A. INTRODUCTION

Initial Coin Offering, known as "ICO", is a relatively new phenomenon that has quickly become the main player in the Financial Services and Crowdfunding industries, as well as being the key subject of discussion in the Blockchain communities. In essence, it is one of the most advanced methods of raising finance from the public and is becoming increasingly popular to fundraise start-ups.

While all jurisdictions are shying away from regulating this industry, Malta has recently introduced a specific regulatory framework for ICOs and has become the first jurisdiction worldwide to regulate ICOs and Blockchain Technology.

This publication in fact seeks to give an overview of the recent laws and regulations relating to ICOs.

Information relating to any ancillary services to cryptocurrencies, including the operation of platforms to exchange such cryptocurrencies, portfolio management and providing investment advice amongst others, is discussed in our brochure: "Malta – Virtual Financial Asset Services – The New Legislation".

B. TO WHOM DOES THE NEW LAW APPLY?

The new legislation applies to anyone who in or from within Malta:

- Will offer or issue Virtual Financial Asset(s) (VFA) to the public – i.e. will do an ICO. Such person shall be hereby referred to as "the Issuer"; or

- Admit a VFA to trading on a DLT Exchange, whether the exchange is in Malta or not.

Hence, if the asset that is offered to the public or admitted on the DLT Exchange is not a VFA, the new legislation does not apply, and other Financial Services laws might be applicable.

C. DEFINITION OF VIRTUAL FINANCIAL ASSET (VFA)

By way of a definition, a VFA is any form of digital medium recordation that is used as a digital medium of exchange, unit of account, or store of value and that is not one of the following as defined below:

- Electronic Money;

- Financial Instrument; and

- Virtual Token.

The following are the legal definitions of the above:

Electronic Money means electronically, including magnetically, stored monetary value as represented by a claim on the issuer which is issued on receipt of funds for the purpose of making payment transactions (as defined) and which is accepted by a natural or legal person other than the financial institutions that issued the electronic money.

Financial Instrument includes the following:

- Transferable securities, including shares and bonds;

- Money market instruments such as treasury bills and certificates of deposit;

- Units in a collective investment scheme;

- Options, futures, swaps and any other derivative contracts relating to securities, currencies interest rates, yields, commodities or those that are traded on a regulated market etc.;

- Derivative instruments for transfer of credit risk;

- Rights under a contract for difference;

- Instruments which confer property rights;

- Foreign exchange held for investment purposes; and

- Emission allowances under EU Emissions Trading Scheme.

Virtual Tokens have been defined as a form of digital medium recordation whose utility, value or application is restricted solely to the acquisition of goods or services, either solely within the Distributed Ledger Technology (DLT) platform on which it was issued or within a limited network of DLT platforms (that exclude DLT Exchanges).

It is important to note that a virtual token which may be converted into another DLT asset type shall be treated as the DLT asset type into which it is or may be converted.

The laws have introduced a compulsory Financial Instrument Test in order to classify the asset and determine whether it is a VFA, Financial Instrument, Electronic Money or Virtual Token.

D. FINANCIAL INSTRUMENT TEST

An Issuer of a VFA shall, prior to offering such asset to the public in or from within Malta, or applying for its admission on a DLT exchange, undertake the Financial Instrument Test (hereinafter "the Test").

The test is crucial to determine whether the DLT asset qualifies to be regulated under this new regime of laws, or whether the other Financial Services Laws will apply.

The Test has to be:

- Signed by its Board of Administration, and

- Endorsed by its VFA Agent.

The process is a two-fold test, being:

- Does the VFA qualify as a Virtual Token as defined under the new laws? If it does, having in mind its restricted definition as per the new laws herein specified, then it is exempted under the new VFA Law and the licensing requirements do not apply.

- If it is not qualified as a Virtual Token, then one has to determine whether this qualifies as a Financial Instrument under MiFID (Section C, Annex 1) considering all the categories of Financial Instatements as identified above. If the answer is negative, then the asset is caught under the VFA Law and its licensing procedure must be followed.

In summary

If a cryptocurrency qualifies as a Virtual Token as defined by the new law and does not qualify as a VFA, Financial Instrument or Electronic Money, then it is exempted from the ambit of applicability of the new law and the licensing requirements are not needed for its issuing or trading.

It is very important to point out that the MFSA shall rely on the determinations made by the Issuer and its respective VFA Agent. It will not make any determination of its own. In case of any disagreement between the VFA Agent and the Issuer, the matter shall be resolved between the said parties prior to a whitepaper's submission for Registration with the MFSA.

Furthermore, the MFSA shall not be accepting any applications where the Issuer's determination has not been endorsed by its VFA Agent.

For more detailed information on the Test, please consult our supplementary brochure: The Financial Instrument Test.

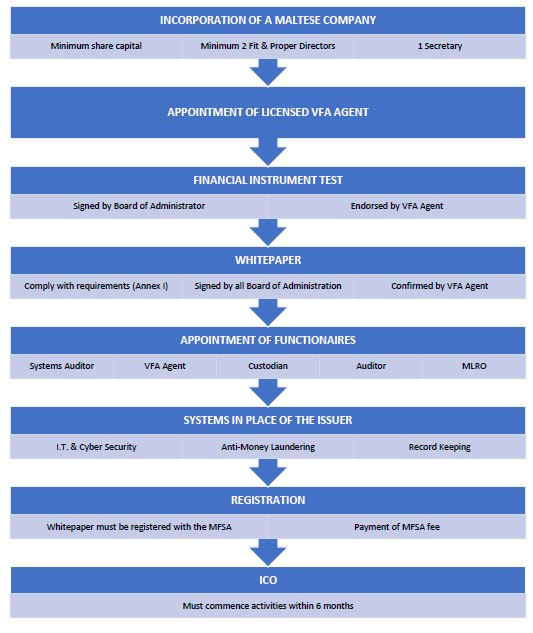

E. SALIENT FEATURES OF THE ICO PROCESS

F. STRUCTURE OF THE ISSUER OF THE ICO

The regulations stipulate the following general requirements which must be met at all times by the Issuer of the VFA.

In essence, by law, it is important that the Issuer:

- Is a legal person (i.e. a company) duly incorporated in Malta.

- Has its business managed by a minimum of 2 individuals with sufficient knowledge and understanding (i.e. fit and proper) of its business.

- Starts its activities within 6 months from date of registration of whitepaper with MFSA.

- Applies the Financial Instrument Test prior to offering a DLT asset to the public that must be endorsed by the VFA Agent.

- Prepares a Whitepaper (see Annex I for the details) and registers this with the MFSA.

- Pays the relevant MFSA fees upon the submission of the Certificate of Compliance (see Annex II for the amount of fees).

- Has a Board of Administration.

- Has the following duly qualified and

approved Functionaries:

- VFA Agent

- Systems Auditor

- Auditor

- Money Laundering Reporting Officer (MLRO)

- Custodian (optional)

- Has the following I.T. and Record

Keeping systems:

- Establishes a 'Cyber Security Framework'

- Has robust Record Keeping Facilities.

- Has I.T. Infrastructure.

All the persons listed above must have sufficient knowledge and experience in the field of I.T., DLT assets and their underlying technologies and maintain such knowledge throughout the duration of the business.

G. DOCUMENTATION TO BE SUBMITTED FOR ICO

An Issuer wishing to offer VFA to the public (i.e. ICO) in or from Malta shall prepare the following documents, which will be submitted to the MFSA through its VFA Agent:

- Whitepaper together with supplementary documentation duly signed by the Board of Administration (see Annex I);

- A copy of the Financial Instrument Test, duly signed by its Board of Administration and endorsed by its appointed VFA Agent;

- A confirmation from its Systems Auditor that the Issuer's Technology Arrangement complies with any qualitative standards set and guidelines issued by the authorities;

- A copy of the Issuer's audited Annual Accounts for each of the last 3 Financial Years;

- Last 3 years Consolidated Accounts of Group of Issuer (if applicable);

- Certified copy of its Constitutional Document/s; and

- Payment of applicable registration fee (see Annex II).

It is important to note that:

- MFSA may request any other documentation.

- MFSA has total discretion whether to accept or reject any applications.

- No application can be submitted to MFGSA unless it is made with the consent of the Issuer, via the VFA Agent.

H. ISSUING OF A VFA – REQUIREMENT OF A WHITEPAPER

The law prescribes that a whitepaper which will be registered and in effect approved by MFSA is compulsory in order for an issuer to:

- Offer a VFA to the public in or from within Malta; or

- Apply for a VFA's admission on a Distributed Ledger Technology (DLT) Exchange.

Ten days before being circulated, the whitepaper has to be:

- Signed by every member of the board of administration; and

- Signed and approved by the duly appointed VFA agent; and

- Delivered to the MFSA, which shall register the whitepaper if it is satisfied that the requirements have been duly complied with.

Most importantly, the whitepaper shall have the contents specified in Annex I of this publication. Non-observance with any of such requirements will automatically disqualify the whitepaper from being registered / approved.

I. BOARD OF ADMINISTRATION

The Issuer's Board of Administration shall be responsible for ensuring that the Issuer complies with its obligations under the laws.

It is crucial that the Board of Administration has, both collectively and on individual basis, sufficient knowledge and understanding of the Issuer's business to enable them to discharge their duties.

Amongst the duties, one finds the following:

- Duty to act honestly, in good faith and to exercise reasonable care, skill and diligence;

- Independence of judgment;

- Obligation to continuously monitor the functions delegated to the other functionaries;

- Identify and manage risk;

- Monitor compliance with the legal requirements;

- Avoid conflict of interest;

- Establish good governance framework;

- Responsible for the issuer's compliance with anti-money laundering laws;

- Ultimate liability towards the unitholders for damages incurred due to negligence or willful misconduct.

J. FUNCTIONARIES OF THE ISSUER

By law, the Issuer is required to appoint the following Functionaries:

- VFA Agent

- Systems Auditor

- Auditor

- Custodian

- Money Laundering Reporting Officer

The identities of the Functionaries must be disclosed in the Whitepaper. These will be analyzed in more detail below:

1. VFA Agent

An issuer of a VFA is required to appoint, and have at all times in place, a VFA agent who is duly registered with the MFSA and duly approved by the same. The VFA Agent must at all times remain independent from the issuer.

The roles of the VFA Agent shall include the following:

- Ensure that the issuer has satisfied all requirements of the laws;

- Ensure that the issuer is a fit and proper person to carry out the relevant activities;

- Advise the issuer on its responsibilities and obligations of the law;

- Submit all required documentation, information and explanations to the MFSA;

- Act as a liaison between the issuer and the MFSA in all matters in connection to the whitepaper or the trading of the issuer's VFA on a DLT exchange;

- Submit to the MFSA on behalf of the issuer an annual certificate of compliance;

- Provide a declaration of independence from the issuer to the MFSA.

The Issuer must provide written confirmations to the VFA Agent that:

- The Board of Administrators has established procedures that allow it to make proper judgements on the financial position of the Issuer;

- It has provided the investors with a clear roadmap that established the milestone of the ICO;

- Any profit forecasts or estimates have been made after due and careful enquiry;

- Financial information presented in any document published has been properly extracted from its accounting records.

The only 2 instances in which a VFA Agent is not required are:

- In case of a Public Sector Issuer; or

- An issue whose VFA are unconditionally and irrevocably guaranteed by the State or a Stat's regional or local authority.

2. Systems Auditor

Where an issuer has Innovative Technology Arrangements in place (e.g. Smart Contracts, DLT Platform), such Issuer has to appoint and have at all times a Systems Auditor, who needs to be approved by the MFSA. The authority may object to the appointment and may replace such Systems Auditor.

The role of the Systems Auditor shall be that of:

- Reviewing and auditing the Issuer's Technology Arrangements (i.e. the smart contracts and the platform).

- Prior to commencement of the ICO, the

Systems Auditor must:

- Prepare a report showing compliance in all areas of the Technology Arrangements;

- Check and certify that nothing in the Technology Arrangements contains rights to unilaterally mutate, amend or destroy without leaving trace.

- Prepare an annual systems audit report on the Technology Arrangement's compliance with any standards duly issued by the Malta Digital Innovation Authority (MDIA).

The regulations also specify the contents of the letter of engagement between the Issuer and the Systems Auditor. The agreement must require the latter to:

- Provide any information requested by the MFSA;

- Afford another Systems Auditor any assistance required;

- Allow the Systems Auditor to vacate his office if he becomes disqualified;

- Notify the MFSA if he ceases to hold office for any reason;

- Report immediately to the MFSA any fact or decision of which he becomes aware as Systems Auditor which constitutes a breach under the laws.

3. Custodian

The regulations require the appointment of a Custodian, in order to be responsible for the safekeeping of the assets and investors' funds. The MFSA consent is required prior to such appointment.

Interestingly, custody of the VFA can be performed through an Innovative Technology Arrangement (a smart contract) which is duly certified by a Systems Auditor.

In any case, the Issuer shall ensure that there are appropriate systems that provide for the reimbursement of investors' funds should the Initial VFA offering be cancelled.

The Custodian is required to be independent and must be one of the following:

- For Virtual Financial Assets –

with a third party:

- Custodian duly licensed in Malta to propvide VFA Custodian Services or

- In a recognized jurisdiction provided that the Issuer shall specify in the Whitepaper the arrangement that will be put in place to ensure adequate safekeeping of the assets and funds.

- Fiat Currencies – with any of

the following:

- Central Bank;

- Credit Institution duly licensed under EU Directive;

- Bank Authorized in a Third Country;

- Money Market Fund;

- Electronic Money Institution; or

- Payment Institution.

4. Auditor

The law requires every Issuer to have at all times an Auditor that is approved by the MFSA who has to be experienced and qualified to act as such to the Issuer.

Apart from preparing the annual audit, the Auditor is also required to prepare a management letter in accordance to the International Standards on Auditing.

The regulations also specify the contents of the letter of engagement between the Issuer and the Auditor. The agreement must require the latter to:

- Provide any information requested by the MFSA;

- Afford another Auditor any assistance required;

- Allow the Auditor to vacate his office if he becomes disqualified;

- Notify the MFSA if he ceases to hold office for any reason;

- Report immediately to the MFSA any fact or decision of which he becomes aware as Auditor which constitutes a breach under the laws.

5. Money Laundering Reporting Officer (MLRO)

The Issuer must at all times have a duly qualified MLRO who must:

- Be a senior employee of the Issuer or a member of the Board of Administration; and

- Has sufficient knowledge and experience of anti-money laundering laws; and

- Fully understands his obligations and liabilities attached to the role; and

- Be of good repute, competent and financially sound.

The person to be appointed as MLRO must be proposed to the MFSA who prior to the approval shall be required to complete a course approved by the MFSA as well as sit for a mandatory interview with officials of the MFSA.

K. I.T. SYSTEMS & INFRASTRUCTURE

The regulations stipulate that the Issuer needs to have in place the following systems:

- Cyber Security Framework

- Record Keeping Facilities

- I.T. Infrastructure

1. Cyber Security Framework

It is compulsory for the Issuer to have a Cyber Security Framework that complies with internationally recognized cyber security standards and be in line with the General Data Protection Regulations (GDPR).

It shall include as a minimum:

- Information and data security roles and responsibilities;

- Access management policy;

- Sensitive data management policy;

- Threats management policy;

- Business continuity plan;

- Response and recovery plan; and

- Security education and training.

2. Record Keeping Facilities

The Issuer has to maintain documents for a minimum of 5 years and must be made available to the MFSA whenever required. It is important that storage is made in a manner that:

- Allows MFSA to able to access and reconstitute each key stage of the processing of each transaction; and

- It must be possible for any documents and subsequent corrections or other amendments to be easily ascertained;

- It must not be possible for Documents to be manipulated or altered.

3. I.T. Infrastructure

The Issuer shall ascertain that its I.T. infrastructure ensures:

- the integrity and security of any data stored therein;

- availability, traceability and accessibility of data; and

- privacy and confidentiality;

- and is in line with the provisions of the GDPR.

The I.T. infrastructure must be located in Malta, EEA member state or a jurisdiction approved by the MFSA. In case that the I.T. infrastructure is not located in Malta or is located in a cloud environment, the Issuer shall ensure that data is replicated real time by virtue of a live replication server located in Malta.

L. ADVERTISEMENT

If the issuer maintains a website, its homepage shall contain such information and in such a format as may be required by the MFSA by means of duly published Rules.

Any type of advertisement that relates to an initial VFA offering or the admission of a VFA to trading on a DLT exchange, shall satisfy the following:

- Adverts shall be clearly identifiable as such, and must not be inaccurate or misleading.

- Information must be consistent with the contents of the whitepaper.

- Adverts must contain a statement that a whitepaper has been / will be duly published in accordance to the law.

M. ADMISSION TO TRADING ON A VFA EXCHANGE

A person can apply for admission of its VFA to trading on a VFA exchange. This application can only be made through a VFA Agent.

Such an admission has to be made in accordance with the Rules duly published by the MFSA.

However, it is important to keep in mind that the offering of VFAs, or the admission to trading on a DLT exchange, in a country outside Malta shall be subject to the laws of that country.

The following prohibitions apply to acts carried out by any person concerning VFA that are admitted to trading on a VFA exchange:

- Prohibition of insider dealing or recommending or inducing another person to engage in such insider dealing;

- Prohibition of unlawful disclosure of inside information;

- Prohibition of market manipulation.

N. DUTIES OF THE ISSUER

By law, the issuer shall:

- conduct its business with honesty and integrity;

- communicate with his investors in a fair, clear and not misleading manner;

- conduct its business with due skill, care and diligence;

- identify and manage any conflict of interest that may arise;

- have effective arrangements in place for the protection of investors' funds;

- have effective administration arrangements;

- maintain all of its systems and security access protocols to appropriate international standards; and

- be considered as a subject person in terms of the anti-money laundering regulations.

In addition, the issuer shall be liable for damages sustained by a person as a direct consequence of such person having bought Virtual Financial Assets, either as part of an initial VFA offering by such issuer or on a DLT exchange, on the basis of information contained in the whitepaper, website or advertisement by reason of any untrue statement included therein.

The law also specifies that a statement in the whitepaper or advertisement shall be deemed to be untrue if it is misleading, inaccurate or inconsistent, either willfully or in consequence of gross negligence.

O. DUTIES UNDER ANTI-MONEY LAUNDERING LAWS

By law, the issuer shall be considered a Subject Person in terms of the Anti-Money Laundering laws.

In essence, this implies that the issuer has to:

- Have adequate procedures and systems to detect and combat money laundering and financing of international terrorism;

- Appoint a qualified Money Laundering Reporting Officer;

- Perform customer due diligence;

- Monitor transactions;

- Conduct periodical risk assessment on the clients;

- Submit suspicious transaction reports to the relevant authorities.

P. CERTIFICATE OF COMPLIANCE & ANNUAL REPORTS

The issuer shall be required to submit on an annual basis a certificate of compliance to the MFSA which will be drawn up by the Issuer, reviewed by the VFA Agent and signed by all the members of the Issuer's Board of Administration.

The certificate will confirm that the issuer is compliant with all the relevant obligations laid down by law and include the following confirmations by the:

- MLRO that all AML regulations are complied with;

- Systems Auditor that all Innovative Technoolgy Arrangemnets conform to the standards set by the Malta Digitial Innovation Authority;

- VFA Agent that the Issuer is a fit and proper person;

- Board of Administrators that there have been no breaches of the laws.

In addition, the Issuer shall on an annual basis also engage an independent auditor to draw up a report to include:

- Confirmation that the AML systems of the Issuer are in place;

- A review of the operations of the Issuer from an AML perspective.

Q. INVESTOR PROTECTION

One of the MFSA's main policies is to ensure investor protection. In order to further mitigate risks and enhance investor protection, the MFSA is requiring enhanced measures, apart from the requisite of the Custodian. In fact, the laws require the following:

1. Monitoring of Milestones

The law requires the Issuer to provide a detailed description of the past and future milestones and project financing within the whitepaper. It will be the duty of the VFA Agent to ensure that the Issuer has provided investors with a roadmap setting out the milestones for the ICO and to check whether the Issuer is meeting the said milestones. In the event that these milestones are not being met, the VFA Agent would be required to inform the MFSA accordingly.

The MFSA also might require such Issuers to disclose progress, by means of public announcements, on the date set out for each milestone within the roadmap provided to investors, and in case of deviations therefrom, to highlight

such deviations in the said public announcement.

2. Maximum Investment Limit for Retail Customers

In order to limit exposures in case of failure, the Issuer shall ensure that an investor does not invest more than €5,000 in its ICO over a period of 12 months. This limitation is only applicable to retail investors as defined by MiFID.

Retail clients include all clients who are not professional clients or eligible counterparties (such as regulated financial institutions and entities).

R. POWERS OF THE MFSA

The MFSA has broad powers in relation to the issuance of the VFA, including the power to:

- Require the inclusion of any additional information in the whitepaper or advertisements;

- Require the amendment of the whitepaper or advertisements;

- Prohibit or suspend any VFA offerings or trading;

- Publicize any of its findings, measures and sanctions.

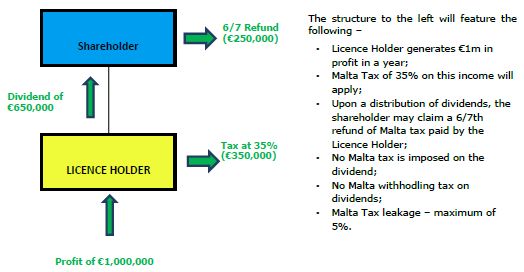

S. CORPORATE TAXATION

As a company resident in Malta, a License holder may also benefit from the advantageous fiscal treatment wherein a shareholder may apply for refunds equivalent to 6/7th of the income tax paid at corporate level, leaving the tax leakage to a maximum of 5% on company profits.

The above is explained in the following basic graphical representation :

T. CONCLUSION

ICOs are an innovative and quick method for companies to raise capital. This new method requires ad hoc regulations, in order to maximize efficiency and investor protection. Via the introduction of the new regulations, Malta has become the first jurisdiction in the world to have specific laws on this, and this will render the island the natural choice of jurisdiction for ICO issuing companies.

One has to always proceed with caution, as there are various laws that might need to be taken into consideration before proceeding with an ICO. Hence, classification of the Token is of paramount importance. Additional legal issues might arise and hence need to be considered if an ICO targets investors globally.

Regardless of the Token structure and its classification, the issuing company needs to provide investors with full, genuine, correct and detailed information and disclose such information comprehensively and transparently to permit an average investor to make a reasonable investment decision.

Non-compliance with any of the above may result in severe legal consequences to the ICO issuer.

To this effect, it is highly advisable that all ICO intended issuers seek proper legal advice and guidance at all stages of an ICO. With such guidance and professional advice, an ICO may become a solid valuable method of financing companies and give a boost to innovative technology and infrastructure.

ANNEX I – FORMAT AND CONTENTS OF WHITEPAPER

The whitepaper shall contain the information which, according to the particular nature of the issuer and of the Virtual Financial Assets (VFA) offered to the public, is necessary to enable investors to make an informed assessment of the prospects of the issuer, the proposed project and of the features of the VFA.

This information must be presented in an easily analyzable and comprehensible form.

It must be drafted in English language and any or no additional languages.

By law, and under penalty of rejection by the MFSA, the whitepaper must contain the following information:

- Date;

- Statement that the whitepaper complies with the requirements of the Maltese law;

- Summary:

- The whitepaper shall contain a summary that in brief and non-technical language shall provide key information in relation to the offering, and essential elements of the VFA concerned in order to aid the investors when considering whether to invest in such VFA;

- The summary shall include a warning

that states that:

- it should be read as an introduction to the whitepaper;

- any decision to invest in the VFA should be based on consideration of the whitepaper as a whole by the investor;

- the offering of VFA does not constitute an offer or solicitation to sell financial instruments and that any such offer or solicitation of financial instruments will be made only by means of a prospectus or other offering documentation in terms of any applicable Maltese law;

- civil liability attaches to those persons who have tabled the summary including any translation thereof and applied for its notification.

- Specific matters to be

included:

- Names, functions and declarations by the persons responsible for the whitepaper that to the best of their knowledge the information contained in the whitepaper is in accordance with the facts and that the whitepaper makes no omission likely to affect its import.

- Offer to the public – the

following information must be included in the whitepaper:

- description of the reason behind the initial VFA offering;

- detailed technical description of the protocol, platform and/or application, as the case may be and the associated benefits;

- detailed description of the sustainability and scalability of the proposed project;

- associated challenges and risks as well as mitigating measures thereof;

- detailed description of the characteristics and functionality of the VFA being offered;

- detailed description of the issuer, VFA agent, development team, advisors and any other service providers that may be deployed for the realisation of the project;

- detailed description of the issuer's wallet/s used;

- description of the security safeguards against cyber threats to the underlying protocol, to any off-chain activities and to any wallets used by the issuer;

- detailed description of the life cycle of the initial VFA offering and the proposed project;

- detailed description of the past and future milestones and project's financing;

- detailed description of the targeted investor base;

- exchange rate of the VFA;

- description of the underlying protocol's interoperability with other protocols;

- description of the manner funds raised through the initial VFA offering will be allocated;

- the amount and purpose of the issue;

- the total number of VFA to be issued and their features;

- the distribution of VFA;

- the consensus algorithm, where applicable;

- incentive mechanism to secure any transactions, transaction and/ or any other applicable fees;

- in the case of a new protocol, the estimated speed of transactions;

- any applicable taxes;

- any set soft cap and hard cap for the offering;

- the period during which the offer is open;

- any person underwriting or guaranteeing the offer;

- any restrictions on the free transferability of the VFA being offered and the DLT exchange/s on which they may be traded, to the extent known by the issuer;

- methods of payment;

- specific notice that investors participating in the initial VFA offering will be able to get their contribution back if the soft cap is not reached at the end of the offering and detailed description of the refund mechanism, including the expected time-line of when such refund will be completed;

- detailed description of the risks associated with the VFA and the investment therein;

- the procedure for the exercise of any right of pre-emption;

- detailed description of the smart contract/s, if any, deployed including inter alia the adopted standards, its/their underlying protocol/s, functionality/ies and associated operational costs;

- if any smart contract/s is/are deployed by the issuer, details of the auditor who performed an audit on it/them;

- description of any restrictions embedded in the smart contract/s deployed, if any, including inter alia any investment and/or geographical restrictions;

- the program agents used to obtain data and verify occurrences from smart contracts (also known as 'oracles') used and detailed description of their characteristics and functionality thereof;

- bonuses applicable to early investors including inter alia discounted purchase price for VFA;

- the period during which voluntary withdrawals are permitted by the smart contract, if any;

- description of the issuer's adopted white-listing and anti-money laundering and counter financing of terrorism procedures in terms of the Prevention of Money Laundering laws and regulations;

- intellectual property rights associated with the offering and protection thereof; and

- the methods and time-limits for delivery of the VFA - Provided that the MFSA shall have the power to waive or modify any of the above requirements within the context of a particular initial VFA offering or a particular application for admission to trading on a DLT exchange, as the case may be.

- Details of the Issuer:

- Name;

- Registered Address and Registration Number;

- Date of Registration;

- The issuer's object/s;

- Where applicable, the group of undertakings to which the issuer belongs;

- Insofar as they are known, indication of the members who directly or indirectly exercise or could exercise a determining role in the issuer's administration;

- Description of the issuer's principal activities including the disclosure of any legal proceedings having an important effect on the issuer's financial position;

- Names, addresses and functions of board of administrators of the issuer;

- Where the issuer has been established for a period exceeding three years, details of its financial track record.

- Third party benefits and

expenses:

- The amount or estimated amount of preliminary expenses and the persons by whom any of those expenses have been paid or are payable, and the amount or estimated amount of the expenses of the issue and the persons by whom any of those expenses have been paid or are payable.

- Any amount or benefit intended to be paid or given to the VFA agent or any person endorsing the offering, and the consideration for the payment or the giving of the benefit.

- Significant new factors, material

mistakes, inaccuracies:

- Every significant new factor, material mistake or inaccuracy relating to the information included in the whitepaper which is capable of affecting the assessment of the VFA and which arises or is noted between the time when the whitepaper is approved and the final closing of the offer to the public, whichever occurs later, shall be mentioned in a supplement appended to the whitepaper. Such a supplement shall be approved in the same way and published in accordance with at least the same arrangements as were applied when the original whitepaper was published. The summary, and any translations thereof, shall also be supplemented, if necessary, to take into account the new information included in the supplement.

- Investors who have already agreed to purchase or subscribe for the VFA before the supplement is published shall have the right to withdraw their acceptance within two working days after the publication of the supplement, provided that the new factor, mistake or inaccuracy referred to in paragraph (a) arose before the final closing of the offer to the public and the delivery of the VFA. That period may be extended by the issuer in which case the smart contract, if any, shall be updated accordingly. The final date of the right of withdrawal shall be stated in the supplement.

- Whenever smart contracts are used,

the Issuer shall ensure that the elements of a whitepaper are coded

within the respective smart contract. This shall, where applicable,

include inter alia coding for:

- Transfer limitations;

- Soft cap and hard cap;

- Refund mechanisms;

- Dispute resolutions;

- Besting schedules; and

- Burning protocols.

ANNEX II – LICENSING FEES PAYABLE TO THE MFSA

The fees payable to the MFSA are as follows:

| DETAIL | APPLICATION FEE | ANNUAL FEE |

| Whitepaper Registration | €8,000 | €2,000 payable upon

submission of the certificate of compliance |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.