Originally published 3rd August 2017

The Biogas Market of Ukraine and its Potential – A Brief Introduction

Ukraine is highly depending on the import of fossil-fuel energy reserves like, oil, gas and coal. The National Renewable Energy Action Plan until 2020 and further measures until 2030 focus on diversifying the country's energy mix and strengthening local production of renewable energies, including the production of biogas. Attractive Feed-In Tariffs aim to attract local and foreign investors.

A short introduction of biogas

For those readers who are not familiar yet with the advantages of biogas production from various organic materials, we provide a brief overview following.

Biogas is a renewable energy source.

Biogas is produced from various organic sources, mainly but not only wastes, such as livestock (chicken, pig, cattle farms) wastes (dung and manure), agricultural wastes, agricultural products especially grown to produce biogas, silage, industrial organic waste, sewage and landfills (waste deposits of mainly municipalities).

The waste substrate to be used for biogas production is a breakdown of organic matters under the absence of oxygen; anaerobic organisms cause anaerobic digestion of organic matters, which results in the production of gas, primarily methane (CH4) and carbon dioxide (CO2).

Biogas itself is mainly used to produce electricity, heat, and, after further refining, as a substitute of natural gas (in the form of bio-methane). Organic fertilisers are a possible by-product of biogas plants.

Biogas plants are often set up as individual plants of agricultural establishments, such as poultry farms, pig farms etc., sugar factories

But the positive effects of biogas production are not limited to its nature as one of the forms of renewable energy! The production of biogas has a very important impact on environmental issues, like, for example, the problem of manure disposal of livestock farms.

The production of biogas helps:

- to solve the huge problem of dung and manure disposal of livestock farms,

- to control unpleasant smells and pathogens in the surrounding of livestock farms,

- to reduce greenhouse gas emissions (mainly methane, carbon dioxide, nitric oxide),

- to address urban waste management problems,

- to reduce the demand for mineral fertilizers, and

- to create new employment.

The situation of the energy markets in Ukraine

The re-shaping of the energy markets of Ukraine is one of the country's most important and most necessary reforms. As a former republic of the USSR, the independent Ukraine was still highly depending on energy and energy reserves from Russia, importing, for example, 70 % of its gas from its neighbour. Cutting gas imports from Russia was crucial though, to further political independence from Russia. Since 25 November 2015, Ukraine does not import any gas from Russia anymore - the current government under President Petro Porochenko did succeed freeing the country from Russian gas dependency.

The current (2016) energy market of Ukraine consists of the following energy mix: coal (31%), gas (29%), nuclear energy (26%), oil (11%), and renewable energy (3%).

Reforming and reshaping the Ukrainian energy markets is inevitable to secure energy supplies today and in the future. Ukraine's dependency on imports of energy reserves needs to be decreased dramatically to save financial resources, desperately needed in the country to finance further reforms.

Ukraine is lucky though. With its geographical size of 603.550 m², Ukraine has a lot of land available for wind power and photo voltaic plants. Ukraine comprises around 25 % of the world's chernozem (rich black soil), and with its population of more than 42 million people, Ukraine has an enormous potential for agricultural production. There is hardly any other country in Europe with Ukraine's potential to produce renewable energy. As per the calculations of the Institute of Renewable Energy of the National Academy of Sciences, the technically available energy potential of renewable energy sources in Ukraine is about 50 % of the country' overall energy consumption.

The National Renewable Energy Action Plan until 2020 of Ukraine, incentives

The Council of Ministers of Ukraine adopted a National Renewable Energy Action Plan until 2020 (NREAP), in form of an executive order on 1st October 2014. NREAP provides goals for 2020 and projections for until 2030. NREAP provides for incentives until 2030. End-user renewable energy consumption is planned to have a share of 11 % in 2020.

As per the National Renewable Energy Action Plan until 2020, several incentives are envisaged. However, some of them were clipped by the Tax Code of Ukraine from end of 2014.

The remaining incentives are:

- value-added tax exemption for the transactions related to importation to Ukraine's customs territory of equipment working on renewable energy sources, equipment and materials for production of alternative fuels or for production of energy from renewable sources;

- import duty exemption for the above-mentioned equipment and materials; (however, the latter is not applicable until now, because the Cabinet of Ministers failed until now to approve the list with applicable goods);

- exemption from excise tax on the sale of electricity that is generated from RES, and on qualifying cogeneration plants.

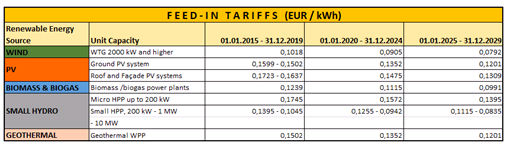

In addition to the aforementioned incentives, the Law of Ukraine on Electric Power Engineering provides for very attractive feed-in tariffs, called "Green Tariff" ("GT") in Ukraine, since 2010:

The previous obligation to partly use locally produced equipment has been replaced by encouragement measures. RE producers who use at least 30 % locally produced equipment when establishing the RE plant, will be paid a premium of 5 %, based on the above figures. In case of at least 50 % locally produced equipment, the premium will be 10 %. These premiums are granted for biogas plants commissioned not later than 31.12.2024.

Private households are also benefiting from the feed-in tariffs in case of wind and solar energy produced (EUR 0,19/kWh for photo voltaic and EUR 0,1163/kWh for wind turbines), provided the installed capacity does not exceed 30 kW.

The feed-in tariff is fixed in EUR, the UAH equivalent is re-calculated every three months. Feed-in tariffs are paid on the energy sold, not on the energy produced.

It is important to note that in case an RES producer is not able to sell its produced electricity to electricity supply companies, the state-owned Wholesale Electricity Market Operator is obliged to purchase the electricity produced from RES at the green tariff agreed with the relevant RES Producer, and is obliged to pay the full price electricity produced from RES when due and in money.

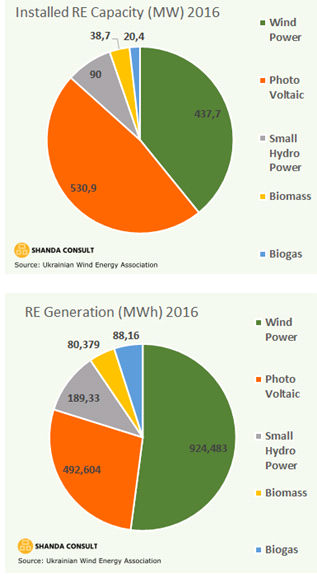

The current mix of renewable energies, both installed capacity and energy generated, are shown below:

The current biogas market of Ukraine

Despite the enormous potential of biogas-to-electricity in Ukraine, the market is not well developed yet. There are currently about 10 larger electricity-producing biogas plants in Ukraine, with a total installed capacity of 35 MW (end of 2016). Some of them are:

- the biogas plant of Ecoprod in Volnovas,

- the biogas plant in the Obukhov district Kyiv (biogas from waste deposit),

- the biogas plant Seaside landfill in Mariupol, Donetsk region,

- the biogas plant of the Rokitnyansky sugar factory (Kyiv region),

- the biogas plant of the Globyno sugar factory, belonging to Astarta Holding, plans to add electricity production from biogas,

- the Myronivsky Hliboproduct (MHP) Biogas Plant, handling the dung of the Oril-Leader Poultry Farm in the region of Dnipropetrovsk,

- the biogas plant of Danosha Company, handling pig manure (Danosha plans to set up more biogas plants for other pig farms),

- biogas plant for waste water treatment in Lviv (under construction).

There are more biogas plants of smaller size in Ukraine, belonging to small and medium-size livestock farms, and around 10 smaller biogas plants related to the production of biogas from municipal waste deposits in various regions. Small biogas plants in Ukraine, as in other countries, are rather producing heat for the farm where they are installed. The production of electricity from biogas on small plants is not viable.

The experience of the larger biogas plants in Ukraine is a successful one. Myronivsky Hliboproduct (MHP), with an installed capacity of 5 MW, plans a new biogas-to-electricity project with an installed capacity of 20 MW. The Rokitnyansky sugar factory plans to extend the capacity of its biogas-to-electricity plant from its current 2,4 MW to 19 MW.

The potential of the biogas market in Ukraine

However, considering the really huge potential for biogas and biogas-to-energy production in Ukraine, there is a bright future for the sector in the country, now also supported by a growing awareness of the agricultural sector for the manifold benefits of biogas plants and biogas as fuel.

Under conservative considerations, the State Agency on Energy Efficiency and Energy Saving of Ukraine sees a potential for biogas plants in the agricultural sector alone of around 5.000 plants with an average installed capacity of 3 MW per plant. These plants could cover 5,7% of the energy consumption of Ukraine.

Not included in the estimation of the State Agency on Energy Efficiency and Energy Saving of Ukraine is the potential for biogas plants related to urban waste deposits (landfill), water (sewage) treatment and the food industry.

In figures only available from 2013, Ukraine has 60 sugar mills, 51 breweries, 58 distilleries, 5079 cattle farms, 5634 pig farms, 785 integrated poultry productions, and maize silage production of over 40 Mio tons.

Technically, Ukraine has the potential to produce up to 10% of its energy consumption from biogas alone!

The government of Ukraine works hard to attract foreign investment in biogas production, calling for a total investment of around 15,5 Mio Euro.

The enormous potential for biogas production in Ukraine raises the interest of biogas planning and construction companies and investors from many countries, including Chinese power companies. Currently (summer 2017), Shandong Qingneng evaluates the establishment of a biogas plant in West Ukraine, and Xi'an ShaanGu Power plans to build a biogas-to-electricity plant on the region of Zhytomyr with an installed capacity of 6,7 MW.

Viability of biogas plant sizes in Ukraine, for the production of electricity

The size categorisation of biogas-to-electricity plants varies from country to country. In Italy, biogas-to-electricity plants of up to 300 kW are considered as small, while Austria considers plants up to 250 kW as small, Germany up to 75 kW, and Belgium up to 30 kW.

The size categorisation of biogas-to-electricity plants in Ukraine is defined as following:

- Small plants: up to 300 kW

- Medium plants: 300 – 1000 kW (1 MW)

- Large plants: over 1000 kW (1 MW)

Feed-in-tariffs (FIT) play a key role in the development of a country's biogas market.

In Germany, until end of 2016, the FIT for small plants of up to 75 kW is 0,2373 €/kW, and 0,1526 €/kW. If a producer of biogas electricity agrees on delivering electricity as per consumers' demands during peak hours, regional networks pay up to 0,40 €/kW.

However, from 01.01.2017 onwards, Germany's FIT for electricity from the production of new biogas plants is as following:

- biogas plants of up to 150 kW 0,1332 €/kWh,

- biogas plants of up to 500 kW 0,1149 €/kWh,

- biogas plants of up to 5 MW 0,1029 €/kWh,

- biogas plants of up to 20 MW 0,0571 €/kWh.

There are some exceptional feed-in-tariffs in Germany. The FIT for the electricity from the fermentation of liquid manure is 0,2314 €/Kw, provided the plant is not larger than 150 kW. Electricity from the fermentation of biological waste is honoured with 0,1488 €/kW for plants not larger than 500 kW, and 0,1305 €/kW for plants from 0,5 to 20 MW.

Since 1. April 2017, each year as per the 1st of April and the 1st of October, the abovementioned tariffs are reduced by 0,5%.

Italy specifically supports smaller biogas plants. The FIT is 0,30 €/kW for plants up to 50 kW, and 0,23 €/kW for plants from 50 to 500 kW.

France pays 0,1997 €/kW for electricity from biogas plants of up to 150 kW, and 0,1119 €/kW for plants over 150 kW.

In Ukraine, the feed-in-tariff for electricity produced from biogas is not aiming to support smaller plants, and thus a further decentralisation of biogas electricity production. The FIT for biogas electricity in Ukraine is 0,1239 €/kW for any size of biogas plant.

However, the usage of minimum 30 % or 50 % locally produced equipment results in an increase of 5 % and 10 % respectively, of the FIT.

The production of electricity from biogas on small plants (up to 300 kW) is currently not viable in Ukraine. Small biogas plants in Ukraine make only sense for heating and domestic use of gas.

The viability of medium-size biogas plants in Ukraine (300 – 1000 kW) for profitable production of electricity is questionable. Biogas-to-electricity plants with an installed capacity of minimum 500 to 600 kW may justify their investment if they operate with high capacity utilisation, and if a relatively high percentage of local equipment has been used during a plant's establishment.

The above evaluations do of course not consider the values of positive side effects like protection of environment, solution for waste disposals, etc. Those values are, unfortunately, not yet of material value.

For the investor in Ukraine, biogas-to-electricity plants from an installed capacity of minimum 2 - 3 MW are of substantial interest. Going into detailed calculations of the return on investment (ROI) would exceed the goal of this article. Generally, the period of amortisation of an investment into a biogas-to-electricity plant in Ukraine, under the condition of benefiting from the Ukrainian FIT, is about 3 – 3,5 years. An investment into a biogas-to-electricity plant of 1 MW would pay off in about 4 to 4,5 years.

Production of biogas for heat by biogas plants in Ukraine

Traditionally, the consumption of natural gas relatively high in Ukraine, leading to a critical dependence on natural gas imports. The traditionally high consumption of natural gas did lead to a well-developed infrastructure of transportation of natural gas, consisting of main pipelines distribution pipeline networks in the country. Ukraine traditionally uses compressed natural gas as fuel for trucks and busses and benefits from a developed network of filling stations.

The market and consumer customs as well as the existing infrastructure suggest the production of biofuel (biomethane biogas).

District heating is very common in Ukrainian cities, a relic from the Soviet times. Although the pipeline network for the distribution of heat is in desperate conditions, partly 40 – 50 years old and thus beyond its economic life, the production and distribution of heat, produced from biogas, is an interesting market, which Ukraine tries to address now.

On 21 March 2017, the parliament of Ukraine, the Verhovna Rada, adopted the Draft Law 4334 on stimulation of heat energy production from RES. The law aims to replace (expensive) imported gas with alternative fuels produced in Ukraine from RES. The law has been signed by the President on 11 April 2017.

Once implemented, the law

- will provide investors with guarantees on investments return in the heat production from alternative sources;

- is expected to reduce the gas import to over 3 billion m3 per year and savings in the economy at least € 520 million;

- will reduce of heat energy production costs and tariffs for end consumers;

- will increase the number of new jobs through the development of new productions for growing, harvesting and transport of local fuels, equipment production, which will significantly increase revenues to local budgets.

Some suggestions to better develop the biogas sector of Ukraine

Without any doubt, Ukraine clearly committed to the development of the renewable energy sector, a decision also driven by the need for the reduction of dependences from Russia, and from other imports.

However, as often, the details play an important role, and unsuitable details may even spoil the best action plan and legislation.

Suggestions to overcome issues:

- It is irreproducible for local and foreign investors that the

Cabinet of Ministers did since years not approve the list

of goods, equipment and machinery for the construction of renewable

energy plants, which qualify for custom duty exemption.

This just leaves a big question mark, not really supporting trust

in the measures to develop renewable energy in Ukraine.

The said list could be and should be approved by the Cabinet of Ministers without any further substantial delay. - The allocation of land for renewable energy projects

generally takes very long time, and de facto procedures and periods

suggest that "unjustified interests and benefits" of

permission-granting authorities sometimes seem to play a

role.

As the Ukrainian Government successfully did in other fields (e.g. VAT system, custom departments), certain measures and organisational re-structuring might help. - Procedures to obtain a "Green Tariff Licence"

are often lengthy, with a lack of modern and supportive

attitude.

A review and re-organisation of the overall procedures for an investor to become an energy producer and to benefit from the Green Tariff might have a positive impact. - Grid connection can become a lengthy issue paved with

obstacles.

A review and re-organisation of the overall procedures for an investor to become an energy producer and to benefit from the Green Tariff might have a positive impact.

Suggestions to encourage the biogas market of Ukraine:

- Stepped FIT for electricity from biogas

The Ukrainian feed-in-tariff for electricity produced by smaller hydro-power plants is differentiated as per the size of the plants, thus taking into consideration the relatively higher investment costs of very small plants.

Unfortunately, the same approach has not been shown for biogas plants in Ukraine. As local hydro-power plants, electricity production from biogas is a typical example for the enhanced decentralisation of energy production, and thus for the furtherance of supply security.

Stepped FIT for electricity from biogas would have a strong impact on the development of the biogas market in Ukraine. This impact would particularly be positive to solve environmental issues, rather than fostering biogas electricity production, because small biogas plants would not have a large share of the overall electricity production from biogas. - Stricter environmental rules and

provisions

As commonly known, and as mentioned at the beginning of this article, biogas production has a very positive impact on environmental issues.

Stricter environmental rules and provisions for the agricultural sector, the industry and for residential waste, and their decisive implementation, would have a positive influence on the biogas market of Ukraine, especially on smaller scale biogas plants.

International Conference "Biomass for Energy 2017"

Since 2002, the Bioenergy Association of Ukraine organises the international "Biomass for Energy" Conference.

This year, in 2017, the conference will take place at the Great Conference Hall of the National Academy of Sciences of Ukraine, on 19 and 20 September. The "Biomass for Energy 2017" Conference is co-sponsored by the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH.

"Biomass for Energy" is a platform for dialogue between Business and Business (B2B) and Business and Government (B2G). Among the participants, 200 - 250 Ukrainian and international experts are expected to discuss topics related to biomass and biogas production.

Shanda Consult, in partnership with its partly subsidiary EUMECON EEIG, consults and assists mainly German investors regarding their investment projects in Ukraine.

Services typically, but not only, take place during the pre-investment-decision and implementation phases, and focus on localisation services, initialisation and facilitation of Joint-Venture Partners from Germany and from Ukraine for investment projects in Ukraine, legitimate political consulting and lobbying, technical and legal assistance in Ukraine.

Please do not hesitate to contact us for further information, to discuss your project and your needs, and for cooperation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.