David Lamb at Conyers Dill & Pearman looks at Bermuda law governing the takeover (or privatisation) of public companies.

INTRODUCTION

This guide deals in general terms with certain aspects of Bermuda law governing the takeover (or privatisation) of public companies.

REGULATIONS GOVERNING TAKEOVERS

- The Companies Act 1981 and other applicable legislation.

- Domestic Takeover Codes and Listing Rules when the shares of the target are listed or traded. These often impose additional thresholds which must be met before any compulsory acquisition can be effected.

- The memorandum of association and bye-laws of the target and any shareholder rights plan or other material contracts.

- Domestic rules on disclosure and transparency, insider dealing, market manipulation and financial promotion.

GENERAL OFFERS

Procedure and Acceptances

A general offer for all the shares of the target or all the shares of a particular class must be made and accepted by the holders of at least 90% of the shares which are subject to the offer to enable the offeror to acquire the remaining shares compulsorily. Bermuda law allows a maximum four-month offer period within which this level of acceptance must be reached.

Where the offeror already holds more than 10% of the shares of the target, acceptances of the offer must not only amount to 90% of the shares but the number of accepting shareholders must be at least 75% in number of the holders of those shares. This requirement is, however, normally avoided by the use of a bid vehicle.

Compulsory Acquisition Thresholds and Timetable

The procedure to effect a 90% squeezeout following a general offer is as follows:

- Within one month of the offeror (together with its subsidiaries and nominees) holding in aggregate 90% in value of the shares in the target, including those held prior to the offer, the offeror must serve an "Ownership Notice" notifying the remaining shareholders that the offeror holds 90% of the shares.

- Dissentient shareholders have three months from receipt of the Ownership Notice to give the offeror notice requiring the offeror to acquire their shares on the terms of the offer or on such terms as may be agreed, or as the Court thinks fit to order.

- The offeror has two months from the date of reaching 90% in which to give notice to the remaining shareholders that the offeror wishes to acquire their shares (a "Compulsory Acquisition Notice"). A Compulsory Acquisition Notice is normally given at the same time as an Ownership Notice.

- Dissentient shareholders have one month from receipt of the Compulsory Acquisition Notice to apply to the Court to set aside the compulsory acquisition.

- Within one month of the offeror becoming entitled and bound to acquire the remaining shares (typically one month after serving the Compulsory Acquisition Notice in the absence of any application to Court) the offeror must send to the target (i) a copy of the Compulsory Acquisition Notice; (ii) a share transfer form signed by the offeror and a person appointed by the offeror to sign on behalf of the dissentient shareholders; and (iii) the consideration. The target must then register the offeror as the holder of the shares and hold the consideration on trust for the dissentient shareholders.

An alternative method of compulsory acquisition applies if a shareholder or group of shareholders acquires 95% or more of the shares. This method will give any dissentient shareholder appraisal rights similar to those which apply on a merger or amalgamation (see below).

SCHEMES OF ARRANGEMENT

Procedure

A scheme of arrangement will provide a 'section 3(a)(10) exemption' from the registration requirements of section 5 of the Securities Act of 1933.

A takeover by way of scheme of arrangement involves the target proposing a scheme to its shareholders to cancel their shares (a cancellation scheme) or to transfer their shares to the offeror (a transfer scheme) in return for cash or securities of the offeror. A cancellation scheme usually avoids stamp duty or documentary tax which would otherwise be payable on a transfer scheme (and on a general offer).

The board of the target will be in control of the scheme and be responsible for drafting the composite scheme document, making the applications to the Supreme Court, mailing the composite scheme document to shareholders, holding the relevant meetings and making the necessary filings. The offeror will undertake to abide by the scheme and pay the scheme consideration.

Indicative Timetable

Day 1: File originating summons and affirmation in

support

Day 7: Summons for directions hearing

Day 14: Despatch of scheme document

Day 44: Court Meeting/SGM

Day 49: Publish notice of reduction of capital

(cancellation scheme)

Day 52: File chairman's report, petition, and

affirmation in support

Day 65: Petition hearing to sanction the scheme

Day 65: Effective Date: file scheme order with Registrar

of Companies

Scheme Document

The composite scheme document will include the expected timetable, a letter from the board of the target, a letter from the independent directors or board committee, a letter from the independent financial advisers, an explanatory statement, financial and general information, the scheme of arrangement document itself and notice of the relevant meeting(s).

Approvals

A scheme of arrangement requires approval from the Supreme Court as well as the approval of the directors (in practise).

All schemes must also be approved by a majority in number (head count) representing three-fourths in nominal value (share count) of the scheme shareholders voting at the requisite meeting which will have been convened pursuant to an order of the Supreme Court.

The voting requirements of any applicable Takeovers Code must also be met.

In addition, the shareholders present and voting at the court meeting must represent a fair cross-section of the shareholders as a whole and every effort should be made to secure a good attendance by shareholders.

The statutory thresholds apply to each class of share. A class will be created if shareholders have rights against the target company which are so dissimilar as to make it impossible for them to consult together with a view to their common interest. The makeup of any classes will normally be settled at the directions hearing but this determination is not necessarily binding at the subsequent petition hearing.

The statutory majority of shareholders must also act bona fide with no coercion of minority shareholders and the scheme must be one that an intelligent and honest man acting in respect of his interests in the class might reasonably approve.

Unlike a general offer these thresholds cannot be reduced or waived; if they are not met, the scheme will fail.

Effective Date

The scheme will be effective when a copy of the court order is delivered to the Registrar of Companies for registration.

Amalgamations by Way of Scheme of Arrangement

Amalgamations may also be effected through a "special" scheme of arrangement. The scheme of arrangement must have been proposed for the purpose of or in connection with: (i) the "reconstruction" or "amalgamation" of the offeror and the target; and (ii) the transfer of the whole or any part of the undertaking of any company concerned in the scheme of arrangement.

AMALGAMATIONS AND MERGERS

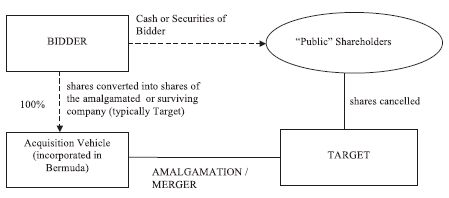

Amalgamations or mergers are the most common structure used in offshore M&A transactions in North America.

Amalgamation

An amalgamation involves two or more companies amalgamating and continuing as one company.

Merger

A merger involves two or more companies merging and their undertaking, property and liabilities vesting in one of the companies as the surviving company.

The basic structure of a typical triangular amalgamation or merger is set out below:

Amalgamation Agreement / Circular

An amalgamation agreement is approved by the respective boards of the acquisition vehicle and the target and submitted to the shareholders of the target for approval. The offeror, as the sole shareholder of the acquisition vehicle, approves the amalgamation agreement.

The target sends a circular to shareholders explaining the amalgamation and including (i) a copy of the amalgamation agreement; (ii) a notice convening a special general meeting to approve the amalgamation; and (iii) fairness opinion from an independent financial advisor. The notice must state the fair value of the shares of the target.

The content of the circular is determined by the Companies Act 1981 but the circular would also be expected to comply with the content requirements of any applicable Takeover Code, listing rules, securities legislation and good market practice, both where the shares are listed and in the jurisdiction where the key shareholders reside.

Approval Thresholds

The statutory threshold for approval of an amalgamation by the target is 75% of shareholders present and voting at a special general meeting at which a quorum of at least two persons holding or representing by proxy more than one-third of the issued shares is present.

However, this can be reduced to a simple majority by an appropriate provision in the bye-laws of the target. If the bye-laws of the target contain no such provision, the bye-laws can generally be amended with board approval by a simple majority vote of the shareholders so that there may be potential for an amalgamation or merger to be approved by a simple majority vote.

Conditions

The amalgamation agreement will contain conditions which are commercially driven, but which will usually include a right of termination if a stated percentage of dissentient shareholders exercise their appraisal rights.

Timetable

An amalgamation can be completed as soon as the special general meeting to approve the amalgamation has been held and any conditions have been fulfilled, typically around one month from publishing the circular.

Appraisal Rights

Dissentient shareholders may apply to the Court within one month of the notice convening the special general meeting to approve the amalgamation to have the fair value of their shares appraised by the Court.

Recent shareholder activism has increased the risk of appraisal proceedings.

Advantages

The advantages of an amalgamation or merger are as follows:

- no court approval is required;

- dissentient shareholders have no statutory right to prevent the amalgamation or merger;

- an amalgamation can be completed more quickly than a scheme of arrangement or a general offer and requires a lower threshold to effect a squeezeout. It may be completed even if appraisal proceedings have been instigated, although in such a case the offeror will lose the right to terminate the amalgamation and will be compelled to pay the fair value determined by the court to the dissentient shareholders.

EFFECT OF AN AMALGAMATION OR MERGER

Amalgamation

The property of each amalgamating company becomes the property of the amalgamated company which continues to be liable for the obligations of each amalgamating company and existing causes of action, claims or liabilities to prosecution are unaffected.

Merger

The surviving company continues to be liable for the obligations of each merging company and existing causes of action, claims or liabilities to prosecution are unaffected.

This article was originally published in American Lawyer's Global Mergers & Acquisitions Guide 2017, January 2017

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.