Much has already been written about the 2015 Alberta budget and its effect on individual taxpayers, in particular the number of significant changes to personal income taxes, taxes on alcohol and gasoline, user fees and additional charges.

For the oil and gas sector, there are very few changes to the existing tax regime, but there are a number of important points and assumptions that the sector should be aware of:

- No change to royalties or taxes. Most importantly, there will be no change to either corporate income tax rates or to the oil and gas royalty structure.

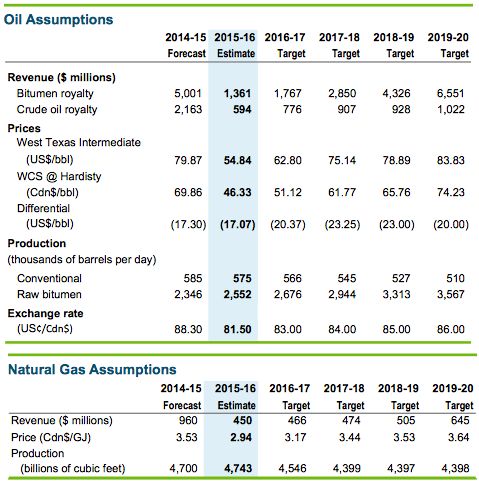

- Low commodity prices

forecast. The province is producing its revenue forecasts

on the basis of significantly depressed oil and gas prices until at

least 2019.

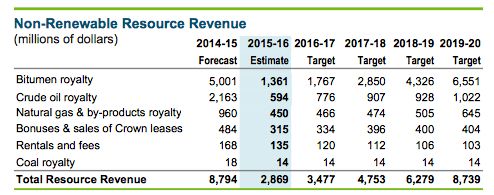

- Non-renewable revenues

continue to be depressed. With continuing depressed prices

and no change to royalty rates, the government is forecasting that

revenues from renewable resources will be significantly below 2014

levels through their entire forecast period.

- Falling energy sector spending. The government is predicting that spending in the oil and gas sector will fall 30% in 2015 and a further 5% in 2016 before starting to recover.

- Oil sands continue to grow. The government is expecting a further 500,000 bpd of oil sands production already under construction to come on stream in the next few years and does not expect significant volumes of such production to be shut-in.

- Pipelines are key to growth. The government remains committed to new pipelines: it states that while rail terminal construction has eased some bottlenecks, the construction of new pipelines continues to be the key to continuing to grow oil production.

- Cost pressures may ease. The government believes that the slowdown in oil and gas spending may ease some labour and capital cost pressures.

A deficit of just under $5 billion for this fiscal year is forecast, and a spring election is now widely expected to be called.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.