Anyone in a family business knows that succession is a huge issue. There are plenty of factors confusing the process, but in this article I want to focus on just one of them: tax.

Specifically, how does the tax burden of transferring company ownership change if the owner passes away versus if he/she retires? What have countries done to help harmonise the rules around transfers? How are highly globalised business families affected differently?

This year's Global Family Business Tax Monitor set out to answer these questions and more. The study found that some countries, like France and the Netherlands, tax family business transfers heavily but offer significant breaks on those tariffs too. In both retirement and inheritance scenarios, pre-exemption rates ranged from nearly 50% (e.g. Spain and France) all the way to 0% (e.g. Switzerland and Russia).

Family business succession through inheritance

Consider a fictional businessperson, Elise Larksen, who has owned her family business, Larksen Networks, for over ten years. She invested €1 million to establish the company and has worked hard over the years to build her business, which is now valued at €10 million on an arm's-length, third-party basis (which includes €5 million of goodwill). All assets in the company are used for the purposes of the business.

Elise's spouse Richard died in 2012, and their only child is Lianne, who is 35 years old. Unfortunately, Elise has recently passed away in a motorcycle accident. Her will stipulates that the business be passed to her daughter, an arrangement that Lianne accepts. Lianne intends to continue the business for the next 20 years or so.

What is the tax impact of Elise's death?

The answer depends heavily on where the inheritance/retirement occurred. The chart below maps the taxes that would be levied across the 65 countries surveyed by KPMG. For now, exemptions or reliefs that may be available (given the asset's nature or the relationships involved) are not taken into account.1

As you can see, the disparity is huge, ranging from over €4 million (40%) in the US, France, the UK, and Australia, all the way down to nil in Hungary, Luxembourg, and Italy—and nearly nil in Vietnam, Monaco, and Austria.

The next chart, however, shows how this outlook changes when exemptions and reliefs are taken into account. As more advanced economies tend to provide generous exemptions to business assets, the end result is often that their treatment of such transfers is closely aligned to that of emerging economies.

Family business succession upon retirement

Let's return to our fictional owner, Elise. Suppose that the details (her business being valued at €10 million on an arm's length, third-party basis, including €5 million of goodwill) are mostly the same, but her wealth is markedly more stable. She wishes to retire—she wants more time for motorcycle lessons—and to give Larksen Networks to Lianne, her daughter, who hopes to run the business for another two decades. The gift is not related to any employment of Lianne in the business.

What's the tax impact of such a gift, then, assuming that Elise lives for at least another decade?

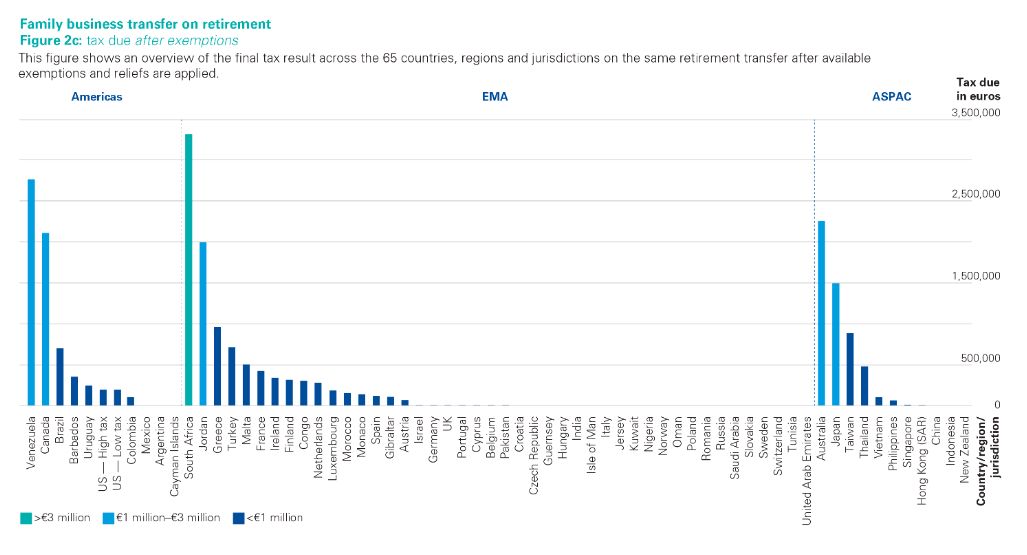

The answer, again, lies in where the company is. The graph below charts this scenario across the same 65 countries as before, again before the application of any exemptions or reliefs.

As you can see, the spread is enormous.

But when exemptions and reliefs are factored in, the chart changes drastically.

Looking ahead

The decision of when to pass on a business is fraught with tough factors, of which tax is only one. As the above results show, however, it can be a particularly important one, depending on where the transaction occurs. Ultimately, succession plans should be aligned with the whole family's values and wishes. For more on the current state of family businesses, read the full Global Family Business Tax Monitor.

For family businesses, structuring your affairs can end up saving huge costs. KPMG Luxembourg has a team of advisors specialised in helping determine the ideal moment to transfer an enterprise, keeping both business and family objectives in mind and aligned.

Next up on the KPMG Blog:

How to offer great customer experience

Footnote

1 The exchange rates used for all the graphs in this article were current as of December 2017 – January 2018.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.