Introduction

The concept of damages due to misstatement has long been unfamiliar to Japanese investors. Civil liability related to disclosure was addressed in the former Securities and Exchange Law (SEL), but, in the case of disclosure in the secondary market, the burden of proof for damages was borne by the plaintiff. This made it difficult for investors to file suit. The absence of the class action system also constrained securities litigation.

However, according to our analysis of Japanese securities cases over the past decade, litigation claiming damages due to misstatement has been on the rise. The turning point has been the revision of the former SEL in 2004, which included a provision for estimating damages related to ongoing disclosure. This provision allows for an estimation of the amount of damages as the difference of average stock prices during one month before and one month after the corrective disclosure date. The provision was introduced in order to lessen the plaintiff's burden of proving damages.1,2 In addition, the Internal Control Report became effective for fiscal years beginning 1 April 2008, and misstatements in Internal Control Reports have become subject to civil liability under the Financial Instruments and Exchange Act (FIEA).

The activities and scope of operations of Japan's Securities and Exchange Surveillance Commission (SESC) have been strengthened and expanded, which has also affected the trend in securities litigation. The FIEA prescribes that "when ... the document contains any misstatement or lacks a statement on important matters that should be stated or on a material fact that is necessary for avoiding misunderstanding," the person who submitted the document shall be held liable for damages. When a misstatement becomes evident from administrative actions including investigations and inspections by the SESC that result in orders to pay penalties, such actions will facilitate the plaintiff's ability to file a civil procedure for the alleged misstatement under the FIEA. The burden of proving a fact of misstatement has therefore decreased from what it was in the past.

The introduction of new accounting standards, more rigorous audits, and disclosure of quarterly reports has added disclosure responsibilities and burdens to companies, thereby increasing the risk that companies may make misstatements and face suits by investors over those misstatements. In 2003, there was only one case in which the Tokyo Stock Exchange (TSE) requested that a listed company submit a report describing remedial actions for failing timely disclosure, but the number of such cases has significantly increased to 11 cases in 2006 and 15 in 2007.3

The change in the disclosure environment has increased the number of stockholders who are filing suit against companies such as Seibu Railway, Livedoor, and IHI for misstatements. However, given that the differences between the legal environment in the US and Japan—the absence of class actions, fewer attorneys, and other social factors—will remain, it is unlikely that the number of Japanese securities litigation cases will approach that of the US, where more than 200 cases are filed annually. Securities litigation in Japan is expected to increase gradually rather than abruptly.

In addition to litigation over misstatements, disputes between financial institutions, including securities companies and their customer investors (known as "broker-dealer" litigation), comprise an important portion of securities litigation in Japan. In the 1990s, when the securities market was in a slump after the end of the bubble economy, illegal acts by securities companies—including compensation of losses and "off-balancing" transactions, in which a customer's securities with unrealized loss are temporarily transferred to another customer at prices higher than market prices (usually with a repurchase condition) by the securities company's brokerage—drove most securities litigation at that time. More recent broker-dealer litigation consists mainly of cases related to foreign exchange margin trading and unlisted stock trading.

Trends In Securities Litigation

NERA has analyzed the statistical trends in securities litigation under the former SEL and the current FIEA. Unlike the US, where litigation statistics are available based on filings,4 such information is unavailable in Japan. Additionally, we have observed that most securities litigation in the US settles prior to judgment, but in Japan there are few such settlements since a majority of securities cases result in a judgment at trial. Therefore the data analyzed in this report are based on judged cases at courts in Japan, and are collected from databases of judged cases or precedents and newspaper articles.5 More specifically, a search for securities litigation defined as criminal procedures and civil liability for damages related to violation of the FIEA or the SEL from 1998 to 2008 has yielded 249 judgment cases. Classification of these cases by year and type is shown in Figure 1.

Figure 1. Civil And Criminal Judgment Cases By Year And Type

We have categorized the cases into "misstatements," for cases related to misstatements in the primary market and secondary market; "market manipulation" for artificially raising stock prices by placing large orders or wash trading; "spreading rumors on stock markets" as spreading rumors or using fraudulent means to drive the securities prices; "insider trading" by obtaining fraudulent profit from undisclosed information; and "broker-dealer" litigation that represents disputes over violations of code of conduct between financial institutions and customers. The broker-dealer litigation category includes cases alleging violation of obligation of explanation, violation of principle of suitability, and guarantee for losses by financial institutions. This category also includes cases with allegations of "unlisted stock" misconduct such as conveying false information by non-registered financial institutions, alleged to have solicited in a way that suggests that the unlisted issuer will go public shortly.

Figure 1 shows that broker-dealer litigation comprises the majority of cases over the past 10 years. As we discuss later, litigation over "off-balancing" transactions and compensation of loss account for a significant portion of cases from 1998 to 2001. In more recent years, we observe an increase in cases related to foreign exchange margin trading and unlisted stock trading. Beginning in the second half of 2000, there is a steady increase in litigation claiming damages caused by misstatements, which by 2008 account for half of all judgment cases.

Litigation Over Misstatements

As Figure 1 illustrates, cases related to misstatements have increased significantly since 2005. The increase is due to rulings in several big litigations, which were divided into several cases by groups of plaintiffs. Since Japan has not adopted the class action system, each filing made by a plaintiff (or a group of plaintiffs) is counted separately as a different case even if the conditions of alleged damages are very similar. Since 2007, district court decisions and higher court decisions were made for cases involving Livedoor and Seibu Railway. There have been 11 civil cases filed against Seibu Railway, and four against Livedoor.

It is worth noting that litigation for damages against audit firms that allegedly failed to detect misstatements has been on the rise since 2006. Although there were only two rulings in civil and criminal cases involving audit firms as "gatekeepers" of the disclosure system from 1998 through 2005, there were five such cases in 2006 alone, two more in 2007, and an additional three in 2008. For example, the audit firm Tohmatsu was partially held liable for damages related to a misstatement by Nanaboshi, a bankrupted construction company of power generation systems. Nanaboshi's trustee claimed damages of 1,019 million yen against Tohmatsu, and the Osaka District Court found that Tohmatsu had been negligent and ordered the firm to pay 17 million yen.6

It is important to note the types of plaintiffs in recent cases. With the increased responsibility of trustees from managed funds, institutional investors including pension funds and trust banks are the main plaintiffs in cases against Livedoor and Seibu Railway. Another recent development is that, while there is no class action system in Japan, attorneys on the plaintiff's side have started forming large plaintiff groups comprising individual investors to file for damages. For example, one of the plaintiff groups in the Livedoor case consists of about 3,300 individual investors. Similar large-sized plaintiff groups have formed in other securities litigation cases.

Broker-Dealer Litigation

According to Figure 1, the majority of rulings for securities litigations were broker-dealer disputes, but the reasons for these cases being brought have evolved over the last decade.

From the end of 1990s to the early 2000s, most broker-dealer cases were brought due to issues of loss compensation and "off-balancing" transactions. Starting with the bankruptcy of Yamaichi Securities, compensation of losses, "off-balancing" trading, and other historically unfair acts committed by securities firms began to come to light and, as a result, litigation relating to these practices increased.7 For example, Yamaichi Securities was ultimately found liable8 in a litigation regarding an agreement over compensation of losses it offered to a subsidiary of a construction company. In another case, Yamatane Securities was found liable for damages due to the "off-balancing" transaction it conducted.9

As new financial products are introduced and become accessible to investors, there has been a tendency for disputes to arise from violations of the principle of suitability and of the failure to fulfill the obligation of providing an explanation of risk between sellers of financial products and investors.

For example, since 2003, we have observed the emergence of cases related to foreign exchange margin trading, involving an alleged violation of the principle of suitability and obligation to provide an explanation of transactional risk. In foreign exchange margin trading, the foreign exchange is traded by settling the margins with the accounts held at the brokerage company. Following the enactment of the revised Foreign Exchange and Foreign Trade Act (FEFT) in April 1998, many companies have entered the foreign exchange margin trading business. Extensive advertisements by brokerage companies and the ability to make relatively simple transactions online have drawn the interest of many individual investors, but the transactions can be highly leveraged and risk management becomes very important.

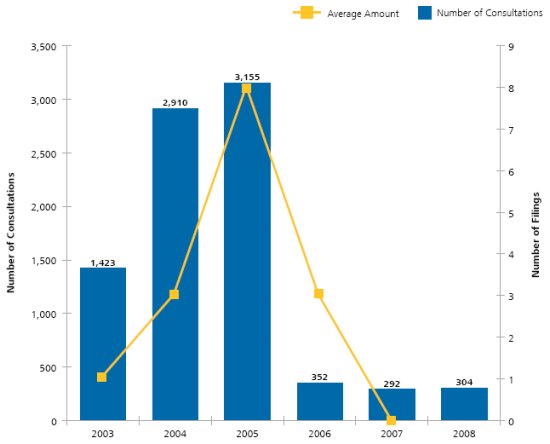

The participation of individual investors in foreign exchange margin trading has led to an increase in disputes between the dealing company and the investor related to inappropriate solicitation or insufficient explanation of transactional risk. According to the National Consumer Affairs Center of Japan (NCAC), which handles consumer problems, there were only four consultations in 2000 related to foreign exchange margin trading. However, by 2005 the number of consultations substantially increased to 3,155. As a result, litigation over alleged violations of the obligation to provide an explanation of risk also increased between 2003 and 2005, and there were eight such cases in 2005. In July 2005, a revised Financial Futures Trading Act (FFTA), which regulates companies dealing with foreign exchange margin trading, was enacted and unlawful solicitations have since decreased. Accordingly, the number of consultations to the NCAC in 2006 decreased as well.

Figure 2. Number Of Consultations And Filings Related To Foreign Exchange Margin Trading10

Cases related to unlisted stocks are another reason for the recent increase in broker-dealer disputes. Of the 33 court judgments in broker-dealer cases in 2007, eight were related to unlisted stock trading. Litigation involving an unlisted stock is typically related to the sale or marketing of unlisted stocks by companies not registered with the Japan Securities Dealers Association (JSDA). Customers, who were told by these unregistered companies that an issuer will go public shortly and that the issuer's stock price will increase, conclude the transaction contract, only to discover later that the issuer actually has no intention of going public. Most of the litigation involves customers filing against such companies for damages related to purchasing unlisted stock.

For example, in a case against Nikko Gulanndam, the Tokyo District Court ruled11 that the justifiable price of the unlisted stock at the time of the transaction had been much lower than the amount of proceeds, and that the price was fraudulently set to mislead the customer into believing it was justifiable.

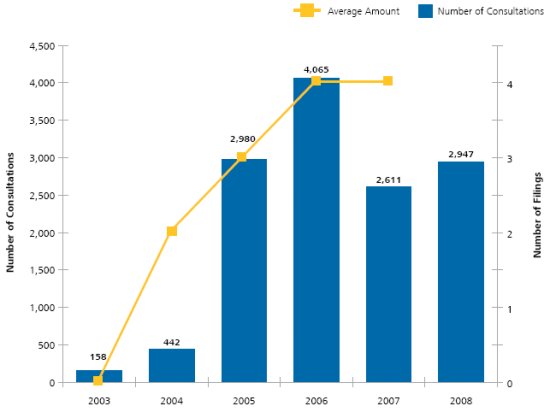

Consultations to the NCAC related to unlisted stock trading have substantially increased since 2004, due to the rising trend in stock prices, the increased number of individual investors, and the boom in IPOs.12 Figure 3 illustrates the number of NCAC consultations and the number of filings related to unlisted stock trading. Since 2004, consultations related to unlisted stock trading have increased in line with the total number of filings.

Figure 3. Number Of Consultations And Filings Related To Unlisted Stock Trading13

Trends By Industry

Figure 4 allocates the number of cases by industry for defendants in civil and criminal securities litigation cases.14 Since broker-dealer litigation almost always involves the financial industry, it accounts for 73% of the cases, by far the majority of securities litigation in Japan. The information, communications, and services industries accounted for 7% of the cases, the majority of which are related to Livedoor. Other industry litigation includes cosmetic accounting cases for Medialynks and Associant Technology. Cases against audit firms account for an important slice of the litigations over misstatements, and comprise 5% of the total.

Figure 4. Civil And Criminal Judgment Cases By Defendants' Industry, 1998-2008

Figure 5. Total And Annual Average Judgment Amounts Of Civil Procedures (Million Yen)

Trends In Damages Amounts

This section examines the trends in damages amounts. Figure 5 shows the total and annual average amount of damages in civil proceedings from 1998 to 2008, using the securities litigation cases shown in Figure 1. While it may be difficult to fully understand the annual trend because of the limited number of historical cases, some characteristics can be observed during this period.

The amounts in 1998, 1999, and 2001 were higher than in other years because of increased litigation over compensation of loss, "off-balancing" transactions, and other illegal practices by securities firms that were revealed after the bankruptcy of Yamaichi Securities. These cases include a 2.3 billion yen damages award in the Yamatane Securities case by the Tokyo High Court in April 1998. No major broker-dealer litigation has been observed since 2002, and the annual average judged damages amount is below 35 million yen.

Increased litigation over misstatements since 2007 has impacted the recent trend in aggregate damages. For 2008, in one of the Livedoor cases the court awarded damages of 9.5 billion yen to the plaintiff institutional investors, significantly raising the total and average damages amount for the year. The average amount of 450 million yen during the same year, however, is still only one-seventh of the average settlement amount in the US, which was $32 million during the first half of 2008.

Figure 6. Distribution For Percentage Of Judged Damages To Claimed Damages Of Civil Procedure By Type (1998-2008)*

Claimed Amount And Judged Amount

When no damages are awarded, the ratio of judged damages to claimed damages amount is 0%; as Figure 6 illustrates, no damages were awarded in 70 of the 193 cases between 1998 and 2008, or 36% of the total. In 35% of the total cases, the damage of more than half of the claimed amount was awarded, and in 14% or 27 of the total cases, the plaintiff was fully awarded with the claimed amount. Looking at the breakdown in Figure 6 by type of case, litigation over misstatements has a very high percentage of instances with no award (16 of the 25 cases, or 64%), while 34% of broker-dealer litigation had no award (54 of 161 cases).

In litigation over misstatements, 16 cases had no damages award. Of that number, eight cases had audit firms as defendants, and four were related to litigation involving Seibu Railway. The defendant audit firm was not held liable for damages in these eight decisions, mainly because materiality in the disclosure documents was dismissed,15 or because there was judged to be no violation of the duty of due care of a prudent manager.16 However, there are also resolved cases in litigation with positive damages against audit firms. For example, Tohmatsu was charged with 17 million yen in damages by the Osaka District Court for misstatements of Nanaboshi on 18 April 2008. Ultimately, after recommendations by the Osaka High Court, Tohmatsu settled in December 2008 by paying a much higher total of 40 million yen, more than twice the amount in the Osaka District Court's order.

Excluding litigation against audit firms, 44% of cases alleging misstatements had damages awards that were more than half of the claimed amount, and the average judged amount for these cases is 1.5 billion yen. Taking into account the award of substantial damages in some of the Seibu Railway cases and the Livedoor cases in 2009, the high level of average damages is expected to continue for this year.

For broker-dealer litigation, there are many cases related to the violation of obligation to provide sufficient explanation where damages have been awarded. Until 2002, many of the securities litigation judgments were related to insufficient explanation of the risk or nature of the product for transactions involving warrants, options, and investment trusts. However, since 2003 judgments related to transactions involving foreign bonds and exchangeable bonds (EBs),17 and the foreign exchange margin trading and unlisted stock trading, have increased. During the litigation process the plaintiff investors are thoroughly scrutinized, including their investment experience, knowledge of securities transactions, investment objective, and financial situation. The defendant's explanation, including terms and conditions of the transaction contract, commissions, and risks, is similarly examined. In 34% of all broker-dealer cases in the last decade, courts have dismissed the allegations of the plaintiff.

Conclusion

Our research indicates that the 2004 reform of the Securities and Exchange Law was successful in increasing the number of litigations claiming damages due to misstatement. In addition to the SEL reform, which allows damages to be estimated under a reduced burden of proof for plaintiffs, more powerful enforcement by the SESC and increased responsibility and burden for disclosure by issuers have contributed to the increasing number of misstatement cases. It is difficult to predict future trends since the majority of recent misstatement cases are related to big cases like Livedoor and Seibu. Nevertheless, given the changes in disclosure and the current litigation environment, securities litigation in Japan is expected to gradually increase in the coming months and years. However, in the longer term, as long as several fundamental differences between the US and Japan (e.g., the absence of class actions, fewer attorneys, and other social factors) remain, it is unlikely that the number of securities litigation cases in Japan will be comparable to the US.

Footnotes

1. The proof requirement that the plaintiff purchased the securities bases on the misstated information (reliability requirement) is not provided in the FIEA, and as yet no legal judgment has been made relating to this requirement.

2. Kuronuma, Etsuro, "Revision for provision of civil liability in the Securities and Exchange Law," Shoujihoumu No. 1708, 15 September 2004.

3. The TSE website.

4. See NERA Economic Consulting,"2008 Trends in Securities Class Actions," December 2008.

5. WestLaw Japan was used for the database of judgment cases. The search criteria were from 1 January 1998 through 31 December 2008 and using "Financial Instruments and Exchange Act" or "Securities and Exchange Law" and "violation" as keywords. No settlement cases are included in this database. Of the searched cases, (i) those related to the Patent Act, Copyright Act, Labor Standards Act, or Taxation; (ii) court decisions on M&A; and (iii) violation of duty of due care of a prudent manager by the board members have been excluded. Note that the cases related to misstatements and breach of audit agreements are included even if they are not alleged based on the FIEA. The number of cases is based on judgment, and the district court decision and the upper court decision of the same case are counted separately. Judgment cases not included in the database but found in newspaper articles have been included, but the authors do not guarantee that the cases covered in this report are exhaustive.

6. Osaka District Court, decision of 18 April 2008 (2004 (Wa) No. 4762): Litigation against Tohmatsu over misstatements of Nanaboshi. Tohmatsu settled in December 2008 in the Osaka High Court by paying 40 million yen, an amount higher than the Osaka District Court's judgment (The Sankei Shimbun, Osaka headquarters edition, 6 December 2008).

7. SESC, Annual Report for fiscal year 2007.

8. Tokyo District Court, decision of 20 June 2001 (1998(Wa)No. 9099).

9. Tokyo High Court, decision of 27 April 1998 (1994(Ne)No. 5404).

10. For the data related to foreign exchange margin trading, the number of consultations is from the NCAC database publicized on 15 May 2009, and the number of filings is counted based on the ruled cases as shown in Figure 1.

11. Tokyo District Court, decision of 30 November 2007 (2007(Wa)No. 7515).

12. "Many problems related to unlisted stocks, damages amount has increased rapidly from 2004, substantial impact from the boom in IPO," The Japan Financial News Co. Ltd. 9 September 2005. Factors other than the IPO boom include former companies dealing with foreign exchange margin trading moving to unlisted stock trading, after exiting the foreign exchange margin trading with the revised FFT, which regulates the level of capital.

13. Data on the number of consultations for unlisted stocks is from the NCAC database publicized on 15 May 2009, and the number of filings is counted based on the ruled cases shown in Figure 1.

14. The industry classification in Figure 6 is based on the TOPIX-17 series of the TSE, which collects 17 industries from the 33 industries established by the Securities Identification Code Committee, except for the audit firm that is not covered by the TOPIX-17.

15. Osaka District Court, decision of 13 April 2007 (1999 (Wa) No. 12705, 2000 (Wa) No. 994).

16. Tokyo District Court, decision of 31 July 2008 (2005 (Wa) No. 19120).

17. Bonds with redemption clause by equity of a specified name instead of by cash at the pre-specified time if the specified conditions are met.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.