Since 1 January 2020, many cantons have allowed an additional deduction for research and development expenditure. The cantons enjoy wide discretion in the application of this additional deduction. Depending on the cantonal implementation, this may result in very attractive tax planning options, not only for multinational enterprises but also for SME's.

1. Which expenditure qualifies for the R&D super-deduction?

As of 1 January 2020, Swiss companies are able to apply for an additional tax deduction on their research and development ("R&D") expenditure. Depending on the canton, this deduction may exceed the ordinary business-related R&D expenditure (so-called "R&D super-deduction") by up to 50%.

Expenditure for scientific research as well as for science-based innovation (e.g. development of new products, procedures, processes, services for the economy and society) both qualify for the R&D super-deduction. The latter will be of particular interest to most enterprises. By definition, science-based innovation requires a certain level of novelty, whereas the "innovative nature" of R&D activities should not be over-emphasized. Activities in connection with the further development or improvement of products, procedures, processes or services may qualify as science-based innovation. This is in line with the core idea of the R&D super-deduction which is to promote Switzerland as an international hub for innovation. Therefore, the R&D super-deduction may only be refused if the R&D activities entail "nothing new" for the Swiss economy and society as a whole.

The qualifying expenses relate to R&D activities in Switzerland and include costs for own activities of Swiss companies as well as for contractual research by Swiss group companies or domestic third parties.

The R&D super-deduction is based on OECD guidelines which ensures its conformity with international tax standards.

2. Scope of application

In addition to typical R&D activities in the pharmaceutical, medical or nutritional sector, research, development or improvement of applications, products, services, etc. carried out in any other sector will generally qualify as R&D activities. Hence, "sector neutrality" prevails.

3. How is the R&D super-deduction calculated?

The calculation of qualifying R&D expenses is primarily based on the Swiss company's personnel expenses that are allocable to R&D activities. This ensures a relatively simple calculation of qualifying R&D expenditure as defined by the Swiss legislature:

- Directly attributable own personnel expenses + 35% surcharge (but not more than total expenses of the company);

- 80% of the invoiced R&D expenses (i.e. for contractual research by Swiss group companies or independent domestic third parties).

The qualifying R&D expenses must be recalculated and documented for each tax period. The legally stipulated calculation of R&D expenses leads to manageable administrative expenses. This is why the R&D super-deduction offers an attractive option for many Swiss companies; including SME's. For contractual research, only the principal but not the contractor is entitled to apply the R&D super-deduction.

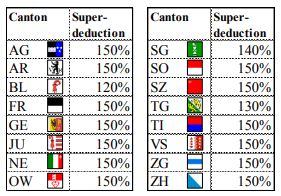

4. Cantonal Implementation

As things stand, the R&D super-deduction is applicable in the following cantons:

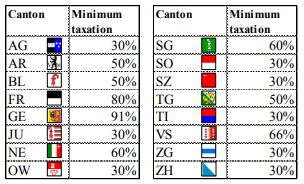

The R&D super-deduction is ultimately subject to an overall tax relief limitation: Despite application of the R&D super-deduction (and other measures of the tax reform), the Swiss company may not fall below a certain cantonal minimum taxation of its taxable profit. The minimum taxation varies from canton to canton:

5. Bottom line

Depending on the concrete cantonal implementation, the R&D super-deduction is a very attractive tax reform measure that also promotes Switzerland as a hub for innovation. The novelty requirements relating to the R&D activities should not be set too high when granting the R&D super-deduction. Otherwise, the legislative intention of promoting Switzerland as a haven for innovation would be unnecessarily undermined.

The concrete application of the R&D super-deduction is subject to a sector-specific, individual case-by-case study. Not least for this reason, it is recommended to involve the responsible tax administration as early as possible in the implementation process of the R&D super-deduction and to further secure the concrete framework of the R&D super-deduction by means of tax rulings, if necessary. Ideally, Swiss companies can benefit from this great tax measure already as from 1 January 2020. Have we kindled your interest? If you have any questions, please do not hesitate to contact our tax specialists.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.