On February 20, 2020, the Canadian Securities Administrators (the CSA), other than the Ontario Securities Commission (the OSC) (the Participating Jurisdictions), published a multilateral notice (PDF) regarding the publication of the final text of the changes that will prohibit the payment by members of the organization of prospectus qualified mutual funds of upfront sales commissions to dealers (the Participating Jurisdictions DSC Amendments), resulting in the discontinuation (or ban) (the DSC Option Ban) of all forms of deferred sales charge options (DSC Options).

Also on February 20, 2020, the OSC published a notice and request for comments (PDF) on a proposed new OSC local rule (the Proposed OSC Rule). The Proposed OSC Rule does not contemplate the discontinuation of all forms of DSC Options but rather would limit the circumstances in which mutual funds with a DSC Option can be sold and provide investors greater flexibility to redeem these investments without penalties.

It is expected that the Participating Jurisdictions DSC Amendments and the Proposed OSC Rule will come into force on June 1, 2022.

The Participating Jurisdictions DSC Amendments are comprised of changes to NI 81-105 Mutual Sales Fund Practices (NI 81-105), Companion Policy 81-105CP to NI 81-05 and Companion Policy 81-101CP to National Instrument 81-101 Mutual Funds Prospectus Disclosure.

The Proposed Ontario Rule is published concurrently with a proposed companion policy (the Proposed OSC CP) and proposed related amendments to NI 81-105.

This bulletin provides an overview of the Participating Jurisdictions DSC Amendments and the Proposed OSC Rule, the transition period for their implementation and a historical background of these amendments and proposals.

Application of the Participating Jurisdictions DSC Amendments

The Participating Jurisdictions DSC Amendments are relevant to members of the organization of prospectus qualified mutual funds (mutual funds), which include:

- investment fund managers;

- principal distributors;

- portfolio advisers;

- affiliates of any of the persons referred above; and

- any person organized as a vehicle to fund payment of commissions to participating dealers and that has a right to arrange for the distribution of the securities of mutual funds;

(collectively, fund organizations).

The DSC Option Ban will apply to distributions of securities of prospectus qualified mutual funds to clients who are resident in Participating Jurisdictions.

The DSC Option Ban

Scope of the DSC Option Ban

The Participating Jurisdictions DSC Amendments prohibit the payment by fund organizations of upfront sales commissions to dealers, which will result in the discontinuation of all forms of the DSC Option, including low-load options. The low-load purchase options have a shorter redemption fee schedule, lower upfront commissions and lower redemption fees than the traditional deferred sales charge option.

The front-load option, which refers to the payment by an investor to a dealer of a sales commission that is negotiated and agreed to exclusively between those two parties, is not impacted by the Participating Jurisdictions DSC Amendments.

Impacts of the DSC Option Ban on Continuous Disclosure Documents and Other Disclosure Obligations

Some investment fund managers currently offer the DSC Option as one of multiple purchase options available under a single series or class of mutual fund securities. As the DSC Option will only be prohibited in the Participating Jurisdictions (which excludes Ontario), to the extent that these investment fund managers wish to continue to offer the DSC Option in Ontario, the simplified prospectus and the fund facts documents for their mutual funds will have to provide disclosure to clearly indicate the jurisdictions where the DSC Option is prohibited and where it is available. For those investment fund managers that provide the DSC Option through a separate series or class of mutual fund securities, once the DSC Option Ban will be in force, such series or classes will only be available for sale in Ontario. As further discussed below, the Proposed OSC Rule currently provides an obligation for investment fund managers to establish a separate series for the DSC Option, therefore the first option may not, in fact, be available to investment funds managers who wish to continue to offer the DSC Option to Ontario residents.

The provisions requiring disclosure about the DSC Option pursuant to National Instrument 81-101 Mutual Fund Prospectus Disclosure (NI 81-101) will no longer be applicable in the Participating Jurisdictions as the DSC Option will no longer be offered.

Implementation Schedule for the Participating Jurisdictions DSC Amendments and Transitional Measures

Subject to the required ministerial approvals, the Participating Jurisdictions DSC Amendments will come into force on June 1, 2022 (the Effective Date).

Any purchase of securities of a mutual fund made as of the Effective Date to a resident of a Participating Jurisdiction will need to be made in compliance with the Participating Jurisdictions DSC Amendments. The Participating Jurisdictions expect that for client name accounts, the investment fund manager will not process a trade if the client resides in a Participating Jurisdiction.

Mutual fund securities purchased under the DSC Option prior to the Effective Date will not have to be converted to the front-end load option or other sales charge option. Instead, the redemption schedules on those holdings as of the Effective Date will be allowed to run their course until their scheduled expiry. Fund organizations will therefore be allowed to charge redemption fees on those existing holdings that are redeemed prior to the expiry of the applicable redemption schedule.

For prospectuses receipted prior to the Effective Date with a lapse date posterior to the Effective Date, staff in the Participating Jurisdictions take the view that the DSC Option Ban, would constitute a material change as defined in National Instrument 81-106 Investment Fund Continuous Disclosure. Accordingly, amendments would normally be required to both the simplified prospectus and fund facts documents to remove the applicability of any references to the DSC Option. Notwithstanding the foregoing, the simplified prospectus and the fund facts documents may provide disclosure to state that the DSC Option will not be available as of the Effective Date in the Participating Jurisdictions rather than proceed by way of an amendment.

Finally, until the Effective Date, the Participating Jurisdictions will grant relief to dealers, with respect to the DSC Option, from the enhanced conflicts of interest requirements under the NI 31-103 Client Focused Reforms (as defined below) (which will come into force on December 31, 2020). Dealers will instead be required to comply with the conflicts of interest requirements that are currently in effect under National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (NI 31-103), in relation to the use of the DSC Option.

The Proposed OSC Rule

Application of the Proposed OSC Rule

The Proposed OSC Rule applies to (a) a distribution of securities of a mutual fund that offers or has offered securities under a prospectus or simplified prospectus in the period throughout which the mutual fund is a reporting issuer and (b) a person or company in respect of activities in that period pertaining to such a mutual fund.

Scope of the Proposed OSC Rule

The Proposed OSC Rule proposes restrictions on the use of the DSC Option to mitigate potential negative investor outcomes including the 'lock-in' effect associated with the DSC Option and to reduce the potential for misuse.

More specifically, the Proposed OSC Rule would prohibit a dealer from accepting a commission under a DSC Option if any of the following apply (a) the dealer knows or reasonably ought to know that the client is aged 60 and over or the client likely would need to redeem the security during the deferred sales commission schedule; (b) the client's account size immediately after the distribution would be greater than $50,000 or (c) the client's source of funds to purchase the security is borrowed money, money from the redemption of securities that had been subject to a redemption fee or could have been if the securities had been redeemed earlier or the reinvestment of distributions received on securities that are subject to a redemption fee or had been subject to one.

In addition, the Proposed OSC Rule would shorten the maximum term of the DSC schedule to three years. It also contemplates more flexibility to holders to redeem DSC securities without paying a redemption fee. Holders of DSC securities would be able to redeem annually 10 per cent of the value of their investment without incurring a redemption fee, on a cumulative basis. In addition, dealers accepting commissions under a DSC Option would be required to have a policy to compel the dealer to reimburse a client for a redemption fee in the event of financial hardship, such as death, involuntary loss of full-time employment, permanent disability or critical illness.

The Proposed OSC Rule would also require investment fund managers to establish a separate series for the DSC Option to prevent the potential for cross-subsidization and so that investors who purchase other sales charge classes do not incur costs of any DSC financing.

Impacts of the Proposed OSC Rule on Continuous Disclosure Documents and Other Disclosure Obligations

The provisions requiring disclosure about the DSC Option pursuant to NI 81-101 will continue to be applicable in Ontario. As discussed above, if the Proposed OSC Rule is enacted investment fund managers will need to clarify that units with a DSC Option are only available for sale in Ontario.

Proposed OSC Companion Policy

The Proposed OSC CP clarifies that the Proposed OSC Rule would not restrict investment fund managers from imposing short-term trading fees or penalties on large redemptions since no amount would be payable to the investment fund manager.

The Proposed OSC CP also states that the OSC is of the view that there is an inherent conflict of interest for registrants to accept upfront commissions associated with a DSC Option and set out their expectation that registered firms address this conflict in accordance with NI 31-103 by implementing policies and procedures to mitigate client risk and to monitor compliance with policies and procedures, the Proposed OSC Rule and suitability obligations.

Implementation Schedule for the Proposed OSC Rule

It is proposed that the Proposed OSC Rule and the Proposed OSC CP would come into force on June 1, 2022.

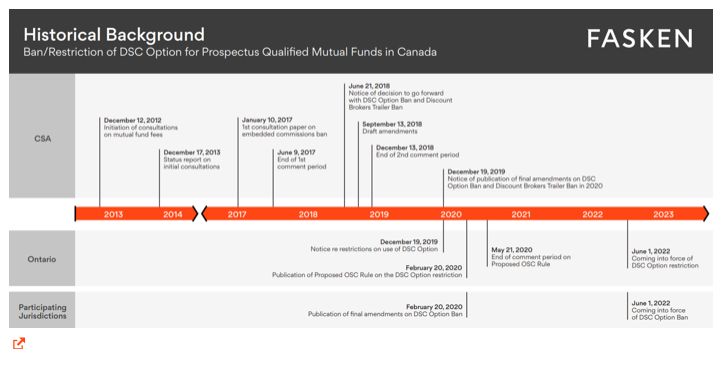

Historical Background

The Participating Jurisdictions DSC Amendments and the Proposed OSC Rule follow from an extensive consultation process on the mutual funds fee structure in Canada, as further detailed below, and, more generally, as a part of a broader initiative by the CSA to better align the interests of the market participants with those of their clients, as well as to make the nature and the terms of their relationship more transparent in order to improve outcomes.

On December 12, 2012, the CSA published CSA Discussion Paper and Request for Comment 81-407 Mutual Fund Fees (PDF) (the Initial Discussion Paper), in which the CSA first undertook to examine the mutual funds fee structure in Canada in order to see whether there were investor protection or fairness issues, and to determine if a regulatory response was needed to address such issues.

The Initial Discussion Paper was followed by in person consultations in several CSA jurisdictions in 2013. On December 17, 2013, the CSA published an overview of the key themes, concerns and proposed solutions that emerged from this consultation process in CSA Staff Notice 81-323 Status Report on Consultation under CSA Discussion Paper and Request for Comment 81-407 Mutual Fund Fees (PDF).

On January 10, 2017, the CSA published for comment CSA Consultation Paper 81-408 Consultation on the Option of Discontinuing Embedded Commissions (PDF)(the DSC Ban Consultation Paper), which narrowed the specific investor protection and market efficiency issues arising from mutual fund embedded commissions. The DSC Ban Consultation Paper sought feedback on the option of discontinuing embedded commissions as a regulatory response to the identified issues and on the potential impacts on both market participants and investors, with the goal to gather sufficient insight to allow the CSA to make a decision on whether to go forward with the ban of embedded commissions or to opt for alternative regulatory responses.

The CSA received 142 public comment letters, 84% of which were from industry stakeholders, the majority of which were strongly opposed to the ban of all forms of embedded commissions and a mandated move to direct-pay arrangements. The remaining 16% non-industry stakeholders (including investors and investor advocates) largely supported the discontinuation of embedded commissions.

On June 21, 2018, the CSA published CSA Staff Notice 81-330 Status Report on Consultation on Embedded Commissions and Next Steps (PDF), in which the CSA formulated their policy decision with regards to embedded commissions, which was comprised of the following regulatory changes :

- the implementation of enhanced conflict of interest mitigation rules through the NI 31-103 Client Focused Reforms (as defined below);

- the prohibition of all forms of DSC Options, including low-load options and their associated upfront commissions in respect of the purchase of securities of prospectus qualified mutual funds; and

- the prohibition of the payment of trailing commissions to, and the solicitation and acceptance of trailing commissions by, dealers who do not make a suitability determination (discount brokers) in connection with the distribution of prospectus qualified mutual fund securities (the Discount Brokers Trailer Ban).

On September 13, 2018, the CSA published CSA Notice and Request for Comment Proposed Amendments to National Instrument 81-105 Mutual Fund Sales Practices and Related Consequential Amendments (PDF), which comprised the draft amendments on the DSC Option Ban and on the Discount Brokers Trailer Ban (the Draft Amendments). The CSA received 56 comment letters on the Draft Amendments.

On December 19, 2019, the CSA published CSA Staff Notice 81-332 Next Step on Proposals to Prohibit Certain Investment Fund Embedded Commissions (PDF) and the OSC published OSC Staff Notice 81-730 – Consideration of Alternative Approaches to Address Concerns Related to Deferred Sales Charges (PDF) to announce that :

- the Participating Jurisdictions had confirmed that they would go forward with the DSC Option Ban and that the Participating Jurisdictions DSC Amendments would be published in early 2020;

- the OSC would not introduce the DSC Option Ban but would explore alternative approaches for addressing the investor protection concerns arising from the use of the DSC Option; and

- all members of the CSA would adopt the Discount Brokers Trailer Ban and that the final amendments for the Discount Brokers Trailer Ban would be published later in 2020.

The Participating Jurisdictions DSC Amendments substantially reflect the Draft Amendments on the DSC Option Ban; only minor changes were made by the Participating Jurisdictions following the review of the comments received. As such the Participating Jurisdictions DSC Amendments are final and will not be republished for further comments.

The Proposed OSC Rule and Proposed OSC CP were published for comment by stakeholders. Comments are required to be submitted by May 21, 2020. Comments are not being sought by the OSC on the proposed consequential amendments to NI 81-105 as these amendments have no impact in Ontario. A summary of the regulatory impact analysis of the Proposed OSC Rule is attached as Annex E to the notice publishing the rule.

It should also be noted that all CSA members previously have adopted complementary additional regulatory initiatives aimed at further promoting the investors' best interests (the NI 31-103 Client Focused Reforms), such as enhanced conflict of interest mitigation rules which when in force will require registered firms (dealers, advisers and investment fund managers) to address material conflicts of interests between a client and the firm in the best interest of the client and to avoid them when they cannot be so addressed. The NI 31-103 Client Focused Reforms, the final text of which was published on October 3, 2019, were featured in the bulletin Final Amendments to National Instrument 31-103 Implementing the First Phase of Client Focused Reforms penned by our Investment Management team.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.