In the first part of this blog post series, we looked at recent general trends in the Canadian M&A market overall, including a decline in overall transaction activity since 2009.

However, when looking at M&A activity in certain sectors or by deal value, we see slightly different trends emerging:

- The steepest decline in activity has been concentrated at the lowest end of the market (value under $5M), where we have seen a 64% decline in the number of transactions since 2009 or an annualized decline of 18% per year.

- At the high end of the market (value over $250M), overall transaction activity has seen strong growth, increasing by 47% since 2009 or an annualized growth of 8% per year.

- Activity in the $10M to $100M level of the market has been resilient, with an overall decline in the number of transactions of only 7% since 2009 or an annualized decline of just 2% per year.

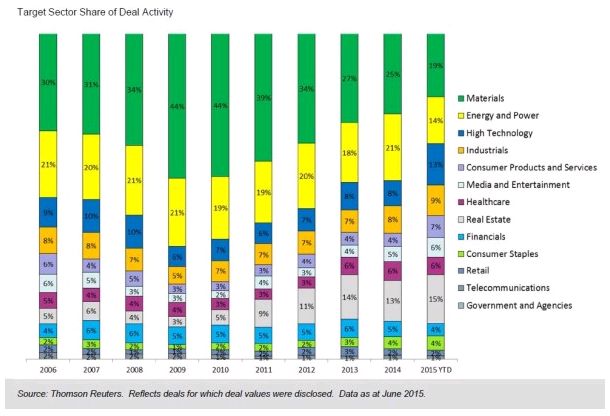

- By number of transactions, the materials sector (paper & forest products; metals & mining; containers & packaging; construction materials; chemicals; and other materials) and the oil & gas sector have made up almost half of Canada's M&A market over the past two years.

- However, as a share of overall transaction activity, the materials sector has been steadily declining, while the real estate and technology sectors have increased.

It is clear from these statistics that, although the overall transaction activity has been declining in recent years, certain segments of the Canadian M&A market remain active and strong.

To view original article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.