Preface

This legal guide sets out a brief summary of the registration requirements for persons or entities engaged in conducting securities business in or from The Bahamas. For further information please contact the Securities Department at Higgs & Johnson.

INTRODUCTION

The legislative regime regulating securities intermediaries in The Bahamas was recently overhauled by the introduction of the Securities Industry Act, 2011 (the “Act”) which came into force on 30th December, 2011 and repealed the Securities Industry Act, 1999. The Securities Industry Regulations, 2012 (the “Regulations”) which accompany the Act, were gazetted on 9th January, 2012 and made public in February, 2012.

REGISTRATION OF FIRMS CARRYING ON SECURITIES BUSINESS

No firm may carry on or purport to carry on securities business in or from The Bahamas unless that firm is registered with the Securities Commission of The Bahamas (the “Commission”) to carry on that business (a “Registered Firm”) or is exempt from registration.

A Registered Firm may be structured as a company incorporated or registered under the Companies Act, 1992 (the “CA”) or incorporated under the International Business Companies Act, 2000 (the “IBCA”) and can apply to the Commission for authorization to carry on one or more of the following four categories of securities business:

Dealing in securities - This includes (i) buying, selling, subscribing for or underwriting securities as an agent, (ii) buying, selling, subscribing for or underwriting securities as principal where the person entering into that transaction (a) holds himself out as willing as principal, to buy, sell or subscribe for securities of the kind to which the transaction relates at prices determined by him generally and continuously rather than in respect of each particular transaction, (b) holds himself out as engaging in the business of underwriting securities of the kind to which the transaction relates or (c) regularly solicits members of the public with the purpose of inducing them, as principals or agents, to buy, sell, subscribe for or underwrite securities and such transaction is entered into as a result of such person having solicited members of the public in that manner.

Arranging deals in securities – Making arrangements with a view to (i) another person (whether as a principal or an agent) buying, selling, subscribing for or underwriting securities or (ii) a person, who participates in the arrangements, buying, selling, subscribing for or underwriting securities. Managing securities – Managing securities belonging to another in circumstances involving the exercise of discretion.

Advising on securities – Advising a person on securities if the advice is (i) given to the person in his capacity as an investor or in his capacity as agent for an investor or potential investor and (ii) advice on the merits of his doing any of the following (whether as principal or agent) (a) buying, selling, subscribing for or underwriting a particular security or (b) exercising any right conferred by a security or buy, sell, subscribe for or underwrite a security.

Parts 3 and 4 respectively of the First Schedule to the Act list the activities and persons which will not be subject to registration under the Act; such exempt activities and persons include, without limitation, (i) entities incorporated in The Bahamas whose sole securities business is the provision of advisory or management services to one or more investment funds licensed or registered with the Commission as standard, professional or SMART funds and (ii) entities engaged in carrying on securities business exclusively for one or more affiliated companies.

PHYSICAL PRESENCE REQUIREMENTS

Registered Firms engaging in the business of dealing in securities or arranging deals in securities must have a physical presence in The Bahamas. Registered Firms engaging in the business of managing and/or advising on securities can satisfy the requirement for a physical presence by appointing a managing representative in The Bahamas. The managing representative must (i) be a Registered Firm, an investment fund administrator operating in The Bahamas holding a restricted or unrestricted administrator’s license, a licensed financial and corporate services provider or a licensed bank or trust company holding an unrestricted license, (ii) have knowledge of the type of activities of the firm for which it wishes to act as managing representative, the technical and managerial resources and operational capacity to act as a managing representative, be fit and proper and meet such other requirements as may be prescribed by the Commission and (iii) be approved by the Commission. A service level agreement containing the prescribed information must be entered into between the proposed managing representative and the relevant firm seeking registration.

LICENSING AND REGISTRATION OF INDIVIDUALS REPRESENTING REGISTERED FIRMS

All persons employed by a Registered Firm performing securities related functions must be registered with the Commission as a Trading Representative, Discretionary Management Representative or an Advising Representative. Each Registered Firm must also register a Compliance Officer and a Chief Executive Officer, who in the case of the latter, must be located in The Bahamas. Any employees performing functions which are solely administrative in nature, including, technology support, facilities support, human resources management and clerical support, are not required to be registered with the Commission.

As a minimum, an applicant for registration as Chief Executive Officer, Compliance Officer, Trading Representative, Discretionary Management Representative or Advising Representative must have no less than six (6) months of securities related experience and have obtained one of the examinations recognized by the Commission from time to time, or at least ten (10) years of securities related experience.

Any non-Bahamian employed by a securities investment advisor or broker-dealer must obtain a work visa from the Department of Immigration.

CAPITAL REQUIREMENTS

A Registered Firm must maintain adequate financial resources to meet its business commitments, withstand the risks to which its business is subject and meet the prescribed requirements. The minimum levels of regulatory capital under the Act for each category of securities business have not yet been prescribed by the Commission.

ANNUAL AUDIT AND INTERIM FINANCIAL REPORTS

Each Registered Firm must (i) appoint an approved auditor, (ii) file a copy of its audited financial statements with the Commission by not later than 120 days after the end of its financial year, (iii) file a copy of its quarterly financial reports and certain other financial information prescribed by the Regulations with the Commission by not later than the 30th day after the end of the first, second, third and fourth quarter of its financial year.

APPLICATION FORMS AND FEES

Applications for registration as a Registered Firm and for the registration of its individual representatives must be made in the form prescribed by the Commission. Such forms are available on the Commission’s website www.scb.gov.bs .

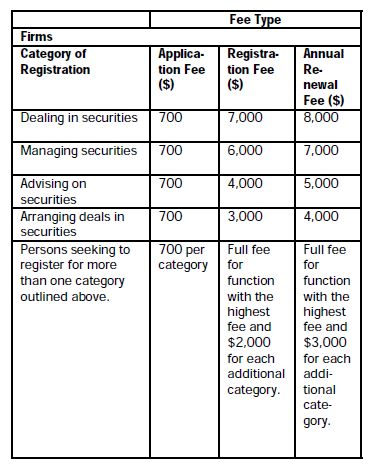

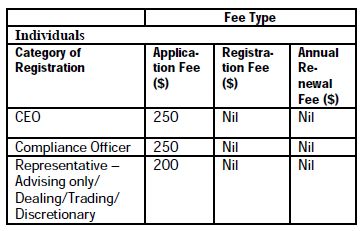

The Commission’s application, registration and annual fees are as follows:

A late payment fee equal to 1/12 of the amount of the annual fee payable is levied each month the annual fee remains outstanding. Clients should allow approximately 3 to 6 months for the Commission to approve an application for registration as a Registered Firm following its submission for consideration.

CENTRAL BANK APPROVAL

If the Registered Firm will be structured as a company incorporated under the CA and one or more of its shareholders will be non-Bahamian, that company must be registered with the Exchange Control Department of the Central Bank of The Bahamas (the “Central Bank”).

If the Registered Firm will be providing services to persons and entities who are "residents" of The Bahamas for Exchange Control purposes, that is, citizens of The Bahamas, individuals in possession of a certificate of permanent residency with an unrestricted right to work or companies incorporated under the laws of The Bahamas that have been designated "resident" for Exchange Control purposes, a "resident" designation will be required from the Central Bank and such Registered Firm will only be allowed to maintain foreign currency accounts for specifically approved purposes.

However, if the Registered Firm will be providing its services to persons and entities that are “nonresident” for Exchange Control purposes, such Registered Firm will require a “non-resident” designation for Exchange Control purposes. This status will permit it to operate foreign currency accounts and hold foreign securities without reference to the Central Bank.

If the Registered Firm will be incorporated under the IBCA and will be providing its services to “nonresidents” only, no designation will be required from the Central Bank for Exchange Control purposes. Work-visa holders, temporary or annual residents and companies incorporated under the laws of The Bahamas that have been designated “non-resident” by the Exchange Control Department of the Central Bank are “non-resident” for Exchange Control purposes.

BUSINESS LICENSE

Registered Firms must obtain an annual business license in accordance with the provisions of the Business License Act (the “BLA”). The initial application fee is $100. Thereafter, if the entity is designated “resident” for Exchange Control purposes, its business license fees will be payable on the annual turnover. However, if the entity is designated “non-resident” for Exchange Control purposes, its annual business license fee will be $300 per annum.

LEGAL FEES

Our fees for incorporating a company under the CA or the IBCA are set out in our memoranda attached hereto.

Our fees for assisting with securing registration with the Commission as a Registered Firm, the approval of the Exchange Control Department of the Central Bank (if necessary) and a business license, are a minimum of $10,000 exclusive of disbursements. Thereafter, we would charge on a time spent basis.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.