Foreword

Material growth is expected in the field of international insurance business. Malta is witnessing an ever increasing number of foreign players registering as insurance licencees, together with an ongoing stream of enquiries on potential new applications. This growth is consistent with Malta's development as a reputable financial services centre, which has accelerated since membership of the European Union in 2004. In the Competitiveness Index 2011-2012, recently published by the World Economic Forum, Malta ranked 15th out of 143 world economies surveyed in the financial market development sub-index. The insurance industry is an important pillar of the Maltese economy, taking advantage of a number of key attributes that Malta offers, including a highly-skilled workforce, excellent service, the appropriate corporate infrastructure and robust legislative and regulatory frameworks, including tax efficiency and innovative structures such as PCCs and ICCs.

PwC Malta is the leading and largest professional services organisation on the island, with 17 partners and around four hundred staff. We provide a range of assurance, tax, and advisory services to a large and varied client base, including leading companies involved in all the spheres of the insurance industry – insurance principals, intermediaries, protected cell companies, captives and insurance managers. This publication is one of an increasing number of initiatives, including surveys and newsletters, which are designed to share our knowledge with the industry. It presents an overview of how we perceive a steadily growing industry, and the services we are geared to provide.

Whilst all reasonable care has been taken in preparing this publication, there is of course no substitute for specific advice. Should readers require further information, we shall be glad to assist and encourage you to contact one of the members of our insurance team listed at Section 9 of this publication.

We look forward to being of service to you.

1. Malta as a strategic location for doing business

Malta's strategic geographical location at the centre of the Mediterranean has played a decisive role in its history and continues to play a very important part in its economical, political and cultural development and prosperity today.

Malta was a British colony until 1964. Today it is an independent Republic, a member of the British Commonwealth, the Council of Europe, and the United Nations and became a member of the European Union (EU) on 1 May 2004.

Over the past two decades, Malta has completed a programme of reforming all its finance sector legislation in line with best practices observed in Organisation for Economic, Co-operation and Development (OECD) countries. It is also actively involved with the OECD, the EU and the Commonwealth in modelling global regulatory policy.

The government is democratically elected and all sides of the political spectrum have agreed to Malta's economic development strategy. This strategy is designed to continue to develop Malta as a manufacturing base, as a quality tourist resort, and as a provider of a growing range of services, particularly financial services.

Malta has an excellent business infrastructure with good telecommunications, extremely well equipped ports and Freeport, a well-developed manufacturing infrastructure and a sophisticated European business environment.

The labour force is skilled, multi-lingual, flexible and adaptable. The official languages are Maltese and English; most Maltese citizens speak the latter fluently. Business correspondence is conducted mainly in English and all laws are published in both languages. A large proportion of the population is also fluent in Italian.

2. The insurance industry in Malta

Malta is considered to be an attractive location in the EU for the establishment of captive and other insurance and reinsurance businesses. The island continues to offer stability to potential investors. Since the early 1990's, Malta has established itself as a renowned and stable financial services sector. The insurance industry is one of the pillars of this development, with the Malta Financial Services Authority (the "MFSA") working to create a stable, yet innovative, jurisdiction aimed at encouraging the growth of insurance and reinsurance business, including captive insurance companies, Protected Cell companies (PCCs) and Incorporated Cell companies (ICCs), passporting their services throughout the European Union.

The insurance industry in Malta boasts a mature domestic market constituted of life and non-life insurers, as well as a thriving international sector, including captives and direct underwriters and reinsurers. The number of insurance intermediaries and service providers also continues to increase. As per Malta Insurance Management Association ("MIMA") survey results published on 30 July 2010, the number of managed insurance companies, and cells in protected cell companies, has increased from 20 in 2008 to 41 in 2010; and assets under management have increased from €555,305,454 in 2008 to €1,099,657,011 in 2010. Similarly, annual gross premium written by insurance companies and cells under management has grown by 68% since 2008.

With its favourable tax system, low-cost location and efficient regulatory environment that accelerates the set-up of new companies, Malta continues to be an attractive destination for insurance companies, PCCs and, more recently, ICCs.

3. Why carry on insurance business in Malta?

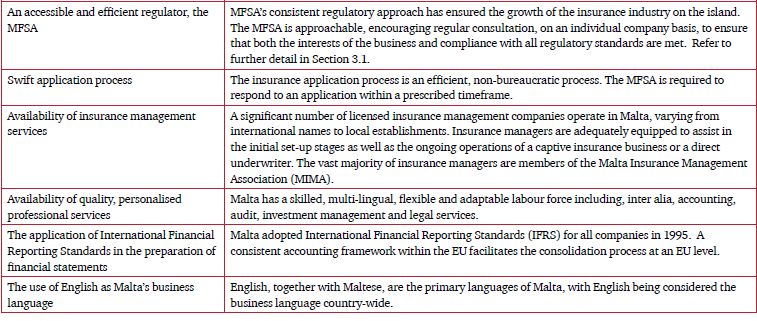

There are a number of benefits associated with setting up insurance business in Malta. A main advantage, of particular appeal to companies intending to write business across EU is that insurance companies incorporated in Malta can passport directly, either through freedom of establishment or services, to all other member states. Significant advantages lie in having a knowledgeable and accessible regulator, the MFSA, coupled with a very experienced professional workforce. Malta's tax regime is stable. As governments across the world move to tighten tax rules, Malta's tax rate of 35%, based on a full imputation tax system that results in tax refunds to shareholders, is seen as tax-efficient and acceptable. Moreover, Malta has a network of Double Tax Treaties with over 55 countries, including most EU countries and the US.

From an operational perspective, Malta has a comparatively lower cost base when compared to other EU domiciles. The country has an excellent business infrastructure with good telecommunications and a sophisticated European business environment.

Malta's legislative framework is also innovative in that it caters for insurance set-up options considered to be relatively new and alternative in the context of the rest of the EU, such as the creation of PCCs, and more recently, ICCs. Malta is the only EU member state to have this legislation in place. The local legal framework further includes migration legislation that facilitates movement into and out of Malta.

The table below summarises what we perceive to be the main benefits of setting up insurance business in Malta.

3.1 The competent regulatory authority

The competent regulatory authority is the MFSA, which is a fully autonomous public institution that reports to Parliament and was established by law on 23 July 2002. The MFSA is the single regulator for all financial services, which includes banking, insurance, investment services, trustee services, pensions, collective investment schemes and their providers. The functions of the Registry of Companies, the International Tax Unit of the Inland Revenue, and the Listing Authority, are all housed within the MFSA.

Creating the MFSA as a single regulator was part of Malta's long-term strategy to create a mainstream finance centre in the country. Financial services have benefited from a reduction in bureaucracy, streamlined procedures, lower fees and compliance costs, and a more consistent implementation of standards.

The organisational structure of the MFSA ensures that the regulatory and operational functions of the Authority are exercised within strict legal demarcations. The Board of Governors, presided by the Chairman, sets out policy and general direction and is assisted by the Legal and International Affairs Unit. The Director of this Unit is also the Secretary to the Board of Governors. The Supervisory Council, headed by the Director General, is exclusively responsible for licencing, supervision and regulation and is composed of the Directors responsible for Authorisation, Banking Supervision, Securities and Markets Supervision, Insurance and Pensions Supervision, and Regulatory Development. Operations are the responsibility of the Board of Management and Resources composed of the Directors responsible for Communications, Human Resource Development, Information Technology and Administration chaired by the Chief Operations Officer. Co-ordination between these three organs is ensured at Co-ordination Committee level.

The MFSA has a staff of over 170 people, consisting of specialist regulators, lawyers, accountants and support staff facilitating the formulation of policy, decision making and support for both licence holders and consumers.

The Authorisation Unit of the MFSA is the department responsible for the licensing of insurance principals, intermediaries, PCCs, ICCs, captives and insurance managers, and may be contacted as follows:

The Director

Authorisations Unit

Malta Financial Services Authority

Notabile Road,

Attard, BKR 3000

Telephone (+356) 2144 1155

Fax (+356) 2144 9308

Email: au@mfsa.com.mt

Website: www.mfsa.com.mt

4. Insurance business set-up options and the relevant Maltese legislation

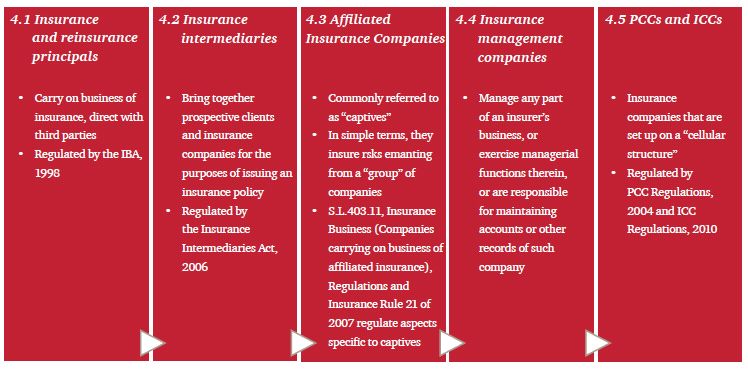

Malta's company law and fiscal legislation is based on tried and tested legal principles and implements all applicable European Union legislation. Insurance-specific pieces of legislation offer a variety of set-up options, together with the governing framework within which they can operate. Further details of the legislative framework are included in Appendix B to this publication. The following is a summary of the possible set-up options:

4.1 Insurance (and reinsurance) principal companies

Insurance (and reinsurance) companies in Malta are mainly regulated by the Insurance Business Act, 1998 ("the Act"). The Act provides for the authorisation and supervision of insurance companies and the MFSA is the Competent Authority for the purposes of the Act. Insurance Business Regulations ("Regulations") constitute subsidiary legislation to the Act, whereas Insurance Rules ("Rules") may be issued by the MFSA under the Act as may be required for carrying into effect any of the provisions of the Act. The Act, Regulations and Rules together constitute the legislative framework for insurers in Malta. Refer also to Appendix B for details on the regulatory framework.

The Malta Insurance Association (MIA) is a non profit-making organisation that represents the views and common interests of all insurance companies in Malta. MIA provides its members with the opportunity to exchange and analyse external developments and issues relevant to their industry's well being. Indeed, part of the MIA's mission is to offer training initiatives and events targeting general and specialised lines of insurance business.

As at December 2011, the number of insurance principals in Malta stood at 35, including 28 primarily underwriting risks outside Malta.

4.2 Insurance intermediaries

An insurance intermediary is defined as a person(s) or a company who brings together prospective clients and insurance companies for the purpose of issuing an insurance policy. All intermediaries, except for introducers, are licensed by the MFSA and are regulated under the Insurance Intermediaries Act, 2006.

The Insurance Business Act, 1998 and the Insurance Intermediaries Act, 2006 are two separate but complementary pieces of legislation that establish the legal and prudential framework for the regulation of insurance business and insurance intermediaries' activities in Malta.

As at December 2011, there were 17 insurance agents and 29 insurance brokers registered in Malta as per the MFSA's list of licence holders.

4.3 Captives

Under the Maltese legislative framework, captives are termed "Affiliated Insurance Companies" ("AICs"). These are defined as companies that insure risks originating from:

- parent companies;

- associated or group companies;

- individuals or other entities having a majority ownership or controlling interest in the AIC, And

- members of trade, industry or profession associations insuring risks related to the particular trade, industry or profession.

The legal and regulatory framework governing captive insurance in Malta is the same that applies to all insurance companies. There are however a number of features which recognise the particular characteristics of captives and cater for their needs. Subsidiary Legislation 403.11, Insurance business (companies carrying on business of affiliated insurance), Regulations and Insurance Rule 21 of 2007 (Business of Affiliated Insurance) regulate those aspects specific to captives. Detail on the setting up of captives is provided in Appendix B5 to this document.

Currently, there are 10 companies authorised by the MFSA as AICs.

4.4 Insurance management companies

The Act defines an insurance manager as a person enrolled to carry out activities that consist of accepting an appointment from an insurance company to manage any part of its business, or to exercise managerial functions therein, or to be responsible for maintaining accounts or other records of such company. Management functions may include the authority to enter into contracts of insurance on behalf of such company under the terms of appointment. A local company authorised under the Insurance Intermediaries Act, 2006 as an insurance intermediary and carrying on business as an insurance broker, restricted to contracts of insurance relating to risks situated outside Malta, may appoint an insurance manager authorised under the Act to manage such business. An affiliated insurance company or an affiliated reinsurance company may also, with the approval of the Authority given in writing, appoint an insurance manager.

The Malta Insurance Managers Association (MIMA), established in Malta in 2007, represents the interests of all authorised insurance managers and managed insurance companies in Malta. MIMA has succeeded in and continues to strive towards the establishment and growth of the international insurance industry in Malta, as well as the development of management expertise.

As at December 2011, there were 15 insurance managers registered in Malta, the vast majority of which are members of MIMA.

4.5 Protected cell companies (PCCs)

With the introduction of Subsidiary Legislation 386.10 of 2004, Companies Act (Cell Companies Carrying on Business of Insurance) Regulations, Malta became the only EU member state to incorporate PCC legislation in its financial legal framework.

The PCC is a risk management tool, enabling different owners with varying interests to participate in one insurance company through the establishment of cells.

As at December 2011, there were 7 PCCs domiciled in Malta, operating 16 cells between them and offering potential investors the opportunity to set up an insurance operation in Malta, with reduced capital requirements compared to a stand-alone insurance set-up, as well as other advantages.

4.6 Incorporated cell companies (ICCs)

Taking account of international developments in the area of cell legislation, the Companies Act (Incorporated Cell Companies Carrying on Business of Insurance) Regulations, 2010 have also been enacted, introducing another innovative type of vehicle in Malta. This legislation builds on the cellular concept under the PCC legislation introduced in 2004, and detailed in section 4.5 above. The most significant difference between the two concepts is that in an ICC, its core and cells are individually separate legal entities.

5. A wider perspective – the global insurance Market

Following the recent global financial crisis, what customers, investors, governments and regulators expect from insurers is changing rapidly. The scenarios we are witnessing today are just the beginning of a process of change.

Macro issues facing insurers include regulatory upheaval, fundamental tax changes and other implications. Facing pressure from the government, supervision will be more intense and regulations are subject to national and European priorities. Solvency II is at the top of all insurers' agendas and is expected to result in an overhaul of regulation as we know it today, influencing key decision makers in the manner in which they conduct their business and manage risk. Similarly, amid moves to increase tax revenues and tighten the tax rules of offshore businesses, the stability of the tax regime is now a key consideration for where insurers are domiciled or where they chose to relocate. At the same time, phase two of IFRS 4 is underway, which is expected to result in a complete overhaul of accounting for insurers as we know it today.

Insurance CEOs, participating in the PwC 14th Annual Global CEO Survey, said that generating profitable growth is going to be challenging for many companies in the face of tight margins, mounting regulation and the fragile economic environment within many developed markets. Of all the threats to growth highlighted by insurance CEOs, over-regulation was by the far the most significant (cited by 79% of insurance CEOs).

They were however upbeat about the future. More than half (56%) were very confident about their company's prospects for revenue growth over the next three years and virtually all the rest are reasonably confident. That makes them more optimistic than CEOs in almost every other sector. Innovation and the smart use of technology are high on the agenda to drive the growth strategy. Malta is well positioned to meet these challenges. As a member of the EU, Malta is currently preparing itself for Solvency II, led by the local supervisor, the MFSA. All Maltese insurance companies adopt IFRS as their accounting framework and preparations for the eventual introduction of the new IFRS on insurance contracts are also underway. The Maltese insurance market has proved to be a stable environment throughout the financial crisis and the major shocks registered in other jurisdictions were not as pronounced locally.

Solvency II

Solvency II, the planned overhaul of prudential regulation for European insurers is well under way. Existing European solvency rules for life, non-life insurers and reinsurers will be significantly upgraded. Structured around three pillars, Solvency II is a risk-based, forward-looking regulatory regime founded on a 'total balance sheet' and market-consistent approach. Companies will need to run their business with an increased focus on risk management, governance and enhanced disclosure.

Amongst the latest developments on Solvency II is the agreement between the European Parliament and the European Council that the full implementation date for Solvency II will be 1 January 2014. With this deadline approaching, it is vital that insurers press ahead with their current plans and timetable. Any distraction now could prove potentially costly in the long run

IFRS 4, Phase II

The IASB is working on a comprehensive standard that will fundamentally change the accounting by insurers, reinsurers and other entities that issue contracts with insurance risk. The proposals are the output of the IASB and FASB's joint efforts to develop a single converged insurance standard. The FASB plans to issue a discussion paper that will incorporate the IASB's proposals. The proposed standard would replace IFRS 4, which currently permits a variety of practices in accounting for insurance contracts.

The proposed standard would apply to all entities that issue contracts that contain insurance risk. IASB expects a review/redraft of the exposure draft (ED), issued in July 2010, to be released in 2012. The date of publishing of the final standard and the effective date are still to be determined, the latter date will not be earlier than 2013. Insurers should understand the implications of the new IFRS, as currently exposed in the ED, on their organisations and should start to assess the requirements, (for example in terms of data management), arising from the eventual introduction of this standard. There are synergies to be found between IFRS Phase II and Solvency II, which if identified, will mean that insurers do not "dig the road twice" when preparing for these two major changes.

6. About PwC Malta

6.1 A general background (PwC Malta)

The firm is the leading and largest practice of accountants and auditors in Malta. It forms part of the worldwide PwC organisation - the world's leading professional services organisation, drawing on the knowledge and skills of almost 169,000 people in 158 countries. This organisation is designed to give a worldwide coordinated service to clients and is under the surveillance of an international partnership which supervises the ethical and professional standards in all offices. Within the broad range of services, which PwC provides, the principal areas are:

- Assurance

- Tax Services

- Company Administration Services

- Transactions

- Crisis Management

- Business & Performance Improvement

- Change & Programme Effectiveness

- Internal Audit Services

- Human Resource Services.

PwC also makes available a range of other services in Malta designed to provide businesses and organisations with a coordinated package of services that will contribute to future growth, efficiency and prosperity. The firm is currently responsible for serving a large and diverse client portfolio comprising some of Malta's top companies. Its client list includes a number of public companies and institutions, private companies both large and small, foreign and local, and Government related companies. The annual report, 'Review Malta Firm' provides more insight into the Malta practice, and includes a list of insurance clients.

The firm's head office is located at 167, Merchants Street, Valletta, where Tax Services and Corporate Services are located. Assurance and Advisory Services are located at Mill Street, Qormi.

6.2 Our insurance client-portfolio

Our firm serves every major segment of the insurance industry, including local and foreign insurance principals, captive insurers and protected cell companies. We have a leading position in the insurance industry. Our clients include the majority of local insurance companies, a number of captives and foreign underwriters registered in Malta, as well as insurance intermediaries and insurance managers.

PwC actively participates in growing and shaping the insurance industry. We have been, and continue to be, involved in assisting in drafting segments of insurance and tax legislation. In recognition of the continued and sustained growth of the insurance sector in Malta and its requirements for high quality audit, tax and business advisory services, the Maltese firm has dedicated resources and professionals to service this industry. We have a team that specialises in this particular sector. The scale of this experienced resource pool cannot be matched by any other service provider in Malta.

Our presence in the insurance industry in Malta:

6.3 PwC – a global network

PwC is the largest provider of professional services to the insurance industry. This has allowed us to develop unique insights into the challenges, issues, and best practices that engage companies across the industry providing services to 86% of insurance companies listed on the Fortune Global 500. Our global network of specialists has a proven track record of helping financial services organisations successfully address complex issues including growth, human capital, mergers and acquisitions, governance and risk management, regulation and compliance, process improvement and operational effectiveness.

More importantly, we are on the forefront of Solvency II developments and the challenge that this overhaul of regulation brings. We have access to an actuarial practice that has over 1,000 specialists in 36 countries providing life, health and non-life assurance and advisory services to the insurance industry, its regulators, and other financial services providers.

We advise a wide range of clients in traditional areas of actuarial work such as reserving, mergers and acquisitions, due diligence, exit solutions and capital modelling. As part of the world's largest professional services organisation, we draw on the extensive knowledge of accountants, risk managers, performance improvement consultants, tax advisors, as well as corporate finance and business recovery specialists.

We specialise in helping financial services and insurance companies create, sustain and increase shareholder value by adopting a value-based approach to the issues they face. Risk quantification and dynamic financial modelling of risk outcomes provides the management tools required for more informed business decisions.

Our actuarial insurance services include:

- Risk management

- Market reporting, governance, regulation and compliance

- Processes

- Mergers, acquisitions and disposals

- Capital management

- Healthcare.

Source: http://www.pwc.com/gx/en/actuarial-insurance-services/index.jhtml updated as at Sep 2011

7. How can we help?

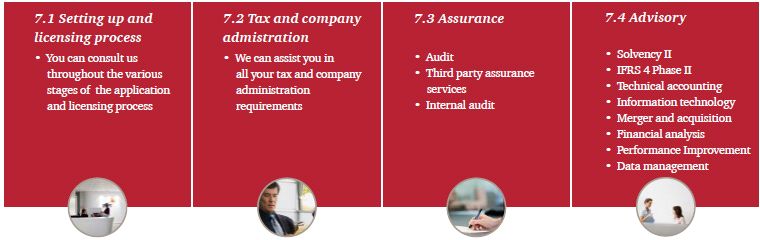

Access to our specialists

PwC is the leading provider of professional services to the insurance industry in Malta. Our market footprint is significantly greater than that of any other accounting firm. We benefit from a wealth of experience and knowledge of insurance market practices, issues and developments, including access to a specialist network that continues to excel in this sector internationally.

This gives us unrivalled strength and depth of specialist insurance resources at all levels and in all disciplines, including audit services, accounting, tax and advisory services. PwC can assist you in all aspects of your business, as further outlined in this section.

7.1 Setting up and licensing process

PwC Malta provides consultancy services throughout the various stages of the licensing process.

These include:

- Introduction to the Maltese regulatory authorities, and the requirements for setting up an insurance business in Malta.

- Assistance in the preparation and/or review of the Scheme of Operations, with a focus on the financial components in the business plan, prior to submission to the Authorities, in liaison with the prospective insurer's insurance managers and/or accountants and/or legal advisors as may be appropriate.

- Assistance in the compilation and/or co-ordination of documentation required at various stages of the licensing application process.

- Assistance in the compilation of the organisation's policies and procedures with appropriate mapping to regulatory requirements and providing value added recommendations.

- Advice on ad hoc regulatory and general queries as they arise, including consideration of implications for complex non-standard insurance contracts.

7.2 Tax and company administration

PwC Malta's tax practice has significant experience in dealing with international structures, including, but not limited to, clients in the insurance industry. Our firm has assisted a large number of clients in setting up Malta structures. Our expertise in this field is enhanced by our membership of the PwC network.

Tax planning and advisory services vary depending on the complexity of the structures and the issues arising. It is our experience that some investment is required particularly in the initial stages in assessing the tax implications of operating in the insurance industry and exploring possible solutions.

Our firm can also provide assistance with the incorporation of a Maltese entity. In addition to dealing with annual income tax compliance, companies are required to submit annual returns to the Registrar of Companies. Our firm is well placed to assist with both of these legal obligations. We also assist with any tax refund claims that may be applicable in certain circumstances, both in advising on the setting up of an efficient tax refund process, as well as assisting in the compliance aspect of tax refund applications.

Particularly in the case of foreign insurance businesses or those employing individuals who are not ordinarily resident in Malta, or employing expatriates qualifying for the personal tax incentives under "The Highly Qualified Persons Rules, 2011", we have the necessary expertise to advise and assist with personal income tax matters. We also provide human resource related services such as advice on organisation design, policies, assistance with global mobility matters, job evaluation and compensation, and payroll administration services.

Our practice is also well placed to provide various accounting services to insurance businesses, which could range from assistance with the production of monthly or quarterly management accounts to involvement in day-to-day book-keeping and reconciliation processes. The preparation of financial statements in accordance with IFRS is a complex process, particularly for insurance entities. We benefit from significant expertise in insurance accounting matters and disclosure requirements, and are well placed to assist our clients in this regard.

7.3 Assurance

Audit

Why choose PwC for your audit?

Our audit proposition focuses on your needs with emphasis on the following key features of our service delivery:

A value-added audit experience

Our audit will focus on the key risk areas in the context of the financial statements. We initiate this process by engaging in conversations with senior members of corporate governance such as the Board or Audit Committee (AC), and we direct our focus to areas of concern, at the same time minimising time on matters that are less significant. We seek to share our knowledge of best practices or issues that are typical of your business.

A 'No surprises' audit

We believe in a 'no surprises' audit and consider that ongoing and transparent communication is critical to this process. We endeavour to communicate with our clients throughout the year as well as at the year end. This helps to ensure that we are able to provide timely advice on events that may have an impact on your business. Communication can take several forms, including meetings with the AC and senior management, sharing of relevant publications, and involvement in related events like CEO Connect.

Third Party (TP) assurance services

Why look to TP assurance services?

When use TP assurance services?

- International Standard on Assurance Engagements (ISAE) 3402 reports are applicable when a service organisation seeks to provide their customers (the user organisations) with an understanding of its internal control environment.

- A user organisation's external auditor can use the report to gain an understanding of, and potentially place reliance on, the testing of the internal controls at the service organisation.

Increased relevance under Solvency II

- The relevance of this type of service increases in the context of assurance on outsourced functions of an insurer, in line with the requirements of Pillar II under Solvency II (eg insurance managers).

- SMEs rely on outsourcing and this is a way of obtaining assurance over the service organisation, providing the outsourced function.

Why PwC for this service?

- PwC is a leading global provider of Third Party Assurance services and is recognised as a thought leader in the development and execution of controls assurance.

There are two types of ISAE 3402 report:

- Type I - details the service organisation's description and design of controls at a specific point in time e.g. 31 December 2011.

- Type II - also includes details on the operating effectiveness of the controls over a period of time and, therefore address both the design effectiveness and operating effectiveness of controls.

Benefits to customers

Customers knowing that an organisation produces an ISAE 3402 report will obtain:

- Relevant information on policies, procedures and controls.

- A focused and independent assessment of controls and operating effectiveness.

- A globally recognised standard for reporting.

Internal Audit

Internal audit is a required function under the Solvency II system of governance. There are various options available to an organisation, through which the required internal audit function may be established. One possibility could be to outsource.

7.4 Advisory

PwC Malta is well positioned to provide advisory and consultancy services in relation to various aspects of setting up and on the operations of insurance businesses in Malta. We can provide various services including, inter-alia, assistance with ongoing regulatory and compliance matters, the implementation of Solvency II and advice on preparation for the requirements of IFRS for insurance contracts (Phase II). In this document, we will focus mainly on our Solvency II and IFRS offerings.

Solvency II

Solvency II is the most significant regulatory initiative for decades within the (re)insurance sector in the European Union and will usher in a new risk-sensitive solvency regime facilitating better capital utilisation, more robust risk management processes and improved competitiveness.

In preparing for all three pillars of Solvency II, PwC can help to:

- prioritise resources and next steps,

- identify areas to fix,

- raise awareness in the company,

- set the vision and ambition,

- tease out the business benefits,

- think about synergies between IFRS/Enterprise Risk management (ERM) and structural and capital issues,

- assist with implementation,

- document controls and procedures.

PwC Malta forms part of a team of representatives of the PwC network across the EU, who meet on a regular basis in the interest of sharing knowledge and experience across the network. We have ongoing access to network knowledge and resources that results in a wealth of Solvency II experience that is difficult to match, including actuarial expertise.

IFRS Insurance Contracts Phase II

On 30 July 2010, the International Accounting Standards Board (IASB) issued an Exposure Draft (ED) in relation to an IFRS on Insurance Contracts, for comment. The IASB plans to release a re-exposure or a review of the draft in 2012. The effective date is not yet clear, but it will not be before 2013. Insurers in Europe will be looking at this timetable in the context of the changes being implemented under Solvency II, which contains similarities in terms of the measurement model. At this stage of the process, PwC can help you understand the exposure draft, identify the main impacts of the proposals and start to consider an outline for a transition plan (resources, data available, systems needs).

PwC Malta provides other general advisory services in the following areas:

Information technology

In preparation for Solvency II, PwC can support you in your assessment of system requirements and in your selection of a software provider in terms of requirements and our market knowledge.

Our data quality methodology and experience can help you address data quality issues by looking at data quality governance, quality of data and tools to manage data quality.

Our IT specialists are able to provide a range of advice from strategic to operational. We focus on assisting clients make the best of the technologies available, aligned to the type of organisation and the business processes concerned.

We also have an Information Security team that can carry out audits of the IT infrastructure, operations and data as well as internet connectivity penetration testing, internal LAN penetration testing and application vulnerability audits. We also provide advice on key issues in regulated sectors such as IT outsourcing; disaster recovery planning; security policies and data protection.

Accounting and reporting

Through its Accounting Consulting Services, PwC Malta has the necessary expertise locally to provide you with solutions to your accounting and reporting needs. We can provide various solutions, tailored to your needs, including:

- Assistance and advice in respect of the impact that new (and proposed) IFRS pronouncements may have on your company;

- Training of your management and/or finance team in respect of new IFRS pronouncements, or in respect of specific existing standards;

- Preparation, or assistance with the preparation, of your IFRS financial statements;

- Assistance in meeting your group's internal reporting requirements;

- Assistance with the preparation of consolidated financial information that incorporates your company and its subsidiaries;

- Assistance with the provision of resources during situations where you have temporary requirements.

As a member of the PwC network of firms, we also have access to network knowledge and resources that we can mobilise according to your needs.

Merger and acquisition

We identify merger and acquisition candidates, perform acquisition advisory procedures and disposition assistance of businesses. We assist our clients through every stage of a transaction, including deal structuring and fund raising, and help clients adapt quickly to the resultant changes.

Financial analysis

Our finance specialists prepare prospective financial analyses for proposed and existing operations. We evaluate actual results, and analyse the effectiveness of an entity's accounting and internal control systems for regulatory compliance and other purposes. Financial analysis services also include assisting entities in structuring joint venture agreements, negotiating management contracts and providing direction in the development of financial terms and the overall capital structure with lending institutions and investment banks.

Performance improvement

Our insurance specialists work within an organisation to assess areas for operational improvement and enhanced financial performance. This includes in-depth analysis by department of current practices, funds flow, staffing, departmental objectives, marketing initiatives and internal communication tools to enhance customer satisfaction and property earnings.

To continue to read this article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.