In late 2019, ASIC's seemingly endless journey in search of a 'better' fee disclosure regime took yet another turn.

On 29 November 2019, ASIC implemented ASIC Corporations (Disclosure of Fees and Costs) Instrument 2019/1070 (the New Legislative Instrument)1 and released a newly updated Regulatory Guide 97 (New RG 97)2 that collectively revamp the disclosure regime for fees and costs of financial products, yet again.

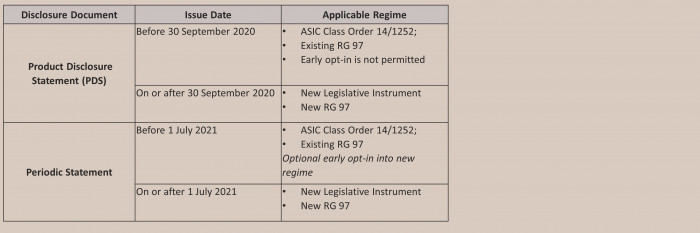

There is a transitional period for the new regime. In particular, disclosure requirements under the current RG 97 (Existing RG 97 and ASIC Class Order 14/1252)3 will be replaced by the New RG 97 effective from 30 September 2020 for Product Disclosure Statements (PDS), and 1 July 2021 for periodic statements. Prior to the commencement dates, requirements under the Existing RG 97 will continue to apply.

To summarise the timing for implementation of the New RG 97:

This is set to be the first of two major shifts by ASIC on the rules around disclosure with the second focussing on Design and Distribution Obligations for financial products. More information on these obligations will be provided in an upcoming article.

WHY HAS THE FEE DISCLOSURE BEEN UPDATED AGAIN?

As discussed in our earlier article4, ASIC has been reviewing the fees and costs disclosure regime with a view to encouraging simplified, transparent, and consumer-friendly disclosure, while ensuring that compliance is not too onerous for product issuers. In essence, ASIC is seeking to reach the 'Holy Grail' of fee disclosure.

Significantly, ASIC's 'world view' is that an improved disclosure regime would keep product issuers accountable and transparent with respect to fees and costs charged to members, thus working toward the statutory target of "clear, concise and effective" disclosures.

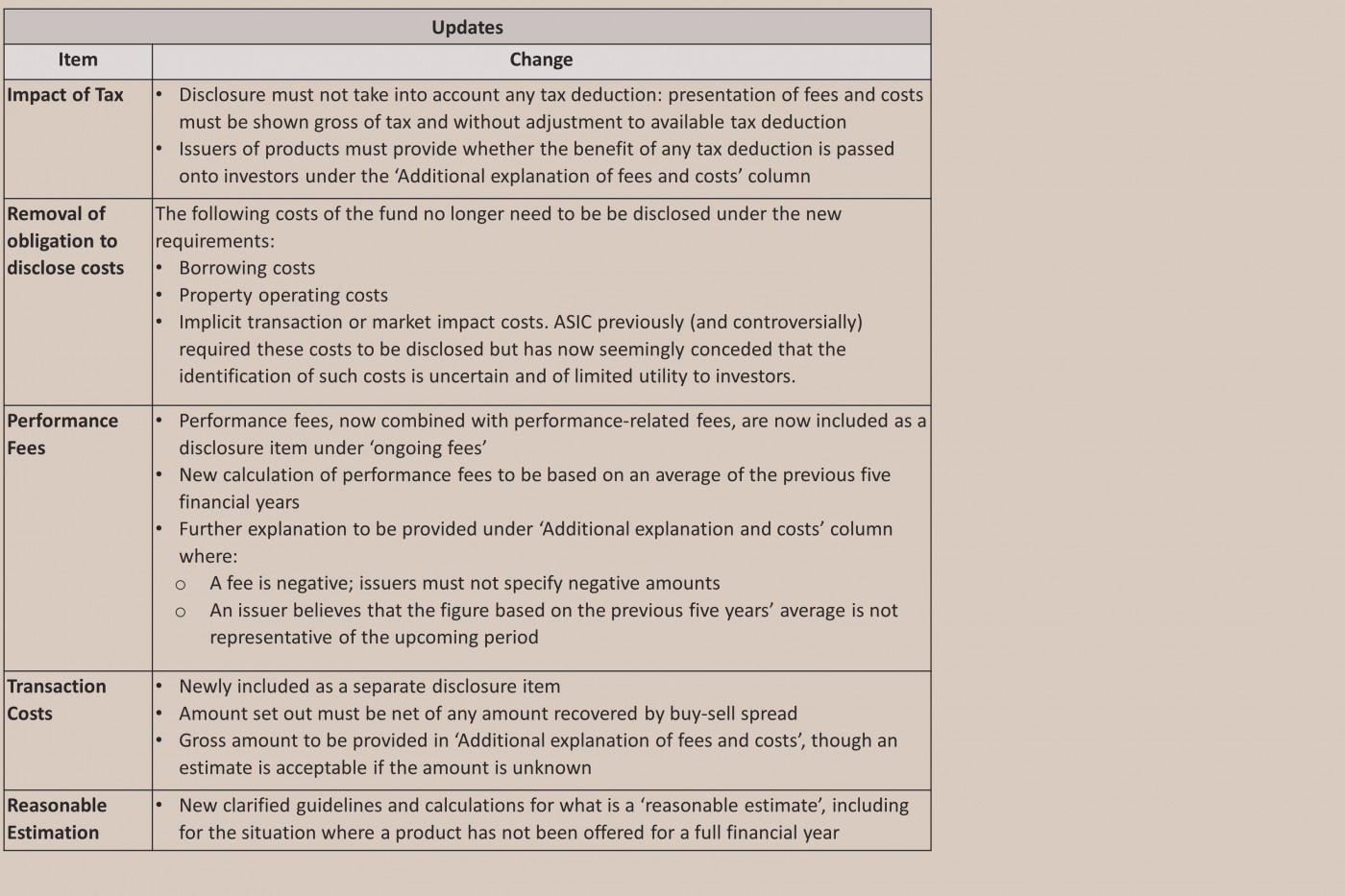

WHAT HAS CHANGED?

We have briefly summarised the key changes applying to fee disclosures in PDS for managed investment schemes in the New RG 97 below:

REFERENCES

1 ASIC Corporations (Disclosure of Fees and Costs) Instrument 2019/1070 ➜

2RG97 (December 2019) Disclosing fees and costs in PDSs and periodic statements ➜

3RG97 (March 2017) Disclosing fees and costs in PDSs and periodic statements ➜

4ASIC puts spotlight on fees and costs disclosure regimes for managed investment and superannuation schemes ➜

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.