Malta has experienced a significant increase in the registration of new companies during the past few years and a consistent growth in Gross Domestic Product, boosted by the success of the financial services sector.

The growth in the financial services sector can be directly attributed to Malta's generous system of tax refunds and unilateral relief, as well as Malta's reputation as a compliant EU International Centre.

Examples of the popular uses of Malta companies and the advantages available are detailed below:

1. Malta Holding Companies: The Benefits and a Typical Structure

Dividends and capital gains derived from a participating holding in a non resident company are exempt from Malta income tax.

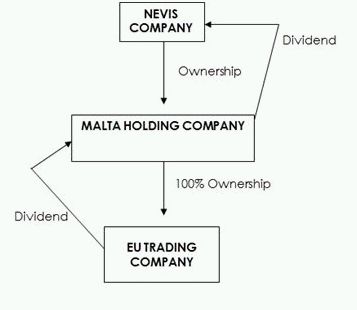

A classic structure for the use of a Malta holding company is detailed below:

In the above example, where the trading company is situated in the EU, the Malta company would benefit from the EU Parent-Subsidiary Directive, resulting in no withholding taxes on payment of dividends to the Malta company.

Where the holding is a "participating holding" there will be no taxation of dividends and capital gains at the Malta holding company level.

There is also no withholding tax on payments to the shareholder of the Malta company, in this case "Nevis Co".

Definitions Applicable to Malta Companies

The holding arises where the holding company:

- Holds more than 10% of the equity shares of the foreign company, or

- Holds at least one equity share and has an option over the balance, or

- Holds at least one equity share and has the right of first refusal over the balance, or

- Holds at least one equity share and has the power to appoint a director, or

- Has made a substantial equity share investment greater than €1,164,000, which is held for at least 183 days, or

- Holds equity shares in furtherance of its business (but not trading stock).

Equity shares are shares which confer the following entitlements to the holder:

- Dividends on a distribution

- Votes at shareholders' meetings

- Surplus assets on a winding up.

A holding is a participating holding if:

- It is resident in an EU country, or

- The company the holding is in is subject to a minimum 15% rate of tax, or

- The target company has less than 50% of its income consisting of passive interest/royalties, or

- Where more than 50% of the target company's income consists of passive interest and royalties, the holding must not constitute a portfolio investment and must be subject to a minimum 5% rate of tax.

2. Malta Trading Companies: The Attractive Tax Refund System

Malta registered companies are subject to corporation tax at 35%.

However, at the end of a financial year, after a dividend is declared to the shareholders of the company and the tax is paid, the authorities will refund 6/7ths of the Malta tax paid.

- This results in a net corporate taxation rate in Malta of 5%.

This is detailed in the example below:

| Company Level | Euro |

| Profit before tax | 1,000 |

| Malta tax | 350 |

| Profit distributed as dividends | 650 |

| Shareholder Level | |

| Gross dividend receivable | 1,000 |

| Malta tax suffered at company level | 350 |

| Refund of 6/7ths of the Malta tax suffered | -300 |

| i.e. an effective Malta tax of € 50, i.e. 5% | 50 |

3. Use of a Malta Company as an Intellectual Property Holding Vehicle

Royalties from Patents: Tax Exemption

- Royalties and similar income derived from patents in respect of inventions are exempt from Malta taxation.

The intellectual property must be the result of research and development activities. Such activities can be performed anywhere in the world, leading to an invention which has then been patented anywhere in the world.

Foreign withholding tax on royalties paid to Malta, where appropriate, will be mitigated through the EU Interest and Royalties Directive and Malta's double tax treaties. In the majority of cases this will reduce the withholding tax on royalties to between 0% and 10%.

Intellectual Property that has not been Patented: Tax Refund

Malta operates the imputation method of taxation. This means that where a dividend is paid from the taxable profit of a company it is possible for the shareholder to claim back a proportion of the tax paid by the company.

- The rate of refund applicable is, in most cases, 6/7ths, which effectively reduces the tax burden to 5%.

- In the case of passive royalties (royalties which are not directly or indirectly related to a trade or business and have not suffered foreign tax of at least 5%), a refund of 5/7ths of the Malta tax paid may be claimed, which gives an effective Maltese tax burden of 10%.

- Where double taxation relief is claimed, a refund of 2/3rds of the Malta tax paid by the company is available.

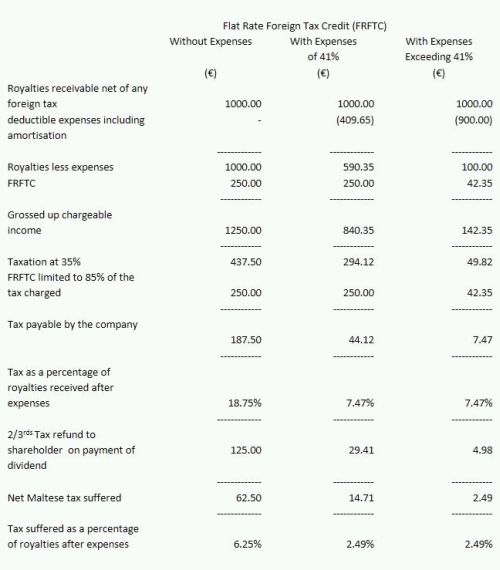

Flat Rate Foreign Tax Credit

An effective way to enjoy additional tax relief on royalty income, that does not relate to patents in Malta, is to claim Flat Rate Foreign Tax Credit. This is best illustrated by a working example:

The jurisdiction of Malta also offers an attractive Yacht Leasing Scheme, please see Article 341 – Malta and the Attractive Yacht Leasing Scheme.

Originally published 14 September 2015

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.