As of 2019, specific tax allowances have been set up by the government for hybrid company cars in Luxembourg (on top of allowances relating to fully electric cars). Since last year, such cars have been taxed according to how environmentally friendly they are, instead of according to a flat rate. The government's aim is to incentivize companies to buy eco-friendly automobiles, an initiative that follows similar tax changes on electric cars and bicycles in past years. Read on for more details.

Background: taxes on company vehicles in Luxembourg

Since early last year, all company cars have been liable to two different types of taxes, a registration tax and a vehicle tax. The former, amounting to €50, must be paid on any newly registered car. The latter is calculated by multiplying three elements together: (1) the value of the CO2 emissions in g/km; (2) a value of 0.9 for cars with a diesel engine, or 0.6 for cars with a non-diesel engine; and (3) a value of 0.5 for vehicles whose CO2 is less than 90 g/km, increasing by 0.1 for each additional 10g of CO2.

Here are a few examples:

Allowances for newly registered cars

In order to encourage lower emissions, newly registered hybrid vehicles emitting 50g of CO2 or fewer are eligible for a tax allowance of €2,500 (implemented as of 1 January 2018). To be eligible, hybrid vehicles must be Category M1, i.e. have a maximum of nine seats (driver's seat included). Also, there is a tax allowance of €5,000 for 100% of electric vehicles, introduced in 2017.

Additionally, as of 1 January 2019, new tax allowances have been announced amounting to €500 for motorcycles and €300 for bikes.

Benefit in kind for employees

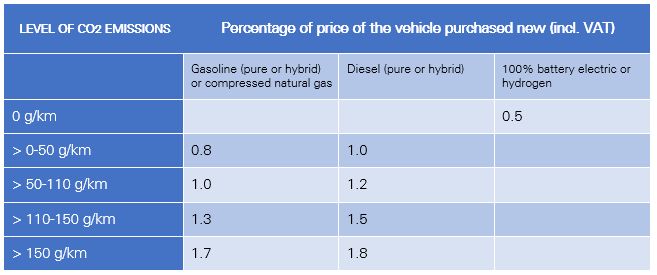

Further to the 2017 tax reform, the benefit in kind for vehicles depends of the type of engine. Indeed, diesel engines are taxed at a higher rate of 0.2% than a petrol engine in the same CO2 category. Electric cars have a tax rate of 0.5% and hybrid cars 0.8%—for these, the benefit in kind varies between 0.5% up to 1.8% of the car's value (VAT included).

All these changes have been summarized in the tables below:

Investment tax credit for vehicles

A notable part of the 2017 tax reform still in effect now is the increase in complementary and global investment tax credits from 12% to 13% (without limitation), and from 7% to 8% up to €50,000 per eligible vehicle as listed below:

- vehicles assigned exclusively to the business of transporting persons or forming part of the net assets of a car rental company

- vehicles assigned exclusively to the transport of goods or merchandise

- vehicles assigned, within an enterprise, exclusively to the transport of employees to or from their place of work, provided that such vehicles are allowed to circulate with a capacity of at least nine occupants (including the driver)

- vehicles specially fitted out exclusively for use as a breakdown/repair service

- self-propelled machinery

The complementary and global investment tax credits shall also be granted for the acquisition (up to an acquisition price of €50,000 for the global tax credit) of certain electric and hydrogen passenger cars in Category M1 whose first registration is made after 31 December 2017 (implemented as of 1 January 2018).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.