Since the PRIIPs Regulation1 ("the Regulation" from here on) was published on 9 December 2014, the concept of a multi-option product (MOP)—created by the European legislator to allow PRIIPs to refer to products which offer several investment options in a wrapped structure—has been one of the most discussed topics among the manufacturers of insurance-based investment products.2

The Regulation does not provide an official definition of investment option, which would be an element essential to defining a MOP. Although the Regulatory Technical Standards have helped shed some light on the topic, each manufacturer in Europe—belonging to, and selling in, insurance markets that may differ significantly—has his or her own opinion on what an investment option, and therefore what a MOP, really is.

According to many stakeholders, the information provided by the European Supervisory Authorities in the public hearings held so far has not been clear enough in defining the investment option concept. In the Luxembourg insurance context, investment option has been defined by the insurers themselves as a combination of investments pursuant to the specific investment profile of an investor or of a group of investors, if applicable. Essentially the MOP is, for the Luxembourg insurance market, nothing else than a unit-linked contract investing in the vehicles that fall under the scope of CAA Circular 15/33 or of a multi-support contract encompassing the mentioned vehicles plus a fund in euros.

Following this understanding, Luxembourg PRIIPs KID manufacturers are approaching the MOP concept in one of two ways:

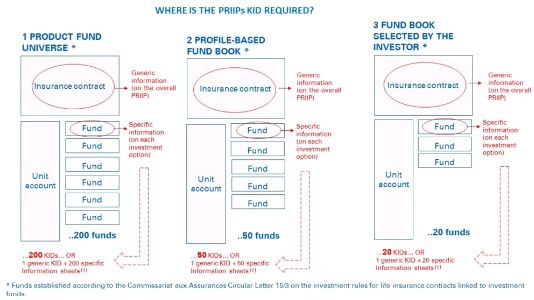

A MOP could be approached as an insurance-based investment contract linked to a fund book

...(conceiving each fund or a specific combination of funds as an investment option), which can be held through three structures:

- A fund catalogue with a wide range of funds (open architecture)

- A fund catalogue offered to the investor (from a wider universe) by the manufacturer after the latter has assessed the profile of each investor (his or her risk appetite, ability to bear losses, knowledge, and investment objectives)

- A fund catalogue chosen entirely by the policyholder from the fund universe proposed by the manufacturer.

In the case described above, it is important to note that the insurer's responsibility to produce the PRIIPs KID is linked to the wrapped life insurance MOP product, not to the funds constituting the underlying investments of such a contract (the exception being if the fund [or funds] is possessed by the insurer itself, and if the insurer complies with its obligation to produce the information indicated in Article 14 of the RTS).

The fund managers/promoters are therefore responsible for the production of the PRIIPs KIDs for the underlying funds. Nevertheless, and despite the potential future convergence of the PRIIPs and the UCITS4 regimes, fund managers/promoters of UCITS funds (which are the most relevant part of the underlying investments of the contracts referred to in this section) do not have to comply with the Regulation before 31 December 2019. In four years' time, the Regulation shall be reviewed to assess if it is reasonable and possible to extend the PRIIPs KID to UCITS funds. It might then be extended and replace the UCITS KIID. If so, from that date UCITS managers would produce PRIIPs KIDs, since UCITS KIIDs5 have been deemed unacceptable as an alternative.

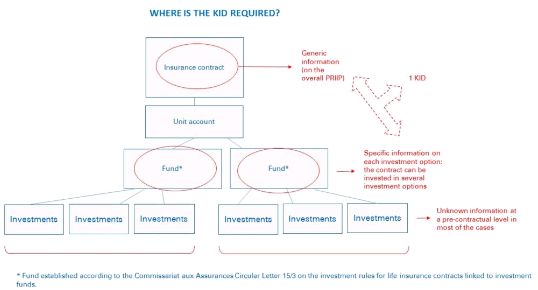

Or, a MOP could be approached as a life insurance contract linked to an investment pocket

...for example one that invests in internal collective funds and internal dedicated funds discretionarily managed at the same time, following the rules of the before-mentioned CAA Circular Letter 15/3.

In such a case, the investment strategy at the contract level would be stated by the policyholder on a high-level basis, after which the relevant asset manager(s) would devise an investment strategy for the pocket or for each of the funds. Each of the funds in which the contract invests could be deemed as an investment option itself, if the pocket invests in one of them only. If the investments are distributed between several vehicles, the combination of investments established in the investment pocket would also be conceived as the investment option. Such options shall be considered for the purposes of the KID.

Pursuant to the above, the following questions arise for PRIIPs KID manufacturers in Luxembourg when preparing for KID production:

- How can you produce a PRIIPs KID at a pre-contractual level for contracts whose underlying assets are not known or are not properly specified yet, as is the case with discretionarily managed funds?

- Some PRIIPs may have an extremely wide investment universe (e.g. the contract could have an open architecture and be linked to thousands of funds). How should you approach KID production in this scenario?

To profile or not to profile?

In response to these scenarios, Luxembourg's insurance sector has chosen an option which allows them to classify the clients by categories (profiles) following the results obtained in the compulsory questionnaire of CAA Circular Letter 15/3. A KID-per-profile is therefore issued, instead of a KID-per-contract. The CAA has not expressed its official position in this regard, and no document (circular, Q&A) has been issued by this regulatory body.

Time will tell if the Luxembourg approach to the PRIIPs Regulation can be adopted without any compliance concerns, and whether the home-country-control principle will be acceptable in this case. (Will a Luxembourg-approved KID built on a profile principle be acceptable to another European regulator?) But time is always a very precious asset and KID producers, rushing for January's implementation, know this very well.

Footnotes

1 Regulation (EU) No 1286/2014 of the European Parliament and of the Council of 26 November 2014 on key information documents for packaged retail and insurance-based investment products (PRIIPs)

2 Although this article is based on the content of the RTS published on 30 June 2016, the information contained herein may be subject to developments pursuant to the ongoing approval process at the European Parliament level of the Commission Delegated Regulation of 30/06/2016, supplementing Regulation (EU) No 1286/2014 of the European Parliament and of the Council on key information documents for packaged retail and insurance-based investment products (PRIIPs).

3 Commissariat aux Assurances, Circular Letter 15/3 on the investment rules for life insurance contracts linked to investment funds

4 Undertakings for the Collective Investment of Transferable Securities (UCITS)

5 UCITS Key Investor Information Document

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.