This overview is prepared to clarify certain key aspects of the competition law treatment of the establishment of joint ventures ("JV") via the creation of a newly-formed JV or acquisition of minority shares in an existing company. The overview considers both the Ukrainian merger control requirements and the practice of the Antimonopoly Committee of Ukraine (the "AMC").

Similar to the EU merger control regime, in Ukraine the establishment of a JV may qualify either as a concentration or as concerted practices.

Section I. The following types of transactions qualify as a concentration1:

- the establishment of a

newly-formed undertaking (for convenience a

"newly-formed undertaking" also hereinafter referred to

as a JV) provided that:

- the JV is established by two or more independent undertakings;

- the JV will independently pursue business activity on a lasting basis; and

- the establishment of the JV does not

result in coordination of the competitive behaviour of either

- the founding parents among themselves or

- amongst the founding parents and the JV.

- the acquisition of a minority

shareholding if it results in:

- reaching or exceeding 25% of the votes in the highest governing body of an undertaking (irrespective of whether or not control is acquired)*; or

- acquisition of direct / indirect control over an undertaking or a part of it (including via acquisition of ''negative control'' through rights of veto over strategic business decisions).

*Under the Law of Ukraine On Protection of Economic Competition (the "Competition Law"), the concept of "concentration" does not provide for "a change of control on a lasting basis" as an essential element for all types of concentrations.

When might establishment of a JV qualify as a concentration in Ukraine?

1) Unlike the EU merger control regime, where the "creation of a JV" means the creation of an undertaking jointly controlled by at least two undertakings, in Ukraine the creation of a new undertaking by two independent undertakings does not require joint control to qualify as a concentration. Thus, the creation of a newly-formed undertaking may qualify as a notifiable concentration even if neither or only one of the founders will exercise control over the newly-formed undertaking.

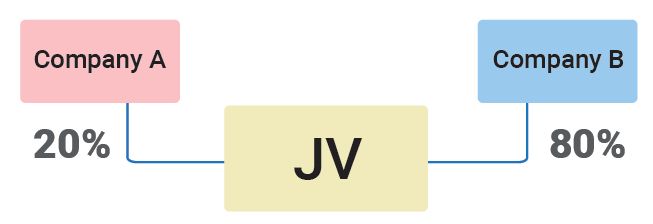

Model example 1:

Company A and Company B establish a JV with 20% and 80% of the voting rights in the JV, respectively. Company A has no negative control rights over the JV.

Although Company A does not obtain any control rights over the JV, under the Competition Law the transaction constitutes a concentration provided that the criteria in Section I, point 1) above are met.

In this case it is possible to avoid a notification by structuring the transaction in 2 steps:

Step 1): Company B establishes a new Company X, and

Step 2): Company A further acquires 20% stake in Company X from Company B.

In this case, neither the Step 1) nor the Step 2) will qualify as a notifiable concentration.

2) Even if a JV is created by two independent undertakings as a special purpose vehicle ("SPV") solely for the purpose of implementing another transaction, the creation of such an SPV technically qualifies as a concentration and requires a separate merger control clearance if the financial thresholds are met.

Example 2 (from the practice of the AMC, 2016):

Company A (Canada) and Company B (Canada) established an SPV in Canada solely for the purpose of implementing a related transaction. The AMC found that failure to obtain a separate merger control clearance for the establishment of the SPV constituted a violation of the Competition Law since the financial thresholds were met by the corporate group of one of the founders of the SPV because of sales on the territory of Ukraine.

3) Even if a newly established JV is not expected to operate in Ukraine, a merger control clearance is required if the financial thresholds are technically met by the corporate groups of the JV founders.

Example 3 (from the practice of the AMC, 2016):

The AMC found a failure to notify the creation of an India-based JV which was expected to operate a brewery business in India. The local nexus was technically met based only on the Ukrainian turnover of one of the founders. The other founder did not operate in Ukraine and the newly established India-based JV was not expected to operate in Ukraine either.

Section II. The establishment of a newly-formed JV may qualify as concerted practices,

if it results in coordination of the competitive behaviour of either:

(i) the founding parents amongst themselves; or

(ii) the founding parents and the JV.

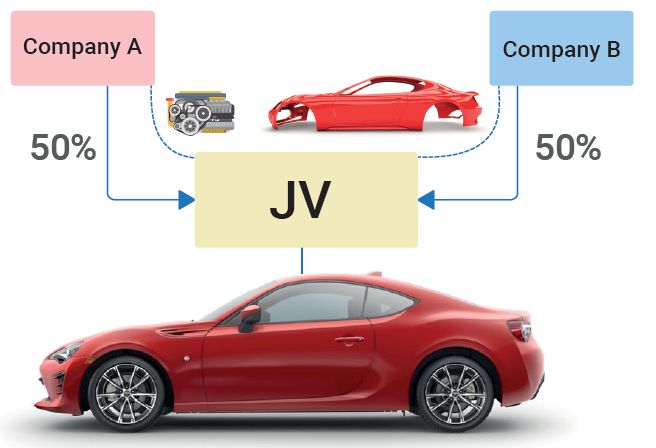

Model example 4:

Company A (a producer of engines) and Company B (a producer of body shells) establish a new 50 / 50 JV.

The JV is expected to assemble engines of Company A and body shells of Company B, which are to be marketed by other legal entities. Since such an establishment of the JV results in coordination of the competitive behaviour amongst the founders on the downstream market, it qualifies as as concerted practices which require an antitrust clearance if the financial thresholds for concerted practices are met.

Section III. Financial thresholds for notification

In case of the establishment of a newly-formed JV, the local nexus is presumed if the following financial thresholds are met by the corporate groups of the JV founders for the previous financial year:

The merger control notification is required for

concentrations2 if any of below Test A or Test B is met

(calculated on the group level of the JV founders):

Test A. At least two JV founders have turnover or assets in Ukraine:

- combined Ukrainian turnover or assets for each of at least two JV founders exceed €4 million; and

- combined worldwide turnover or assets of all JV founders exceed €30 million.

- combined Ukrainian turnover or assets of at least one of the JV founders exceed €8 million; and

- worldwide turnover of at least one other JV founder exceeds €150 million.

The antitrust notification is required for concerted

practices3 if the below thresholds are met (calculated

on the group level of the JV founders):

- combined worldwide turnover or assets of the JV founders exceed €12 million; and

- combined worldwide turnover or assets for each of at least two JV founders exceed €1 million; and

- combined Ukrainian turnover or assets of at least one JV founder exceed €1 million.

1. Which party is responsible for filing the establishment of the JV?

If the JV is established by means of:

- the creation of a new entity, the founders of the JV are responsible for filing;

- the acquisition of minority shareholdings / control, the acquirer and the target are both responsible for filing. As a matter of practice, the acquirer is normally held liable for failure to notify in such case.

2. Might a notification be required for the creation of a newly-formed JV if only the founders generate turnover in Ukraine (but not the JV)?

Yes, even if a newly-formed JV is not expected to operate in

Ukraine, a merger control clearance is required if the financial

thresholds are met based on the turnover or assets of the corporate

groups of the JV founders (please see examples 2 and 3 on page

2).

3. Does the acquisition of a minority shareholding trigger a notification requirement, even if it does not result in change of control?

Yes, provided that the acquisition results in the direct / indirect acquisition of 25% or more of the voting rights in the highest governing body of the target. The Competition Law defines "reaching or exceeding 25% of the votes in the highest governing body of an undertaking" as a separate form of a notifiable concentration.

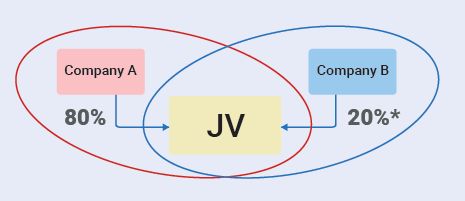

4. If a controlling stake is acquired in a jointly controlled JV, how are the JV's turnover / assets calculated for the purposes of financial threshold

Where two or more parents jointly control the JV, the turnover / assets of each of the controlling parents (on the group level) are taken into account for calculation of the JV's turnover / assets, e.g.:

Notes:

*joint control due to veto rights of Company B over strategic business decisions of the JV.

**Company A and Company B are not related by control.

The full turnover / assets of Company A and Company B (including their own parent companies / UBOs, and other legal entities connected to each of them by control relations) should be taken into account for calculation of the turnover / assets of the JV.

5. Might a creation of a newly-formed, non-full-function JV be a notifiable concentration in Ukraine?

Yes. It should be noted that there is no definition of a "full-function undertaking" in the Competition Law similar to the one applied in the EU. Furthermore, under the Competition Law, "exercising control over a legal entity " as such constitutes a business activity. Thus, even the establishment of an SPV or a holding company which only holds / manages corporate rights of related legal entities on a lasting basis, meets the criteria of "pursuing an independent business activity on a lasting basis", and, thus, might be a notifiable concentration.

6. In case of a multi-step transaction involving the establishment of an SPV, is it possible to clear the entire transaction within one merger control clearance?

No. If separate steps within the same multi-step transaction formally qualify as concentrations, each step will require a separate merger control clearance. The AMC has repeatedly imposed fines for failures to notify the establishment of SPVs within a multi-step transaction.

Footnotes

1 For more information on transactions qualifying as concentrations and exemptions from the obligation to notify, please refer to page 1 of the leaflet "Merger Control in Ukraine".

2 For general information on the financial thresholds for other types of concentrations, please refer to page 1 of the leaflet "Merger Control in Ukraine".

3 For general information on the financial thresholds for other types of concerted practices, please refer to page 2 of the leaflet "Merger Control in Ukraine".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.