Unselbständig erwerbende Personen unterliegen in der Schweiz dem Schweizer Sozialversicherungsrecht und leisten u.a. Beiträge in die 2. Säule. Das angesparte Alterskapital ist in der Regel bis zur Erreichung des Rentenalters gebunden. Ein vorzeitiger Bezug in Form einer Kapitalauszahlung ist bei der Aufnahme einer selbständigen Erwerbstätigkeit, beim Erwerb von selbstbewohntem Wohneigentum oder bei der definitiven Ausreise aus der Schweiz möglich. Letzteres ist insbesondere bei Expat - riates häufig anzutreFen, da deren Einsatz in der Schweiz meist zeitlich beschränkt ist. Im Beratungsalltag wird immer wieder festgestellt, dass Expat - riates, aber auch deren Arbeitgebern, nicht bewusst ist, dass bei der defini - tiven Ausreise ins Ausland mit wenig Aufwand und ohne Risiken erheblich Steuern eingespart werden können.

Die Höhe des möglichen Kapitalbezugs ist davon abhängig, in welches Land der auswandernde Schweizer bzw. der heimkehrende Ausländer zieht. Zum einen muss beachtet werden, dass ein vollständiger Bezug nur für jene Per - sonen möglich ist, die sich ausserhalb der EU/EFTA-Staaten niederlassen oder innerhalb dieser Staaten keiner Versicherung für Alter, Invalidität und Hinterlassenenleistungen unterstellt sind. Alle anderen Personen können nur den überobligatorischen Teil ihres Guthabens beziehen.

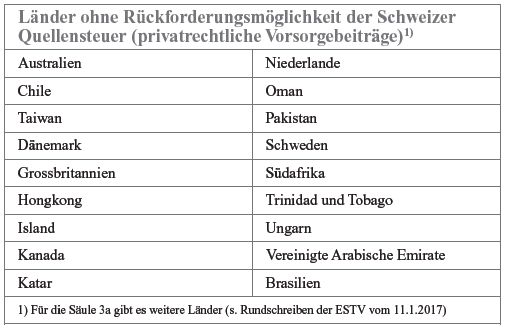

Sieht das Doppelbesteuerungsabkommen (DBA) vor, dass die Besteuerungskompetenz auf den Zuzugsort fällt und kann die Schweizer Steuer lediglich zurückgefordert bzw. angerechnet werden, lässt sich eine Steuerersparnis nur in vereinzelten Fällen umsetzen, wenn z.B. die Steuerbelastung in der Schweiz über derjenigen am Zuzugsort liegt und die dortige Steueranrechnung auf die schweizerische Steuerbelastung begrenzt ist. Die Steuerersparnis ist grundsätzlich in jenen Fällen am grössten, wo die Bestimmungen der DBA zwischen der Schweiz und dem Zuzugsstaat das Besteuerungsrecht ausschliesslich der Schweiz zuweisen oder kein DBA vorhanden ist (z.B. UK, Kanada, Niederlande und Brasilien).

Besteht Klarheit über die bilateralen Bestimmungen zwischen der Schweiz und dem Zuzugsort, sollte die Auszahlung des Vorsorgekapitals sorgfältig geplant werden. Wichtig ist, dass die Barauszahlung des Pensionskassenguthabens erst beantragt wird, nachdem der Wohnsitz ins Ausland verlegt wurde. Nur dann ist sichergestellt, dass der Vorsorgebezug nicht im ordentlichen, sondern im Quellensteuerverfahren durchgeführt wird. Dies ist deshalb entscheidend, weil die Quellensteuer am Sitz der Vorsorgeeinrichtung oder Freizügigkeitsstiftung und nicht etwa am letzten Wohnsitzort erhoben wird. Vor diesem Hintergrund soll das Pensionskassenguthaben vor der Auszahlung der Pensionskasse des Arbeitgebers in eine Freizügigkeitsstiftung eines steuergünstigen Kantons transferiert werden. Nur dann kommen im Zeitpunkt der Auszahlung die dortigen tiefen Steuersätze zur Anwendung. Hierbei gilt es lediglich zu beachten, dass nach einem Transfer noch 30 Tage abgewartet werden müssen, bis das Kapital schliesslich bezogen werden kann.

Die Steuerersparnis lässt sich zusätzlich steigern, sofern das Vorsorgekapital bei der Überweisung auf verschiedene Freizügigkeitskonten transferiert wird (sogenanntes Splitting). Durch den gestaFelten Bezug kann der auf Bundesebene ausgestaltete progressive Steuersatz gebrochen werden. Diesbezüglich gilt es lediglich zu beachten, dass die Aufteilung des Guthabens zwingend vor der Über weisung auf die Freizügigkeitskonten festgelegt werden muss, da später keine Auf - teilung mehr möglich ist. Des Weiteren ermöglicht das Splitting einen Teilbezug.

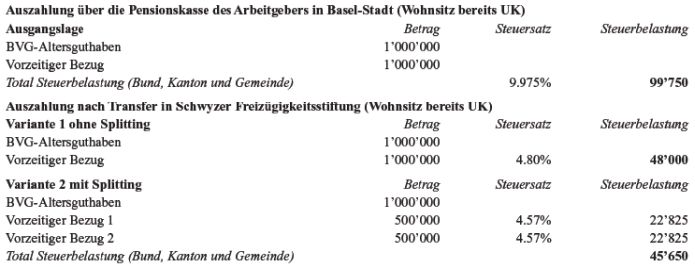

Berechnungsbeispiel für die Pensionskassenauszahlung

Die aus Grossbritannien stammende Person hat während 10 Jahren als leitender Angestellter im Kanton Basel-Stadt gearbeitet und in dieser Zeit ein beträchtliches BVG-Altersguthaben von 1'000'000 Franken angespart. Mit 60 Jahren entscheidet die Person, in ihre Heimat zurückzukehren. Nach dem Wegzug stellt sich die Frage, ob sich die Person ihr Vorsorgeguthaben über ein Freizügigkeitskonto im Kanton Basel-Stadt (ehemaliger Wohn- und Arbeitsort) oder über ein Freizügigkeitskonto im Kanton Schwyz ausbezahlen lassen soll. Wie der nachfolgenden Tabelle zu entnehmen ist, resultiert bei der Auszahlung des Vorsorgekapitals und bei vorgängiger Übertragung des Vorsorgekapitals auf ein Freizügigkeitskonto im Kanton Schwyz eine Steuer - ersparnis von 51'750 Franken. Bei einem Teilbezug (Splitting) des Vorsorgeguthabens im Kanton Schwyz können nochmals zusätzlich 2'350 Franken eingespart werden.

Taking a cash disbursement of the pension fund assets when leaving Switzerland

Employees in Switzerland are subject to Swiss social insurance law and are hence obliged to contribute into the occupational benefits scheme (BVG resp. 2nd pillar). In general, pension fund assets in the 2nd pillar are restricted until reaching the age of retirement. An early disbursement in the form of a capital payment is possible, if an employee becomes self-employed, if self-occupied real estate is purchased or upon the definitive departure from Switzerland. The latter is of particular interest for expatriates, as their professional stay in Switzerland is usually limited in time. When consulting our clients and companies, we have repeatedly noticed that not only the expatriates, but also their employers (even big firms with large HR departments) are not aware that with little eFort and without any risks, considerable tax savings can be achieved when leaving Switzerland.

The amount of cash disbursement depends on which country the person intends to move to. It must be taken into account that a full withdrawal is only possible for persons who are relocating to countries outside the EU/EFTA or who are not subject to insurance for old age, invalidity or survivors' benefits within these countries. All other persons can only withdraw the non-compulsory funds.

If the Double Tax Treaty (DTT) assigns the taxation right to the country where the person relocates to, the levied Swiss taxes can be reclaimed or credited. If the latter is the case, tax savings can only be achieved when the Swiss tax burden is higher than the taxes levied in the other country. The highest potential tax savings can be achieved when the provisions of the applicable DTT between Switzerland and the other country assigns the taxation right exclusively to Switzerland (e.g. UK, Canada, Netherlands etc.). This is also the case for countries which don't have a DTT with Switzerland.

Once it is clarified which state is allowed to tax the capital disbursement, the withdrawal of the pension funds must be carefully planned. First of all, it must be noted that the pension fund assets are not transferred before moving abroad. In such a case the pension funds are subject to source taxation as the unlimited tax liability of the person ends when leaving Switzerland. This is crucial because taxation at source ensures that the funds are being taxed where the pension funds are held or where the vested benefits foundation's headquarters is based, instead of the person's last domicile in Switzerland. As a result the employee's funds can be transferred to a vested benefits account in a canton with low tax rates. It is important to note that the transfer to a low-tax canton leads to a 30-days blocking period until the capital can finally be withdrawn.

The resulting tax savings from the transfer can be increased further if the pension capital is transferred to diFerent vested benefits accounts (so-called splitting). This is because the tax rates at federal level are of a progressive nature and can be "breached" by multiple withdrawals. Such splitting must take place before the transfer to the vested benefits accounts, otherwise a later allocation between diFerent accounts will not be possible. Besides the additional savings resulting from the splitting, it grants flexibility to only partially withdraw money from the Swiss vested benefits account.

Originally published in Das Geld-Magazin

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.