlin Stock Exchange. The first four of them have alternative markets (specially organized trading platforms admitting the issuers that do not qualify for listing on the respective stock exchanges). Should no alternative trading platforms have been available, there would have been a rather limited number of Ukrainian issuers which would satisfy all eligibility criteria for listing on foreign stock exchanges, including such criteria as the amount of equity capital and availability of audited financial statements prepared in accordance with IFRS for the last 3 (three) years.

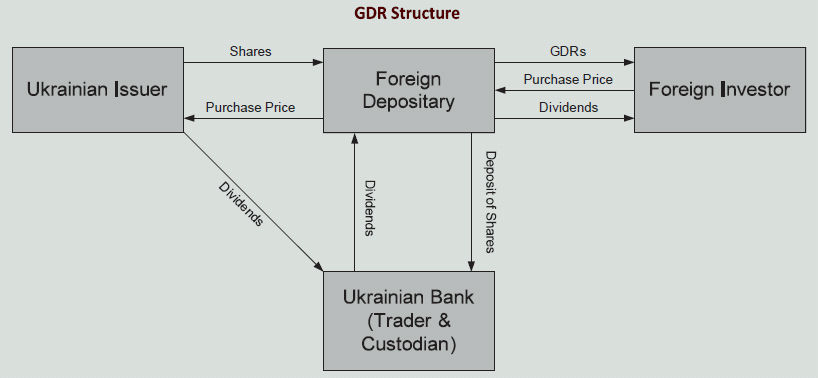

The issue of GDRs enables to use both existing and new shares. In doing IPOs through issues of GDRs, a foreign depositary bank depositing its shares with a Ukrainian custodian acts as a shareholder of record. GDRs are issued on the basis of a Depository Agreement. It should be noted that investors - GDR holders, being beneficial owners of shares of the Ukrainian issuer, with their interests represented by the depositary bank, do not become the shareholders of record of such shares from the standpoint of the Ukrainian law (as the concept of beneficial ownership is not developed in Ukrainian law). Thus, the shareholder of record of the shares is the depositary bank, acting on behalf of the GDR holders, being beneficial shareholders.

In structuring an IPO through GDR issue, special attention should be given to the following legal aspects:

- acquisition of shares of the Ukrainian issuer by foreign depository requires involving a Ukrainian bank, acting as a securities broker and custodian of foreign depositary's shares, into the transaction (for the purpose of meeting the requirements of the Ukrainian law in respect of the circulation of securities and recording of title thereto);

- antitrust implications must be analyzed to address the issues arising in connection with the purchase of shares and GDRs (an approval from the Antimonopoly Committee of Ukraine must be obtained to acquire an indirect control over the Ukrainian issuer in the amount of 50% and more of voting shares);

- the procedures of voting at the shareholders meetings of the issuer on behalf of beneficial shareholders must be structured properly; and

- it is necessary to structure properly the transaction on raising of funds from investors in order to pay up shares in full until completion of the share issue registration (i.e. registration of a share placement report with the SSMSC). This issue may be solved through (i) short-term financing of the share issue by existing shareholder (through purchase of additionally issued shares with subsequent reimbursement of the invested funds by the proceeds from the sale of GDRs to investors), or (ii) issuing GDRs as a condition subsequent to share issue. Each of the two above options is related to different allocation of risk between the investors and the existing shareholders.

Considering the above, the simplest and, consequently, the most preferred option of doing IPOs through GDR issue supposes utilization of already existing shares of the Ukrainian issuers.

The structuring of GDR issues in case of simultaneous issues of GDRs and shares in Ukraine is a more complicated process, which requires fully concerted actions to be taken in respect of the issue of shares and GDRs in different jurisdictions.

2. Setting up a Holding Company for Doing IPOs (Criteria and Requirements)

If the amounts of the share issues are insignificant, a lot of issuers, instead of using GDRs structures, being a rather cumbersome from the standpoint of process administration and timing, prefer to use an alternative option of doing IPOs, that supposes setting up a holding company (i.e. issuer de jure), controlling a Ukrainian issuer de facto.

This IPO structure is acceptable to foreign stock exchanges considering that it was elaborated due to certain regulatory restrictions of the Ukrainian laws, which could be legally avoided through setting up a foreign holding company.

The following factors need to be considered when structuring a transaction to enter the IPO market by setting up a foreign holding company:

- the reputation of the respective jurisdiction;

- the level of protection of shareholders rights and interests prescribed by the laws of such foreign jurisdiction; and

- available opportunities for effective tax planning (including the double tax treaty in place between Ukraine and the jurisdiction of the holding company).

Considering the above criteria, the most popular jurisdictions for setting up a holding company to bring a Ukrainian issuer to the IPO market are: Cyprus, the Netherlands, Switzerland, Austria, the UK, Luxembourg and the British Virgin Islands (although utilization of the last two jurisdictions requires additional tax planning actions, due to absence of a double tax treaty between Ukraine and these jurisdictions).

Within the course of this structure implementation, a special attention should also be given to the following criteria to be met by the holding company for a successful IPO:

- a "transparent" ownership structure;

- an effective corporate governance system;

- a possibility of preparing consolidated financial statements; and

- solid business reputation of the holding company's officers, as well as availability of accountants, auditors, and lawyers.

The key function to be performed by the holding company in the structuring of an IPO is a transfer of IPO proceedings to the Group, as well as obtaining and further payment of dividends with a minimum tax burden.

Alternative tools, which could be used by the holding company for obtaining a revenue from a Ukrainian de-facto issuer, include: (i) loan interest (subject to the requirement of mandatory loan agreements registration by the NBU (the "NBU") and to the interest rate limits set forth by the NBU – applicable for loans borrowed from non-residents); (ii) lease payments; and (iii) royalties under license agreements.

Utilization by the holding company of any of the above tools for obtaining a revenue, or their combination requires effective tax planning to minimize a tax burden.

3. IPO Structures and Alternative Options of Funds Raising in the US Public Capital Markets

The most frequently used option for entering the US stock markets is a standard, time and cost consuming procedure of issuing American Depositary Receipts ("ADRs"), being the US equivalents of GDRs, that must be nominally owned by an American depositary.

However, this standard option preferred by highly capitalized companies is usually too costly and time-consuming for companies with medium and low capitalization.

For this reason, reverse merger procedure, involving a merger of a private operating company and a publicly traded shell company, could be an efficient and less expensive option to raise funds in the US public market for medium and low-capitalized companies.

The typical shell company to be used for the purposes of the reverse merger is usually a public company (incorporated in the USA) which terminated its core activity at certain point of time, sold its assets and suspend its business operations.

Free of any debt or litigation burden, the shell company is still listed on the Over-the-Counter Bulletin Board electronic quotation service and may even remain "dormant" on NASDAQ for several months. Its shares are still listed, officially quoted (at about zero, as this company no longer has any assets or operations) and may be sold and purchased. Through acquisition of such shell company, a foreign entity may quickly and inexpensively enter the US stock market.

Compared to IPOs, reverse mergers offers the following advantages:

- lower fund-raising costs;

- less lengthy fund-raising process (a reverse merger may be implemented within three or four months after completion of due diligence, while an IPO will take nine to twelve months);

- minimum dependence on IPOs market fluctuations; and

- going public without an underwriter.

Footnotes

1 Article 6 of the Law of Ukraine "On Securities and Stock Exchange," dated 23 February 2006.

2 Part 2 of Article 6 of the Law of Ukraine "On Securities and Stock Exchange," dated 23 February 2006, and Article 27 of the Law of Ukraine "On Joint Stock Companies," dated 17 September 2008.

3 Clause 4, part 2 of Article 7 of the Law of Ukraine "On State Regulation of Securities Market in Ukraine," dated 30 October 1996.

4 Resolution No. 36 of the SSMSC "On Approval of the Regulation on the Procedure for Granting Permits to the Circulation of Shares or Bonds of Ukrainian Issuers Outside Ukraine," dated 17 October 1997.

Vasil Kisil & Partners

Through relentless focus on client success, the Vasil Kisil & Partners team delivers integrated legal solutions to complex business issues. In Ukraine, the Vasil Kisil & Partners brand is synonymous with great depth and breadth of legal expertise and experience, which has created superior value for our clients since 1992.

Vasil Kisil & Partners is a Ukrainian law firm that delivers integrated business law, dispute resolution services, tax law, energy and natural resources law, intellectual property law, international trade law, labour and employment law, real estate and construction law, as well as public private partnership, concessions & infrastructure law.

The firm serves international and domestic companies, as well as private individuals, dealing in agriculture, banking, chemical, construction, financial, energy, high-tech, general commodities, insurance, IT, media, metallurgy, pharmaceutical, real estate, shipbuilding, telecommunication, trading, transport, and other industries and economy sectors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.