In principal, all Managers of Alternative Investment Funds (AIFM) have to be authorized by the CSSF (the local regulator in Luxembourg) and appoint a depositary, under the rules of Directive 2011/61/EU of the European Parliament and the Council of 8 June 2011 on Alternative Investment Fund Managers (AIFMD), which was transposed into national law by the Luxembourg Law of 12 July 2013 on Alternative investment fund managers (AIFM Law).

However, a limited number of exemptions exist in term of the obligation of authorization from the CSSF.

Indeed, the first exemption concerns AIFMs that are only invested into by the AIFM or by its associates (as, for instances, parent, subsidiaries, and subsidiaries of the parent).

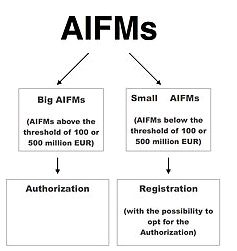

Moreover, the exemption concerns principally the small AIFMs as:

- AIFMs managing AIFs with assets under management of 500 million EUR, which are not leverage and without redemption rights for a period of five years.

- AIFMs managing AIFs with combined assets under management of 100 million EUR, including any assets acquired through the use of leverage.

These small AIFMs shall not be required to be authorized from the CSSF and to appoint a depositary. Nevertheless, they shall be required to register with the CSSF and shall be subject to regulatory reporting.

However, it is important to raise that these small AIFMs can also decide to ask for the authorization provided by the CSSF and then fully benefit from the application of the AIFMD as, for instance, the marketing passport.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.