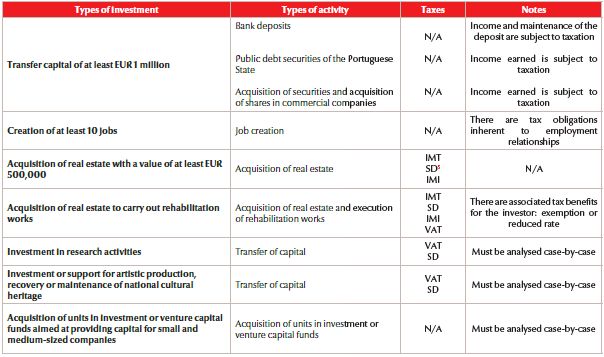

The regulations of the legal framework for foreigners in Portugal and the procedure and rules to be followed by applicants for Investment Residence Permits (normally referred to as "Golden Visas" or "ARIs"), provide for a large number of investment models within the eight types of investment activity with the following specifics.

INVESTMENT ACTIVITIES

a) Transfer of capital of at least EUR 1,000,000.00

Bank deposits: the applicant must have a declaration from a credit institution authorised or registered in Portugal by the Bank of Portugal. This declaration must prove the ownership, free of any burdens or charges, of bank deposits with a balance of at least EUR 1,000,000.00, resulting from an international transfer, or of a share in the balance of the same amount in the case of joint accounts. To renew a Golden Visa, the applicant must demonstrate that the average quarterly balance of the bank deposit has been at least EUR 1,000,000.00;

Public debt securities of the Portuguese State: it possible to obtain a Golden Visa by first acquiring public debt of the Portuguese State, including treasury bonds, savings certificates or treasury bills. In this case, the Treasury and Public Debt Management Agency (Agência de Gestão de Tesouraria e Dívida Pública – IGCP, E.P.E.), must attest to the ownership, free of any burdens or charges, of one of those instruments with a value of at least EUR 1,000,000,00. In the case of renewal, the applicant must obtain a declaration from that Agency attesting to the ownership, free of any burdens or charges, of debt instruments with an average quarterly balance of at least EUR 1,000,000.00;

Acquisition of securities and acquisition of shares in commercial companies: it is also possible to obtain a Golden Visa by acquiring book entry securities or bearer or registered securities (whether or not in a centralised system) for an amount of at least EUR 1,000,000.00. In any of these cases, it will always be mandatory to have a certificate proving ownership, free of any burdens or charges, issued by the registering or custodial entity, by their issuer or by the financial intermediary, respectively, for both granting and renewal of the Golden Visa. In the case of acquisition of shares in commercial companies, the applicant must have an up-to-date commercial registration certificate and the acquisition contract, with an indication of the value.

b) Creation of at least 10 jobs: the applicant must prove that he or she has actually hired the employees and registered them with the Social Security – by presenting an up-to-date certificate issued by that entity. In the case of renewal, the applicant must present an up-to-date social security certificate proving that he or she has maintained the minimum number of jobs.

c) Acquisition of real estate with a value of at least EUR 500,000.00: in relation to what has been the predominant investment activity to obtain Golden Visas, the applicant must acquire or promise to acquire real estate with a value of at least EUR 500,000.00. The applicant may acquire the real estate as a co-owner as long as each of the co-owners invests at least EUR 500,000.00. The Golden Visa applicant may also be a promissory purchaser as long as the deposit he or she has paid is at least EUR 500,000.00. The money used to pay the purchase price or deposit must come from an international transfer to a bank account in Portugal held by the applicant.

To prove compliance with the minimum requirements for this investment activity, when he or she makes the Golden Visa application, the applicant must file: (i) the document that proves the acquisition or promissory purchase of the property, (ii) a declaration issued by a financial institution attesting to the transfer of the capital, and (iii) an up-to-date land registry certificate that includes registration of the acquisition or, whenever possible, of the promissory sale and purchase in favour of the Golden Visa applicant).

It should be noted that if the second renewal occurs 36 months after the Golden Visa is granted, the visa holder must present the definitive sale and purchase contract and an up-to-date land registry certificate of his or her acquisition.

d) Acquisition of real estate with construction completed at least 30 years ago or located in an urban rehabilitation area, with execution of rehabilitation works: to obtain a Golden Visa on the basis of prior acquisition of real estate assets with construction completed at least 30 years ago or located in an urban rehabilitation area and execution of rehabilitation works on the property acquired, the minimum investment is reduced to EUR 350,000.00. Besides demonstrating that he or she is the owner of the property, free of any burdens or charges, the applicant may present: (i) proof of filing of a request for prior information or for the licensing for rehabilitation or (ii) a works contract for the works on the property acquired. In either of these cases, the applicant must also deposit the difference between the property purchase price and the minimum investment required – to be used to pay for the works – in a bank account at a bank in Portugal held by him or her.

To renew the Golden Visa, the applicant must have an authorisation to carry out the rehabilitation works as well as the works contract. At the same time, the applicant continues to be under an obligation to prove that he or she has maintained the deposit of the works contract price at a bank in Portugal and, whenever possible, present the receipts for partial or full payment for the works.

e) Transfer of capital of at least EUR 350,000.00, invested in research carried out by public or private scientific research institutions that are part of the national scientific and technological system: for this purpose, the applicant must make an international transfer of at least EUR 350,000.00 to a bank account held by him or her in Portugal. The applicant must also obtain a declaration issued by a public or private research institution that is part of the national scientific and technological system, attesting that it has received the capital in question.

f) Transfer capital of at least EUR 250,000.00, as investment or support for artistic production, or recovery or maintenance of national cultural heritage: the applicant must make an international transfer to his or her bank account in Portugal and obtain a declaration issued by the Office of Cultural Strategy, Planning and Evaluation (Gabinete de Estratégia, Planeamento e Avaliações Culturais) attesting to the transfer of that capital.

g) Transfer capital of at least EUR 350,000.001, destined to acquire units in investment or venture capital funds aimed at providing capital to companies that meet certain requirements: to obtain a Golden Visa, the applicant must acquire, for the price of at least EUR 350,000.00, units in investment or venture capital funds aimed at providing capital to companies. These funds must be incorporated under the Portuguese law, with a maturity date of at least five years as of the investment date and, at least, 60% of its investments must be made in companies with registered office in Portugal.

h) Transfer capital of at least EUR 350,000.00, to incorporate or increase the share capital of a company with registered office in Portugal, together with a creation of five permanent jobs, for a period of three years2.

SPECIFICS OF THE GOLDEN VISA PROGRAM

Time of making the investment and mandatory duration: The investment activity chosen by the applicant must have been made at the time the application for a residence permit is presented and the investment must be maintained for a minimum period of five years, though investors can change the type of investment in the renewal applications. This five-year period runs from the date the Golden Visa is granted.

Shareholding and investment through companies: If the chosen investment is made through a commercial company, it must be made through a single shareholder limited company (sociedade unipessoal por quotas) with its registered office in Portugal, or in another Member State of the European Union with a permanent establishment in Portugal.

Validity periods and obligation to stay in Portugal: The Golden Visa is a temporary residence permit valid for one year from the date it is issued. It can be renewed for successive periods of two years as long as the requirements necessary for it to be granted are maintained. For residence permits to be granted and renewed, the applicants must regularise their presence in Portugal within 90 days of their first entry into Portuguese territory. Whenever necessary, they must obtain a short-term visa from the Portuguese Consulate in their country of origin. They must also prove they have met the minimum quantitative requirements in relation to the chosen investment activity. To renew a Golden Visa, applicants must demonstrate that they have stayed in Portugal for at least (i) 7 days, whether consecutive or not, in the first year and (ii) 14 days, whether consecutive or not, in each of the subsequent 2-year periods.

Financial benefits for investing in areas of "Low Population Density": To encourage decentralisation of investment away from large urban centres, the minimum quantitative amount or requirement for most investment activities3 can be reduced by 20%, whenever those activities are carried out in "Areas of Low Population Density".

Reduction of the tax burden for investments in urban rehabilitation: The Portuguese Government has created tax benefits for the activity of urban rehabilitation, introducing tax efficiency to investment opportunities. Golden Visa applicants can enjoy these benefits if (i) they acquire real estate assets, whose construction was completed at least 30 years ago or are located in an urban rehabilitation area and (ii) they carry out rehabilitation works on those real estate assets. These benefits take the form of (i) exemptions from Municipal Property Transfer Tax (Imposto Municipal sobre as Transmissões Onerosas – "IMT") when acquiring the properties in question, (ii) exemptions from Municipal Property Tax (Imposto Municipal sobre Imóveis – "IMI"), for the three years following acquisition of the properties and (iii) a reduced rate of Value Added Tax (Imposto Sobre o Valor Acrescentado – "IVA") in relation to the works.

Schengen area: Like any other Portuguese residence permit, Golden Visa holders can travel freely in the Schengen Area4.

Right to family reunification: Besides the spouse, minor children or relatives in the ascending line, the Implementing Decree makes it clear that Golden VISA holders may be reunified with adult children in the care of the couple or one of the spouses if those children are studying in Portugal or abroad.

Footnotes

1 The reduction of the minimum investment amount to EUR 350,000.00 results from an amendment to the legal framework that will only be in force on 27.11.2017

2 New Investment Activity that will also be in force on 27.11.2017

3 The exceptions are transfers of capital of at least EUR 1,000,000.00 and the acquisition of units in investment or venture capital funds, for a minimum of EUR 350.000,00.

4 Austria, Belgium, the Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Lichtenstein, Lithuania, Luxembourg, Malta, the Netherlands, Norway, Poland, Portugal, Slovakia, Slovenia, Spain, Sweden and Switzerland.

5 Stamp duty.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.