Each year, the financial services industry spends almost $20 billion on printing and distributing paper based customer communications (including credit cards and P&C insurance lines). Some larger banks and brokers own full scale distribution centers, which add millions more in overhead costs without providing any strategic benefit to the firm. Aside from being costly, paper based communications also present significant security risks and environmental impact. As a result, firms have been imploring their customers to "go paperless" for years. So, why haven't they?

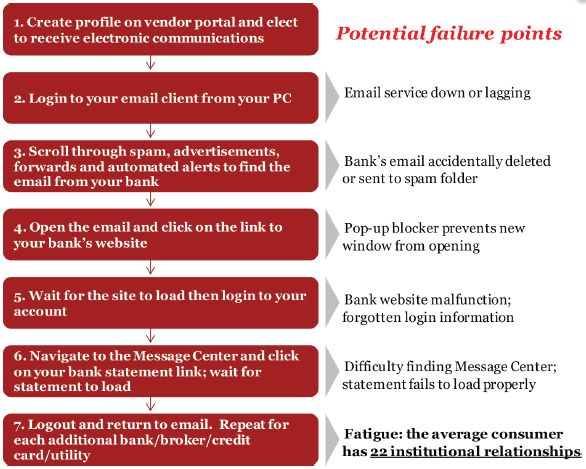

A leading reason why customers are avoiding the current alternative to paper – i.e., email – is that the user experience is frequently disjointed and inconvenient. Across the financial industry, email-based customer communication has reached a plateau. While customers are increasingly willing to conduct business online, many still receive paper based communications for their financial relationships, particularly account related materials (statements, confirms, notices, etc.).

Until more customers can be convinced to go paperless, firms will continue to incur burdensome printing and postage costs. But if customers won't accept email, a new channel is needed. An emerging technology that may be a compelling alternative to email is Digital Mail.

What is Digital Mail?

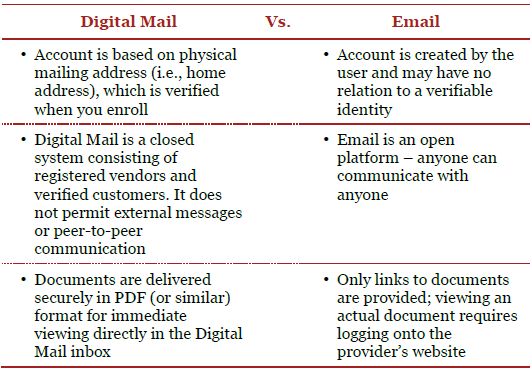

Digital Mail is a hybrid of physical documents with electronic delivery. It combines the best aspects of email and parcel mail, while eliminating their respective drawbacks. Customers access digital copies of their physical mail through a PC, tablet, Smartphone or other internet enabled device.

On a Digital Mail platform, a bank, utility company or other provider securely sends communication material directly to their customers. For the consumer, the advantage is that they received each of their bills and statements in one place (their digital "mail box") with one click access.

The problem with email

Americans online1

- 80% of US population has access to the internet

- 71%+ of US internet users have Facebook accounts

- 45% of US population has mobile internet access

- 85% of US households pay at least some of their bills online

- <11% of US population receives documents electronically

While internet access is nearly ubiquitous, the vast majority of consumers still receive most of their documents through physical delivery. This contradiction is particularly noticeable in the brokerage industry where even relatively affluent and tech savvy customers choose paper. On average, fewer than 15% of customers receive their statements, confirmations, regulatory and tax documents electronically.2

The low adoption rates are not difficult to understand. Even where information security concerns are allayed and simple inertia thwarted, the cumbersome user experience of receiving email based communications from banks and brokers is still preventing customers from switching to electronic delivery.

How to receive your bank statement via email in 7 (not so) easy steps:

Understanding the advantages of Digital Mail

Digital Mail is an attractive option in several respects. It not only eliminates the most cumbersome aspects of email-based delivery, but it also provides strong security and identity verification, offers new opportunities for customer relationship management, is flexible enough to accommodate enhanced functionality and is easy to put into effect. Already taking hold in Europe and Asia with over 90% adoption in some markets, Digital Mail has the potential to end our reliance on email in the US and alter the dynamics of customer communications.

Core features of Digital Mail include:

- Allowing users to store and manage their documents in one secure portal

- Interactive functionality such as the ability to respond to communications, set calendar alerts or conduct simple account transactions

- Enhanced security – as a closed system only official, genuine documents reach the user (no spam, no phishing scams)

Enhanced functionality may include:

- Message tracking and monitoring (e.g., sender knows when a document has been opened) on individual and aggregate basis

- Ability to push additional messaging to users' screens

- Account management and transactional capabilities (e.g., bill pay) through "widgets"

- Ability to integrate with personal finance software

- Direct click through to provider web sites/portals without additional log-in required

- Social media integration (e.g., cross-over alerts/reminders on Facebook or Twitter streams)

- Bill payment scheduling

Digital Mail also has implications for institutional customers with potential uses from integration with ERP platforms to automation of invoicing or implementation by fund managers to manage content across accounts.

In addition to the technological benefits and features, digital mail also offers branding and marketing benefits. Unlike bill pay solutions, which stand between the provider and the consumer, digital mail preserves the relationship by the provider's brand (e.g., logo) and messaging present in the digital mail inbox, along with links back to the provider's internet portal. The move to digital mail can also be positioned as a "green" initiative to environmentally conscious consumers.

Illustrative Digital Mail end user interface

Current providers of Digital Mail and similar services

Launched in 2009, Zumbox was the first digital mail provider in the US. It started in L.A. and has 400,000 registered users. It connects large transactional, financial and government mailers to consumer households for the delivery and storage of digital postal mail via the Internet.

Volly is an in-development offering from Pitney Bowes expected to launch in late 2012. It will offer digital mail service (direct connections between institutions and customers), as well as bill pay capabilities and other transactional functionality. Australia Post has selected Volly to power their Digital Mailbox service. Pitney Bowes also has a strategic partnership with Broadridge Financial Solutions, who will make the platform available to their financial services industry clients.

Backed by Jeff Bezos, Doxo, Inc. positions itself as an online/digital file cabinet solution for businesses and customers. Its value proposition focuses primarily on bill payment capabilities. It differs from Zumbox and Volly in that it does not facilitate direct business to consumer mailing.

In 2011, Manilla began a service designed to simplify consumers' account management. Like Doxo, Manilla uses "screen scrape" technology to allow users to access their registered accounts, regardless of whether or not Manilla has established a partnership with the biller or magazine subscription provider. Since launching, they have delivered over 2 million bills and statements.

Numerous other companies are expanding their offerings in adjacent spaces, such as bill payment (Bill.com, MyCheckFree, Billeo) and money management (Pageonce, Quicken). To date, the US Postal Service has not indicated any intent to offer Digital Mail on a nationalized basis, though this has been done successfully throughout Europe and Australia.

Global adoption

Postal services around the world are facing similar pressures to those experienced by the United States Postal Service – including declining mail volumes and increasing costs. In response, many are embracing digital mail technology. Digital Mail platforms are available in 25 countries, some of which have already seen 25 - 50% household adoption rates.3 For firms with a global client base, establishing compatibility with digital mail platforms should be a near term priority, irrespective of what happens in the US.

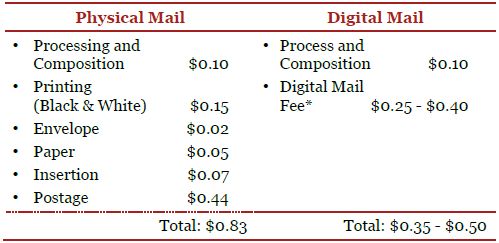

If the advantages of Digital Mail drive consumers to switch away from paper based communication, the potential cost savings are significant. On a per unit average basis, Digital Mail costs less than half as much as a paper based mailing. For firms sending out millions of mailings per year, even a modest adoption rate would translate to noticeable savings, directly impacting the bottom line. For example, a hypothetical bank with 10 million customer savings accounts could save over $5M annually with only a 5% digital mail adoption rate. For a brokerage house with a similar size client base, the savings is potentially much larger, assuming a greater volume of mailings (e.g., statements, confirms, prospectus, proxy).

Longer term, a broad adoption of digital mail would allow some firms to greatly reduce their cost base by retiring their current printing and distribution centers. As the amount of paper generated decreases, the dynamics of consolidating print facilities or out-sourcing production completely, become more favourable.

Digital mail offers significant cost savings versus physical mail

(Cost comparison for a small, black & white mailing4)

*Fees vary based on platform and country

From an investment standpoint, Digital Mail is relatively simple and inexpensive to implement. Firms that want to plug directly into a system like Zumbox or Volly need only establish a data connection from their existing content generation system to the Digital Mail system. No infrastructure build or system implementation is required. Firms that outsource their production and distribution may avoid any investment by requesting their business partners establish the connection with a Digital Mail provider.

Broader trends are contributing to the case for Digital Mail

Though email has been the most prominent digital communication channel (and will likely continue to play an important role), several factors suggest the environment is right for a new channel to emerge:

- Cost pressures – current economic pressures combined with increased regulatory scrutiny are putting ever more pressure on margins. Financial firms are seeking new ways to reduce costs without sacrificing customer experience or operational efficiency.

- Customer expectations – with over 45% of Americans owning Smartphones and tablet PCs, the overall expectation of multichannel access to account information is growing.5 The ability to access social media "anytime, anywhere" is also reducing the importance of email as a personal communication medium.

- Postal service changes – Mail volumes have dropped 20% in the past three years and are expected to continue to decline.6 As a result, the US Postal Service's revenue is declining in parallel. To address these losses, the USPS is closing offices, cutting service and raising rates.

Over 70% of consumers under the age of 35 are willing to try Digital Mail7

The potential benefits

Like email in its early days, the success of Digital Mail will depend on network effects. The more banks, brokers, utilities and credit card providers that offer digital mail, the greater the value proposition to individual customers. The more customers that use Digital Mail accounts, the greater the savings to the firms they do business with. The firms that understand the value of this technology must be willing to take the first step – knowing that their decision will make it more likely that others will follow suit. Consumer adoption, however, is not guaranteed. Ultimately, wide-spread adoption could benefit everyone as customers get a better experience and less paper clutter, while firms can re-allocate resources toward more strategic uses.

Conclusions

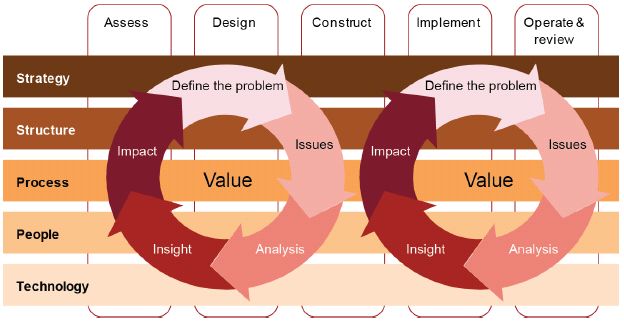

Email has been fundamentally unchanged for many years and it may now be time for electronic messaging to evolve. As consumer adoption of email-based account communications stagnates, financial firms need to consider alternatives – and the cost saving potential of Digital Mail technology is too compelling to ignore. At the same time, however, adding a new digital communication channel is an opportunity to revisit digital strategy more broadly. Beyond Digital Mail, new channels will continue to proliferate. As recently as 10 years ago, it was difficult to imagine any meaningful electronic medium beyond email and static websites. Today, the emergence of social media and ubiquitous internet connectivity has opened new dimensions of communication that most firms are only just beginning to explore.

Understanding that new communication channels will only continue to emerge, firms should consider reassessing their current IT architecture considering the following:

- Is their architecture flexible enough to quickly adjust to the demands of new channels (and rapidly changing customer expectations)?

- Can content be delivered anytime, anywhere, across platforms, devices and channels?

- Do existing applications support the idiosyncrasies of each channel?

- Can you effectively control the quality of your content and fidelity of your message in a connected world?

- Do you know what happens to your content once it passes through your company's firewall?

Some firms may reach the conclusion that channel management is not a core competency and should be outsourced to a communications solution provider who can distribute their data across channels and provide enhanced functionality on their behalf. In addition to managing the channels themselves, firms will also face the added burden of managing their customers channel preferences. In the near future, the options available will no longer be a simple toggle between email and paper mail – firms will need to track multiple options across a variety of accounts, adding to the ever-growing data deluge.

Our approach

We are a leader in digital strategy and have assisted clients throughout the financial services industry with transformative information technology initiatives. The proliferation of customer interface channels critical business challenge not just for information delivery, but also for sales and relationship management. By understanding emerging technology, shifting customer demands and macro business trends, you can transform your organization and reap the benefits of improved customer experience and reduced operational costs.

Footnotes

1 Broadridge Digital Trends Analysis, 2012

2 Ibid

3 Ibid

4 Ibid

5 Ibid

6 Source: Comprehensive Statement on Postal Operations, USPS, 2011

7 Source: The Emergence of Digital Mailbox Services, InfoTrends, 2011

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.