For companies considering relocating to the EU, local remuneration practices are, naturally, an important factor. Luxembourg is well-known for offering highly flexible remuneration packages. But what exactly does the term remuneration package entail?

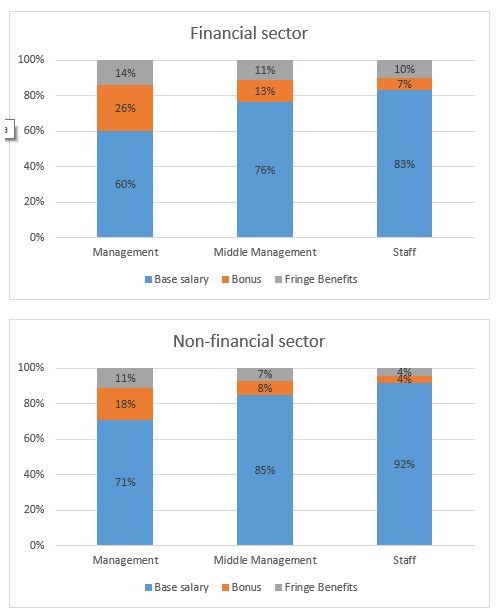

In Luxembourg, a remuneration package comprises three elements: base salary (fixed salary), variable salary (e.g. performance bonus, sales bonus), and fringe benefits (e.g. company car, meal allowance). The graphs below show, for both financial and non-financial sectors, the proportions of these elements within the remuneration packages of management, middle management, and staff members.

Sources: KPMG Remuneration Survey for the financial sector / non-financial sector

Although the figures vary slightly, a trend is shared in both sectors: the higher the grade of the employee, the more important variable salary and fringe benefits become.

While our last blog posts looked at employee lifecycle and employment legislation in Luxembourg, this article will separate fact from fiction with regard to Luxembourg's remuneration practices.

Is there a minimum wage in Luxembourg?

Yes. As of January 2017, the minimum wage ranges from €1,998.59 per month for low-skilled employees to €2,398.30 for highly-skilled ones. Age is also a relevant parameter:

Compared to other European countries, Luxembourg offers the highest minimum wage to its employees—higher than Ireland, Germany, the Netherlands, France, and the UK do. Cost-of-living allowances, per diems, and foreign services premiums may be also count as part of the minimum wage (with the exception of the reimbursement of professional expenses).

How does Luxembourg rank within the EU in terms of employer cost and employee net income?

In most countries, social security taxes and income taxes are levied separately. Income tax is typically calculated through progressive income tax rates, and social security tax rates are generally fixed (and, in various countries, only calculated up to a certain income). Income tax is typically owed by the employee only, whereas social security tax is most often a cost to both the employee and employer. All these elements affect both employee net income and employer costs.

So how does Luxembourg compare to, for example, the UK? Imagine two married employees, one living and working in Luxembourg, and the other in the UK. Each has two dependent children and works full-time.

Let's say each employee makes €100,000 in annual gross salary. The Luxembourg resident would, after social security and income tax, make a net income of €73,140. His or her UK counterpart would make €67,083.

If the gross salary were €200,000, the Luxembourg resident would net €128,771 and the UK resident €110, 355.

Regarding employer costs associated with the same two employees:

For gross salaries of €100,000, the Luxembourg employer's total cost would amount to €113,390. The UK employer would pay roughly the same: €112,485.

For gross salaries of €200,000, the Luxembourg employer would pay €216,057, but the UK employer would face much higher costs: €226,285.

Luxembourg thus offers a more competitive tax framework than the UK, from both employee and employer perspectives.

Looking Europe-wide, Luxembourg still scores well, though in both the €100,000 and €200,000 gross salary scenarios, Switzerland (Zürich) offers the highest net income and Denmark the lowest employer cost, as shown below:

Source: KPMG report on employee taxes in Europe

What fringe benefits do Luxembourg companies offer?

Thanks to Luxembourg's "flexible reward plan" companies are free to offer whichever fringe benefits they judge to be best for their sector, needs, and specificities. For both the financial and non-financial sectors, Luxembourg's top four fringe benefits are meal allowances, company cars, parking slots, and company pension schemes (2nd pillar). Only the order varies from one sector to another.

The company pension scheme is particularly noteworthy in the financial sector: for a qualifying pension plan in Luxembourg, the employer pays a 20% employer tax, plus a 0.9% fund management contribution. Future benefits from this qualifying plan are not taxable for the [retired] employee, assuming he/she is a Luxembourg resident. The employee can pay up to 20% of his/her ordinary annual salary into such a qualifying company pension plan, and this contribution is tax-deductible up to €1,200 per year.

Also notable, regarding company cars specifically, is a very recent tax reform which offers tax advantages for those vehicles with low CO2 emission levels and certain fuel types.

In addition to these four main fringe benefits, companies are investing more and more in initiatives contributing to employee happiness, health, and workplace quality-of-life (e.g. fruit baskets, Sympass cards, internal fitness facilities, crèches, concierge services).

Offering fringe benefits does not require a great effort for employers, and can bring a significant level of satisfaction to employees. Luxembourg offers many of these nice-to-haves, and many companies can (and have) become employers of choice by offering such benefits.

How can employee pension plans be transferred to Luxembourg?

For company pensions built up abroad, several options exist. The employee can, for example, suspend his/her home country company pension plan, meaning that no further contributions to the home country plan will be made. Future benefits will be calculated based on the rules of that plan. The applicable tax treaty between the home country and Luxembourg will determine how the future benefits will be taxed.

Another option would be transferring the pension capital to the Luxembourg pension plan. European guidelines are in place to provide certain assurances and to strengthen the cooperation between the supervision authorities. However, this can often be administratively burdensome, making suspension usually an easier route. For more guidance on international pensions, read our blog article here.

What is the impatriate regime for employees relocating to Luxembourg?

A specific tax regime exists for highly qualified workers who are relocating to Luxembourg, relevant to the costs of moving, housing, travel, children's education, etc. Under this regime, these costs may be reported as operating expenses and can be reimbursed tax-free. Indeed, a highly qualified worker ("impatriate") who is hired by or seconded to a company located in Luxembourg may, under certain circumstances and for a limited period of time, receive a full or partial tax exemption for the expenses in kind or in cash related directly to the move to Luxembourg. This regime applies to highly qualified workers who begin working in Luxembourg after 31 December 2010. It is available for the year of arrival and the five subsequent calendar years.

In order to take advantage of this tax regime, the employee must be a resident for tax purposes of Luxembourg and have a full-time working contract. In addition to that, he/she must:

- be employed for a job that is his/her main professional occupation

- earn a fixed annual salary in Luxembourg of at least €50,000 (gross amount before benefits in cash and in kind)

- use his/her specialised knowledge and know-how for the benefit of the company's staff

When all conditions are met, qualifying expenses may be reimbursed tax-free. Qualifying non-recurring expenses may include expenses arising from relocating to Luxembourg from one's homeland. Qualifying recurring expenses may include rent (and utilities) of the accommodation in Luxembourg and annual home leave. These so-called expatriation expenses can be reimbursed tax-free up to 30% of the total annual fixed remuneration of the impatriate, or €50,000 (€80,000 for joint filers) per year.

In conclusion

Luxembourg offers indisputable advantages in the flexibility of remuneration packages and the impatriate relocation process. Read more about what Luxembourg has to offer here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.