As part of a global effort to improve corporate transparency and combat serious financial crime, private companies incorporated under the British Columbia Business Corporations Act ("BCBCA") will be required to prepare and maintain a Transparency Register as of October 1, 2020. The Register must list individuals who directly or indirectly control 25% or more of the shares or votes of the company and include certain personal information about them.

Note: This post updates and replaces our original March 5, 2020 post in light of three recent developments: the new start date (October 1, rather than May 1), the list of "special intermediaries", and the specific exemptions from the Register.

Overview And Status Update

Comparison With The CBCA's ISC Register

Under Bill 24, which received Royal Assent in May 2019, a Transparency Register will be required of private BCBCA companies as of October 1, 2020. The Transparency Register is similar in principle to the Canada Business Corporations Act's register of individuals with significant control ("ISC Register") that has been in effect since mid-2019 (see our post here). However, the BCBCA Transparency Register does depart from the CBCA model in a number of significant respects – in contrast to the registers that have been introduced at the provincial level in Manitoba, Prince Edward Island, Saskatchewan and Nova Scotia. Some of the differences between the BCBCA and CBCA registers are summarized at the end of this post.

Overview Of The BCBCA Provisions

As discussed below in greater detail, the Transparency Register provisions, which will be included in Part 4.1 of the BCBCA, create the following obligations, among others:

- BCBCA private companies will be required to prepare and

regularly update a Transparency Register that includes for

each person who is a significant individual, as discussed below:

- the significant individual's name, birthdate, address, citizenship and tax jurisdiction;

- a description of how the individual is a significant individual; and

- the date on which the individual became or ceased to be a significant individual.

- There are several tests for determining who is a significant individual, as well as some exemptions as discussed below. The B.C. Ministry of Finance may consider future exemptions.

- Recent amendments to the regulations exempt wholly-owned subsidiaries of public companies, as well as certain other entities, from the requirement to maintain a Transparency Register.

- Access to the Transparency Register is restricted to directors of the company, police officers, the tax authorities of British Columbia and Canada and certain regulators (including but not limited to the British Columbia Securities Commission, the British Columbia Financial Services Authority (formerly FICOM) and the Law Society of British Columbia). Those who access the Register may use the information for certain specific purposes only.

- A company that fails to maintain a Transparency Register or incorrectly includes or omits information could be liable to fines of up to $100,000, and individuals who fail to comply with the requirements can be liable to fines of up to $50,000.

The Government of British Columbia has created a website that provides guidance on creating a Transparency Register and on how to decide who qualifies as a "significant individual".

Consultations Continue On The Possibility Of Creating A Central Repository For Transparency Registers

According to the legislation as currently drafted, the Transparency Register will be kept at the company's records office in British Columbia. However, the Ministry of Finance of British Columbia is also seeking input on a potential government-maintained, publicly accessible registry of company beneficial ownership. The consultation closes April 30, 2020. (We note that Quebec initiated a similar consultation in October 2019, including a comment period that concluded on December 15, 2019.)

Frequently Asked Questions

Which Companies Need A Transparency Register?

The requirement to maintain a Transparency Register applies to any "private company" incorporated under the BCBCA – specifically a company that is not a reporting issuer, a reporting issuer equivalent, listed on a designated stock exchange within the meaning of section 248(1) of the Income Tax Act (Canada), or within a prescribed class of companies.

The following classes of B.C. companies have been exempted by regulation from the requirement to maintain a Transparency Register:

- Wholly-owned subsidiaries of public companies (meaning reporting issuers, reporting issuer equivalents or companies listed on a designated stock exchange within the meaning of section 248(1) of the Income Tax Act (Canada));

- Trust companies and insurance companies, each as defined in the Financial Institutions Act, and government corporations as defined in the Financial Administration Act;

- Wholly-owned subsidiaries of a special act corporation;

- Companies that operate as independent schools; and

- Wholly-owned subsidiaries of municipalities and Indigenous nations.

Additional exemptions may be made by regulation in the future.

All BCBCA companies that do not fall under an exemption should prepare and maintain a Transparency Register.

Where Is The Transparency Register Kept, And In What Format?

A private company must keep its Transparency Register at its records office in British Columbia either in electronic form or in a bound or loose-leaf form. Provided that it is available for inspection and copying at its records office by means of a computer terminal or other electronic technology, the Transparency Register, in a bound or loose-leaf form, may be kept at a location other than the company's records office.

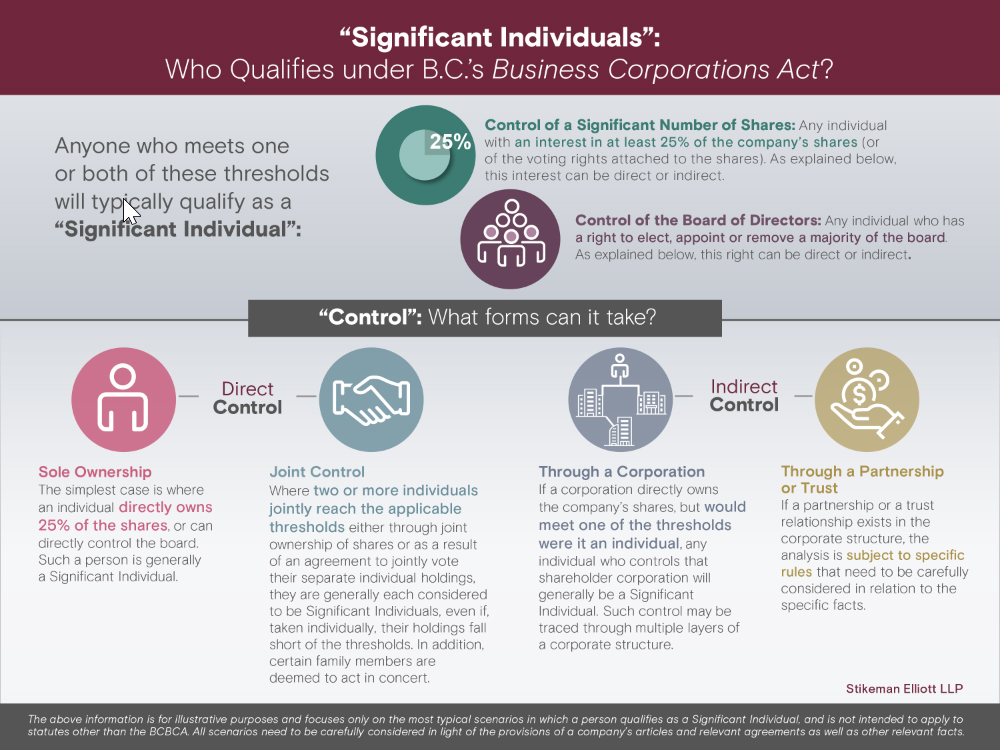

Whose Names Go Into The Transparency Register?

The Transparency Register must contain information for each "significant individual". An individual will be considered significant with respect to the company if the individual has:

- Any of the following interests or rights or a combination of

them in a significant number of the shares (being 25% or more of

the issued shares, or 25% or more of the voting rights):

- an interest as a registered owner of at least one of the company's shares;

- an interest as a beneficial owner of at least one of the company's shares (other than an interest contingent on the death of another individual);

- indirect control of at least one of the company's shares;

- The right, indirect control of the right, and/or the ability to exercise direct and significant influence1 over an individual who has the right or indirect control of the right to elect, appoint or remove a majority of the directors; or

- A prescribed interest, right or ability or is subject to a prescribed criterion or circumstance.

The regulations set out additional detail with respect to "indirect control" and when certain persons are deemed to control intermediaries, including corporations, partnerships and trusts.

As noted above, the BCBCA provisions specifically exclude wholly-owned subsidiaries of public companies from the Transparency Register requirement. In addition, as discussed below, certain "special intermediaries" (and their owners) are not required to be listed in the Transparency Register

1 See the discussion of "Significant influence" below.

Some of the key concepts in the "significant individual" definition are considered below.

Significant Influence

Under certain circumstances, an individual who would otherwise not qualify as a significant individual may nevertheless be able to influence a second individual who has or indirectly controls the right to elect, appoint or remove one or more of the company's directors. If such influence is "direct and significant", the first individual is a significant individual under the legislation and must be included the Transparency Register.

Importantly, the Government of British Columbia states on its website that "direct and significant influence" for these purposes requires a "legally binding or enforceable arrangement, such as a legal agreement or contract." The corollary of this is that significant influence does not include non-legal forms of influence, such as the influence of familial relationships, major customers or other business circumstances involving economic dependence.

Examples of arrangements that would count as "significant influence" include:

- Share transfer agreements whereby the transferor retains approval rights for the replacement of the board of directors; and

- Loan agreements (to finance the private company) whereby the

lender retains the right, in its absolute discretion, to recall the

loan and the following were made clear:

- the lender will recall the loan if the lender disagrees with who sits on the board of directors; and

- the private company will not survive without the financial support of the loan.

Interests Or Rights Held Jointly

If two or more individuals jointly own one of the above interests or rights, then each such individual is "significant" for the purposes of the Transparency Register and must therefore be listed.

Interests Or Rights Exercised In Concert

Groups of individuals who, under an agreement or arrangement, are acting in concert must add their interests together for the purpose of the "significant individual" test. If the group as a whole has interests that meet either the 25% threshold or, alternatively, has the direct or indirect right to elect, appoint or remove a majority of the directors of a private company, the company must list every member of the group in its Transparency Register.

The rules regarding acting in concert may have potentially significant impacts on family businesses because certain persons, such as a spouse, son, daughter, or relative of the person or person's spouse living in the same home, are all presumed to act in concert. This means that, when determining who is a significant individual, private companies must add together the interests of persons who are "associates" if their combined interests meet the requirements to be a significant individual. Associates include spouses and children, as well as other relatives who live in the same home.

Registered vs. Beneficial Ownership

The BCBCA provides that beneficial ownership "includes ownership through any trustee, personal or other legal representative, agent or other intermediary," but does not otherwise define "beneficial ownership". The Government of British Columbia's website differentiates "registered ownership" from "beneficial ownership" as follows:

- A registered owner holds the shares personally and is listed as a shareholder in the central securities register; and

- A beneficial owner is an individual who is legally entitled to receive benefits of property rights in equity even though legal title of the property belongs to another person (e.g. the trustee of a trust is the registered owner and the beneficiary is the beneficial owner).

Direct vs. Indirect Control

When shares are held by an intermediary, the following control concepts may be important in determining who the significant individuals of the company are:

- Corporation: control is a product of the right to elect or appoint a majority of the directors of the corporation;

- Partnership: each partner is considered to control a partnership;

- Agent: controlled by the principal of the agent; and

- Trustee or a legal representative: control derives from the ability to direct the exercise of the rights attached to shares or the rights creating the ability to appoint or remove one or more of the directors of a private company.

An individual will have indirect control over shares if the individual (who is not an intermediary) controls an intermediary that is the registered owner of the shares or controls a chain of intermediaries, the last of which is the registered owner of the shares.

An individual will have indirect control of rights relating to the ability to elect, appoint or remove one or more directors of a private company if the individual (who is not an intermediary) controls an intermediary that has the right or controls a chain of intermediaries, the last of which has that right. Additionally, an individual will be considered to have such a right if the individual is a trustee or personal or other legal representative in a chain of intermediaries, the last of which has that right.

Special Intermediaries Not Required To Be Included In Transparency Register

Under the indirect control rules described above, a natural person who indirectly controls the shares or the board of the company must generally be included in the Transparency Register. This is not the case, however, if an entity that is a "Special Intermediary" under the Regulations owns shares of the company or is in its chain of ownership. Where that is the case, the analysis with respect to those shares simply stops: it is not necessary to "look through" the entity for natural persons who own or control it and no such persons need be included in the Transparency Register (unless they qualify on another ground).

Special intermediaries include:

- Public companies;

- Wholly-owned subsidiaries of public companies;

- Special act corporations and their wholly-owned subsidiaries;

- Government corporations;

- Companies incorporated or wholly-owned by municipalities or Indigenous nations;

- Trust companies, insurance companies and credit unions, each as defined in the Financial Institutions Act;

- Certain schools; and

- Trustees of a testamentary trust.

For example, if a public company directly or indirectly owns 25% of the shares of the company, the company does not need to determine if any individual controls that public company. However, the company still needs to determine if there are significant individuals with respect to the remaining 75% of the shares of the company. (On the other hand, if a company is wholly-owned by a public company, the company is not required to prepare a transparency register at all.)

How Do We Prepare The Transparency Register?

For some private companies, it will be relatively easy to determine who the significant individuals are. In other cases, the analysis will be more complicated, particularly if:

- Shares are registered in the name of an intermediary (whether a corporation, partnership, agent, trustee or personal or other legal representative); or

- There are multiple classes of shares or an agreement that governs voting rights and control of the company.

The Government of British Columbia suggests that companies start by looking at the central securities register and the articles of the company to determine which individuals have one or both of the following:

- Direct or indirect interests in 25% of the shares or 25% of the votes; or

- Rights to elect, appoint or remove a majority of the directors of the company.

Such a review might also help to identify individuals who are related to one another or who could be acting in concert.

Once the company has identified who the significant individuals are or has determined that it needs more information from a shareholder that is an intermediary, the company will need to contact the shareholders in order obtain the required information for the Transparency Register.

The Government of British Columbia website provides a sample questionnaire for shareholders as well as a sample Transparency Register template.

As noted below, once a company has prepared its Transparency Register, the company has an obligation to notify each individual who is listed on the Transparency Register within 10 days.

What Information Must The Transparency Register Contain?

The Transparency Register must include the following details for each significant individual of the private company:

- Full name, date of birth and last known address;

- Citizenship;

- Whether the individual is a resident of Canada for purposes of the Income Tax Act (Canada);

- A description of how the individual is a significant individual; and

- The date on which the individual became or ceased to be a significant individual.

If there are no significant individuals, the Transparency Register must expressly say so.

What If A Shareholder Does Not Provide The Required Information To The Company?

Shareholders have a duty to take reasonable steps to compile and promptly provide information to the private company following a request by the company for information for the Transparency Register.

However, if a private company is unable to obtain or confirm some or all of the required information, the Transparency Register must set out the information that the company was able to obtain, together with the steps it took to obtain or confirm the missing or unconfirmed information.

Certain penalties apply to shareholders who fail to provide accurate information, as noted below under "Penalties".

Who Will Have Access To The Transparency Register?

Only the following persons will have access to the Transparency Register:

- Directors of the company;

- Police officers;

- The tax authorities of British Columbia and Canada; and

- Certain specific regulators, including but not limited to the British Columbia Securities Commission, the British Columbia Financial Services Authority (formerly FICOM) and the Law Society of British Columbia.

For What Purposes Can These Persons Inspect The Register?

It is important to remember that those with access to the Transparency Register may do so only for specific purposes relating to their functions:

- Officials and employees of taxing authorities are permitted to inspect the Transparency Register only for specific purposes related to the administration and enforcement of tax laws;

- Police officers are permitted to inspect the Transparency Register only for specific law enforcement purposes; and

- Officials and employees of other regulators are permitted to inspect the Transparency Register only for purposes related to administering or enforcing a law for which the regulator is responsible.

In each case, the authorities may also inspect the Transparency Register to provide information to assist their counterparts in another jurisdiction if this assistance is authorized under an arrangement, written agreement or treaty.

Unlike the CBCA's ISC Register, shareholders and creditors will not be permitted to access the Transparency Register (unless they are entitled to do so in their separate capacity as directors).

Ongoing Obligations

After the company has prepared its Transparency Register, it must notify each individual who is listed in the register within 10 days (the same applies whenever an individual is added to the register as well as when the company notes in its register that an individual is no longer a "significant individual"). Significant individuals must remain on the Transparency Register for 6 years after they cease to have that status and must then be removed from the register within 1 year.

Companies with a Transparency Register are required to take reasonable steps to confirm or update the register annually within 2 months of the company's anniversary of incorporation. In addition, if the company becomes aware of new information relevant to the Transparency Register (for example, because of a share transfer or issuance of shares), the register must be updated within 30 days.

Offences and Penalties

Companies

A private company will be considered to have committed an offence (subject to a knowledge and diligence defence) if it does the following in respect of the company:

- Incorrectly identifies an individual as a significant individual;

- Excludes an individual who is a significant individual;

- Includes information about a significant individual that is false or misleading in respect of a material fact; or

- Omits information about a significant individual and the omission makes the information false or misleading.

Directors And Officers

Any director or officer of the company who permits or acquiesces in the above listed offences also commits an offence, whether or not the company is prosecuted (similarly subject to a knowledge and diligence defence).

Shareholders

A shareholder commits an offence if the shareholder

- Fails to comply with its obligation to provide to the company the information for the Transparency Register; or

- Provides information for the Transparency Register that is false or misleading or omits a material fact, and the omission is false or misleading (and the shareholder knows or should reasonably have known that such information or omission is false or misleading).

Amounts

A person other than an individual who commits one of these offences is liable to a fine of not more than $100,000.00; and an individual who commits one of these offences is liable to a fine of not more than $50,000.00. Imprisonment is not a penalty under the British Columbia legislation.

Notable Exclusions

These requirements do not apply to public companies, wholly-owned subsidiaries of public companies, extra-provincial companies or certain other companies (described above under Which companies need a Transparency Register?). The Government of British Columbia may consider additional exemptions in the future.

BCBCA And CBCA: Some Key Differences

There are several significant differences between BCBCA Transparency Register and the CBCA ISC Register, including those summarized below:

Individuals Who Belong On The Register

The following criteria and concepts are used in determining who is to be included in the CBCA ISC Register but not in the BCBCA Transparency Register:

- Value of shares owned;

- "Voting rights" (rather than "rights to vote at general meetings" in the BCBCA); and

- "Direct control" of a company's directors (rather than the right to elect, appoint or remove one or more of the company's directors in the BCBCA).

On the other hand, there are some things in the BCBCA provisions that are absent, or at least differently treated, in the CBCA:

- "Indirect control" with respect to the company's shares and/or the right to elect, appoint or remove one or more of the company's directors is addressed in the British Columbia regulations, with specific reference to chains of intermediaries;

- The BCBCA has a narrower "influential person" definition; and

- Under the BCBCA, specific family members must be included when making the determination for significant individuals.

Form And Contents Of The Register

The BCBCA provides more specifications in some instances than the CBCA regarding content of the Transparency Register in the following ways:

- The BCBCA requires citizenship information (Canadian or otherwise);

- In the event that a shareholder fails to respond to a request for information, the BCBCA specifically allows the company, in at least some circumstances, to record that the information was requested but not received;

- The BCBCA specifies that a Transparency Register can be in various forms (paper, electronic, etc.);

- The BCBCA specifies that even if there are no significant individuals, a Transparency Register is still required; and

- The BCBCA requires indication of whether the significant individual is resident in Canada for purposes of the Income Tax Act (Canada).

Maintenance of The Register

Unlike the CBCA, the BCBCA specifically requires the following with respect to maintenance of the Transparency Register:

- A company must notify individuals within 10 days of such individual being placed on or removed from the Transparency Register; and

- The Transparency Register must be reviewed annually within 2 months of the company's anniversary of incorporation.

Inspection Rights

There are a number of differences between the two regimes when it comes to access rights, including the following:

- The tests for access to the Transparency Register by the tax authorities, police officers and regulators are different under the BCBCA than the CBCA (for example, the CBCA lists specific offences to which an access request must relate).

- Shareholders and creditors do not have access rights under the BCBCA.

Various Requirements And Penalties

Other distinctions between the BCBCA Transparency Register and the CBCA ISC Register include:

- The BCBCA's prohibition against listing someone who is not a significant individual (the CBCA has no comparable provision).

- The heavier burden placed on the shareholders under the BCBCA in virtue of the fact that they must complete due diligence (rather than answering to the best of their knowledge as under the CBCA).

- The possibility of imprisonment as a penalty for individuals who fail to comply with the requirements under the CBCA (imprisonment is not a potential penalty under the BCBCA).

Exemptions

As discussed above under Which companies need a Transparency Register?, wholly-owned subsidiaries of public companies and certain other types of companies are exempt from the requirement to prepare a Transparency Register. As discussed under Special Intermediaries not required to be included in Transparency Register, "special intermediaries", including public companies, are not required to be listed in the transparency register. Currently, there are no equivalent exemptions from the CBCA ISC Register requirements, although Corporations Canada is conducting a public consultation on further exemptions from the requirement to maintain an ISC Register.

Recommended Action

Private BCBCA companies should take steps before October 1, 2020 to gather the information required to prepare their Transparency Register, which they must maintain from that date forward. If your company would like help in preparing its Transparency Register, please contact the author, Denise Duifhuis.

Article originally published on 20 April 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.