SIX Exchange Regulation, the regulatory body of the main Swiss stock exchange, has confirmed plans to overhaul its regulatory listing standards. The sub-division into Main Standard and Domestic Standard will be abolished and issuers may choose between an International and a National or Swiss Standard. The only major difference between the two new regimes will be the applicable financial reporting standard. IFRS or US GAAP must be used on the International Standard. Issuers who do not wish to report under either of these two standards, but opt for Swiss GAAP FER instead, will be listed on the National Standard. The changes are planned to become effective on 1 July 2015.

By Thomas U. Reutter (Reference: CapLaw-2015-1)

SIX Exchange Regulation, the regulatory body of the main SIX Swiss Exchange Ltd. (SIX), will overhaul its regulatory listing standards. The changes contemplated by SIX are not a response to a revised regulatory framework. Although Swiss primary market regulation is poised for fundamental change of paradigm in light of the planned Financial Services Act (FinSA), the amendments discussed herein have been prompted by pressure on the part of issuers. In fact, many issuers listed on the Main Standard have come to perceive their reporting under IFRS as too costly and burdensome. As a result, some of them have decided to opt for a standard that is perceived less stringent – Swiss GAAP FER. These companies not only include local firms but also the big and international watch manufacturer Swatch.

Swiss GAAP FER is not Swiss GAAP. Swiss GAAP is a set of mandatory minimum rules for accounting of Swiss corporates set forth in the Swiss Code of Obligations. It does not aim to provide a "true and fair view", but advocates a prudent accounting favoring creditor protection. Swiss GAAP FER, by contrast, is a set of accounting and reporting recommendations promulgated by a committee of experts with a view to providing a "true and fair view" of the financial situation and the results of operations. In this respect, Swiss GAAP FER is comparable to IFRS or US GAAP, but remains more principle based and much less detailed and prescriptive. Issuers listed on the current Domestic Standard may report under Swiss GAAP FER. By contrast, issuers listed on the Main Standard are precluded from doing so, but have to use IFRS or US GAAP instead.

Currently, an issuer listed on the Main Standard who wishes to report according to Swiss GAAP FER instead of IFRS would have to change to the Domestic Standard. Such a change would obviously come with a price, be it only the likely perception among the investor community of having downsized from a global to a local player. It is no surprise, therefore, that issuers tried and try to challenge such a "relegation". SIX has come up with a proposal to solve the problem in October 2014. It proposed a new conceptual framework for listing standards and conducted a hearing with interested parties. According to a report published on 11 December 2014, the hearing showed largely positive feedback to the proposed changes.

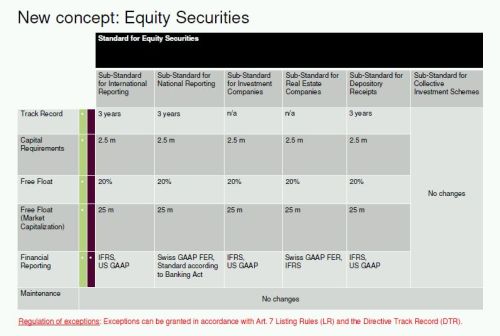

The new concept is based on two new distinct listing standards whose main differentiator is the issuer's reporting standard. There will be an international reporting standard (comparable to the current Main Standard) and a national or "Swiss" reporting standard. The latter, however, is much different from the current Domestic Standard. In fact, the minimum equity and minimum free float requirements of the National Standard will be the same as for the International Standard. Issuers wishing to list on the National Standard will therefore have to satisfy significantly higher thresholds than the issuers on the current Domestic Standard.

The following table gives on overview of the requirements in the two new standards compared to the status quo (source SIX Swiss Regulation: http://www.six-exchangeregulation.com/download/regulation/vernehmlassung/presentation_consultation_20141009_en.pdf (visited on 19 February 2015)):

In addition, SIX will also overhaul the regulatory listing standards regarding debt securities. Currently, debt securities have an own listing regime, but are listed according to the Main Standard. The new concept will consider the different listing requirements and will provide three standards (Standard for Bonds, Standard for Derivatives and Standard for Exchange Traded Products). However, the changes are of formal nature and the listing requirements for debt securities remain the same.

SIX is currently adapting the various levels of the regulation framework to reflect the proposed new concept. The changes are planned to come into force on 1 July 2015.

Previously published by CapLaw 1/2015

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.