Introduction

Once again, I am pleased to present the annual review of our firm, this time covering the year ended on 31st December 2011. This publication incorporates our transparency report for 2011, as required by the EU Statutory Audit Directive, as well as summarising our activities during the year. It also details our policies and values, to portray who we are, what we do, and how we do it.

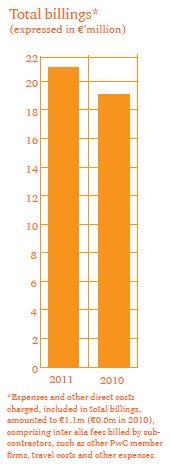

2011 has been a year of continued growth for the firm in Malta, and we have recorded a 13% increase in our fee income, which now totals €21.5 million. Much of this growth has been achieved in line with the expansion of the financial services industry in Malta, but it is also the result of an increase in the number of local clients to whom we provide services. Local businesses remain the foundation upon which our firm is built, and we are committed to continue to deliver a quality service to them, and all who choose to work with us. We recognise that the choice of a professional advisor or independent auditor is an important one based upon many factors, including adding value and value for money, doing what is right, and having the right skills and resources to be able to deliver on a consistent basis.

We have invested heavily in human resources during 2011, and will continue to do so. We are always looking to attract talent to enhance our business relationships, deepen our industry knowledge and refresh our view. But attracting top talent means constant assessments and challenges in order to answer the questions: "To attract the people we need, what kind of business must we be, and what kind of jobs must we offer?"

We have also continued to listen to our clients' feedback on the issues that are important to them, and we have enhanced our capabilities as a result across all our service lines. The PwC brand is defined by the values that it represents and the values that we live by, and we take extremely seriously our obligations towards all those stakeholders who place reliance on our opinions. Our quality control and risk management processes, which are described in more detail in this publication, remain robust and have been confirmed by the various external and internal reviews carried out during the year.

As the largest professional services organisation in Malta, we are conscious of our wider professional and corporate social responsibilities. We continue to participate in numerous for a to provide our contribution towards Malta's economic and social development, sustainability, continuing professional education, our cultural heritage, and numerous other areas. We believe that we have a responsibility to help create a sustainable future and play our part in making Malta a better place.

These issues are high on the agenda for our people and the communities in which we work.

At PwC, our people are supported and encouraged to become actively involved in community programmes. We have an enviable record in the number of volunteer hours and charitable donations made across a wide spectrum, and we aim to do more.

Delivering value and growth in a volatile world is a challenge for our clients, and of course for us. For the past 15 years, PwC has set out to uncover how CEOs view the most challenging business issues of the day, and how they're responding. Our 15th Annual Global CEO Survey is set against a backdrop of global uncertainty and volatility and, unsurprisingly, we found that confidence in business growth prospects is down across nearly all regions. But we also found a growing sense of preparedness and a surprising optimism: CEOs are nearly three times as confident of their own company's growth prospects in 2012 as they are in the global economy's.

Successful business strategies focus on getting the right business model for a world where risks and opportunities are often very much localised, by building resilience to global disruptions and local risks, and by facing the talent challenge in a more systematic and strategic way.

What is clear is that the fundamental changes to business dynamics which are apparent will compel companies and governments to rethink their strategies and operating models in the effort to realise value.

In addition to operating during uncertain economic conditions, our profession is also dealing with a rapidly shifting regulatory environment. Major initiatives that could impact our business - either through legislation or direct regulation - are under discussion in jurisdictions including Europe and the US. The European Commission, for example, has published wide-ranging draft legislation on auditing, addressing key issues such as independence, competition and governance. In the UK, regulators are examining competition in the audit market to decide whether changes may need to be made in the structure of the profession. And in the US, the Public Company Accounting Oversight Board is considering a number of options to strengthen the objectivity of audit firms. We are actively engaged in the debate about these and many other issues affecting our profession.

Our goal is clear: we want to remain the number one professional services firm in Malta - defined not only by size, but also from the perspectives of quality, brand and talent. This is about more than a ranking; it's about continuing to be known as the firm that does the right thing for clients, people, communities and the capital markets. We strive to hear and understand the goals of our clients, our people and other stakeholders, and work with them to create value.

My thanks goes to our clients and our people, and all who have contributed in one way or another to make PwC in Malta what it is today. I look forward to updating you on our progress next year.

Highlights

- Fee income grew by 13% in calendar 2011 to €21.5 million (€19.0 million in 2010).The firm won important new mandates across all its lines of service.

- International business continued to grow significantly during the year, and has remained a key driver of growth. As Malta matures further as a financial services centre of repute, this sector may reshape the country's economy, as it has already reshaped its professional services sector.

- Overseas secondments of staff participating in statutory audits overseas amounted to 28,200 hours, a 20% increase over the 23,400 hours recorded in 2010.

- In all, overseas work and international business (excluding foreign owned companies operating in the local market), accounted for 54% of the firm's income in 2011.

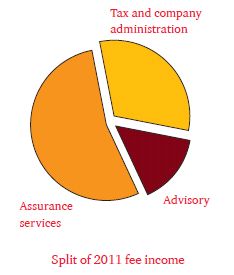

- Statutory audit fees, including fees derived from seconding assurance staff on overseas audits, amounted to €11.5 million, accounting for 54% of total billings.

- During 2011, the maximum fees we earned from any one client or client group amounted to 2% of the total billings of the firm.

- 65% of our advisory and tax fees in 2011 were earned from clients with whom we have no statutory audit relationship. If routine tax compliance work is excluded, this proportion rises to 75%.

- The firm had a full time staff complement of 308 at 31 December 2011, drawn from various disciplines. The firm also had 144 students on CareerDeal and ACCA full time study programmes.

- The aggregate staff attendance at training courses during 2011 totalled 42,800 hours. Training of professional staff averaged 160 hours per person in 2011.

- Time value on community work and pro-bono services, together with cash donations, totalled €154,400 in 2011.

Serving our clients

The range of services we provide

The size of our client base has enabled us to recruit and develop specialists across a varied spectrum of services in assurance, tax and advisory (deals and consulting).

Our strength often lies in the firm's ability to combine these offerings to help meet a client's particular needs. We offer a service, and not products, supported by our ability to field teams from across the different lines of service; and by our ability, where necessary, to leverage the experience and specialist skills available across the PwC network. Many of our competitors in consulting cannot offer this combined approach.

Our non-assurance services are offered to the business community at large. Excluding routine tax compliance services, which are closely allied to our audit of tax provisions, 75% of our non-assurance services were in 2011 delivered to a range of clients, both in the private and public sector, with whom we have no audit relationship.

A number of the services that we offer, such as business and property valuations, would in certain circumstances not be provided to our audit clients to avoid any subsequent self-review independence threats. We continued to invest in 2011 in the recruitment of specialists, and in training, to meet the growing business needs of our clients. We have for instance, recruited specialists in the areas of sustainability, corporate governance and regulatory compliance. We have also trained experienced staff in new developments such as the US FATCA legislation, which impacts on financial services companies in other jurisdictions.

To view this article in full please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.