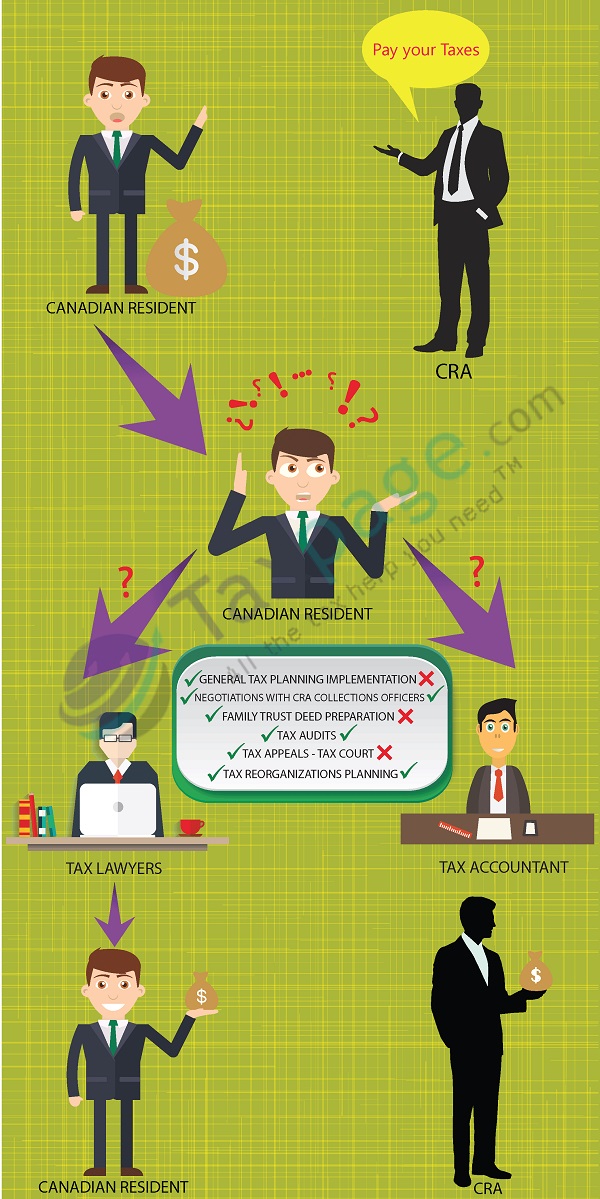

DIFFERENCES BETWEEN TAX LAWYERS AND ACCOUNTANTS

| CATEGORY | TAX LAWYERS | ACCOUNTANTS |

|---|---|---|

| GENERAL TAX PLANNING | ✓ | TAX ACCOUNTANTS ONLY |

| GENERAL TAX PLANNING IMPLEMENTATION | ✓ | x |

| TAX REORGANIZATIONS - PLANNING | YES | TAX ACCOUNTANTS ONLY |

| TAX REORGANIZATIONS - IMPLEMENTATION | YES | NO |

| TAX REORGANIZATIONS - FORMS | x | ✓ |

| ESTATE PLANNING | ✓ | ✓ |

| WILL DRAFTING | ✓ | x |

| ESTATE RETURN PREPARATION | x | ✓ |

| TAX RETURN PREPARATION | x | ✓ |

| FINANCIAL STATEMENT PREPARATION | x | ✓ |

| TAX AUDITS | ✓ | ✓ |

| TAX APPEALS - NOTICES OF OBJECTION | ✓ | ✓ |

| TAX APPEALS - TAX COURT | ✓ | x |

| NEGOTIATIONS WITH CRA COLLECTIONS OFFICERS | ✓ | ✓ |

| TAXPAYER RELIEF (FAIRNESS) APPLICATIONS | ✓ | TAX ACCOUNTANTS ONLY |

| VOLUNTARY DISCLOSURE (TAX AMNESTY APPLICATION) | ✓ | SOME ACCOUNTANTS WILL SUBMIT, BUT NO PRIVILEGE IF THEY DO |

| BUSINESS PLANS | x | ✓ |

| LOAN APPLICATIONS | x | ✓ |

| BUY VS LEASE CALCULATIONS | x | ✓ |

| FAMILY TRUST DEED PREPARATION | ✓ | x |

| TRUST T3 TAX RETURNS | x | ✓ |

| TAX RESEARCH | ✓ | TAX ACCOUNTANTS ONLY |

| TAX OPINION LETTERS | ✓ | TAX ACCOUNTANTS ONLY |

| TAX OPINIONS FOR OFFERING MEMORANDUM OR PROSPECTUS | ✓ | x |

| CALCULATION OF POTENTIAL TAX LIABILITY | x | ✓ |