Ireland and Luxembourg have long been the preferred jurisdictions in which to establish a fund in Europe, and the prevalence of funds established in Ireland and Luxembourg make them important jurisdictions for lenders to understand. The ever-increasing use of Ireland and Luxembourg funds for private equity structures and the long track record in both jurisdictions, combined with the impact of Brexit mean that the importance of Irish and Luxembourg funds is likely to further increase, both for capital call/subscription line facilities and net asset value ("NAV")/asset-backed facilities. Each jurisdiction offers managers access to the EU-wide marketing passport for Undertakings for the Collective Investment in Transferable Securities ("UCITS") and alternative investment funds ("AIFs"). The use of Irish and Luxembourg structures has continued unabated throughout the COVID-19 pandemic.

This chapter addresses, on a comparative basis, a number of key legal and practice issues that should be considered when an Irish or Luxembourg fund is a borrower (or other obligor) in a fund finance structure. Although Ireland and Luxembourg have different legal systems (Ireland is common law; Luxembourg is civil law), as each is an EU Member State, they share much in common when it comes to fund finance. Both jurisdictions facilitate credit lines to investment funds in a manner that allows flexibility to borrowers, and certainty and robust security to lenders. In each jurisdiction, the following EU legislation play an important part in fund finance structures: the Alternative Investment Fund Managers Directive (Directive 2011/61/EU) ("AIFMD"); and the EU Directive on financial collateral arrangements (Directive 2002/47/EC) (the "Collateral Directive").

Legal entity types and introduction to regulatory framework

Common considerations

Each of Ireland and Luxembourg have a number of different legal entity structures: corporate; partnership; contractual; and, in the case of Ireland, trusts. Umbrella funds with segregated liability between sub-funds/compartments are a feature of each jurisdiction. In each jurisdiction, a sub-fund may, as an economic matter, be analysed as a separate entity. Both Irish and Luxembourg sub-funds benefit from legislative ring-fencing, and each jurisdiction allows a sub-fund to be wound-up and liquidated, leaving the remainder of the umbrella structure intact. However, and importantly, a sub-fund of an Irish/Luxembourg fund does not have separate legal personality. Accordingly, care needs to be taken, in drafting the parties clauses, granting clauses and execution blocks, that the appropriate legal entity is expressed to be the party (with further care taken where, as is common, an investment manager is entering into the financing as agent of the fund).

Ireland

Irish structures can be broadly divided into regulated and unregulated structures. Regulated structures are regulated by the Central Bank of Ireland ("CBI") under the Irish law implementation of the UCITS Directives or, much more commonly for fund finance, the AIFMD – as considered in detail further below). The main types of regulated fund structures in Ireland are: (i) variable capital investment companies; (ii) Irish collective asset-management vehicles ("ICAVs"); (iii) unit trusts; (iv) common contractual funds ("CCFs"); and (v) investment limited partnerships ("ILPs"). Each of these entity types (other than ILPs) may be established as AIFs or UCITS. ILPs are AIFs, only. The limited partnership (under the Limited Partnership Act 1907) is the most favoured structure for unregulated investment funds in Ireland.

At present, the ICAV (a corporate entity which can elect to be fiscally transparent for US federal tax purposes) is the most common Irish structure encountered in funds finance. ICAVs may be UCITS or under AIFMD. In fund finance, they will invariably be under AIFMD. Changes to the ILP legislation are expected to mean ILPs, once the legislation takes effect, will become more commonly used and more frequently seen in fund finance.

Luxembourg

Luxembourg offers a wide range of vehicles which may suit various needs and expectations that fund initiators may have. Luxembourg funds may either be regulated or non-regulated vehicles, with or without a legal and/or tax personality, with the possibility of using an important number of corporate entities, to which a regulatory framework may be added.

There are various structuring options, particularly in an AIFMD context. The fund-specific legislation is rich and mainly composed of the following: the Luxembourg law of 12 July 2013, as amended, on alternative investment fund managers ("Luxembourg AIFM Act"), implementing AIFMD, as well as the law of 15 June 2004, as amended, on risk capital investment companies ("SICARs"); the law of 13 February 2007, as amended, on specialised investment funds ("SIFs"); the law of 23 July 2016 on reserved alternative investment funds ("RAIFs"); and the law of 17 December 2010, as amended, on undertakings for collective investment ("UCIs", which are covered by the Luxembourg AIFM Act and UCITS). RAIFs bearing the corporate form of a special limited partnership ("SCSp") have recently been extremely successful given the important flexibility that they offer (most aspects may be contractually agreed).

AIFMD and other regulatory considerations

AIFMD

Regulatory considerations deserve close attention as part of the due diligence on a fund finance deal. Non-compliance with the regulatory requirements by a fund adversely impacts the financing transaction. Although Irish and Luxembourg funds may also be UCITS, in fund finance structures, lenders will typically encounter only AIFs, so the AIFMD considerations should be noted in financings involving Irish or Luxembourg funds.

Under AIFMD, the relevant fund (Irish or Luxembourg) will have appointed to it an alternative investment fund manager ("AIFM"). The AIFM is responsible for the risk management and portfolio management functions of the fund, and will typically delegate (under an investment management agreement) the portfolio management function to an investment manager (as agent of the AIFM). This chain of delegated authority, and in particular, the terms of the investment management agreement, should be verified as part of the diligence process. AIFMs are typically required to be regulated by their home member regulator (CBI, in the case of Ireland; the Commission de Surveillance du Secteur Financier ("CSSF"), in the case of Luxembourg).

Another key requirement of, and actor in, the AIFMD structure is the depositary – which must be a separate entity to the AIFM and will have its registered office or a branch in the AIF's home member state (Ireland or Luxembourg). The depositary is responsible for the safekeeping of the fund's assets. The depositary is also generally liable for the failure of its delegates.

Another key actor is the administrator. The administrator plays an important role in processing subscriptions, and recording and registering subscriptions. In addition, the administrator performs the role of calculating the NAV of the fund and its units/shares.

Other EU regulatory regimes may require close attention when dealing with an Irish or Luxembourg fund. Where derivatives are used at the fund level, the European Market Infrastructure Regulation (Regulation (EU) No 648/2012, known as "EMIR") will apply (and, as an EU Regulation, its terms should not vary between Ireland and Luxembourg). EMIR is, insofar as derivatives are concerned, broadly the EU equivalent of the relevant aspects of the Dodd-Frank Act in the US.

Where the transfer to the lenders of personal data relating to natural persons is involved (for example, in the case of a subscription line involving investors who are high-net-worth individuals), the General Data Protection Regulation (Regulation (EU) No 2016/679, known as "GDPR") may be relevant. This privacy law is an EU Regulation that should apply equally as between Ireland and Luxembourg.

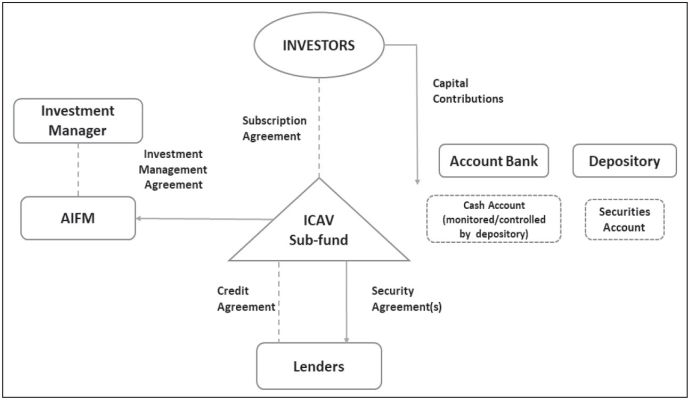

Ireland

A typical Irish fund structure is set out below in simplified form (Fig. 1) and illustrates the AIFMD architecture. In fund finance, lenders dealing with Irish funds will typically encounter qualifying investor alternative investment funds ("QIAIFs"), whose corporate structure will most commonly be an ICAV. A QIAIF is marketed to professional investors only. It is not subject to any investment or borrowing limit. In Ireland, the AIFM may be an external manager of the AIF or, in the case of an ICAV or investment company, the fund itself.

Luxembourg

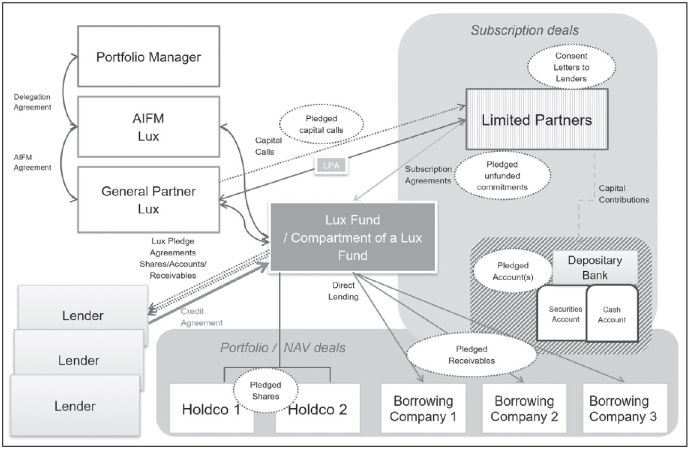

The Luxembourg financial supervisory authority, CSSF, has not specifically addressed fund finance activities. Nevertheless, fund finance is considered as being covered by the general regulatory framework applicable to a fund entering into a financing and to its manager, and in particular, the guidelines on portfolio management. A typical Luxembourg fund structure is set out below (Fig. 2). As with Fig. 1 (for Ireland), the AIFMD "actors" are the same – AIFM and depositary.

Fig. 1 – Ireland

Fig. 2 – Luxembourg

Diligence

Common considerations

In any lending structure, it is essential that appropriate due diligence is undertaken in good time. As in any jurisdiction, the usual issues of capacity and authority need to be examined at an early stage so that any issues may be identified and addressed early in the transaction. The AIFMD aspects introduce additional diligence requirements (for example, on the AIFM (or its delegates) and the regulatory authority of the fund), all of which underline that in the case of Irish or Luxembourg funds, early engagement on diligence is recommended. In the case of both Irish and Luxembourg funds, typically there are no leverage limits imposed, but this needs to be verified by reference to the nature of the fund and any self-imposed leverage restrictions.

In addition, the AIFMD, adopted in the wake of the financial crisis and the Madoff scandal, has put increased liability on the depositary, who holds a duty to monitor and reconcile the fund's cash flows and supervise its assets, and a prevention and detection role (the scope of obligations may vary depending on the type of fund used but, in general, the foregoing applies to all funds that are subject to the AIFMD).

Any action that might affect the fund's assets requires the approval of the depositary. Hence, a smooth enforcement of the pledge requires that the depositary be informed beforehand of the existence of the pledge and acceptance by the depositary of its terms (it might even be a party to the pledge agreement). Contractual arrangements would normally be included to ensure a periodic valuation of and reporting on the pledged portfolio, with the consent and contribution of the depositary. Moreover, the depositary arrangements commonly provide for a pledge over all or part of the fund's assets in favour of the depositary. Any security to be granted over such assets will need to take into account the existing pledge in favour of the depositary, either by releasing such pledge or by creating a higher-ranking pledge in favour of the lenders.

Ireland

The establishment documents of the fund should be carefully reviewed. Subject to any self-imposed leverage limit (for which the prospectus should be reviewed), the fund can be expected to have broad powers, in its establishment documents, to borrow and create security. It is particularly important, in a subscription line facility, to determine that the power to create security extends to security over the fund's uncalled capital commitments.

In a subscription line facility, plainly the agreement between the fund and investor in relation to the subscription is a key document. Typically, this document is set out in a subscription agreement. It is important to determine in the subscription process: (i) who can make calls on investors; (ii) who determines the price at which units or shares are issued and by what means; (iii) when capital calls can be made on investors; (iv) what an investor can be asked to fund; (v) the implications of an investor not funding a capital call; and (vi) to what account subscription proceeds are paid.

Finally, as the management function of the fund is vested in the AIFM (or an investment manager as its delegate), the correct authorisation of, and approval of the transaction by, the AIFM (or the investment manager) should be appropriately addressed.

Luxembourg

The fund's organisational documents (limited partnership agreement, subscription agreement, articles of association, AIFM and/or portfolio management agreements, depositary agreement, etc.) set the rules governing commitments and any limits on the involvement of each of the fund parties.

It is important to make sure from the outset that there are no contradictions between the facility agreement and the organisational documents. In the context of the Luxembourg AIFM Act, for instance, the AIFM bears the regulatory responsibility as part of its portfolio management responsibilities; consequently, the financing transaction must be approved by the AIFM and, if applicable, the party to which the AIFM has delegated the portfolio management function.

In the last few years, it has become increasingly accepted to have specific provisions on fund financing included in the fund's organisational documents. This is particularly helpful in the context of subscription facilities, for which – as stated earlier – provisions on capital calls, disclosures, escrows, clawbacks and certain waivers are included.

Most Luxembourg AIFs (within the meaning of the Luxembourg AIFM Act) are not subject to statutory limitations on leverage, although there may be some limitations – resulting mainly from the fund's organisational documents. A Luxembourg AIF is required to conduct a self-assessment of its leverage level in order to determine whether or not it must appoint an authorised AIFM. If exceeded as a result of the bank financing, leverage level might trigger statutory obligations to appoint an AIFM and a depositary.

Common features for security interests

Collateral Directive

The Collateral Directive is important in relation to taking and enforcing collateral. It has been implemented into both Irish and Luxembourg domestic law and is an important feature of security arrangements in each jurisdiction.

The Collateral Directive provides to collateral takers, in the case of qualifying collateral arrangements, a number of perfection and enforcement benefits. This includes rights of rehypothecation, substitution of collateral, disapplication of stays, and a right of appropriation on enforcement.

As regards the Collateral Directive and its impact on perfection, first, a preliminary note on what we mean by the term "perfection". When used in some jurisdictions, "perfection" is taken to mean the steps needed to ensure a first-ranking security interest. In each of Ireland and Luxembourg, "perfection" generally refers to the steps that, if not taken, mean that the security is void but which steps, by themselves, will not necessarily render the security interest first-ranking. In this regard, it should be noted that the Collateral Directive disapplies, in respect of any qualifying collateral arrangement, any filing or registration requirements that may otherwise apply under the domestic regime of the applicable EU Member State.

Security agency

Both Irish and Luxembourg law accommodate security being held by one entity for the benefit of many, whether through a security trustee or security agent structure in Ireland, or a security agent structure in Luxembourg.

Security through insolvency

In general terms, security granted by an Irish or Luxembourg fund is effective on and through insolvency and may be enforced without court intervention.

No stamp or transfer taxes

Generally speaking, no stamp, transfer or other similar taxes are typically payable under Irish or Luxembourg law on the creation of security or execution of security documents.

Conflicts-of-law considerations

Due to the multi-jurisdictional nature of finance transactions involving Irish and Luxembourg funds, it is essential to properly address questions of private international law. This is the case for the choice of law and choice of jurisdiction in the finance documentation, but more specifically, as it relates to the recognition of the right in rem over the collateral and its enforceability against the pledgor, the investor and any other third party (competing creditors) in a context where all such parties are located in different jurisdictions. Moreover, the impact of an insolvency of the fund or of any other guarantor or security provider should be considered in an international context.

Whereas it is fairly typical for the lending documents to be governed by New York law or another law chosen by the lender, local law considerations come into sharper focus in relation to collateral arrangements. In general terms, similar conflict-of-laws principles arise for consideration in Ireland and Luxembourg. In each case, for the creation, perfection and enforcement of collateral, the law of the location (or deemed location) of the secured asset (the lex situs) is very relevant.

Accordingly, whereas there is no concern with the credit agreement or other document regulating borrowing being governed by the law preferred by the lender (typically New York law or English law), in each of Ireland and Luxembourg, there is a preference for security to be taken under the lex situs. The lex situs will often be Irish law or Luxembourg law (as the case may be). Claims governed by Irish or Luxembourg law or owed to a debtor located in Ireland or Luxembourg, or cash or securities accounts in Ireland or Luxembourg, will generally be regarded as having an Irish or Luxembourg lex situs.

Regulation (EC) No 593/2008 is also relevant. Better known as the Rome I Regulation, or simply Rome I, it applies equally in Ireland and Luxembourg and refers to the law chosen by the parties for all contractual aspects. Article 14 of Rome I also addresses the relationship between assignor and assignee under a voluntary assignment of a claim against another person (the debtor). This is relevant to security over capital calls exercisable against investors. Article 14 provides that the relationship between assignor (i.e. the fund) and assignee (i.e. the lender or the security agent) under a voluntary assignment of a claim against the debtor is governed by the law that applies to the contract between the assignor and assignee (i.e. the governing law of the subscription agreement or, as applicable, limited partnership agreement). Article 14 also provides that the law governing the assigned claim shall determine its assignability, and certain effects against the debtor of such claim (investor).

As fund documentation is typically governed by the law of the location of the establishment of the fund (so Ireland or Luxembourg, as the case may be), Irish or Luxembourg law will apply to such matters and such application will, throughout the EU, be supported by Rome I. However, Rome I does not expressly provide for conflicts-of-law rules as regards the enforcement of such security interests against third parties. The impact on third parties is dealt with by national rules, which often designate the law of the location of the relevant investors to govern the effect on third parties. Investors in funds (whether Irish or Luxembourg) are typically located outside the fund jurisdiction (and often outside Europe), so this is something to be taken into account. A draft EU Commission proposal for a regulation on the law applicable to the third-party effects of assignments of claims, published on 12 March 2018, is set to deal with this question. The draft proposal aims to reduce the uncertainty as to the law applicable to perfection requirements and the enforceability of security interests over claims against third parties. The proposal provides that, as a rule, the law of the country where the assignor has its habitual residence will govern the third-party effects of the assignment of claims.

In addition, Regulation (EU) No 2015/248, which applies to companies and to unregulated funds equally across Ireland and Luxembourg (and the rest of the EU other than Denmark), is of relevance. More commonly known as the EU Insolvency Regulation, this regulates the insolvency proceedings of corporates throughout the EU. Under the EU Insolvency Regulation, claims against an EU investor with an EU centre of main interest ("COMI") will be considered located in the EU Member State where that COMI is located.

Typical security package

The security package for a financing of an Irish or Luxembourg fund will, as with any other jurisdiction, depend on the nature of the financing – subscription line or NAV facility (or hybrid). Typically, in each of Ireland and Luxembourg, a combination of at least the following is used: a security interest over unfunded capital commitments, together with security over the bank account into which investors are required to pay subscription/commitment amounts. NAV and other asset-backed facilities will involve collateral over other of the fund's assets and, in particular where this involves securities owned by the fund, the role of the depositary in the security arrangement becomes of central importance.

Typical security package for subscription line deals

In both Ireland and Luxembourg, security interests provided by a fund in respect of capital call rights against an investor are recognised and enforceable against the fund, even if no notice is given to the investor. As regards enforcement against the investor, until the investor is given notice that its rights have been assigned, it may be validly discharged (including by set-off) as against the fund. For this reason, consideration is given to notifying investors of the creation of such security, where practicable. Ideally, such notice is acknowledged by the investor.

Ireland

As with any financing, there is no universal security package. That said, the following are typical features. In a capital call/subscription facility, a typical security package includes security over the fund's rights on capital calls against investors, and security over the relevant bank account into which the subscription monies are to be credited. In addition, a security power of attorney is usually sought from the fund.

As mentioned, the administrator plays a key role in the subscription process. In certain cases, it is appropriate to seek security over the fund's interest in the related administration agreement to provide a lender with "step-in" rights. In other cases, a side letter to the lender is obtained from the administrator in relation to the performance of its duties following enforcement. Control agreements in respect of the subscription proceeds account may be appropriate. The appearance of an Irish fund in a financing will not necessarily be limited to the Irish fund in the role of borrower. The use of Irish funds (particularly ICAVs) in feeder fund structures is common.

One issue that will require careful consideration in this context is the issue of guarantees and other third-party credit support. An Irish AIF cannot generally provide "guarantees" (which is generally taken as including third-party credit support more generally) to collateralise the obligations of third parties. The use of "cascading pledges" can be a useful tool in this regard. In the case of security created by an Irish fund, the Collateral Directive, where applicable, displaces any security filing requirements. Nonetheless, it is market practice to consider precautionary security filings (particularly where contractual rights are secured). These are made at the Companies Registration Office or (in the case of ICAVs) the CBI. Unless there is a transfer of the security interest to a new lender, these are one-time filings with no renewal requirement (unlike, for example, financing statements in certain jurisdictions). It is permitted under Irish law to take security over future assets.

Luxembourg

The collateral package in Luxembourg subscription deals usually consists of security over: (i) the unfunded commitments by the fund's limited partners to make capital contributions when called by the general partner; and (ii) the account where the contributions are funded. The Luxembourg law of 5 August 2005 on financial collateral arrangements implementing the Collateral Directive, as amended (the "Luxembourg Financial Collateral Act"), captures these two types of assets to offer lenders a secure and bankruptcy-remote pledge while allowing the fund, as pledgor, to benefit from a continuing and flexible management of the collateral.

Pledges under the Luxembourg Financial Collateral Act can be granted over virtually all types of securities and claims (the latter include bank accounts and receivables). In addition, they can be granted under private seal and, in principle, are not subject to any filing or publication requirements in Luxembourg.

Contributions in the form of equity, notes or loans can be captured by the Luxembourg Financial Collateral Act, with flexibility as to any contractual arrangements on timing and mechanics. Furthermore, the Luxembourg Financial Collateral Act allows pledges to be granted not only over present assets, but also over future assets. Consequently, counsel in Luxembourg have a large degree of flexibility in structuring the security package for subscription facilities.

In order to be fully effective, a pledge over a claim, including bank accounts, must be notified to and accepted by the debtor of the relevant claim. There are no stringent rules with respect to the form of the notification. Acknowledgment of the notice by the investor may be sought, for evidence purposes only.

Typical security package for NAV deals

Ireland

NAV facilities, involving as they do, security over the fund's securities and other assets within the fund's investment portfolio, invariably involve account security. Control agreements may be an important feature of this. As the depositary is charged with safekeeping of a fund's financial instruments and has an overall supervisory obligation, the role of the depositary in taking and enforcing collateral is important. As with subscription line facilities, the security may benefit from the Collateral Directive even if precautionary security filings may be made. Where security requires enforcement over an Irish-situated account or other asset in the investment portfolio located in Ireland, there is a strong preference, from a lender perspective, to take Irish law security.

Luxembourg

When structuring a NAV facility involving a Luxembourg fund, the Luxembourg counsel to the lenders will always seek to ensure that the security package is structured under Luxembourg law to avoid discrepancies upon enforcement and, in particular under the Luxembourg Financial Collateral Act, to take full advantage of a bankruptcy-remote security package recognised across the EU.

In terms of composition of the security package, in addition or as an alternative to the deposit accounts on which the capital contributions are funded, NAV facilities are mainly granted against the fund's investment portfolio. Depending on the investment policy of the fund, and the way it is structured (whether it is a fund of fund or not, and the way the holding of the underlying assets is structured), the collateral might fall into a different class of assets, and hence be subject to a different form of pledge.

The most common approach in Luxembourg is to have the security package in a NAV facility include a pledge over the portfolio companies (HoldCos), a pledge over receivables (in particular, for credit funds), and a pledge over bank accounts. All such pledges can be governed by the Luxembourg Financial Collateral Act and take advantage of its flexible and efficient regime. With a flexible legal framework, variations are possible around these types of pledges, which can be adjusted to align to the type of transaction and the structure involved. For funds of funds, when the portfolio is composed of hedge funds, certificates are held within a bank account chosen by the lender, who further benefits from a control agreement.

Under Luxembourg law, the terms that are normally used in a control agreement may be incorporated in a pledge over bank account receivables, so that they may take advantage of the robust protections offered by the Luxembourg Financial Collateral Act.

Execution formalities

Both Irish and Luxembourg law facilitate ease of execution by powers of attorney and (as has assumed increased importance during the pandemic) electronic signature.

Conclusion

COVID-19 has of course impacted all financial markets. However, and particularly since the start of H2 2020, Ireland and Luxembourg have seen an uptick in fund finance transactions, mainly driven by the need for liquidity, with larger asset managers benefitting from existing relationships and the emergence of NAV and hybrid deals as a means of obtaining liquidity by the monetisation of existing portfolios. The on-going impact of Brexit is likely to see increasing relocation of asset management activity from the United Kingdom to Ireland or to Luxembourg, resulting in ever-increasing importance of Ireland and Luxembourg in fund finance. The continued importance of Ireland and Luxembourg as fund domicile jurisdictions will ensure that Irish and Luxembourg funds will continue to be prominent in financing structures, whether as borrowers or part of a broader master/feeder structure. The laws of both Ireland and Luxembourg, although different in many respects, allow lenders to obtain a comprehensive security package in relation to an Irish or Luxembourg fund.

This article, which is co-authored with Phil Cody of Arthur Cox, first appeared as a chapter in Global Legal Insights Fund Finance 2021.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.