On 16 July 2019, an expert panel chaired by Graeme Samuel published their Capability Review of the Australian Prudential Regulation Authority (APRA).1 Commissioned by the Federal Government as a response to recommendations made by Commissioner Kenneth Hayne's Royal Commission Final Report (Report), the Capability Review made 24 recommendations, with 19 directed to APRA and the remaining five to the Federal Government.

In our article published following the release of the Report, we noted that although many recommendations were levelled at the financial services sector and its regulators, the substance of Commissioner Hayne's recommendations were in fact lighter in their impact than was anticipated.

By contrast, the APRA Capability Review is much meatier, longer and highly critical of APRA. An overarching theme of the review was that cultural change within APRA is necessary to build its capability. The Panel also commented that APRA needs to lift its effort on superannuation and shift its thinking and focus by:

- developing its policy and supervision framework; and

- building its skills and resources dedicated to the sector.2

Below, we share our thoughts on some of the key recommendations made by the Panel and what it means for the financial services sector, in particular the superannuation industry.

The reform journey

APRA's shortcomings first surfaced following the Productivity Commission's report on the A$2.7 trillion superannuation industry,3 which highlighted that the industry's regulators focused too much on the interests of funds and not members. A conclusion of that report was that APRA should be subject to a Capability Review to examine how efficiently and effectively it operates to achieve its strategic objectives in relation to superannuation.

The Productivity Commission's recommendations to undertake a Capability Review were reinforced by Commissioner Hayne's Report, which stated that ASIC and APRA should be subject to regular capability reviews, with the latter being more in need of a review given it has not previously been subject to an independent examination.

Commissioner Hayne further added that APRA (as well as ASIC) must change their culture and take a tougher approach to enforcement, as the many case studies of the Royal Commission showed a scarcity of action taken by Australia's regulators to address and punish wrongdoing.

One of the motives of the Panel's Capability Review appears to have been ensuring that APRA does not slip back into its old habits now that the Royal Commission has wrapped up. In a recent article in The Australian Financial Review,4 Graeme Samuel foreshadowed the tone of the Capability Review by describing the role of APRA as 'ex ante', which in his words means:

"[APRA] is about acting to ensure the conduct of the financial services industry meets the necessary standards of governance, culture and accountability so misconduct becomes the expectation rather than the rule. The current Capability Review of APRA is directed to advising on how this objective can best be achieved."

A superannuation shake-up

In the context of superannuation, the Panel found that APRA had largely regulated the superannuation system by focusing on the stability of funds and systemic risks. However, such an approach has been criticised for potentially under-resourcing the oversight of superannuation, and not appreciating that the supervisory tools for superannuation need to differ from those used for banking and insurance.

The Panel has criticised APRA's progress on improving the superannuation system's efficiency, fees and transparency, citing 'little focus on member outcomes and whether trustees had complied with legal requirements designed to protect members' savings, including the sole purpose test, MySuper obligations or fee requirements under the SIS Act'.5

Further, the Panel also highlighted the fact that '...while APRA looked at potential conflicts of interest between individual directors and the trustee, the supervisors paid little attention to the lack of conflict of interest between trustees and related parties in their broader group structures and the members of the fund'.6

Against this backdrop and a myriad of other issues, the Panel made a number of sweeping recommendations – 19 in total – including the creation of a new superannuation division within APRA.

Key recommendations

APRA has responded to the Capability Review by supporting all 19 recommendations.7

APRA believes that many of the recommendations are in line with its current Corporate Plan, however it will seek to strengthen its Corporate Plan for 2019-2023 (which is set to be published in August 2019) in light of the recommendations.

Some of the key recommendations include:

Recommendation 2.1. Building on APRA's strategic initiative to enhance 'leadership, people and culture', APRA should address culture, accountability and governance at all levels.

Recommendation 4.3. APRA should have sufficient powers and flexibility to prevent inappropriate directors and senior executives from being appointed or re-appointed to regulated entities.

Recommendation 5.1. The creation of a new superannuation division to oversee the system for all members, headed by an Executive General Manager.

Recommendation 5.2. APRA should work to improve its performance benchmarking and supervisory model to increase focus on member outcomes in the superannuation industry.

Recommendation 5.3. The Government should clearly outline its expectations for APRA on superannuation in its next Statement of Expectations, and legislate to make APRA's member outcomes mandate more explicit.

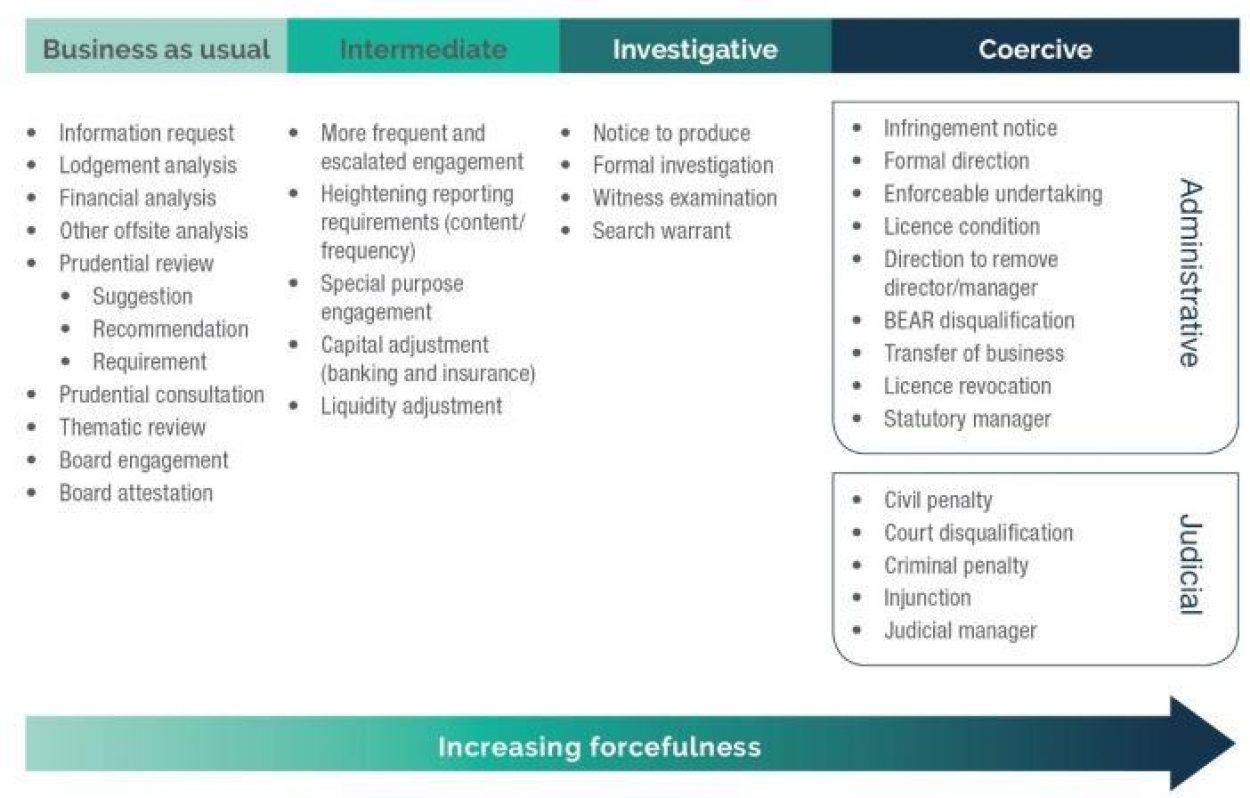

Recommendation 6.1. APRA's enforcement approach should be more transparent and more willing to use the full range of the 'escalation toolkit'. The toolkit (image below – accessed from the Capability Review) is a range of powers available to APRA. The Panel advocates that APRA increase its risk appetite and explore the range of options available under the toolkit more effectively, and also that APRA be more transparent in its use of the toolkit.

APRA's supervisory toolkit

Recommendation 6.2. Current penalties available to APRA should be reviewed to ensure a more forceful supervision and enforcement approach.

Recommendation 6.6(d). APRA should be more transparent in relation to superannuation, including publishing objective benchmarks for superannuation performance on member outcomes and a strategy to promote long-term industry performance.

Some final thoughts

Following the Royal Commission, many commentators remarked that despite the theatre and shock value of the Commission's case studies and hearings, the Report was much softer and less resounding than anticipated.

Questions about the inability of regulators to anticipate and deal forcefully with the misconduct revealed by the Royal Commission were also raised. The Capability Review, however, appears to respond to the critics of the Royal Commission, and provides targeted and actionable recommendations to improve the regulation of the financial services sector.

The superannuation sector in particular is set for some shake up, with APRA indicating it will move to increase supervision of this sector and build on the impetus of changes to its regulatory toolkit initiated when the Treasury Laws Amendment (Improving Accountability and Member Outcomes in Superannuation) Act 2019 was legislated.

The effect of the Capability Review will be further understood when APRA publishes its revised Corporate Plan in August 2019. However, the shots have already been fired and it seems that, combined with the extension of the Banking Executive Accountability Regime (BEAR) across other prudentially regulated industries, we can expect to see an increase in formal enforcement action by APRA in the future.

Footnote

1 Australian Prudential Regulation Authority Capability Review, June 2019, available here: https://www.treasury.gov.au/sites/default/files/2019-07/190715_APRA%20Capability%20Review.pdf

2 Ibid, xxi.

3 See Productivity Commission, Overview – Inquiry Report – Superannuation: Assessing Efficiency and Competitiveness.

4 Graeme Samuel, The Australian Financial Review, "Regulators must not backslide into pre-Hayne practice", 27 March 2019

5 Above, n 1, 102

6 Ibid, 102-103

7 APRA, Media Release – "APRA welcomes Capability Review report and outlines action plan", 17 July 2019. https://www.apra.gov.au/media-centre/media-releases/apra-welcomes-capability-review-report-and-outlines-action-plan

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

|

|

| Chambers Asia Pacific Awards 2016 Winner

– Australia Client Service Award |

Employer of Choice for Gender Equality

(WGEA) |