BACK TO BASICS – THE IASB GOES TO WORK ON THE CONCEPTUAL FRAMEWORK

The IASB rekindled the Conceptual Framework project in September 2012. We take a look at key questions underpinning the debate and progress to date.

Focus returns to the nuts and bolts of IFRS – the Conceptual Framework (the 'Framework') as convergence recedes as a priority and the big '4' standard level projects are nearly behind us. It was identified as a high priority in the recent agenda consultation. A discussion paper (DP) is expected this summer; it is time to get engaged in the debate.

Project in a nutshell

There are hopes that a completed Framework will enhance standard setting going forward. The project's objective is to give the Board a clear conceptual basis for its decisions going forward. It should also provide preparers another reference point, especially in circumstances where standard level guidance does not exist.

The project will cover four main areas:

- Elements (assets, liabilities, etc)

- Measurement

- Reporting entity

- Presentation and disclosures

The Board plans to take a 'big bang' approach rather than developing the Framework in phases. But there are no plans to revisit the objective and qualitative characteristics (issued in 2010) unless work on the other parts indicates a need. The Board will build on existing work.

Key questions

The project highlights some key questions facing standard setters. Answering them will be fundamental to Framework's success.

Performance reporting and other comprehensive income (OCI)

Preparers and users continue to seek a relevant measure of performance but there is no clear consensus on how to improve today's model. Net income remains the primary performance measure for many, while some investors frequently look elsewhere (such as EBITDA or operating income) and many preparers present alternative earnings measures.

No clear principle currently exists to determine what should or should not be recorded within net income. OCI has evolved over time into a parking lot for some items and a graveyard for others. These are largely unrelated items for which immediate recognition in net income is viewed as inappropriate. There is also no consistent basis for whether amounts recorded in OCI are 'recycled' to the income statement.

OCI is likely to be a focus area in the DP and attract passionate feedback.

Defining assets and liabilities

Articulating the definition of an asset and liability might also be challenging. Assets are defined today by reference to resources, control and economic benefits. The existence of an asset is clear in many cases. But a growing focus on 'intangible' resources (such as rights to a future resource or 'know how') raises concerns about whether application of existing standards guidance provides sufficient useful information.

Recent debates have raised questions about the definition of a liability, which is likely to be an even bigger challenge. For example, does a liability exist if it is contingent on the action of a third party? What is a constructive obligation? How do you consider economic compulsion?

And then there is the question of liabilities versus equity. The Board has already tried, unsuccessfully, to solve this through defining the characteristics of equity instruments. The project was suspended in 2010. Many, however, still view equity as the residual.

Measurement – cost versus fair value

A single measurement attribute that applied to all elements of financial statements might seem an elegant way to solve the many difficulties that arise in the mixed measurement model we use today in IFRS. It is unlikely that the IASB would propose (and stakeholders would accept) a historical cost model. Not even the most prudent of accountants or regulators would suggest that derivatives should be at cost, for example. A single measurement model would be much more likely to focus on 'current value' or 'fair value'. However, users and preparers will be hesitant to leave historical cost accounting in the past.

Rather than trying to achieve the impossible, the project is likely look at the circumstances when different models are most relevant. There also seems to be a drive to clearly separate factors affecting the existence of assets and liabilities from how they are measured.

What is next?

The board is expected to discuss the first draft of the DP in February. The completed Framework is expected in 2015. Outreach will continue throughout the project. Look out for opportunities to get involved, such as public forums and surveys.

IAS 19 REVISED: ARE YOU READY?

The revised employee benefits standard is effective from 1 January 2013. Tak Yano from PwC's Accounting Consulting Services sheds light on the top 10 issues.

IAS 19 'Employee Benefits' ('IAS 19R') has introduced several changes to employee benefits accounting. Here are some key points for consideration upon transition and for disclosure in year-end accounts.

Top 10 reminders

1. Net interest cost

A 'net' interest cost is determined based on the net defined benefit asset (liability) and the discount rate at the beginning of the year. This will increase the interest cost for most entities, compared to the previous accounting which required that the interest cost on the obligation and the expected return on plan assets were recognised separately.

2. Remeasurements

'Remeasurements' replace 'actuarial gains and losses' and include the difference between actual investment returns and the return implied by the net interest cost and any effect of an asset ceiling. They are recognised in other comprehensive income and not recycled to income. The 'corridor' method and the option to recognise immediately in the income statement are no longer available. This will increase balance sheet volatility for many entities.

3. Disclosures

IAS 19R introduces additional disclosures intended to be more relevant to users of the financial statements. The requirements are extensive and judgement will be needed to determine what information is disclosed.

4. Past service costs

All past service costs are now recognised immediately in the income statement. This will increase volatility. A reduction in the obligation to employees is a negative past service cost. A curtailment will arise only from a reduction in the number of employees in a plan.

5. Settlement

The payment of normal benefits, even if as a single lump sum, is not a settlement. This is consistent with current practice. The accounting is unchanged, although there will no longer be an impact of unrecognised gains or losses or past service cost.

6. Risk and cost-sharing plans

The accounting for risk-sharing features which limit the employer's obligation to contribute has been clarified. These features might include, for example, employee contributions and benefits that vary based on the plan experience. The expected cost of benefits should reflect the plan terms and might require specific actuarial assumptions.

The Interpretations Committee ('IC') is discussing plans that promise a benefit based on the higher of an actual return or a fixed minimum return. Entities might continue to apply their existing policy for these arrangements until deliberations are completed. The accounting policy should be clearly disclosed.

7. Employee contributions

The IC is considering further guidance on whether employee contributions are a 'negative' short-term benefit recorded in the period due, or whether they should be included in the measurement of the long-term obligation. We believe an entity may continue the accounting previously applied until this guidance is issued. Alternative interpretations might also be acceptable.

8. Taxes and other expenses

The costs of managing plan assets continue to be recognised as a reduction in the return on plan assets.

Taxes are included in either the return on assets or the calculation of the obligation, depending on their nature. Previously they were part of the return on assets.

Other expenses are recognised in the income statement as incurred. This will be a policy change for some that could require retrospective adjustment to the obligation, return on assets and pension expense.

9. Other long-term benefits

The definitions of short- and long-term benefits have been further refined. The distinction is based on whether payment is expected to be made within the next 12 months, not whether payment can be demanded within the next 12 months.

10. Termination benefits

Benefits that must be earned by working in a future period are not termination benefits. A liability for a termination benefit is recognised when the entity can no longer withdraw the offer of the termination benefit or any related restructuring costs are recognised. This might delay the recognition of voluntary termination benefits in some cases.

What's next?

Management should first consider the 2012 accounts; IAS 8 requires disclosure of the potential effect of new accounting standards not yet adopted. We believe the impact of the changes should be quantified. The amendments are applied

retrospectively. This requires restatement of the comparatives, a third balance sheet and additional disclosures. Some limited exceptions apply including no restatement of assets with benefit costs in their carrying amount and no comparative information for sensitivity disclosures.

CANNON STREET PRESS

IASB consider feedback received on the hedging review draft

The IASB discussed feedback received by respondents on the review draft of the forthcoming IFRS on general hedge accounting at the January meeting. The review draft was open for editorial comments until December 2012. It is no longer expected that the final standard will be issued before the end of Q1 2013.

The focus of the discussion was in the following areas:

- foreign exchange basis spreads being included in the change in value of the hedged item;

- transition requirements for the designation of 'own use' contracts as at fair value through profit or loss; and

- the scope of the draft requirements and the interaction with macro hedging activities.

The IASB requested the staff to spend more time considering the interaction between IAS 39 and the new hedge accounting requirements as it relates to macro hedge accounting. Given the additional analysis required, we expect that the issuance of the final standard will be delayed from the original timetable.

Exposure draft on recoverable amount disclosures for nonfinancial assets

The IASB is proposing changes to the disclosures required by IAS 36, Impairment of assets, when recoverable amount is determined based on fair value less costs of disposal. The key proposals are:

- to remove the requirement to disclose recoverable amount when a cash generating unit (CGU) contains goodwill or indefinite lived intangible assets but there has been no impairment;

- to require disclosure of the recoverable amount of an asset or CGU when an impairment loss has been recognised or reversed; and

- to require detailed disclosure of how the fair value less costs of disposal has been measured when an impairment loss has been recognised or reversed.

The deadline for comments is 19 March 2013.

IASB and FASB continue revenue project deliberations

The IASB and FASB (the 'boards') clarified scope and confirmed the accounting for repurchase agreements, performance fees by asset managers and transfers of nonfinancial assets. The key decisions from the January meeting are described below.

Disclosure and transition requirements are the key outstanding issues expected to be redeliberated at the February meeting.

We anticipate a final standard in the second quarter of 2013. The effective date will be no earlier than 2015.

Scope

The proposals will apply to all contracts with customers, including transactions with collaborators or partners if they are in substance a customer in the transaction.

The boards also retained the proposed guidance in their 2011 exposure draft that an entity will apply guidance in other applicable standards first when a contract includes multiple deliverables, and will apply the guidance in the revenue standard only if other applicable guidance does not exist.

Repurchase agreements

An entity may enter into a variety of arrangements where it agrees to repurchase goods it has previously sold (for example, call options, put options, or forward sales). These transactions might be treated as a lease, a financing or a sale with a right of return, depending on the substance of the arrangement. The boards confirmed the principles in the 2011 exposure draft for such arrangements and clarified the interaction with leasing guidance.

Effect of the proposed revenue recognition model on asset managers

Performance-based incentive fees charged by asset managers will be subject to the same constraint on recognising revenue from variable consideration as other industries. That is, revenue is only recognised up to the amount that is not subject to a significant reversal. Many performance-based fees might not be recognised until consideration is fixed.

Transfers of assets that are not an output of an entity's ordinary activities

The guidance in the revenue proposals related to the existence of a contract, transfer of control and measurement (including the constraint on revenue recognition) will apply to transfers of nonfinancial assets that are not an output of an entity's ordinary activities (for example, a sale of property, plant and equipment).

IASB to propose a narrow exception for novated OTC derivatives designated as a hedging instrument

The IASB has agreed to propose a narrow exception in IAS 39 and IFRS 9 in response to regulatory developments. This precisely worded amendment will allow an over-the-counter (OTC) derivative that is designated as a hedging instrument, but is subsequently novated through a clearing house as required by legislation or regulation, to be deemed to be a continuation of the existing hedging relationship (assuming there are no other changes to the hedging relationship).

In July 2012, the European Market Infrastructure Regulation (EMIR) was adopted by the European Commission. One of the new requirements introduced under the regulation is central clearing for certain OTC derivatives. The issue arising as a result is whether an entity should discontinue hedge accounting when an OTC derivative is designated as a hedging instrument under IAS 39 and the OTC derivative is novated to a central counterparty in accordance with EMIR. Similar questions have arisen in territories outside Europe. For example, the SEC, the regulator in the United States, has already allowed such novations to be treated as a continuation of an existing hedging relationship under US GAAP.

The comment period for the exposure draft will be 30 days in order to promptly address the needs of the market.

KNOW YOUR IFRS 'ABC': C IS FOR 'CONSIDERATION'

Mark Bellantoni from PwC's Accounting Consulting Services Central team gives practical guidance assessing contingent payments in a business combination.

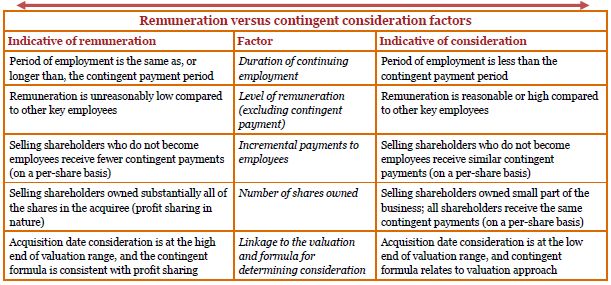

This month we take a look at contingent consideration in a business combination. Specifically, how do you distinguish contingent consideration from remuneration for future services?

Contingent consideration is an obligation of the buyer to transfer assets or equity interests to the seller of the business if future events occur or conditions are met.

A contingent payment that is deemed to be consideration becomes part of the acquisition price and increases goodwill at initial recognition. If the contingent payment is deemed to be remuneration, it is recognised in the income statement over the service period.

Key messageIn addition to the explicit terms, consider whether the commercial substance of the payment has an implicit service obligation |

Differentiating consideration from compensation for services

The substance of the arrangement will dictate the treatment of contingent payments to employees or selling shareholders who continue to provide services. The assessment requires an understanding of why the payment is included in the arrangement, which party initiated the arrangement and when the parties entered into the arrangement.

A number of indicators (described below) should be considered to determine whether the payment is consideration or remuneration. These criteria need to be applied to all arrangements for payments to employees or selling shareholders, including cash payments and share-based arrangements.

Examples

Background: Entity A is acquired by Entity B for cash consideration of C250m. Entity B must make an additional payment to the selling shareholders ('Sellers') if Entity A achieves a pre-determined sales volume target in each of the following three years. Other key facts include:

- Entity A has four shareholders;

- all Sellers were employees of Entity A prior to acquisition and remain employees of Entity B; and

- payment will be made at the end of the three years only if all targets are met.

Example 1 – No link to continuing service

Facts: In addition to the background above, assume the following:

- the Sellers maintain similar salaries to the other employees at their level;

- the Sellers cannot influence the sales volume target, even as employees;

- the Sellers are not required to remain employed during the three years in order to receive the additional payment;

- an independent valuation performed on Entity A placed a value on the business of between C250m and C300m; and

- the Sellers will receive payment in proportion to prior interest owned.

Is the additional payment consideration or remuneration?

Analysis: The payments are not forfeited if employment ceases, so additional indicators should be analysed.

The level of remuneration, without the additional payments, is reasonable compared to the other employees. The contingent payment appears to compensate for low up-front consideration because the purchase price is at the low end of the independent valuation range.

These factors indicate that the payment is consideration paid to the Sellers in exchange for Entity A, so it would be included in the purchase price.

Example 2 – Cash distributed among multiple shareholders linked to retention

Facts: In addition to the background above, assume the following:

- the Sellers have low salary levels compared to other employees;

- the Sellers can influence the sales revenue if they continue as employees;

- if a Seller resigns, that employee forfeits their portion of the payment (which is shared among remaining Sellers); and

- if none of the Sellers remains employed at the end of the three years but all sales targets are met, the additional payment is distributed to all Sellers in proportion to their prior ownership interests.

Is the additional payment consideration or remuneration?

Analysis: The contingent payments are not automatically forfeited if all of the Sellers cease employment, but each individual Seller controls their ability to earn their portion of the additional payment by continuing employment.

The Sellers receive low salary levels compared to other employees at their level and have the ability to influence the sales targets if they continue as employees.

The commercial substance of the agreement incentivises the Seller to continue in employment. The scenario where all Sellers cease employment lacks substance, because the last Seller employed is unlikely to forfeit the entire payment.

These factors indicate that the additional payment would be accounted for as remuneration for the post-combination employee services of the Sellers.

This just in...The Interpretations Committee confirmed in the January IFRIC Update that a contingent payment would be compensation when it is automatically forfeited if employment terminates and the service condition is substantive. |

THE BIT AT THE BACK.....

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.