Bermuda has long been established as one of the largest and most developed offshore jurisdictions for asset-backed securitisation (ABS) transactions, most notably in the aircraft and aircraft engines sectors, but also significantly in respect of shipping container leases, insurance securitisations through catastrophe bonds or transformation transactions, and other asset classes. Historically, a great deal of aviation- based equity and debt has been raised through Bermuda and we have seen this trend expand in the last decade into a variety of other assets, making Bermuda the automatic choice for ABS deals with an offshore component.

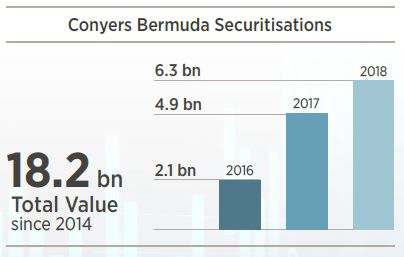

This bulletin features a recap of recent securitisation transactions involving Bermuda companies, as well as describing other market developments which we hope will be of interest to our legal colleagues, clients and Bermuda market followers.

Aviation

Bermuda has been domicile to some of the most significant aircraft ABS transactions of the last decade, including high profile deals such as Elix Aviation Capital's Prop 2017-1 Limited in 2017 and START Ltd in 2018, the first aircraft portfolio purchase vehicle structure to include a dedicated asset manager for equity investors and the first aircraft ABS transaction to use a 144A tradeable E-note. START 2018-1 won ABS Deal of the Year in the Airfinance Journal Awards 2018.

- Acted for the issuers, START II Ltd and START Holding II Ltd, in respect of an asset backed securitisation comprising three tranches of notes secured on a portfolio of 20 in-production aircraft on lease to 13 global airlines in 11 countries, with an appraised value of approximately US$597 million. This ABS transaction marks another aircraft portfolio purchase vehicle structure which includes a dedicated asset manager for equity investors. Conyers also provided Cayman law in respect of the listing of the notes issued by START II Ltd. and the equity certificates issued by START Holding II Ltd on the Cayman Stock Exchange. (Neil Henderson, Director; Angela Atherden, Counsel; Elizabeth Blankendal, Associate; Matthew Stocker, Partner Cayman office)

- Acted for MAPS 2019-1 Limited, in respect of Merx Aviation's latest aviation asset- backed securitisation comprising US$429 million in three tranches of notes secure on a portfolio of 19 aircraft. (Neil Henderson, Director; Angela Atherden, Associate)

- Advised START Ltd. and START Holding Ltd., in respect of an asset backed securitisation comprising three tranches of notes secured on a portfolio of 24 in- production aircraft on lease to 16 global airlines in 15 countries, with an appraised value of approximately US$700 million. START Ltd. is notable as the first aircraft portfolio purchase vehicle structure to include a dedicated asset manager for equity investors. (Neil Henderson, Director; Angela Atherden, Associate; Matthew Stocker, Partner Cayman office)

- Acted for MAPS 2018-1 Limited, in respect of Merx Aviation's inaugural aviation asset backed securitisation comprising of US $506.5 million in three tranches of notes secured on a portfolio of 25 aircraft. The proceeds from the notes were used to refinance the original AABS Limited Asset Backed Secured Term Loan aircraft ABS transaction, which was renamed MAPS 2018-1 Limited. Of the 25 aircraft in this portfolio, 19 were also securitized in the AABS portfolio. (Neil Henderson, Director; Angela Atherden and Edward Rance, Associates)

- Acted for Aircastle Funding (Ireland) DAC, a wholly-owned subsidiary of Aircastle Limited on the admission of its US$1.28 billion unsecured senior A and senior B notes to the official list of the Bermuda Stock Exchange. (Jason Piney, Director; Alexandra Macdonald, Associate)

Shipping & Containers

Bermuda maintains a strong reputation among container lessors as the offshore jurisdiction of choice for securitisation transactions. Bermuda is also a popular domicile for lessor group holding companies and their operating subsidiaries. As such, a large number of both parent companies and subsidiaries of the leading lessor groups are incorporated in the jurisdiction with ABS transactions effected by Bermuda issuers.

- Advised Textainer Group Holdings Limited in connection with the issuance of US$350 million of Fixed Rate Asset Backed Notes by its subsidiary Textainer Marine Containers VII Limited. (Sophia Greaves, Director; Edward Rance and Andrew Barnes, Associates)

- Advised Textainer Group Holdings Limited in connection with an amendment to expand Textainer Limited's revolving credit facility from US$700 million to US$1.5 billion, lower pricing and extend the term for five years. (Sophia Greaves, Director; Edward Rance, Associate)

- Acted for CAL Funding III Limited in respect of an offering consisting of US$331.5 million of 4.34% Series 2018-2 Fixed Rate Asset-Backed Notes, Class A and US$12 million of 5.22% Series 2018-2 Fixed Rate Asset-Backed Notes, Class B. CAL Funding III is an indirect wholly-owned subsidiary of NYSE-listed CAI International, Inc. (Sophia Greaves, Director; Jennifer Panchaud, Associate)

- Acted for CAL Funding III Limited in respect of an offering consisting of US$332 million of 3.96% Series 2018-1 Fixed Rate Asset-Backed Notes, Class A and US$16.9 million of 4.80% Series 2018-1 Fixed Rate Asset-Backed Notes, Class B. (Sophia Greaves, Director; Jennifer Panchaud, Associate)

- Advised Textainer Group Holdings Limited in connection with the issuance of US$300 million of Fixed Rate Asset Backed Notes by its subsidiary Textainer Marine Containers VI Limited. (Sophia Greaves, Director; Edward Rance, Associate)

- Advised Textainer Group Holdings Limited in connection with the issuance of US$500 million of Fixed Rate Asset Backed Notes by its subsidiary Textainer Marine Containers V Limited. This was one of the largest ABS transactions in the history of the intermodal containers leasing industry. (Sophia Greaves, Director; Edward Rance, Associate)

Insurance

Bermuda is the principal offshore jurisdiction for a range of insurance-linked securities issuances, which use a Bermuda special purpose insurer as the issuer. The issuance of catastrophe bonds, sidecars or similar insurance-related bond issuances are particularly common in Bermuda.

- Advised Sanders Re II Ltd. on the establishment of its principal at-risk variable rate note program to provide Allstate Insurance Company and certain affiliates with risk protection for certain named storms, earthquake, severe weather, fire and other perils. Sanders Re II Ltd. first issuance was for US$300 million Series 2019-1 Class B Principal-at-Risk Variable Rate Notes due April 7, 2023. (Charles Collis, Director; Jacqueline King, Associate)

- Advised Home Re 2018-1 Ltd. in connection with the completion of its first securitisation of mortgage insurance portfolio risks. Home Re 2018-1 Ltd. was established to facilitate a program of mortgage insurance linked securities transactions with Mortgage Guaranty Insurance Corporation. It issued a total of US$318.6 million Series 2018-1 Mortgage Insurance-Linked Notes due October 25, 2028. (Charles Collis, Director; Alexandra Macdonald, Associate)

- Advised SD Re Ltd., a California wildfire cat bond, on the launch of its principal at-risk variable note program pursuant to which it issued US$125 million Series 2018-1 Class A Principal At-Risk Variable Rate Notes due October 19, 2021. The issuance provided Sempra Energy with fully collateralised reinsurance protection against covered exposures, with Hannover Re acting as ceding reinsurer to facilitate access to the risk capital. (Charles Collis, Director; Alexandra Macdonald, Associate)

- Advised on FloodSmart Re 2018-1, the first catastrophe bond sponsored by the US Federal Emergency Management Agency (FEMA) to provide reinsurance protection to the National Flood Insurance Program (NFIP). The issuance by FloodSmart Re Ltd, a newly- created Bermuda-based special purpose vehicle, was successfully completed at US$500 million. (Charles Collis, Director; Alexandra Macdonald, Associate)

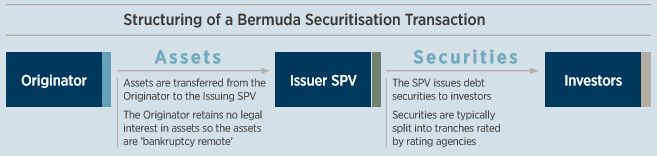

Securitisation and Structured Finance: The Bermuda Model

Although the asset classes are diverse, Bermuda securitisation structures are usually established with similar essential features and for similar reasons. By using a Bermuda SPV, funding and leasing arrangements may obtain certain tax, regulatory and capital restriction relief through a reliable and trusted jurisdiction. As a host jurisdiction for an ABS transaction, Bermuda offers tax neutrality ensuring there are no additional taxes in Bermuda that will impact the transaction. The involvement of a Bermuda SPV can act as a counterbalance to operator jurisdictions where such stability is less evident. Investors, lenders, rating agencies and various service providers are familiar with Bermuda's legal system and have demonstrated a continued commitment to participate in Bermuda structures with limited additional due diligence necessary on their part.

Bermuda securitisation structures accommodate the bankruptcy remoteness, true-sale, non-consolidation, off-balance sheet ownership, credit enhancement and certainty of security interest priority features common to most ABS transactions. However, there are additional benefits Bermuda confers. In lease transactions, Bermuda law provides extral comfort to the lessees because, unlike the laws of many jurisdictions which empower liquidators or their equivalent to disclaim unilaterally onerous property (such as a lease), Bermuda law only allows such a disclaimer with the leave of the Bermuda Supreme Court. This allows any interested party leasing the asset the ability to be heard before such a step is taken.

Many ABS transactions involve an SPV that is directly owned by a parent, but often a transaction will require an "orphan" SPV, meaning that it is not part of the originator's corporate group. By selling the asset to the orphan SPV, the asset is removed from the originator's balance sheet. When an orphan structure is established in Bermuda, the SPV is incorporated with all the shares issued to a trustee (also offshore) pursuant to a purpose trust. A Bermuda purpose trust is of particular benefit in an ABS transaction, structured in this manner, as the purposes of the trust and the duties of the trustees can be clearly linked to the contemplated transactions. In other jurisdictions a charitable trust is usually established where the duties of the trustees of the charitable trust are to maximise the benefits for the charity or charitable purposes and, depending on the circumstances, a conflict of interest may arise. Additionally, a charitable trust created primarily to facilitate a particular structure or transaction, so that the benefits to the charity are not maximised, may be exposed to a substance over form argument that the trustees are really acting in the interests and for the benefit of those who actually benefit from the structure rather than the stated beneficiaries.

Until 2018 the sale of equity notes/E-notes in aviation ABS transactions has involved large investments that trade under strict confidentiality agreements. For securitisation structures to be more attractive, the markets want them to be executed quickly and enable access to more liquid institutional investment on the equity side. To achieve this, recent ABS transactions have started to employ liquid/tradeable E-notes. These have taken the form of Reg S/144A securities which are able to trade in smaller minimum investment sizes, with dealers able to make two-way markets and provide monthly marks. Put simply, tradeable E-notes are intended to create investment opportunities in the aviation market comparable with the way other structured products work, such as the collateralised loan obligation (CLO) market.

Bermuda Stock Exchange

Bermuda has seen a steady acceleration in the number of new international debt listings, both through ABS and intercompany loan note transactions listing on the Bermuda Stock Exchange (BSX), a member of the World Federation of Exchanges, with aircraft operating lessors and other issuers keen to take advantage of the BSX's favourable disclosure requirements and listing fee structure. The BSX is not bound by or subject to any European Union directives or regulations, including the EU Market Abuse Regime.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.