Introduction and scope

Maltese legislation allows the setting up of pension schemes towards which individual members can voluntarily make contributions with the intention of deriving benefits. Depending on the setup of the retirement scheme and the tax residence of the individual member, the payment of retirement benefits may be subject to tax in Malta. Where the member is not resident for tax purposes in Malta, the same pension income (hereinafter "pension income") may also be subject to tax in the country of residence of the recipient in terms of the tax legislation of that jurisdiction. The purpose of this analysis is to provide a high-level comparison of how double taxation on certain pension income may be eliminated in terms of the double taxation treaties Malta currently has in place with sixty other tax jurisdictions.

This analysis does not cover the taxation of pension income or similar remuneration received in consideration of or in connection with past employment, or out of funds from, or in respect of services rendered to, a state, or subdivision or local authority of a state. Also outside the scope of this study are payments made under the social security legislation of a contracting state or such other statutory social security schemes.

The elimination of double taxation on benefits paid out of certain Maltese personal retirement schemes

Analysis

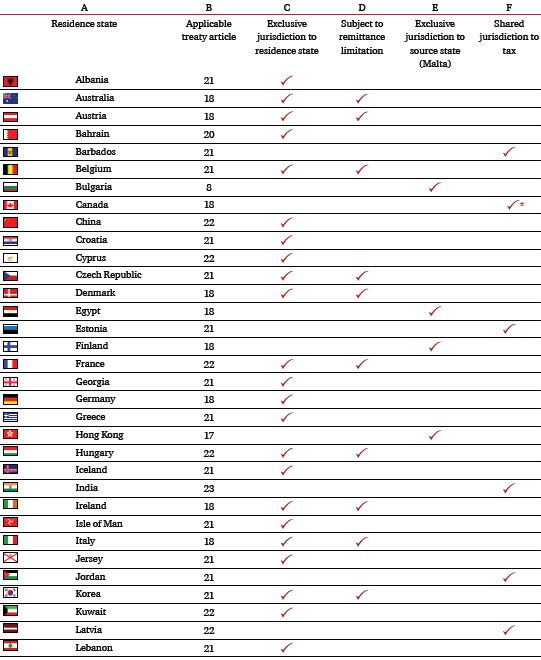

Our analysis relates only to payments made out of a Maltese retirement scheme to an individual beneficiary who, at the time of receipt of income, is resident for tax purposes in the other contracting state in terms of the double taxation treaty ("treaty") Malta has in place with such state. A summary of the key facts arising from our analysis is illustrated in the quick reference table.

a) Exclusive taxing rights to residence state

While some of Malta's double tax treaties include within the scope of the Pension Income article the receipt of 'annuities' (as defined) or pension or other similar remuneration not necessarily linked to past employment, the vast majority of Malta's treaties restrict applicability of such article to remuneration received in consideration of, or in connection with, past employment. In the latter treaties, the taxation of pension income that is not linked to past employment appears to be governed by the Other Income article which typically covers all items of income, wherever arising, that are not dealt with in the other articles of the treaty.

Whether covered by the Pension Income or Other Income articles of the treaties, the vast majority of Malta's treaties (refer to Column C of the table) allocate exclusive taxing rights on such income to the country of residence of the individual beneficiary (the residence state), unless the income is effectively connected with a permanent establishment or fixed base located in the source state. In such cases, in terms of the said treaties, it would therefore appear that payments made out of a Maltese retirement scheme to an individual member who in terms of the treaty is resident for tax purposes in the other state, should not be subject to tax in Malta.

However some of these treaties (refer to Column D) restrict the applicability of the exemption in Malta (as the state in which the pension arises) if under the law in force in the state of residence of the recipient the income is subject to tax only by reference to the amount remitted to or received therein. In such case, in terms of the treaty, relief from Malta tax only applies on the income that is received in, remitted to (and hence taxed in) the residence state.

b) Exclusive taxing rights to source state

As illustrated in Column E of the table, the treaties with Bulgaria, Egypt, Finland and Hong Kong allocate exclusive jurisdiction to tax in respect of pension income to the country of source, i.e. Malta. However, the applicability or otherwise of this exclusive jurisdiction would depend on whether the particular income is classified as "pension income" in terms of the particular treaty.

c) Shared taxing rights

Nearly all of the remaining treaties (refer to Column F) provide for the taxation of the pension income in the residence state while still allowing the source state to tax the income in terms of its domestic law. In such cases, if the income is subject to tax in Malta, the residence state is required to grant relief in respect of the Maltese tax suffered thereon. These treaties essentially therefore grant to the source state (i.e. Malta) primary jurisdiction to tax, while affording secondary jurisdiction to tax (i.e. the right to tax subject to providing double taxation relief) to the residence state.

In contrast, the treaty with Libya provides that where such income may be taxed in Malta in terms of the treaty, Libya must exempt such income from tax.

Concluding comments

Our above comments do not purport to be exhaustive in nature and should be construed as addressing what, in our view, are some salient tax considerations arising from our understanding of the relevant treaties. These comments represent exclusively our views, which views may not necessarily be agreed to by the Maltese Revenue and/or by any other authorities, whether Maltese or foreign.

This analysis is intended as a quick reference guide only and should not be construed as tax advice. One should also keep in mind that treaties include various anti-avoidance provisions which should also be taken into consideration. The taxpayer's tax position will depend upon personal and specific circumstances. In all circumstances, all interested parties should refer to the relevant provisions of the tax laws of their country of residence and seek advice from a suitably qualified tax advisor.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.