On Oct. 6, 2020, the Alberta government released "Getting Alberta Back to Work: Natural Gas Vision and Strategy" setting forth Alberta's plan for becoming "a global supplier of clean, responsibly sourced natural gas and related products".

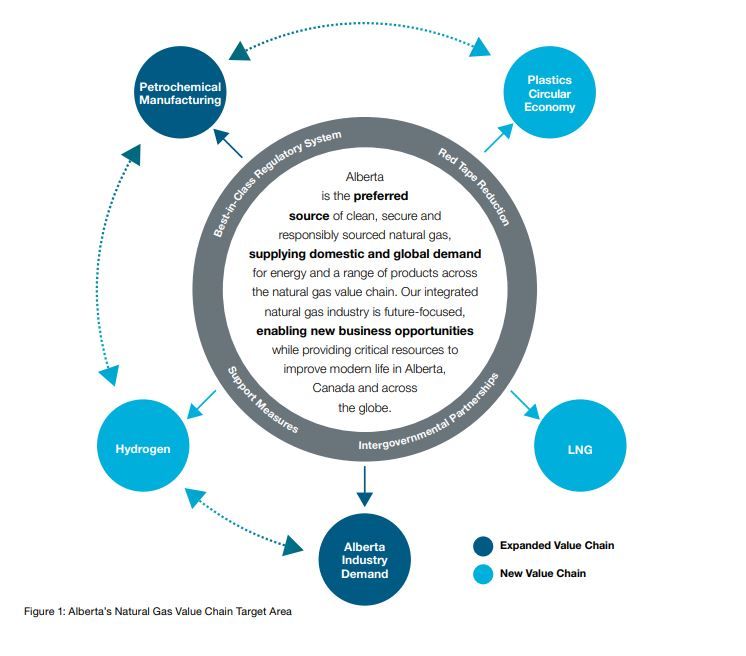

The document lays out specific Natural Gas Value Chain Target Areas and identifies five Key Growth Areas: two as Expanded Value Chains and three as New Value Chains.

The plan, among other things, seeks to "improve on our already best-in-class environmental, social, and governance policies", promote "the expansion and innovation of our low-cost, low-carbon natural gas value chain", and "spark growth in ... liquefied natural gas and the emerging hydrogen economy."

The strategy set out in the policy document is summarized in the following diagram:

The complete document can be found here.

Long-term participants in the Western Canadian Sedimentary Basin may recognize this spotlight on natural gas as a renewed focus on what has served as an important commodity for Alberta's economy for many years.

Prior to the advent of horizontal drilling and fracking technologies that have unlocked massive natural gas reserves in North America, a concern about gas supply led market participants to pursue the development of LNG import terminals, in an attempt to ensure that a stable supply of natural gas remained available in North America. Plans for an import market quickly changed once exploration and production teams achieved tremendous shale gas production and accessed the associated natural gas from shale oil.

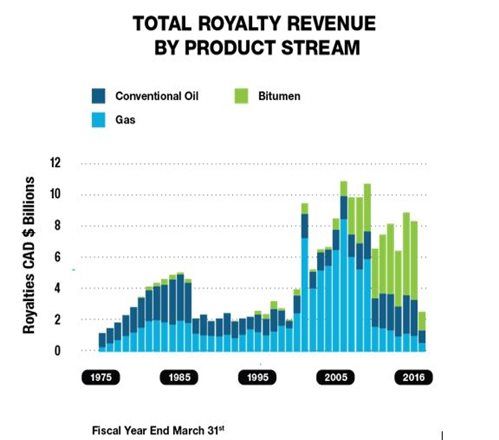

As shown by the following chart, in the late 1990s and well into the 2000s, the lion's share of Alberta's royalty revenue came from natural gas.

Source: History of Alberta Royalties, Government of Alberta, https://www.alberta.ca/royalty-history.aspx

The ability of natural gas producers to convert Canada's abundant natural gas resources into segments of the Expanded or New Value Chains (as described by the province) will inevitably alter the composition of the government's royalty revenues. This will allow Canada to become a leading participant in the global energy transition, a position that has yet to be achieved in the international LNG market.

Canada clearly has the resources (both human and natural) to succeed in these existing and emerging industries. With the advancement of decarbonisation globally, COVID-19 and the ever more interesting times in which we are living, there has been increasing incentives for policy makers to expedite the advancement of these industries through various support measures. Nonetheless, just as with the development of the LNG market and the exponential growth that occurred in the 2000s, energy transition is costly and takes time - the ultimate success of these policies will only be ascertainable in the future, as both technologies and markets mature.

"Read the original article on GowlingWLG.com".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.