Many companies have issued their 2017 financial reports, disclosing the impacts of IFRS 9 and 15, which became applicable at the start of this year. The next challenge: interim financial reports. The two new standards bring certain changes in this area that corporates shouldn't underestimate.

Accounting standards haven't changed this much in years, if not decades, in terms of financial reporting. IFRS 15 is an obvious one for corporates, but IFRS 9 should be assessed carefully too given that its additional information requirements can vary company by company. And anyway, it is imperative that disclosures are in line with the standard, even if top-line figures are not greatly affected.

Information required in interim financial statements

In accordance with IAS 34, companies must disclose a complete set of financial statements as defined in IAS 1 (the same applies for condensed reports). However, it does permit them to provide less information in interim reports, and to disclose only selected explanatory notes, since these reports will ultimately be read together with the year-end reports. This standard has not been modified by IFRS 9 or 15.

The main requirements of IAS 34 can be found in paragraphs 15 and 16A, in which the following are mentioned as items to disclose:

- significant events and transactions (i.e. allowances for financial assets or changes for such allowances, IAS 34.15)

- any changes in the accounting policies and methods of computation and nature and effect of these changes (IAS 34.16A(a))

- changes in estimates relating to figures reported in prior periods (IAS 34.16A)

- fair value for financial instruments in accordance with IFRS 13.91-93(h), 94-96 and 99, IFRS 7.25,26, and 28-30 (IAS 34.16A(j))

For issuers, this means interim disclosures that will be extensive and time-consuming.

Re: IFRS 15

The new standard asks for extensive disclosures of one of a company's main KPIs: revenue. This didn't use to be the case, but now companies must disclose what's behind the figures as well as "commercial sensitive" information. Many issuers are displeased about the latter requirement. The main challenge could be summed up as walking a line of disclosing enough information to meet the requirements, but not so much as to threaten competitiveness.

Re: IFRS 9

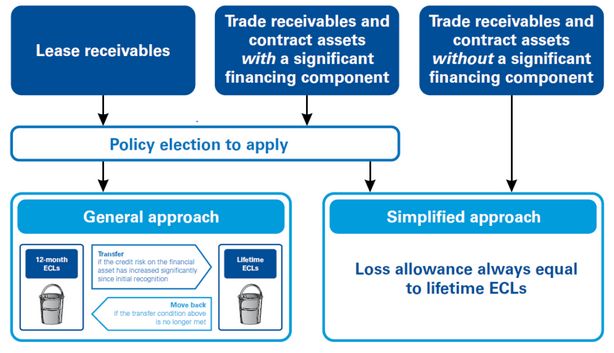

IFRS 9 will affect banks rather heavily, while corporates less so—depending on their business strategies. The requirements in relation to the new impairment model, however, are extensive, and do affect corporate companies because trade receivables, contract assets, and lease receivables are within the scope of the standard.

This means that as soon as a corporate expects a customer to meet his/her obligation later than initially agreed upon, it needs to recognise an impairment loss. The standard permits the use of a simplified approach for certain financial instruments, but only if there is no significant financing component included and if the trade receivables are owned by the entity.

If using the simplified approach, companies do not need to monitor for significant increases in credit risk, but are required to measure lifetime expected credit losses from initial recognition. To learn more about the simplified approach, check out our guide to IFRS 9 for corporates.

It's different this year

The interim financial statement will be a first chance to show stakeholders the real effects of the new standards, and investors will be keen to look closely. It's about more than just numbers: it's about choosing the right words and definitions.

(And, additionally, don't forget about IFRS 16!)

KPMG has developed quick guides to IFRS 9, IFRS 15, and IFRS 16, as well as a guide to the interim financial statements and a corresponding disclosure checklist.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.