Foreword

Material growth is expected in the field of international insurance business. Malta is witnessing an ever increasing number of foreign players registering as insurance licencees, together with an ongoing stream of enquiries on potential new applications. This growth is consistent with Malta's development as a reputable financial services centre, which has accelerated since membership of the European Union in 2004. In the Competitiveness Index 2011-2012, recently published by the World Economic Forum, Malta ranked 15th out of 143 world economies surveyed in the financial market development sub-index.

The insurance industry is an important pillar of the Maltese economy, taking advantage of a number of key attributes that Malta offers, including a highly-skilled workforce, excellent service, the appropriate corporate infrastructure and robust legislative and regulatory frameworks, including tax efficiency and innovative structures such as PCCs and ICCs.

PwC Malta is the leading and largest professional services organisation on the island, with 17 partners and around four hundred staff. We provide a range of assurance, tax, and advisory services to a large and varied client base, including leading companies involved in all the spheres of the insurance industry – insurance principals, intermediaries, protected cell companies, captives and insurance managers. This publication is one of an increasing number of initiatives, including surveys and newsletters, which are designed to share our knowledge with the industry. It presents an overview of how we perceive a steadily growing industry, and the services we are geared to provide.

Whilst all reasonable care has been taken in preparing this publication, there is of course no substitute for specific advice. Should readers require further information, we shall be glad to assist and encourage you to contact one of the members of our insurance team listed at Section 9 of this publication.

We look forward to being of service to you.

Kevin Valenzia

Territory Senior Partner

25 January 2012

1. Malta as a strategic location for doing business

Malta's strategic geographical location at the centre of the Mediterranean has played a decisive role in its history and continues to play a very important part in its economical, political and cultural development and prosperity today.

Malta was a British colony until 1964. Today it is an independent Republic, a member of the British Commonwealth, the Council of Europe, and the United Nations and became a member of the European Union (EU) on 1 May 2004.

Over the past two decades, Malta has completed a programme of reforming all its finance sector legislation in line with best practices observed in Organisation for Economic, Co-operation and Development (OECD) countries. It is also actively involved with the OECD, the EU and the Commonwealth in modelling global regulatory policy.

The government is democratically elected and all sides of the political spectrum have agreed to Malta's economic development strategy. This strategy is designed to continue to develop Malta as a manufacturing base, as a quality tourist resort, and as a provider of a growing range of services, particularly financial services.

Malta has an excellent business infrastructure with good telecommunications, extremely well equipped ports and Freeport, a well-developed manufacturing infrastructure and a sophisticated European business environment.

The labour force is skilled, multi-lingual, flexible and adaptable. The official languages are Maltese and English; most Maltese citizens speak the latter fluently. Business correspondence is conducted mainly in English and all laws are published in both languages. A large proportion of the population is also fluent in Italian.

2. The insurance industry in Malta

Malta is considered to be an attractive location in the EU for the establishment of captive and other insurance and reinsurance businesses. The island continues to offer stability to potential investors.

Since the early 1990's, Malta has established itself as a renowned and stable financial services sector. The insurance industry is one of the pillars of this development, with the Malta Financial Services Authority (the "MFSA") working to create a stable, yet innovative, jurisdiction aimed at encouraging the growth of insurance and reinsurance business, including captive insurance companies, Protected Cell companies (PCCs) and Incorporated Cell companies (ICCs), passporting their services throughout the European Union.

The insurance industry in Malta boasts a mature domestic market constituted of life and non-life insurers, as well as a thriving international sector, including captives and direct underwriters and reinsurers. The number of insurance intermediaries and service providers also continues to increase. As per Malta Insurance Management Association ("MIMA") survey results published on 30 July 2010, the number of managed insurance companies, and cells in protected cell companies, has increased from 20 in 2008 to 41 in 2010; and assets under management have increased from €555,305,454 in 2008 to €1,099,657,011 in 2010. Similarly, annual gross premium written by insurance companies and cells under management has grown by 68% since 2008.

With its favourable tax system, low-cost location and efficient regulatory environment that accelerates the set-up of new companies, Malta continues to be an attractive destination for insurance companies, PCCs and, more recently, ICCs.

3. Why carry on insurance business in Malta?

There are a number of benefits associated with setting up insurance business in Malta. A main advantage, of particular appeal to companies intending to write business across EU is that insurance companies incorporated in Malta can passport directly, either through freedom of establishment or services, to all other member states. Significant advantages lie in having a knowledgeable and accessible regulator, the MFSA, coupled with a very experienced professional workforce. Malta's tax regime is stable. As governments across the world move to tighten tax rules, Malta's tax rate of 35%, based on a full imputation tax system that results in tax refunds to shareholders, is seen as tax-efficient and acceptable. Moreover, Malta has a network of Double Tax Treaties with over 55 countries, including most EU countries and the US.

From an operational perspective, Malta has a comparatively lower cost base when compared to other EU domiciles. The country has an excellent business infrastructure with good telecommunications and a sophisticated European business environment.

Malta's legislative framework is also innovative in that it caters for insurance set-up options considered to be relatively new and alternative in the context of the rest of the EU, such as the creation of PCCs, and more recently, ICCs. Malta is the only EU member state to have this legislation in place. The local legal framework further includes migration legislation that facilitates movement into and out of Malta.

The table below summarises what we perceive to be the main benefits of setting up insurance business in Malta.

|

Reasons that make Malta an attractive location for setting up an insurance business |

|

|

EU membership/passporting rights |

Insurance companies that incorporate in Malta are effectively an EU-domiciled insurer with the opportunity to benefit from passporting rights which facilitate the underwriting of insurance business anywhere in the EU without the need for costly fronting arrangements. |

|

EU compliant legislation |

As a member of the EU, insurance businesses incorporated in Malta can benefit from harmonised EU legislation and regulation. Of particular relevance, at this point in time is the alignment with the rest of the EU in preparation for the advent of the Solvency II regime. |

|

An advanced and innovative legal system |

Regulations specific to PCCs and to ICCs are examples of pieces of legislation aimed at establishing an innovative legal framework to govern insurance business, whilst promoting such business in Malta. Refer to further detail in section 4 of this publication. |

|

Efficient tax environment, for companies and individuals |

The main advantages of Malta's tax system are :

Further details of the fiscal framework applicable to insurance companies in Malta is provided in Appendix C of this publication. |

|

Re-domiciliation |

Malta's legislative framework, specifically the Continuation of Insurance Business Companies Regulations, allows established insurance businesses to seamlessly transfer their seat to Malta, without any break in the company's corporate existence or the need to re-execute any reinsurance treaties or other contracts. |

|

An accessible and efficient regulator, the MFSA |

MFSA's consistent regulatory approach has ensured the growth of the insurance industry on the island. The MFSA is approachable, encouraging regular consultation, on an individual company basis, to ensure that both the interests of the business and compliance with all regulatory standards are met. Refer to further detail in Section 3.1. |

|

Swift application process |

The insurance application process is an efficient, non-bureaucratic process. The MFSA is required to respond to an application within a prescribed timeframe. |

|

Availability of insurance management services |

A significant number of licensed insurance management companies operate in Malta, varying from international names to local establishments. Insurance managers are adequately equipped to assist in the initial set-up stages as well as the ongoing operations of a captive insurance business or a direct underwriter. The vast majority of insurance managers are members of the Malta Insurance Management Association (MIMA). |

|

Availability of quality, personalised professional services |

Malta has a skilled, multi-lingual, flexible and adaptable labour force including, inter alia, accounting, audit, investment management and legal services. |

|

The application of International Financial Reporting Standards in the preparation of financial statements |

Malta adopted International Financial Reporting Standards (IFRS) for all companies in 1995. A consistent accounting framework within the EU facilitates the consolidation process at an EU level. |

|

The use of English as Malta's business language |

English, together with Maltese, are the primary languages of Malta, with English being considered the business language country-wide. |

3.1 The competent regulatory authority

The competent regulatory authority is the MFSA, which is a fully autonomous public institution that reports to Parliament and was established by law on 23 July 2002. The MFSA is the single regulator for all financial services, which includes banking, insurance, investment services, trustee services, pensions, collective investment schemes and their providers. The functions of the Registry of Companies, the International Tax Unit of the Inland Revenue, and the Listing Authority, are all housed within the MFSA.

Creating the MFSA as a single regulator was part of Malta's long-term strategy to create a mainstream finance centre in the country. Financial services have benefited from a reduction in bureaucracy, streamlined procedures, lower fees and compliance costs, and a more consistent implementation of standards.

The organisational structure of the MFSA ensures that the regulatory and operational functions of the Authority are exercised within strict legal demarcations. The Board of Governors, presided by the Chairman, sets out policy and general direction and is assisted by the Legal and International Affairs Unit. The Director of this Unit is also the Secretary to the Board of Governors. The Supervisory Council, headed by the Director General, is exclusively responsible for licencing, supervision and regulation and is composed of the Directors responsible for Authorisation, Banking Supervision, Securities and Markets Supervision, Insurance and Pensions Supervision, and Regulatory Development. Operations are the responsibility of the Board of Management and Resources composed of the Directors responsible for Communications, Human Resource Development, Information Technology and Administration chaired by the Chief Operations Officer. Co-ordination between these three organs is ensured at Co-ordination Committee level.

The MFSA has a staff of over 170 people, consisting of specialist regulators, lawyers, accountants and support staff facilitating the formulation of policy, decision making and support for both licence holders and consumers.

The Authorisation Unit of the MFSA is the department responsible for the licensing of insurance principals, intermediaries, PCCs, ICCs, captives and insurance managers, and may be contacted as follows:

The Director Authorisations Unit Malta Financial Services

Authority Website:

www.mfsa.com.mt

4. Insurance business set-up options and the relevant Maltese legislation

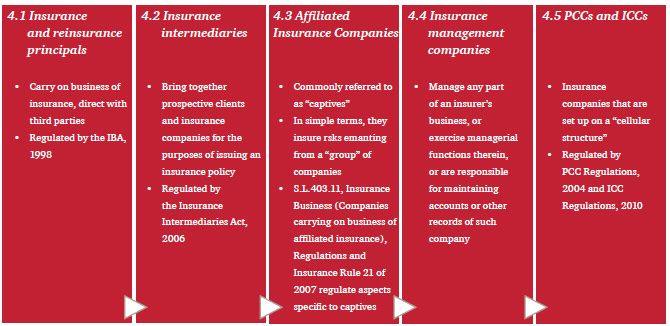

Malta's company law and fiscal legislation is based on tried and tested legal principles and implements all applicable European Union legislation. Insurance-specific pieces of legislation offer a variety of set-up options, together with the governing framework within which they can operate. Further details of the legislative framework are included in Appendix B to this publication. The following is a summary of the possible set-up options:

4.1 Insurance (and reinsurance) principal companies

Insurance (and reinsurance) companies in Malta are mainly regulated by the Insurance Business Act, 1998 ("the Act"). The Act provides for the authorisation and supervision of insurance companies and the MFSA is the Competent Authority for the purposes of the Act. Insurance Business Regulations ("Regulations") constitute subsidiary legislation to the Act, whereas Insurance Rules ("Rules") may be issued by the MFSA under the Act as may be required for carrying into effect any of the provisions of the Act. The Act, Regulations and Rules together constitute the legislative framework for insurers in Malta. Refer also to Appendix B for details on the regulatory framework.

The Malta Insurance Association (MIA) is a non profit-making organisation that represents the views and common interests of all insurance companies in Malta. MIA provides its members with the opportunity to exchange and analyse external developments and issues relevant to their industry's well being. Indeed, part of the MIA's mission is to offer training initiatives and events targeting general and specialised lines of insurance business.

As at December 2011, the number of insurance principals in Malta stood at 35, including 28 primarily underwriting risks outside Malta.

4.2 Insurance intermediaries

An insurance intermediary is defined as a person(s) or a company who brings together prospective clients and insurance companies for the purpose of issuing an insurance policy. All intermediaries, except for introducers, are licensed by the MFSA and are regulated under the Insurance Intermediaries Act, 2006.

The Insurance Business Act, 1998 and the Insurance Intermediaries Act, 2006 are two separate but complementary pieces of legislation that establish the legal and prudential framework for the regulation of insurance business and insurance intermediaries' activities in Malta. As at December 2011, there were 17 insurance agents and 29 insurance brokers registered in Malta as per the MFSA's list of licence holders.

4.3 Captives

Under the Maltese legislative framework, captives are termed "Affiliated Insurance Companies" ("AICs"). These are defined as companies that insure risks originating from:

- parent companies;

- associated or group companies;

- individuals or other entities having a majority ownership or controlling interest in the AIC, and

- members of trade, industry or profession associations insuring risks related to the particular trade, industry or profession.

The legal and regulatory framework governing captive insurance in Malta is the same that applies to all insurance companies. There are however a number of features which recognise the particular characteristics of captives and cater for their needs. Subsidiary Legislation 403.11, Insurance business (companies carrying on business of affiliated insurance), Regulations and Insurance Rule 21 of 2007 (Business of Affiliated Insurance) regulate those aspects specific to captives. Detail on the setting up of captives is provided in Appendix B5 to this document.

Currently, there are 10 companies authorised by the MFSA as AICs.

4.4 Insurance management companies

The Act defines an insurance manager as a person enrolled to carry out activities that consist of accepting an appointment from an insurance company to manage any part of its business, or to exercise managerial functions therein, or to be responsible for maintaining accounts or other records of such company. Management functions may include the authority to enter into contracts of insurance on behalf of such company under the terms of appointment. A local company authorised under the Insurance Intermediaries Act, 2006 as an insurance intermediary and carrying on business as an insurance broker, restricted to contracts of insurance relating to risks situated outside Malta, may appoint an insurance manager authorised under the Act to manage such business. An affiliated insurance company or an affiliated reinsurance company may also, with the approval of the Authority given in writing, appoint an insurance manager.

The Malta Insurance Managers Association (MIMA), established in Malta in 2007, represents the interests of all authorised insurance managers and managed insurance companies in Malta. MIMA has succeeded in and continues to strive towards the establishment and growth of the international insurance industry in Malta, as well as the development of management expertise.

As at December 2011, there were 15 insurance managers registered in Malta, the vast majority of which are members of MIMA.

4.5 Protected cell companies (PCCs)

With the introduction of Subsidiary Legislation 386.10 of 2004, Companies Act (Cell Companies Carrying on Business of Insurance) Regulations, Malta became the only EU member state to incorporate PCC legislation in its financial legal framework.

The PCC is a risk management tool, enabling different owners with varying interests to participate in one insurance company through the establishment of cells.

As at December 2011, there were 7 PCCs domiciled in Malta, operating 16 cells between them and offering potential investors the opportunity to set up an insurance operation in Malta, with reduced capital requirements compared to a stand-alone insurance set-up, as well as other advantages.

4.6 Incorporated cell companies (ICCs)

Taking account of international developments in the area of cell legislation, the Companies Act (Incorporated Cell Companies Carrying on Business of Insurance) Regulations, 2010 have also been enacted, introducing another innovative type of vehicle in Malta. This legislation builds on the cellular concept under the PCC legislation introduced in 2004, and detailed in section 4.5 above. The most significant difference between the two concepts is that in an ICC, its core and cells are individually separate legal entities.

5. A wider perspective – the global insurance market

Following the recent global financial crisis, what customers, investors, governments and regulators expect from insurers is changing rapidly. The scenarios we are witnessing today are just the beginning of a process of change.

Macro issues facing insurers include regulatory upheaval, fundamental tax changes and other implications. Facing pressure from the government, supervision will be more intense and regulations are subject to national and European priorities. Solvency II is at the top of all insurers' agendas and is expected to result in an overhaul of regulation as we know it today, influencing key decision makers in the manner in which they conduct their business and manage risk. Similarly, amid moves to increase tax revenues and tighten the tax rules of offshore businesses, the stability of the tax regime is now a key consideration for where insurers are domiciled or where they chose to relocate. At the same time, phase two of IFRS 4 is underway, which is expected to result in a complete overhaul of accounting for insurers as we know it today.

Insurance CEOs, participating in the PwC 14th Annual Global CEO Survey, said that generating profitable growth is going to be challenging for many companies in the face of tight margins, mounting regulation and the fragile economic environment within many developed markets. Of all the threats to growth highlighted by insurance CEOs, over-regulation was by the far the most significant (cited by 79% of insurance CEOs).

They were however upbeat about the future. More than half (56%) were very confident about their company's prospects for revenue growth over the next three years and virtually all the rest are reasonably confident. That makes them more optimistic than CEOs in almost every other sector. Innovation and the smart use of technology are high on the agenda to drive the growth strategy.

Malta is well positioned to meet these challenges. As a member of the EU, Malta is currently preparing itself for Solvency II, led by the local supervisor, the MFSA. All Maltese insurance companies adopt IFRS as their accounting framework and preparations for the eventual introduction of the new IFRS on insurance contracts are also underway. The Maltese insurance market has proved to be a stable environment throughout the financial crisis and the major shocks registered in other jurisdictions were not as pronounced locally.

What customers, investors, governments and regulators expect from insurers is changing rapidly.

Solvency II

Solvency II, the planned overhaul of prudential regulation for European insurers is well under way. Existing European solvency rules for life, non-life insurers and reinsurers will be significantly upgraded. Structured around three pillars, Solvency II is a risk-based, forward-looking regulatory regime founded on a 'total balance sheet' and market-consistent approach. Companies will need to run their business with an increased focus on risk management, governance and enhanced disclosure.

Amongst the latest developments on Solvency II is the agreement between the European Parliament and the European Council that the full implementation date for Solvency II will be 1 January 2014. With this deadline approaching, it is vital that insurers press ahead with their current plans and timetable. Any distraction now could prove potentially costly in the long run

IFRS 4, Phase II

The IASB is working on a comprehensive standard that will fundamentally change the accounting by insurers, reinsurers and other entities that issue contracts with insurance risk. The proposals are the output of the IASB and FASB's joint efforts to develop a single converged insurance standard. The FASB plans to issue a discussion paper that will incorporate the IASB's proposals. The proposed standard would replace IFRS 4, which currently permits a variety of practices in accounting for insurance contracts.

The proposed standard would apply to all entities that issue contracts that contain insurance risk. IASB expects a review/redraft of the exposure draft (ED), issued in July 2010, to be released in 2012. The date of publishing of the final standard and the effective date are still to be determined, the latter date will not be earlier than 2013. Insurers should understand the implications of the new IFRS, as currently exposed in the ED, on their organisations and should start to assess the requirements, (for example in terms of data management), arising from the eventual introduction of this standard. There are synergies to be found between IFRS Phase II and Solvency II, which if identified, will mean that insurers do not "dig the road twice" when preparing for these two major changes.

6. About PwC Malta

6.1 A general background (PwC Malta)

The firm is the leading and largest practice of accountants and auditors in Malta. It forms part of the worldwide PwC organisation - the world's leading professional services organisation, drawing on the knowledge and skills of almost 169,000 people in 158 countries. This organisation is designed to give a worldwide coordinated service to clients and is under the surveillance of an international partnership which supervises the ethical and professional standards in all offices.

Within the broad range of services, which PwC provides, the principal areas are:

- Assurance

- Tax Services

- Company Administration Services

- Transactions

- Crisis Management

- Business & Performance Improvement

- Change & Programme Effectiveness

- Internal Audit Services

- Human Resource Services.

PwC also makes available a range of other services in Malta designed to provide businesses and organisations with a coordinated package of services that will contribute to future growth, efficiency and prosperity. The firm is currently responsible for serving a large and diverse client portfolio comprising some of Malta's top companies. Its client list includes a number of public companies and institutions, private companies both large and small, foreign and local, and Government related companies. The annual report, 'Review Malta Firm' provides more insight into the Malta practice, and includes a list of insurance clients. The firm's head office is located at 167, Merchants Street, Valletta, where Tax Services and Corporate Services are located. Assurance and Advisory Services are located at Mill Street, Qormi.

Visit the Malta firm website www.pwc.com/mt to know more about us, about our services, and get the latest industry updates.

6.2 Our insurance client-portfolio

Our firm serves every major segment of the insurance industry, including local and foreign insurance principals, captive insurers and protected cell companies. We have a leading position in the insurance industry. Our clients include the majority of local insurance companies, a number of captives and foreign underwriters registered in Malta, as well as insurance intermediaries and insurance managers.

PwC actively participates in growing and shaping the insurance industry. We have been, and continue to be, involved in assisting in drafting segments of insurance and tax legislation. In recognition of the continued and sustained growth of the insurance sector in Malta and its requirements for high quality audit, tax and business advisory services, the Maltese firm has dedicated resources and professionals to service this industry. We have a team that specialises in this particular sector. The scale of this experienced resource pool cannot be matched by any other service provider in Malta.

To view full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.